U.S. inflation fever does not retreat, saying that the Fed's rate cut may slow sharply in the future.

While the Fed's inflation governance over the past year has been effective under the existing restrictive interest rate policy, it is still far from its 2% target, which is enough to worry Fed officials。

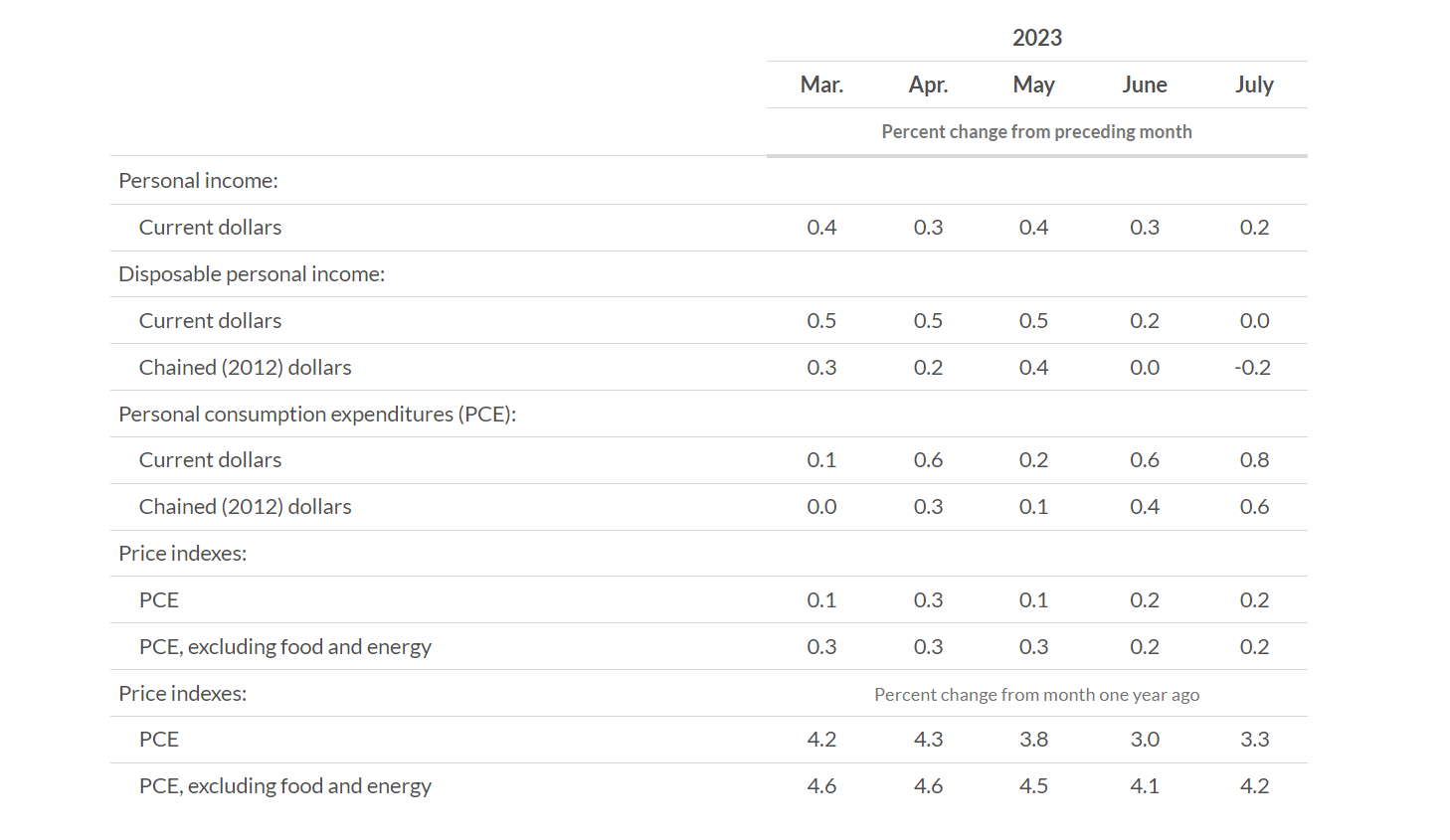

On August 31, an important inflation data before the Fed's September meeting - U.S. personal consumption expenditure index (PCE) data for July was released: core PCE rose 0.2%, up 4.2%, in line with market expectations。

U.S. Consumer Spending Remains Strong in July

The data show that, on the one hand, inflation in the United States continues to be high and consumer spending remains strong, helping to boost market expectations that the economy will avoid a recession;。

Specifically, PCE personal consumption spending in current dollars increased by $144.6 billion in July.。Of this amount, reflecting an increase in spending on services and goods consumption of $102.7 billion and $41.9 billion, respectively。

Among the services, the four projects that contribute the most to the data are the Financial Services and Insurance Project, the Housing and Utilities Project, the Food Services and Accommodation Project, and the Healthcare Project, driven by Portfolio Management Investment Advisory Services, Housing, Food Services and Outpatient Services, respectively.。

Within the merchandise segment, the largest contributors to growth were "other" non-durable goods, driven primarily by pharmaceuticals and recreational goods.。In addition, food and beverage items, recreational goods and vehicles also contributed to the growth of commodity items.。

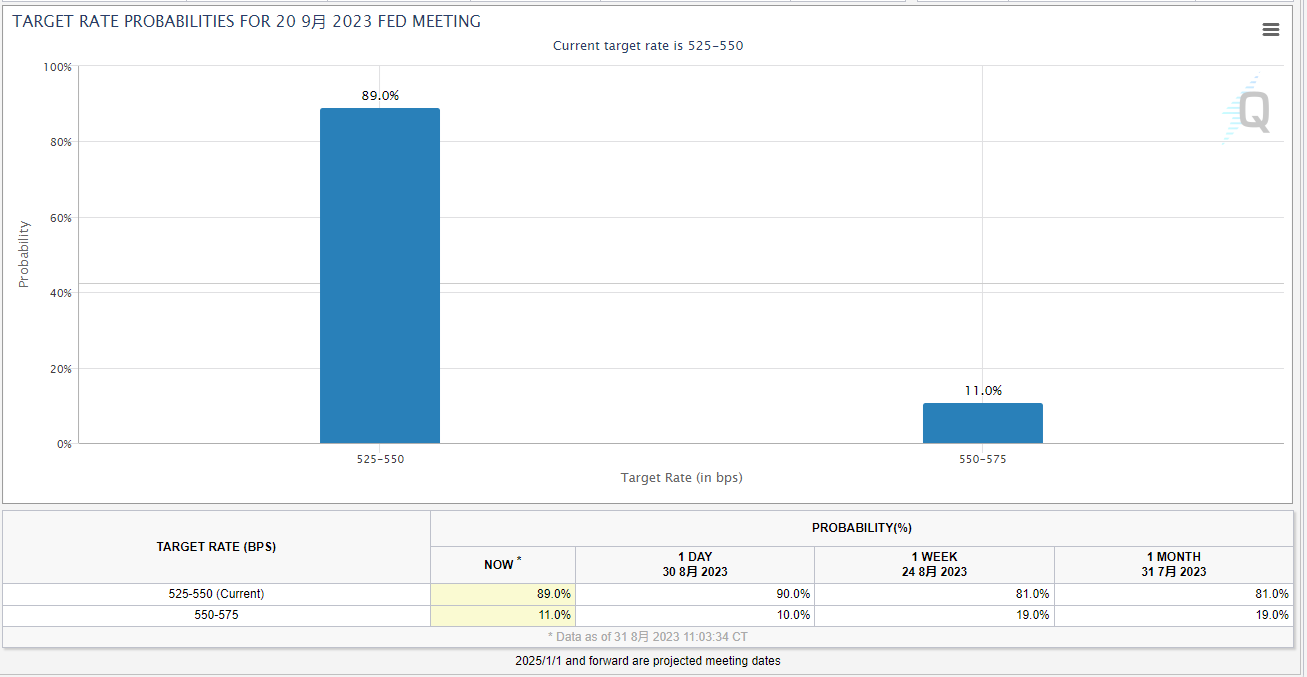

Commenting on the data, LPL Financial chief economist Jeffrey Roach said: "The market has largely ignored today's inflation data.。While the specifics of the data were somewhat disappointing, it reinforced market speculation that the Fed would not change its plan to keep interest rates unchanged in September.。"

Wall Street: Fed may keep restrictive interest rates for longer

Already this week, the U.S. labor market is showing signs of cooling。Ahead of the PCE data, US ADP employment rose less than expected in August, recording just 17.70,000 people。The previous value plunged 45% and recorded the smallest increase in 5 months.。Data show that in August this year, the wages of American employees increased by 5.9%, a record low in nearly two years。

However, if the U.S. inflation data continues to be high, the Fed has every reason to keep the restrictive rate for more time。Wall Street expects future Fed rate cuts could slow sharply more than expected。Recently, Karen Karniol-Tambour, co-chief investment officer of Bridgewater, said in an interview that rapid rate cuts usually require a rapid economic collapse, "which is a far cry from where we are today."。

She believes the Fed will not rush to raise or lower interest rates。She said: "If I were in their position, I would think that the threshold for both options is quite high.。"I need to watch events unfold, but with inflation more stubborn or higher than it should be, I'm certainly not excited about a big rate cut."。"

Bank of America also said that the hawkish stance expressed by Fed Chairman Jerome Powell (Jerome Powell) supported the agency's expectations for the pace of Fed rate hikes.。Bank of America economists said in the report that the Fed is expected to raise interest rates by 25 basis points in November and will maintain a high benchmark interest rate for a long time in 2024.。In addition, the bank's expectation of a Fed rate cut in 2024 is just 75 basis points。

Notably, 10-year U.S. bond yields hit a three-week low after the PCE data, but were still up four months in a row as of August。The dollar index, on the other hand, halted its three-week decline and moved off a two-week low.。As of press time, according to CME Fed Watch, the bank's chances of standing still in September are close to 90%。

At present, the market has turned its attention to the important non farm data released。Hugh Gimber (Hugh Gimber), a strategist at JPMorgan Asset Management, said the Fed's interest rate decision was the most anticipated event in September, while non-farm payrolls were highly correlated with the rate decision, and a soft landing would have been impossible without lower pay growth.。

The market expects U.S. non-farm payrolls to record 170,000 after the August quarter, slightly lower than the previous value of 18.70,000 people。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.