The market made a big mistake in looking at the Fed's determination to fight inflation.

Of the many bets, the only thing the market is betting on right is the Fed's determination to fight inflation。

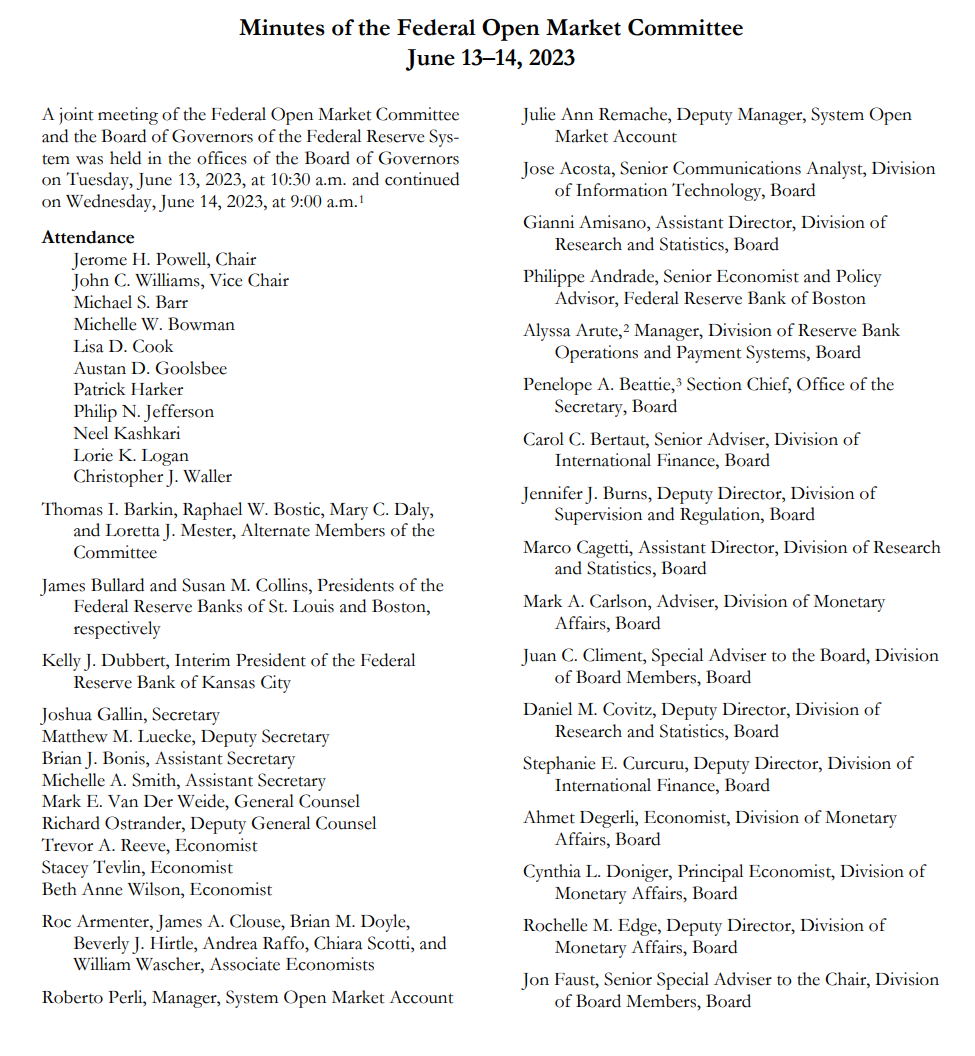

On July 5, local time, the minutes of the Federal Reserve's June monetary policy meeting were released.。

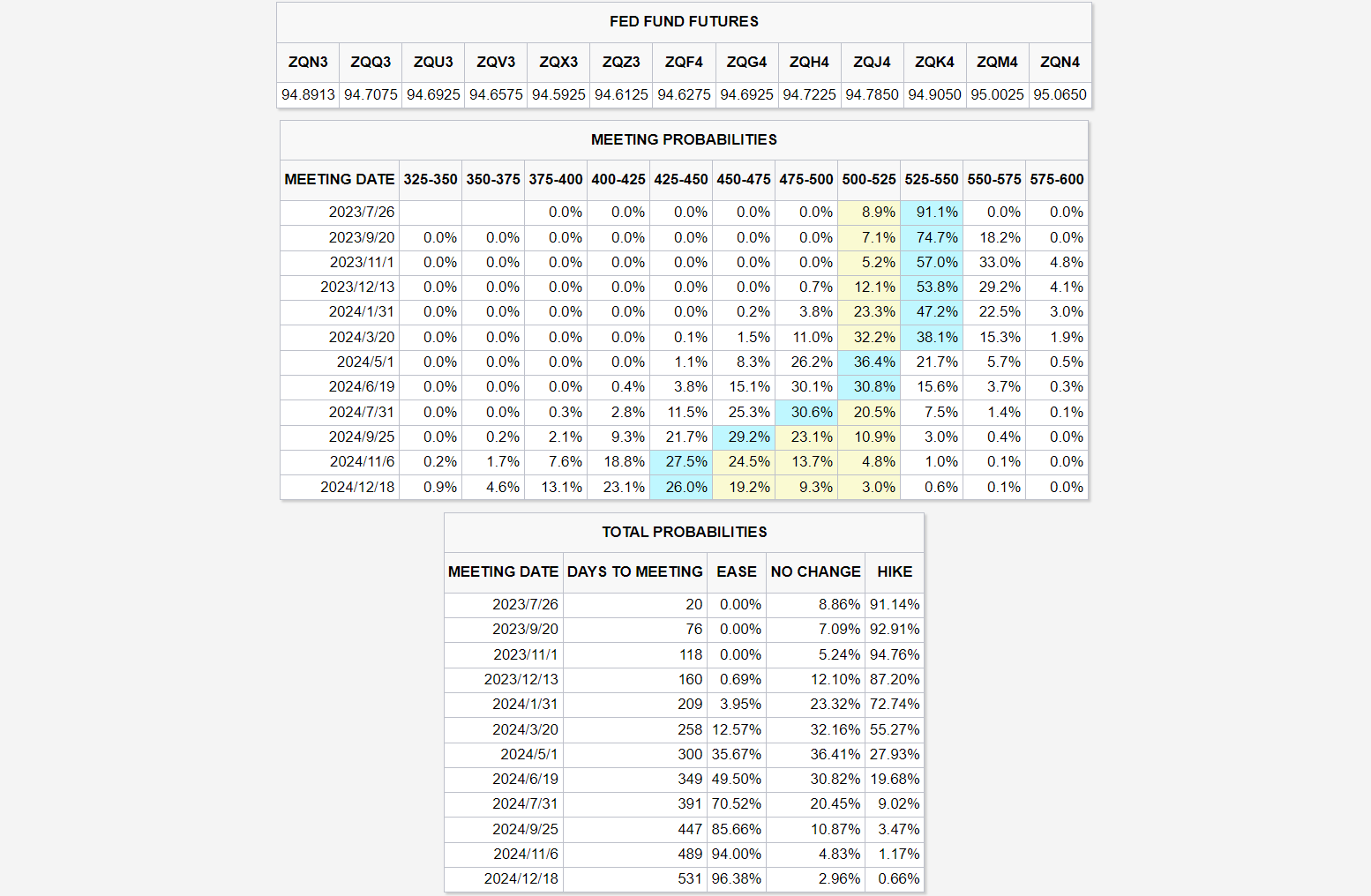

At the June FOMC meeting, the Fed slowed its pace for the first time after entering a rate hike cycle, capping the policy rate at 5.25%, in line with market expectations。Surprisingly, in the SEP dot plot released with the interest rate decision at the time, the median of the Fed's interest rate forecasts for the end of the year jumped to 5.625 per cent, which means the bank will raise interest rates twice more during the year, exceeding market expectations.。For this extremely hawkish dot plot, the market has consistently rejected the Fed's proposal that it will raise interest rates twice during the year。According to CME Fed Watch, traders are still "stubborn" that the bank will raise interest rates only once during the year, by 25 basis points, and then maintain 5.5% policy rate cap until the end of the year, followed by a rate cut window in 2024。

It is precisely because of the market and the Fed's disagreement, as well as a series of unexpected events after the FOMC meeting in June, making the minutes of the meeting particularly concerned.。On the one hand, in the first half of this year to maintain a strong U.S. stocks are in urgent need of a dove report to continue its second half of the "stamina";。

Fed: Space for time

Conclusion first, market concerns are right, Fed hawks again。And, in this report, the Fed seems to be revealing a message: to put inflation governance above all else, even at the expense of a slowing economy。Combined with traders always willing to accept the idea that they will only raise interest rates once during the year, the market is likely to underestimate the Fed's resolve in inflation governance。

One piece of evidence is that in the minutes, the participants had foreseen the economic slowdown that would result from high interest rates, but still believed that the current level of inflation was too high and that further rate hikes were needed.。According to the minutes, in assessing the economic outlook, most participants had noted that real GDP growth had been resilient in recent quarters, but there was general agreement that growth would slow for the rest of the year.。

According to the participants' assessment, over the past year, the cumulative effects of monetary tightening have become apparent, in the form of tighter financial lending conditions and lower demand in interest rate-sensitive industries.。According to the minutes, participants acknowledged that the power of this monetary policy lag is fraught with uncertainty and often requires collective discussion to confirm its effectiveness.。

Simply put, the monetary tightening policy adopted by the Federal Reserve over the past year has been gradually working, but because of the lag and cumulative effects of the policy, participants can only judge by camera choice.。

Despite the complexity of monetary policy and the Committee's awareness of the possibility of a slowdown in the U.S. economy, the bank expressed its determination to combat inflation in its monetary minutes。In its minutes, the Committee noted that, with inflation remaining above the Committee's long-term target of 2 per cent, participants hoped that "a period of below-trend real GDP growth and weakening job market conditions" would bring aggregate supply and aggregate demand into better balance in order to keep inflation down.。

In other words, the Fed has begun to fight hard on inflation governance, at the expense of space for time, sacrificing the strong growth of U.S. GDP, as well as the growth space of the hot job market, but also to make U.S. inflation in the shortest possible time into the downward channel, in the medium and long term to reach the 2% target。

From this point of view, if the U.S. economy really slows down in the second half of the year, the market should not be surprised, because this is both the result of the Fed's policy of raising interest rates, but also a means used by the Fed to control inflation, the two are mutually causal, together for the bank's inflation governance escort。

The June pause in rate hikes was the result of an extremely hawkish compromise

In addition, the Fed's vote committee's attitude at the monetary policy meeting is a good illustration of the bank's determination to fight inflation to the end。

Previously, according to the Fed's SEP dot plot, among the 18 policymakers who voted on the dot plot, interest rates were expected to reach 5.5% -5.75% or more of the commissioners reached 12, three of whom wanted the terminal rate to have reached 5.Continue to raise interest rates on a 625% basis, which is actually a good indication of the Fed's overall hawkish attitude。

And according to the minutes of this meeting, after 15 months of 10 consecutive rate hikes, there are even members who want to continue raising rates by 25 basis points at that meeting.。In their eyes, the labor market remains strong, the momentum of economic activity is stronger than previously expected, and there are few clear signs that inflation will enter a long-term 2% downward path.。

This will strengthen the market's understanding of the Fed's "pause" rather than "suspension" of monetary policy actions in June.。

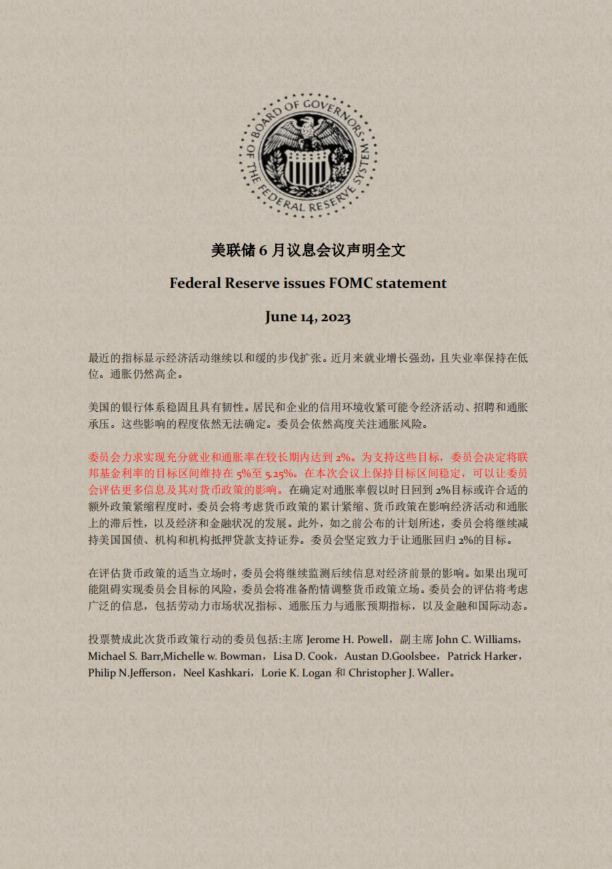

First of all, the Fed has always stressed that in June to keep the policy rate unchanged, the purpose is to "have more time to assess the progress of the economy," rather than to untie the economy, the two starting points are significantly different.。Second, according to the minutes, all participants agreed that inflation is still well above the Fed's target, which will force the bank to continue to act on monetary policy.。Finally, according to the minutes of the above-mentioned meeting, the Federal Reserve in June made a decision to suspend interest rate hikes in the initial is not a unanimous vote, but a part of the committee "compromise" product, which may give them in the July meeting to add a certain voice.。

The market is wrong.

Finally, as mentioned several times in this summary, participants were not very satisfied with the current inflation indicators.。

According to the minutes, Fed officials believe that while headline inflation has slowed over the past year, core inflation has shown no signs of sustained improvement since the beginning of the year。Among the indicators, officials also specifically cited the U.S. CPI data for May as an example, saying the indicator was declining at a slower rate than they had originally expected.。

Interestingly, the release of the U.S. May CPI data coincided with an overlap with the Fed's June policy meeting schedule, and the data recorded a more-than-expected decline at the time, from April's 4.9% fell sharply to 4%, the lowest level since March 2021。After the release of the data, the market once thought the Fed would be positive about the data, and the bank's subsequent pause in rate hikes seems to have endorsed the market's conjecture。

The results show that the market is very wrong。The Fed is not only unhappy with this unexpected drop in CPI, the bank pressed the pause button at its June meeting just to take stock of the situation.。The market's conjectures were completely lost from start to finish, when seemingly dovish decisions were actually full of hawks.。

Of the many bets, the only thing the market is betting on right is the Fed's determination to fight inflation。

On this point, Fed Chairman Jerome Powell (Jerome Powell) has long been revealed in a press conference at the June meeting.。He has said that, as shown in the SEP dot plot, the FOMC Committee agrees on the need to reduce inflation to the 2% target level and will do whatever it takes to do so (Whatever it takes)。

The three major U.S. stock indexes fell, and the probability of the Federal Reserve raising interest rates in July exceeded 90%.

Such a hawkish monetary minute certainly hit the market, and yesterday the three major U.S. stock indexes fell in response。

By Wednesday's close, the Dow was down 0.38% to 34288.64 points, S & P 500 down 0.2% at 4446.82 points, Nasdaq down 0.18% to 13791.65 points。

Currently, according to CME Fed Watch, the bank's probability of raising interest rates in July has exceeded 90% and is almost certain。In addition, the bank's probability of another rate hike in November or December has come to near 30%, and the market is gradually repricing the information released by the Fed's June policy meeting。

Attached again is the full text of the Fed's June meeting statement.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.