U.S. CPI fell more than expected in May, but Powell at the conference table couldn't laugh.

On June 13, local time, the U.S. Department of Labor released CPI data for May。According to the published data, the US CPI in May increased from 4 in April..9% fell more than expected to 4%, the 11th consecutive decline, hitting a new low since March 2021。

On June 13, local time, the U.S. Department of Labor finally released CPI data for May。Due to the overlap between the timing of this data and the Fed's June policy meeting schedule, the market is highly concerned about it。At the end of this meeting, Fed officials will not only announce the crucial interest rate decision, but also the second economic outlook for the year (with dot plot)。

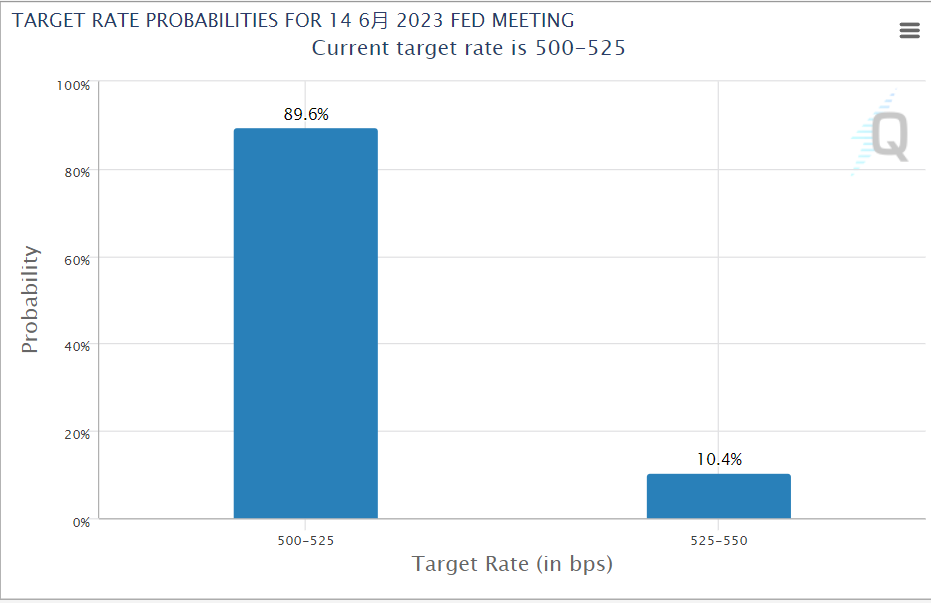

U.S. CPI fell more than expected in May and the probability of suspending interest rate hikes in June was nearly 90%.

According to the published data, the US CPI in May increased from 4 in April..9% fell more than expected to 4%, the 11th consecutive decline, hitting a new low since March 2021。In addition, according to a monthly consumer expectations survey released by the New York Fed on the 12th, the median expected inflation rate of U.S. consumers for the coming year fell by 0.3 percentage points to 4.1%, also the lowest level in two years。All the information seems to point to an end - inflation is gradually slowing and the Fed will press the pause button for rate hikes on its June rate decision。

In fact, the Fed did deliver a good report card in this "most aggressive" rate hike cycle in history.。Although it is still some way from its ultimate goal, the 4% CPI figure is already higher than last June 9..The peak of 1% is more than halved.。At the same time, the U.S. GDP data performance is fair, the labor market resilience is still in, a variety of "black swan events" does not seem to expand into systemic risk.。It can be said that the Federal Reserve is doing everything possible to protect the U.S. economy from a "hard landing."。

In this case, the market has also increased its bets on the Fed to stay put in June.。According to CME "Fed Watch," the market is currently betting that the Fed will maintain 5.The probability of a 25% interest rate cap has risen to 89.6%。If nothing else, the Fed's fight against inflation since March 2022 may come to an end, and looking back, the bank has raised interest rates ten times in 15 months, a staggering 500 basis points, enough to go down in history.。

Data fell more than expected by high base interference Core CPI data rose instead of falling.

I don't know what the other members of the policy meeting will think when they see this CPI data, but Fed Chairman Jerome Powell (Jerome Powell) is certainly not laughing.。

The reason is also obvious, yesterday's release of the CPI data of the unexpected decline, a large part of the reason is to eat the same period last year, high energy prices, high base pressure on the current inflation data dividends.。In May last year, due to the fermentation of the conflict between Russia and Ukraine, global crude oil, natural gas and other energy project prices are high, superimposed on core inflation remained high, the month's CPI data exceeded expectations recorded 8.6% and rose to a recent peak of 9 the following month.1%。

In this case, the energy segment of the CPI data for May this year decreased by 11.7%, has laid the groundwork for the data to exceed expectations of a big drop.。However, if you exclude energy, food and other seasonally volatile data sub-items, the U.S. core CPI data for May actually climbed 5.3%, even higher than market expectations of 5.2%。

Core CPI data increased instead of falling, mainly driven by used car prices and rent growth from the previous year.。US used car prices up 4 in May month-on-month, according to data.4%, the second consecutive month of high growth, which led to the second consecutive month of growth in core commodity prices 0.6%, year-on-year growth from 1 at the beginning of the year..0% to 2.0%; May rents rose 8% year-on-year..2%, which has been at a high of more than 8% for five consecutive months, up 0% from the previous month..5%。It is worth noting that, as a highly sticky sub-item, the CPI rent sub-item, while lagging behind market rents, shows little sign of sustained negative growth。

It is worth noting that both of these indicators are expected to fall in the third quarter of this year, according to the forecasts of the leading indicators.。

So, last night's CPI data, on the one hand, announced that the shadow of energy commodity inflation is gradually dissipating, on the other hand, also indicates that housing rents and used cars and other core commodities are still strong stickiness.。Thus, the downward movement of inflation will be a slow process in the future。

From this perspective, the Fed may be inclined to "skip" a rate hike at this meeting, rather than directly end the entire rate hike cycle。If there is no accident, the Fed will also be after this meeting, and the Australian Federal Reserve and the Canadian Federal Reserve on the same, while suspending the assessment of the road, and this road will be the Fed's "camera decision-making" ability to put forward quite high requirements.。

Debang Securities: Inflation Stickiness and Low Base Effect or Double Raise Inflation

After the data was released, Lu Haomin, a researcher at the Bank of China Research Institute, said that on the one hand, the benefits of improved supply are running out.。At present, energy prices have basically stabilized, and there is limited room for inflation to continue to decline, and the moderating effect of falling energy prices on CPI has also declined significantly.。On the other hand, demand-driven inflation remains stubborn, and the still tight labor market has led to strong market demand.。As a result, the marginal effect of the improvement in supply factors has weakened, while the demand factor has not cooled significantly, leaving uncertainty about the fall in U.S. inflation.。

Zhao Wei, chief economist at IFC Securities, said that the "second half" of inflation will mainly rely on the contraction of the demand side.。As the rental inflection point is approaching, service de-inflation may accelerate compared to the first half of the year, and the uncertainty of the slope mainly comes from the rebound in commodity inflation and the stickiness of wage inflation.。The U.S. economic cycle remains in a downward range and economic growth will remain below potential。

Debon Securities chief economist Lu Zhe warned, said by the same period last year high base effect suppression, May, June CPI tail effect is obvious, June CPI year-on-year or the continuation of the downward trend to 3%, but need to be wary of inflation viscosity and the second half of the low base effect, or make inflation rise twice to 4% ~ 5% range。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.