Fed's November interest rate decision: continue to hold back the door to rate hikes may be closed

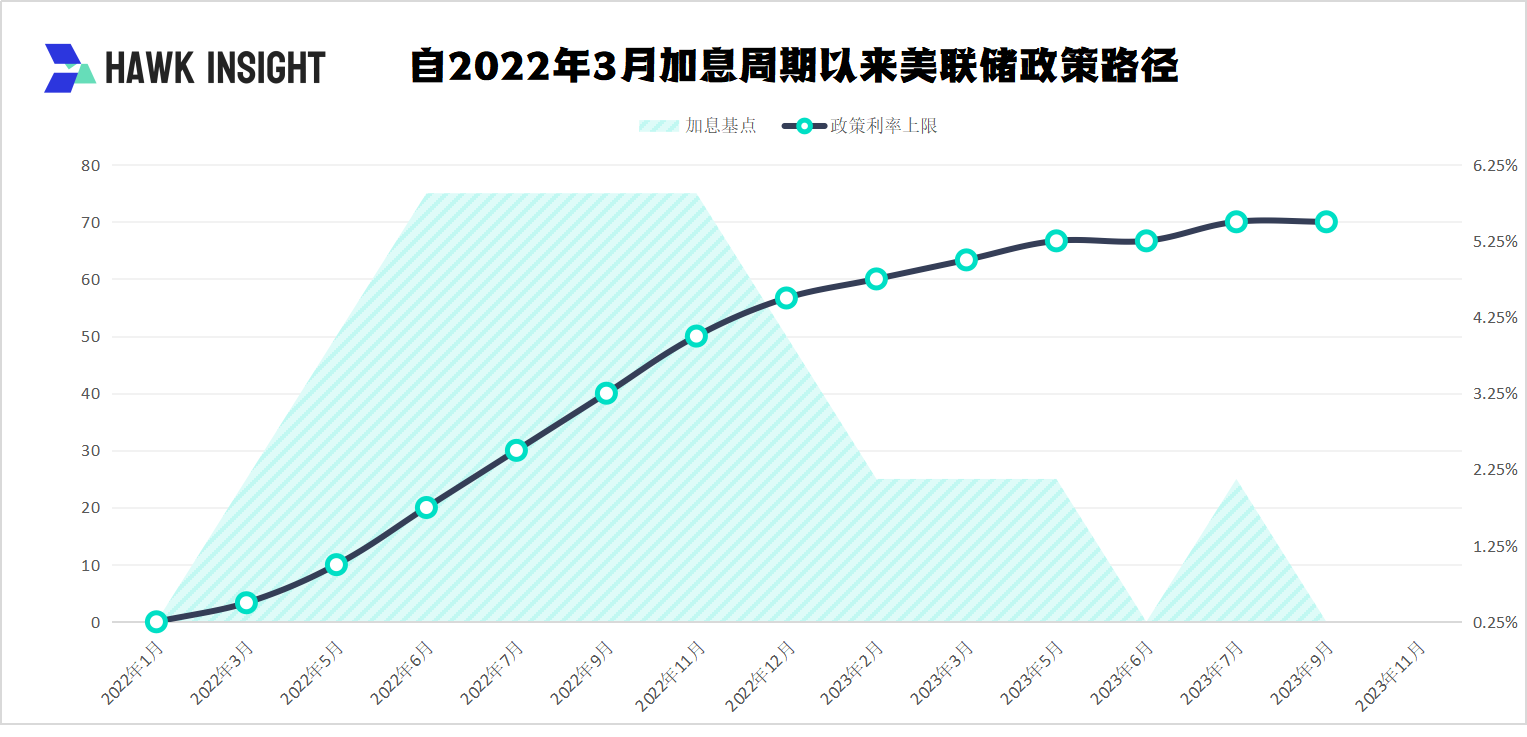

The Fed's latest interest rate decision has been out, two consecutive holds, giving us reason to believe that the Fed may have closed the door to raising interest rates.。

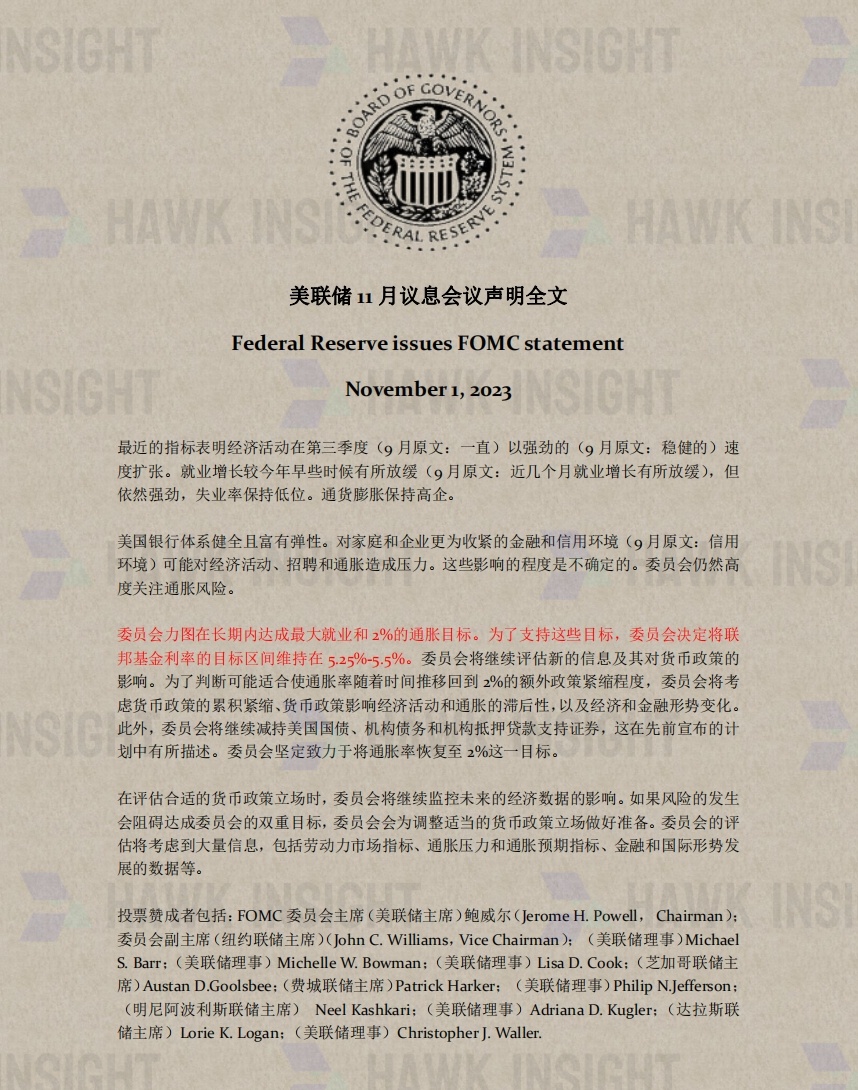

Unsurprisingly, on November 1, local time, the Federal Reserve announced its interest rate decision, keeping the target range for the federal funds rate at 5.25% -5.5% unchanged, twice in a row, in line with market expectations。

High interest rate environment eases Fed policy burden

Despite no rate hikes, 5.25% -5.The 5% interest rate is also the highest in the Fed's 22-year history, and the impact of the high interest rate environment is gradually becoming apparent through the bond market, where U.S. 10-year Treasury yields are approaching the 5% level.。As the "global asset pricing anchor," the U.S. 10-year Treasury yield symbolizes the cost of acquiring dollars and has pricing properties for other assets.。When Treasury yields continue to rise, the cost of consumption and borrowing for U.S. residents will also rise, which will have a dampening effect on the economy and reduce the policy burden on the Federal Reserve.。

According to Wall Street economists, the sharp decline in U.S. stocks and rising bond yields have had a fairly significant dampening effect on the economy over the past few months, to the extent that the Federal Reserve has raised interest rates by 3 to 4 basis points.。Powell has also said in response that tightening financial conditions is exactly what we want to achieve。

In addition, in the interest rate resolution statement, the Fed also said that the tightening of the financial environment brought about by rising U.S. bond yields may have an impact on the economy and inflation, which represents the Fed's officials attach great importance to the bond market changes to the overall financial environment to tighten the role of promotion.。Analysts also said that at this Fed press conference, Fed officials impressed the public that they are highly concerned about the volatility of the U.S. bond market。

U.S. stocks closed higher on the third line yesterday, spurred by news of the Fed's suspension of rate hikes。Among them, the Dow rose 0.67% at 33,274.58 points; S & P 500 up 1.05% at 4,237.86 points; Nasdaq composite up 1.64%, at 13,061.47 points, up four days in a row。

U.S. bond yields fell across the board.。2-year U.S. bond yields fall 14.2 BPS 4.954%, 3-year U.S. bond yields fell 17 basis points to 4.759%, 5-year U.S. bond yields down 19.6 BPS 4.66%, 10-year U.S. bond yields down 19.4 BPS 4.739%, 30-year U.S. bond yields down 16.1 BPS 4.932%。

Powell: Inflation is continuing to fall towards our target

Fed Chairman Powell attended a regular press conference after the rate decision was announced。

At the press conference, Powell still stressed the importance of keeping inflation down, which is already the traditional art of the Fed's press conference.。Powell said: "My colleagues and I remain focused on our dual task of promoting maximum employment and stable prices for the American people.。We understand the difficulties posed by high inflation and we remain firmly committed to our goal of reducing inflation to 2 per cent.。Price stability is the Fed's responsibility。Without price stability, the economy doesn't work for anyone。In particular, without price stability, we will not be able to achieve consistently strong labour market conditions that benefit everyone.。"

Powell appeared to be satisfied with the current economic activity, saying that recent economic data showed that economic activity has been growing strongly, much higher than earlier expectations.。He went on to say that real GDP rose 4% year-on-year in the third quarter, driven by a surge in consumer spending..9%。After a pick-up in the summer, activity in the real estate sector has leveled off and remains well below where it was a year ago, largely driven by rising mortgage rates.。Higher interest rates also appear to weigh on corporate fixed-asset investment。

For the job market, Powell stressed that the labor market remains tight, but supply and demand conditions continue to converge.。In the past three months, the average monthly increase of 26.60,000 jobs, a robust growth rate that is still below levels seen earlier this year.。Unemployment remains low at 3.8%。Strong job creation has been accompanied by an increase in the labour supply: the labour force participation rate has risen since the end of last year, with the most pronounced increase among those aged 25 to 54, and the number of immigrants has rebounded to pre-epidemic levels.。Nominal wage growth has shown some signs of easing, with job openings falling so far this year.。Although the gap between employment and workers has narrowed, labor demand still exceeds the supply of available workers.。

On inflation, Powell said, "Inflation remains well above our long-term target of 2 percent.。In the 12 months to September, the overall PCE price index rose 3.4%。Excluding volatile food and energy categories, the core PCE price index rose 3.7%。Inflation has slowed since the middle of last year and the summer values are quite favorable。But months of good data are just the beginning of building confidence that inflation is continuing to fall towards our target.。There is still a long way to go to bring inflation down to 2%.。Despite high inflation, long-term inflation expectations appear to remain well anchored, as reflected in extensive surveys of households, businesses and forecasters, as well as measures of financial markets.。"

With regard to future monetary policy, the likelihood of the Fed raising interest rates by another 25 basis points at its next meeting on December 13 has gradually diminished.。According to CME Fed Watch, the implied probability of a December rate hike has fallen to 17.1%, down from 28 on Tuesday.8% and 29 a week ago.3%。

There is reason to believe that the Fed may have closed the door to raising interest rates。

Attached: Full text of the Federal Reserve's November interest rate resolution statement

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.