Fed meeting outlook: inflation governance "last mile" in the end or not to finish?

At 14: 00 EST on July 26, the Fed will announce its July rate decision。In a policy news conference to follow, Powell will reveal more about the。

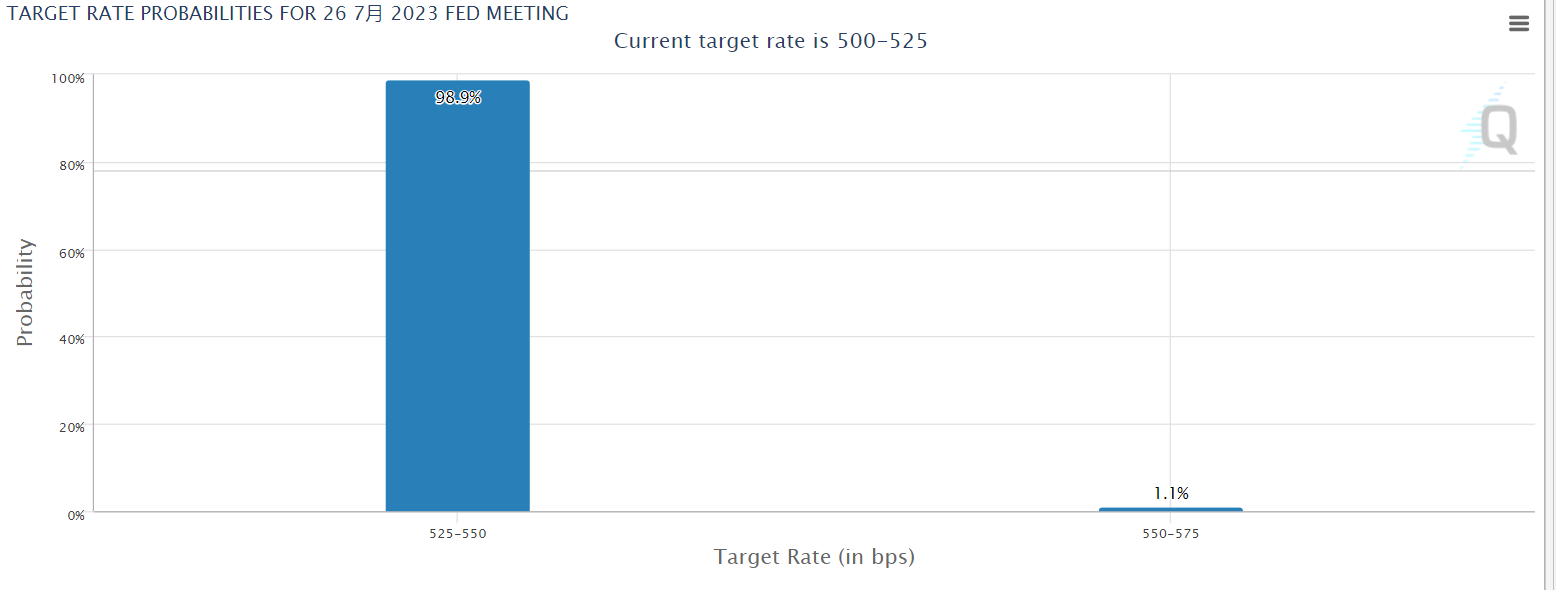

On July 26, local time, the Federal Reserve is about to announce its July policy rate cap。According to market pricing, the bank in this meeting to restart the possibility of raising interest rates has been as high as 98..9%。If nothing else, after today, the Fed will push the policy rate ceiling to 5.5%, which is also highly likely to be the peak of the current rate hike cycle。

Inflation pressure easing does not change the Fed's determination to raise interest rates.

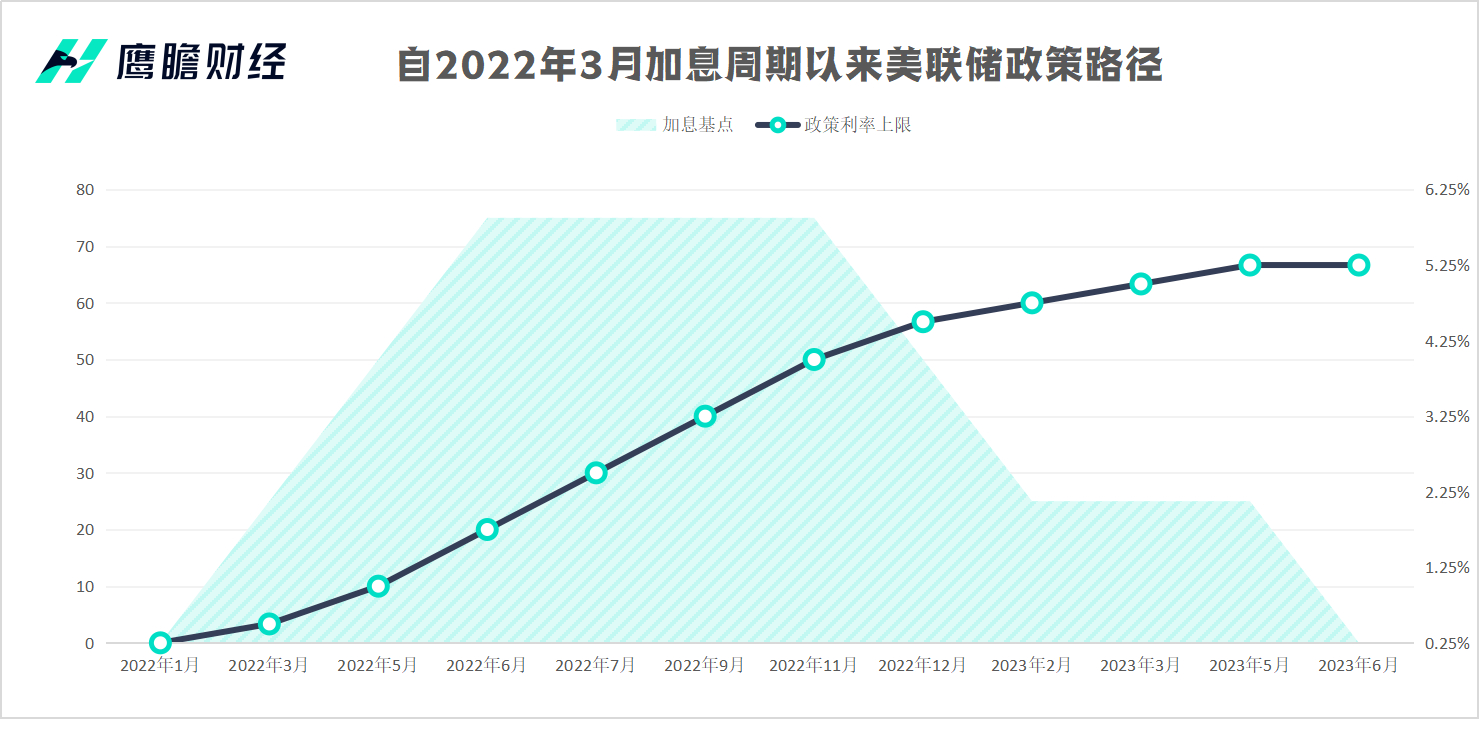

Since March 2022, in an effort to curb high inflation, the Federal Reserve has embarked on a particularly aggressive monetary tightening cycle, raising interest rates ten times in a row for more than a year, cumulatively by a staggering 500 basis points, until the pause button was pressed last month.。

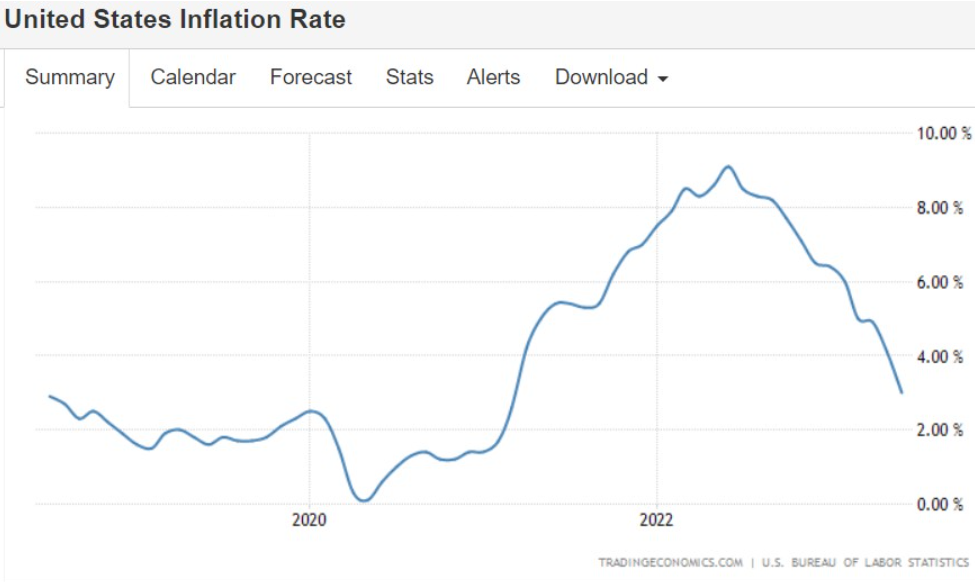

Thanks to the bank's tireless efforts, inflation governance in the United States has finally come to fruition: the U.S. CPI data for June has returned to the 3-word front, which was as high as 9 in June last year..1%。Not only that, even the Fed's recent focus on core CPI data also recorded a decline this month, representing the cooling of U.S. prices into deep water.。Today, the U.S. Bureau of Economic Analysis will also release the initial annualized quarterly value of the core PCE price index for the second quarter of this year, which was 4.9%, already lower than the same period last year。

According to the analysis of IFC, since the second quarter of 2023, the United States has been more than half of the overall de-inflation action, after which the downward movement in inflation will be premised on a contraction in aggregate demand.。The agency pointed out that, from a structural point of view, the commodity to inflation will shift to services to inflation, the downward slope of inflation will flatten; from a dependency point of view, the United States inflation governance has gradually shifted from supply-led to demand-led, which means that the magnitude of the downward movement of U.S. inflation will be more dependent on the degree of demand contraction;。

Based on past experience, PPI is ahead of CPI and CPI is ahead of core CPI in order of de-inflation。According to data released by the U.S. Bureau of Labor Statistics in the middle of this month, the U.S. June PPI rose only 0.1%, compared with 1 in May.1% fell sharply and was below the 0 that economists generally expected.4%, a three-year low。Worldwide, the PPI in all countries are rapidly bottoming out, among which, the United States, the European Union, the United Kingdom and China, India, Brazil, Russia and other PPI year-on-year has been in the low range of nearly three years.。

Overall, although the recent inflation data in the United States has handed over a series of relatively satisfactory report card, but this report card is not enough to shake the Fed in July to restart the interest rate hike "established plan."。From the minutes of each meeting, regardless of the market's voice, the Fed's position has never changed, that is, "spare no effort" to implement the anchor target of pulling inflation back to 2%。

On this issue, Fed Chairman Jerome Powell (Jerome Powell) has never expressed a trace of timidity, repeatedly reiterated that the Fed will fight inflation to the end。He has said impassively that the FOMC committee agrees on the need to reduce inflation to the 2% target level and will do whatever it takes to do so, and that's our plan。Price stability is for the benefit of today's workers, families and businesses, benefits generations, is the cornerstone of the economy, and is our top priority.。

Discussions continue on the "last mile" of inflation governance

Of course, the market is not disillusioned with the Fed's interest rate hike this month, its real concern is whether the rate hike is the Fed's "last plus."。

Some say the Fed should accept a 3% inflation rate and use the cumulative and lagging effects of monetary policy to pull inflation down to 2% in the long run。In the eyes of these people, further rate hikes could be counterproductive as it could plunge the U.。

Mohamed El-Erian, a well-known economist from the Allianz Group, holds this view.。He argues that inflation of around 3% is already acceptable to the Fed and should not be allowed to plunge the U.S. economy into recession in order to bring price increases down to the 2% target。

Well-known economist Paul Krugman (Paul Krugman) also agreed with this view, he said this month, inflation has been reduced to the limit of people's hearts, the Fed continues to raise interest rates will bring "pain."。The Nobel laureate said in a tweet that once inflation falls below the important threshold that people have been noticing, the issue of inflation becomes less pressing。

The view is that once inflation falls to around 3-4%, it fades out of the public consciousness and not everyone cares about it, and employees don't pre-emptively demand raises to ward off rising prices, so prices don't rise as fast。Krugman said U.S. inflation has now fallen below that threshold, and that if the Fed continues to raise interest rates, it will only bring very limited benefits, but will bring great pain to those who suffer wage cuts or lose their jobs as a result.。

In addition, former Federal Reserve official Vincent Reinhart (Vincent Reinhart) also believes that the so-called inflation governance "last mile" to the end "difficult" - that is, the U.S. inflation rate to 2% annual growth rate may be more difficult than inflation to 3%。The reason: inflation is widespread in the service sector, where prices tend to be more sticky and wages account for a larger proportion of operating costs。

In the eyes of others, the Fed's inflation governance is far from over, the intensity of monetary policy is far from enough, and further interest rate hikes are "reasonable and necessary."。

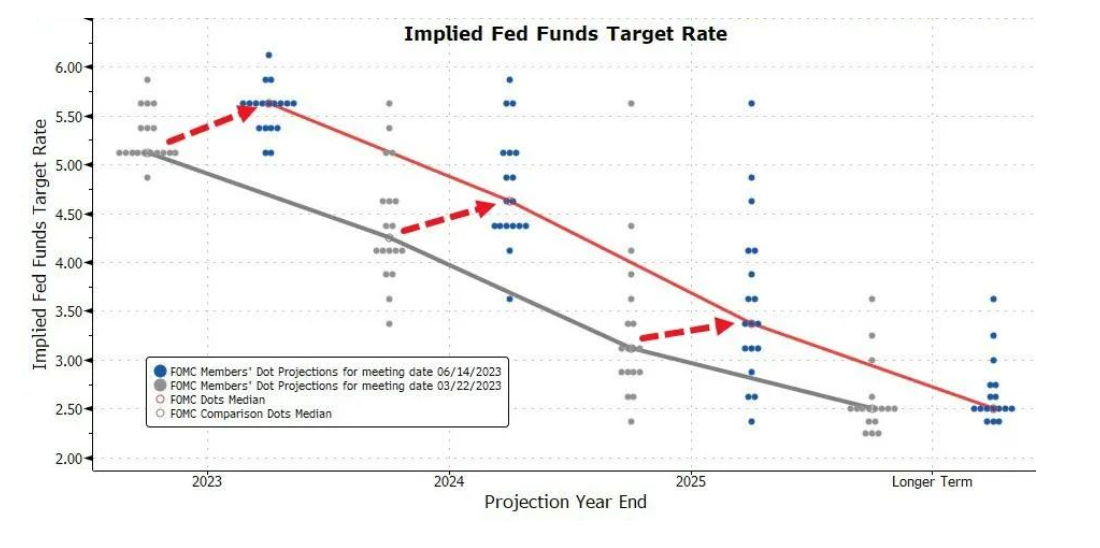

In fact, this view can also be regarded as the "official view" of the Federal Reserve.。According to the dot plot released by the Fed after its June meeting, the bank's median interest rate forecast for the end of the year went from 5.1% jump to 5.625%。This means that at least two more rate hikes will be needed in the four Fed meetings in July, September, November and December to complete the Fed's suggested rate hike target on the dot plot.。

Two weeks later, the Fed released the minutes of the above meeting, which was more hawkish than the market thought: the minutes repeatedly mentioned that participants were not very happy with the current inflation indicators.。Fed officials believe that while headline inflation has slowed over the past year, core inflation has shown no signs of sustained improvement since the beginning of the year。Among the indicators, officials also specifically cited the U.S. CPI data for May as an example, saying the indicator was declining at a slower rate than they had originally expected.。

Interestingly, the release of the U.S. May CPI data coincided with the timing of the Fed's June policy meeting and recorded a more-than-expected decline at the time.。The Fed then suspended rate hikes as expected, and the market had thought the bank was moved by the better-than-expected CPI data。However, judging from the minutes of the meeting, the Fed does not seem to be interested in the data, and the pause in rate hikes is just to take stock of the situation.。

Former U.S. Treasury Secretary Lawrence Summers also said it would be a bad idea for the Fed to settle for just 3 percent inflation, as it could lay the groundwork for a stronger price growth trend in the next economic cycle.。

In Summers' eyes, no matter where the inflation target set by Fed officials goes, it is only likely to be the low point of the current inflation cycle, not the average.。This suggests that low inflation is at risk of rebounding at any time, as "inflation may rise during the recovery."。He also stressed that while the likelihood of a "soft landing" in the United States with inflation below 3 per cent was indeed greater than before, the likelihood was still "well below 50 per cent."。

Fed megaphone: Strong wage growth worries economists

Before the announcement of the interest rate decision, Nick Timiraos, a senior journalist known as the "Fed's mouthpiece," wrote that it is difficult to predict the Fed's next move after Thursday's rate hike due to the uncertainty of inflation.。

In an article titled "Why the Fed Is Not Ready to Declare Inflation Victory," he said the Fed is expected to raise interest rates by 25 basis points at this meeting。But some Fed officials and economists worry that inflation is only easing temporarily and that underlying price pressures may persist, requiring the Fed to raise interest rates and hold them for longer.。

They argue that there is too little slack in the economy and too much demand to be reasonably confident that inflation will return to the Fed's 2% inflation target in the next few years。They do not share investors' recent optimism that inflation can continue to ease without the economy falling into recession.。

In such an environment, the focus of many economists' concerns is strongly rising wages。They argue that without a recession, labor market tensions will push up core inflation next year。According to the U.S. Labor Department's Employment Cost Index, U.S. wages and salaries jumped 5 percent year-on-year in the first quarter of this year, which could lead to a rebound in inflation。

In terms of employment, U.S. non-farm payrolls remained strong in June: non-farm payrolls exceeded 200,000, unemployment, labor force participation remained stable, and wages rose slightly, all indicating that the labor market remains tight and relatively healthy.。

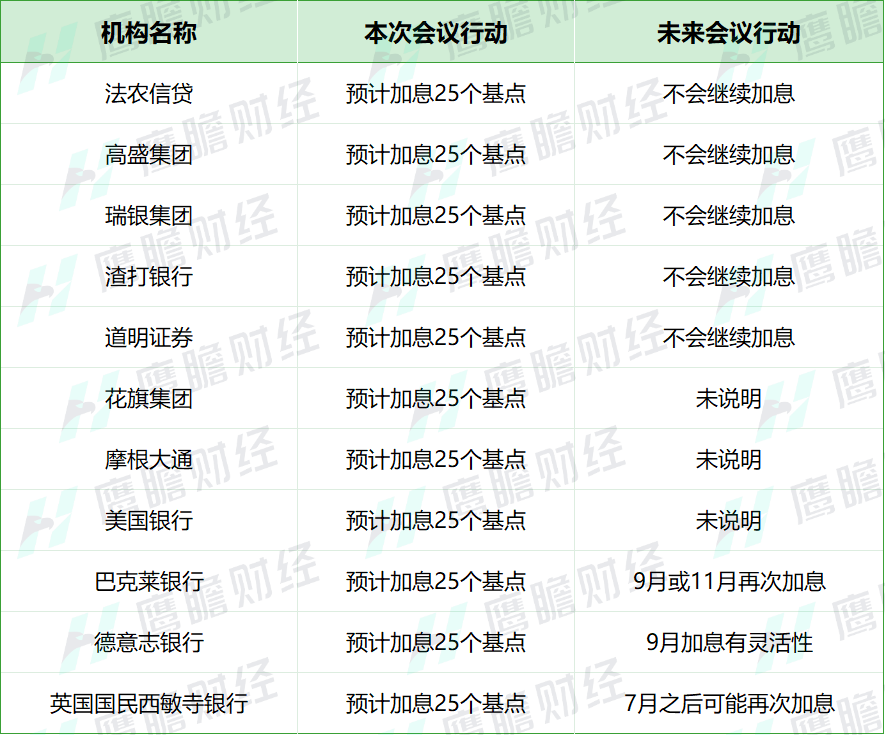

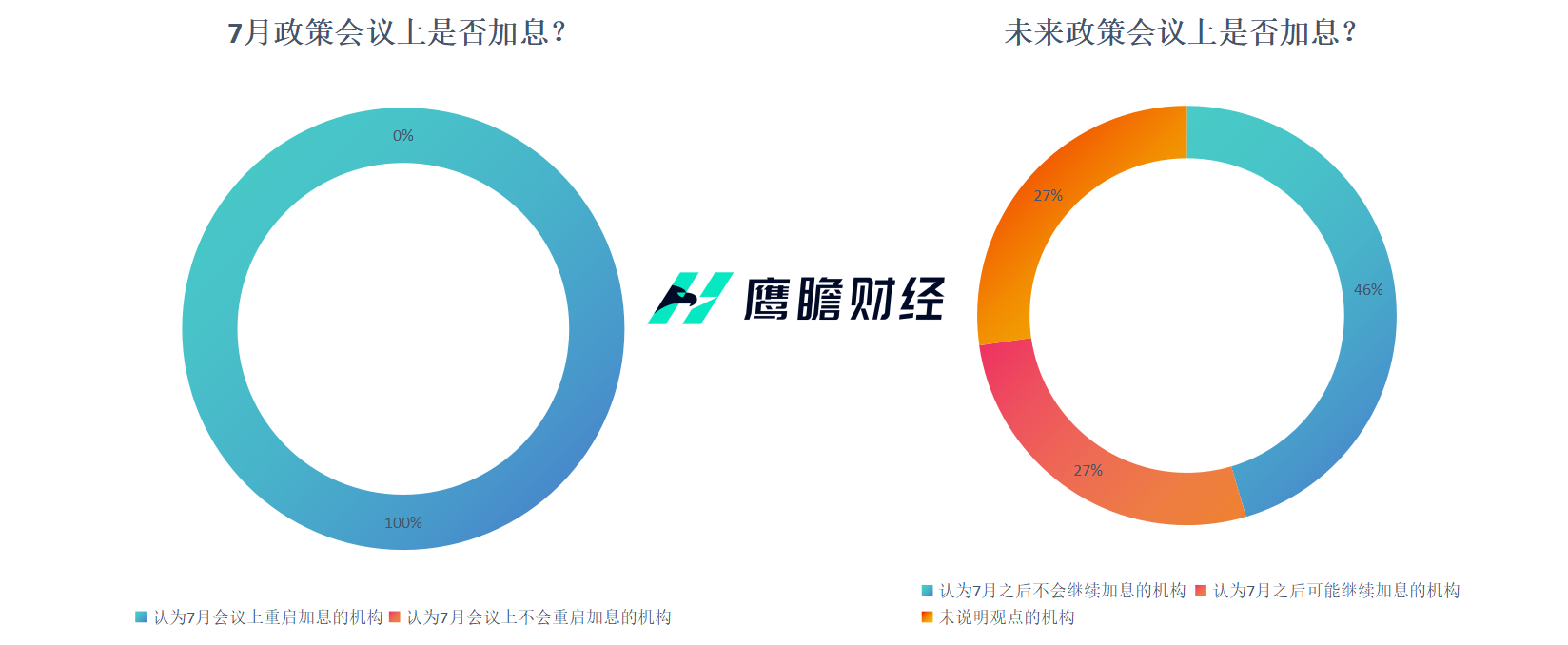

Currently, of the 11 institutions summarized by the media, all believe that the Fed will continue to raise interest rates by 25 basis points at this meeting。However, the institutions are divided on future monetary policy movements: five believe that the Fed will not continue to raise interest rates after July; three believe that the Fed will remain flexible in its policy movements after July; and three have not expressed their views.。

At 14: 00 EST on July 26, the Fed will announce its July rate decision。In a policy news conference to follow, Powell will reveal more about the。At that time, the market can peek from its speech, the Fed is willing to walk the "last mile" of inflation governance.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.