Biden roll call! The Fed's new second-in-command is on fire, and monetary policy is quietly changing.?

On May 12, the White House announced that U.S. President Joseph Biden had nominated Philip Jefferson, a member of the Federal Reserve Board of Governors, as vice chairman of the committee, and if confirmed by the U.S. Senate, he would become the second African-American to serve as the Fed's second-in-command.。

On May 12, the White House announced that U.S. President Joseph Biden had nominated Philip Jefferson, a member of the Federal Reserve Board of Governors, as vice chairman of the committee, and if confirmed by the U.S. Senate, he would become the second African-American to serve as the Fed's second-in-command.。

Scholar background debuted Biden entrusted with the task of Jefferson's top Fed second-in-command at a speed comparable to "riding a rocket"

According to official Federal Reserve information, Philip Jefferson joined the Board of Governors of the Federal Reserve by an overwhelming vote (91-7) on May 23, 2022, and served until 2036.。Previously, he served as Vice President of Academic Affairs, Provost and Professor of Economics at Davidson College, a leading liberal arts college in the United States, focusing on poverty and monetary policy.。In addition, he served as president of the National Economic Association and advised on current economic policy.。

Some analysts pointed out that last year Jefferson voted by a large margin into the Federal Reserve Board of Governors, the nomination of its re-vice chairman, in the Senate "may hardly be opposed," it can be said that Jefferson as the Fed's second-in-command is basically "a certainty."。

Surprisingly, in less than a year, Jefferson, 61, has stepped into the Fed's inner circle at a speed comparable to "boarding a rocket."。In this circle, along with him is Federal Reserve Chairman Jerome Powell (Jerome Powell), as well as the Fed's "third-in-command," New York Fed President John Williams (John Williams)。

Biden said in a statement that the nominees understand that the job is not partisan (not a partisan one) and that they need to play a key role in pursuing maximum employment, maintaining price stability and regulating financial institutions.。He also expressed confidence that the nominee, under this administration, can help build a "historically strong economic recovery."。

Upon hearing the news, Jefferson's reaction was quite scholarly, saying that I was deeply honored and humbled。

hawkish views have been "loosened"?Jefferson or hinted at a wait-and-see on monetary policy Eagle king rare dove.

Previously, the market judged Jefferson to be on the hawkish side of the monetary consolidation policy view.。Beginning in May 2022, as a member of the Federal Reserve Board of Governors, he voted in favor of all Fed rate hikes。On unemployment, he is in line with Powell, who has noted that the unemployment rate may have to rise, at least slightly, to bring inflation down to the Fed's 2 percent target。

While Jefferson's predecessor, Lael Brainard, who has been reappointed by Biden as director of the White House National Economic Council (NEC), has also been more hawkish in his previous views, he also publicly supported the Fed's aggressive rate hike policy last year.。However, since the end of last year, her attitude has begun to shift, gradually emphasizing the different factors that need to be considered when setting policy, and saying that these factors may require a less aggressive approach, raising doubts that Jefferson's approach to monetary policy may be significantly different from that of his predecessor.。

A few hours later, Jefferson delivered a speech at the Hoover Institution at Stanford University, his first public comment since the White House nomination announcement.。

In a prepared speech, he noted that current U.S. inflation remains high, but that policy will take time to penetrate the economy and is "going well."。He said: "Apart from the unexpected fall in used car prices in March, core commodity prices have been less anti-inflationary than expected.。There are long-term and diverse lags in the impact of monetary policy on the economy and inflation, and the full impact of our rapid tightening may be ahead。"

On the issue of the banking crisis, he said the pressure on banks following the recent collapse of several mid-sized U.S. banks could lead to tighter credit conditions in the future, helping the Federal Reserve to further cool the economy.。Jefferson said: "We are seeing financial conditions tighten as a result of our monetary policy actions, which may be exacerbated by the impact of recent banking stress on credit conditions.。But he also said that because the current turmoil is isolated and quickly contained, credit restrictions may only have a "moderate" negative impact on economic growth, adding that there is still "significant uncertainty" in credit this year.。

It is worth noting that in this speech, Jefferson's hawkish view of monetary policy appears to have moderated, beginning to suggest that he will wait and see how the lag and diversity of monetary policy and tighter credit conditions cool the economy.。

Coincidentally, the so-called Fed "Eagle King" of the St. Louis Fed Chairman James Bullard (James Bullard) also said at the meeting "rare" in view of the current macroeconomic conditions, monetary policy is currently in can be said to be "fully restricted low-end."。Some analysts point out that Brad may be suggesting that the Fed's rate hike process is coming to an end。

In addition, Jefferson's language is consistent with the Federal Open Market Committee (FOMC) statement issued by the Federal Reserve at the beginning of the month.。In the statement, the Fed announced its 10th rate hike since March 2022, raising the target range for the federal funds rate by 25 basis points to 5% to 5%..Between 25%。However, in the statement, the Fed did not re-emphasize its "full tightening" stance, but committed to consolidating the tightening effect through the cumulative and lagging effects of monetary policy.。In determining future additional monetary tightening, the Committee will take into account the cumulative effects of existing monetary policy, the lag in monetary policy, and the overall economic and financial environment, the statement said.。

At that time, the Fed's "mouthpiece" Nick Timiraos (Nick Timiraos) also said that the Fed's FOMC from the March policy statement to delete a sentence, that "some additional policy tightening may be appropriate" (The Committee anticipates that some additional policy confirming may be appropriate), the market generally believes that this is the Fed to suspend the interest rate hike cycle signal。

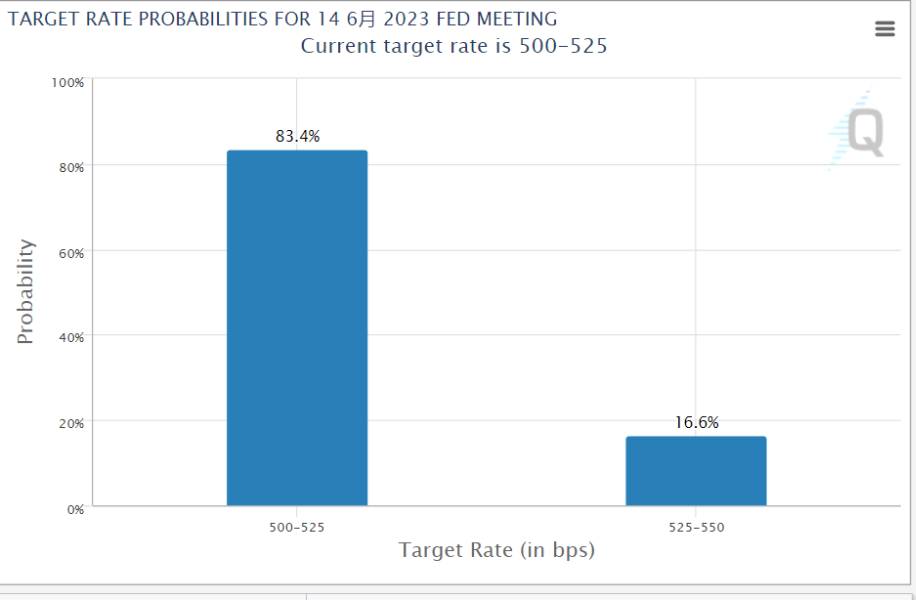

As of press time, according to CME Fed Watch, the probability of the Fed standing still at the June meeting is as high as 83.4%。

As for Jefferson's remaining committee seat vacancy, Biden chose Adriana Kugler, the U.S. representative to the World Bank, to replace him.。If confirmed by the Senate, she would become the first Hispanic on the Fed's rate-setting committee.。

Earlier, it emerged that the White House was initially considering another candidate, Janice Eberly, who served as assistant secretary for economic policy at the U.S. Treasury Department.。But some senators have called for Hispanics to be considered for Fed seats, and the White House may have scruples about that。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.