Technology stocks one after another came "good news"! Amazon Q1 net profit year-on-year turnaround AWS, advertising business into a "pillar."

This week's bright results from Silicon Valley technology giants became the biggest driver of the rise in U.S. stocks, and Amazon was not to be outdone after Google, Meta and Microsoft disclosed better-than-expected results, adding another firewood to the rise in the U.S. technology sector.。

This week's bright results from Silicon Valley technology giants became the biggest driver of the rise in U.S. stocks, and Amazon was not to be outdone after Google, Meta and Microsoft disclosed better-than-expected results, adding another firewood to the rise in the U.S. technology sector.。

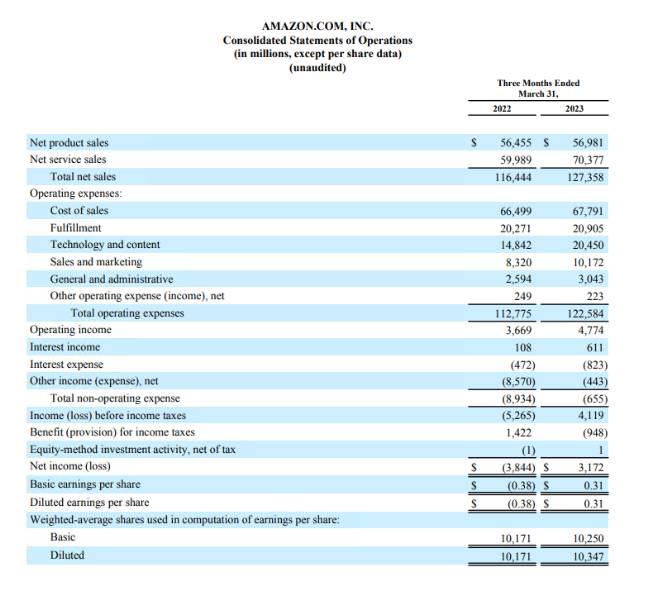

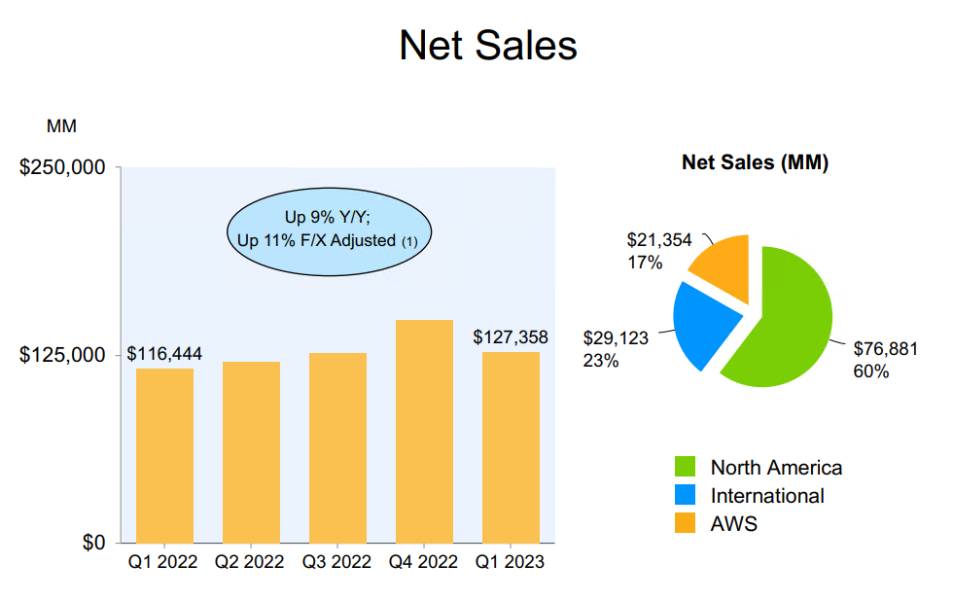

After the U.S. stock market on April 27, e-commerce giant Amazon released its first quarter 2023 results report。Amazon's first-quarter revenue rose 9% year-on-year to 1273, according to earnings data..$5.8 billion, higher than analysts' expectations of $124.7 billion; net profit turned around year-on-year to 31.$7.2 billion, net loss of 38.$4.4 billion; earnings per share of 31 cents, above market expectations of 21 cents。

By business, Amazon Q1's three core businesses generated more revenue than expected。The first is the North American business (60%), which accounts for the bulk of the company's total revenue, with Amazon's North American business generating 768 revenue in the first quarter..$800 million, higher than market expectations of 755.$400 million, followed by the second-largest international business (23%), with revenue of 291 in the first quarter..$200 million, higher than market expectations of 276.$500 million; and finally, Amazon's Web Services business (AWS), which generated 213 revenue in the first quarter.$500 million, also higher than market expectations of 210.300 million dollars。

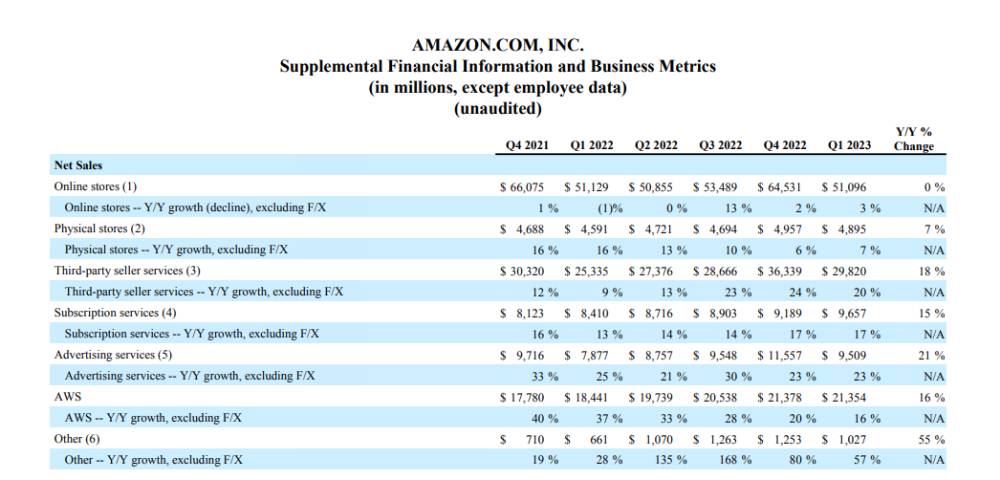

In terms of breakdown, Amazon's online store revenue in the first quarter was 510.$9.6 billion, exceeding market expectations of 505.$700 million; physical store business revenue 48.$9.5 billion, higher than market expectations of 4.7.$700 million; revenue from third-party seller services business 298.$200 million, also beating market expectations of $28.7 billion; subscription services revenue 96.$5.7 billion, also higher than market expectations of 92.$900 million; ad services revenue 95.$9 billion, in line with market expectations。

In response to a number of better-than-expected performance figures, Amazon CEO Andy Jassy said in an earnings report: "Our online store business is continuing to reduce the cost of services for our fulfillment network while accelerating the speed at which we get our products into the hands of our customers.。The advertising business continues to grow strongly, thanks in large part to ongoing machine learning investments that help customers see relevant information when they interact with us, which in turn has led to exceptionally strong results for brands.。

In addition, while the AWS business leads companies to spend more cautiously in this macro environment, we continue to prioritize building long-term customer relationships that both help customers save money and make it easier for them to take advantage of large language models and uniquely cost-effective technologies such as machine learning chips Trainium and Inferentia, hosted large language models, and artificial intelligence code companion CodeWhisperer。We like the fundamentals of AWS and believe there is still a lot of room for growth in the future。Andy said.

After the first quarter results, Amazon gave guidance on its second quarter revenue。Amazon's guidance is expected to fall between $127 billion and $133 billion, with a year-on-year growth rate of between 5% and 10%, with a median of $130 billion and a year-on-year growth rate of only 7.2%, would be the second lowest growth rate in history, but roughly in line with market expectations of $130.1 billion。Amazon expects operating profit in the second quarter to be between $2 and $5.5 billion, with market expectations of 47.$400 million。

It is worth noting that in the post-performance conference call, Amazon said that AWS growth in April may be about 5 percentage points lower than in the first quarter.。As soon as the news came out, the gains, which had been due to better-than-expected earnings, narrowed rapidly after the session, from a gain of around 11% to a decline of more than 2%.。

Bright earnings in exchange for huge layoffs.?

Jassie succeeded Amazon founder Jeff Bezos as CEO in July 2021.。Faced with a year-on-year loss-making Amazon, Jasi has been aggressively reducing costs and increasing efficiency since taking office to cope with the slowdown in revenue at Amazon's online shopping and cloud computing divisions。

In November last year, Amazon was exposed to a 10,000-person layoff plan, with the cuts mainly involving Amazon's equipment, retail and human resources departments.。But by the time the layoffs were officially confirmed on January 18 this year, Amazon announced that it would cut nearly 1.80,000 people。Such massive layoffs have become the "most layoffs" among Silicon Valley's tech companies.。

Last month, the US e-commerce giant announced a new round of layoffs, and the company decided to lay off 1.On the basis of 80,000 people, 9,000 people will be laid off again.。In other words, cut the plan by 2 in just 3 months..70,000 people。

In addition to relying on layoffs to cut costs, Amazon has also stopped several unproven investments in the past two years, such as telemedicine programs and a series of fitness wearables.。The company also slowed expansion of new warehouses and suspended construction of its second headquarters in Virginia.。

Of course, Amazon's drastic cost cuts have had a positive effect on the company, and the first quarter's results are enough to show that the company's efforts to reduce costs are starting to pay off.。In addition, operating expenses increased by 8% in the first quarter..7%, the lowest increase in at least a decade。In addition, Amazon's first-quarter delivery costs, packaging and shipping costs were close to expectations, indicating that spending is beginning to be brought under control.。

wrong bet?Rivian still gives Amazon a loss

In late 2021, Amazon, which intends to take a share of new energy vehicles, invested in an electric car startup called Rivian。But it was this investment that caused Amazon's profits to be severely affected last year.。Amazon lost $2.3 billion in pre-tax valuation on its investment in Rivian in the fourth quarter of 2022 alone, according to earnings reports。

The electric car company's stock continued to plummet after the IPO, with its share price rising from a peak of 179 at the time of the IPO..47, down to 12 at Thursday's close.67 美元。

This wrong investment has undoubtedly added to the woes of the overburdened Amazon.。

But fortunately, Amazon's first-quarter results included a $500 million pre-tax valuation loss from its investment in electric car maker Rivian's common stock, but overall it was better than the same period last year.。

Amazon also revealed its follow-up outlook for Rivian in its performance report.。Amazon says expanding the use of Rivian electric delivery vans is part of the company's commitment to significantly reduce carbon emissions。These custom vans from Rivian are now used to deliver more than 75 million packages in 500 cities and territories across the U.S.。Amazon started rolling out electric delivery vans in the summer of 2022, and now there are thousands on the road。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.