US August CPI data: Overall, it's a mixed bag

The CPI data released last night was misread by the market at the beginning.。

Finally, the Fed's last inflation report before its September 20 meeting came out.。

The market misreads the "base effect" of the three major U.S. stock indices V-word reversal.

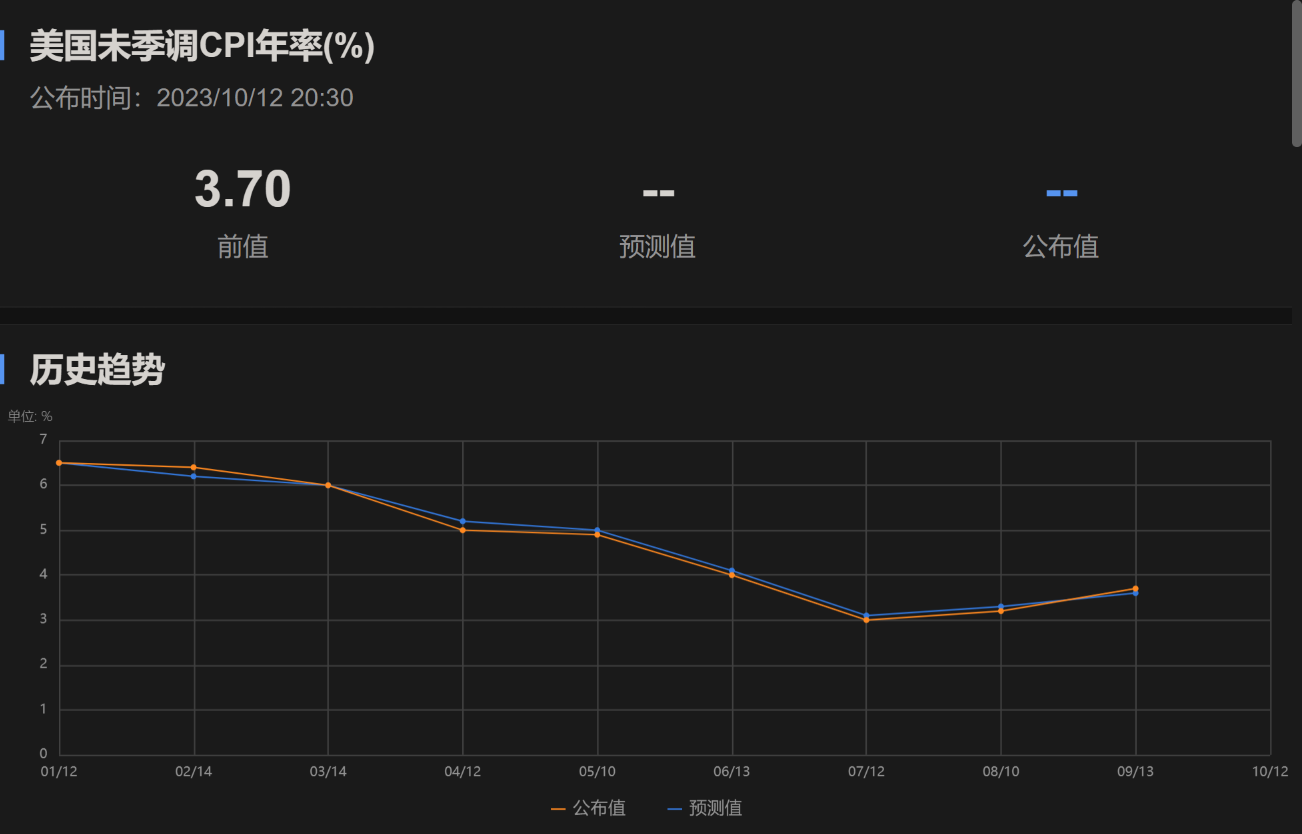

The U.S. consumer price index (CPI), which measures the cost of various goods and services, rose 3 percent in August from a year earlier, data showed..7%, higher than expected 3.60% and previous value 3.20%, a new high since May this year, has rebounded for the second time in a row.。

At first glance, this seems like a bad inflation data。After all, the Fed's September rate meeting is just around the corner, and any hint of wind and grass is likely to stimulate the nerves of FOMC members.。Not surprisingly, the three major U.S. stock indexes quickly dipped after the opening yesterday, once forming a killing trend。

However, this pessimism seems to be quickly corrected。After the opening dive, U.S. stocks stopped falling and went back up。By the close, the Dow was down 0.20% at 34,575.53 points; S & P 500 up 0.12%, at 4467.44 points; Nasdaq up 0.29%, 13813.59 points。

This shows that the CPI data released last night was misread by the market at the beginning.。

The reason for this misreading is related to the U.S. Department of Labor's statistical caliber of CPI data, as CPI year-on-year data is to compare commodity prices in August this year and commodity prices in August last year, so, for year-on-year data, the same period last year's data will have a significant impact on the CPI growth, which is also known as the "base effect."。

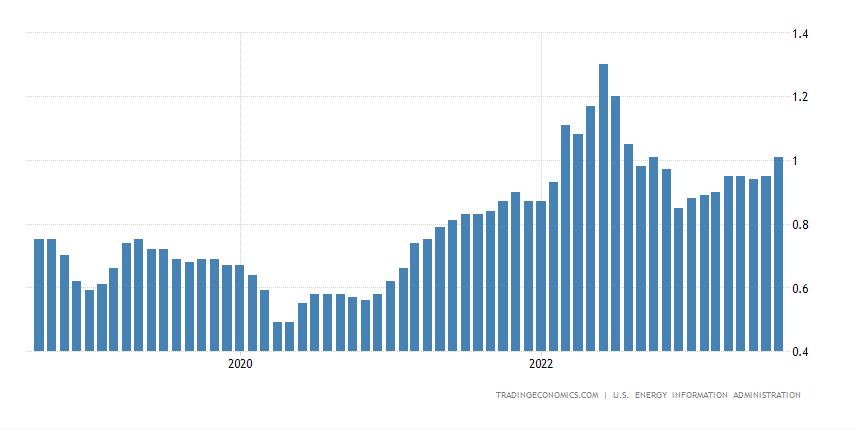

As last summer, the U.S. gasoline prices ushered in a wave of rapid decline, this factor is also likely to raise the price level of energy commodities in the U.S. CPI data in August this year, as energy commodities in the non-core CPI statistics accounted for a large proportion, so the upward movement of the project will have an impact on the overall CPI year-on-year climb。

On the issue of the base, White House officials have also said that the year-on-year increase in inflation data does not mean that the month-on-month increase is widening, and the market needs to include the level of inflation in the same period last year as a reference.。

Not to mention, as can be seen from the chart, gasoline prices in the United States have also risen in recent months, amplifying the effect of the base effect。According to the EIA, U.S. gasoline prices experienced a surge in August, reaching 3 per gallon in the third week of the month..$984 peak。In this month's CPI statistics, gasoline prices also increased by 10% month-on-month..6%。

Therefore, in the case of strong interference in the energy sector, the market turned to focus on the CPI ring data and the core CPI data excluding food and energy.。

Data show that the overall U.S. CPI data for August was only 0 higher than the previous month..6%; unseasonally adjusted core CPI up 4.3%, the lowest since September 2021, with growth falling for six consecutive months;.3%, slightly above the 0 expected by economists surveyed by Dow Jones.2% increase。

The increase in core CPI was mainly due to high prices of core services.。Among them, inflation in the services sector, excluding housing, remains high, while the price of housing services, which accounts for a third of the overall CPI, also rose by 0 in August..3%, climbing for 40 consecutive months, contributing to the upside of core CPI。

So, overall, it's a mixed bag of data, not one-sided pessimistic expectations。

Wall Street: sure the Fed is on hold in September

After the CPI data was released, Wall Street economists have also expressed their views, most of them said that although the CPI data is mixed, but the Fed will still suspend the process of raising interest rates in September。

Evercore ISI analyst Krishna Guha said: "While this report is not surprising on the policy front, it is not a disaster either.。It's not an excellent consumer price index report, but it won't change the Fed's basic outlook either.。The Fed is not eager to raise rates again, and we believe that it will take more effort to push the FOMC to actually raise rates again, and we basically judge that the Fed has completed its task of raising rates。"

Chris Zaccarelli, chief investment officer of Independent Advisor Alliance, also said that the CPI data is not the ideal situation the market wants to see, but the market can still trade within a range.。Inflation is high enough that the Fed still needs to act, but not high enough to change the "Fed is almost done" storyline。He noted that as long as the economy remains resilient and inflation no longer intensifies, the market can rebound at the end of the year, especially after a generally weaker period in September and October.。

Titan Asset Management Chief Investment Officer John Leiper also believes that the data did not have much impact on the market, and they still expect the Fed to keep interest rates unchanged at its next meeting.。The market may be pricing in the possibility of another rate hike this year.。

Florian, an analyst at Lombard Odier Asset Management, expressed much the same view, saying the inflation report made the Fed feel more comfortable and could take a wait-and-see approach.。Inflation is slightly higher than expected this time, but mainly due to fluctuations in energy prices, the Fed should not be too worried at this time。

On the other hand, Damian McIntyre, portfolio manager for Federated Hermes' alternative stocks, said that while today's U.S. CPI report did not have a significant impact, the data could give the FOMC another pause in rate hikes in September, but did not provide a clear clue about Fed action thereafter。

He expects that in the fall, the Fed may issue contradictory statements and consensus on the best way forward is unlikely to be reached, which could lead to another hawk-dove fight at the Fed's November meeting.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.