U.S. 13F third-quarter positions exposed! A number of hedge funds still prefer technology stocks

As a number of funds continue to announce their third-quarter positions, a number of prominent hedge funds are increasing their bets on large technology stocks, according to the published documents。

The deadline for filing 13F documents for the third quarter, which has attracted much attention from the capital markets, is Tuesday (November 14).。Judging from the positions announced by a number of hedge funds, you can see that a number of prominent hedge funds are increasing their bets on large technology stocks。

Although large tech stocks such as Amazon, Microsoft and Meta Platforms saw some declines in the third quarter, this does not affect hedge funds' optimistic outlook for tech stocks。

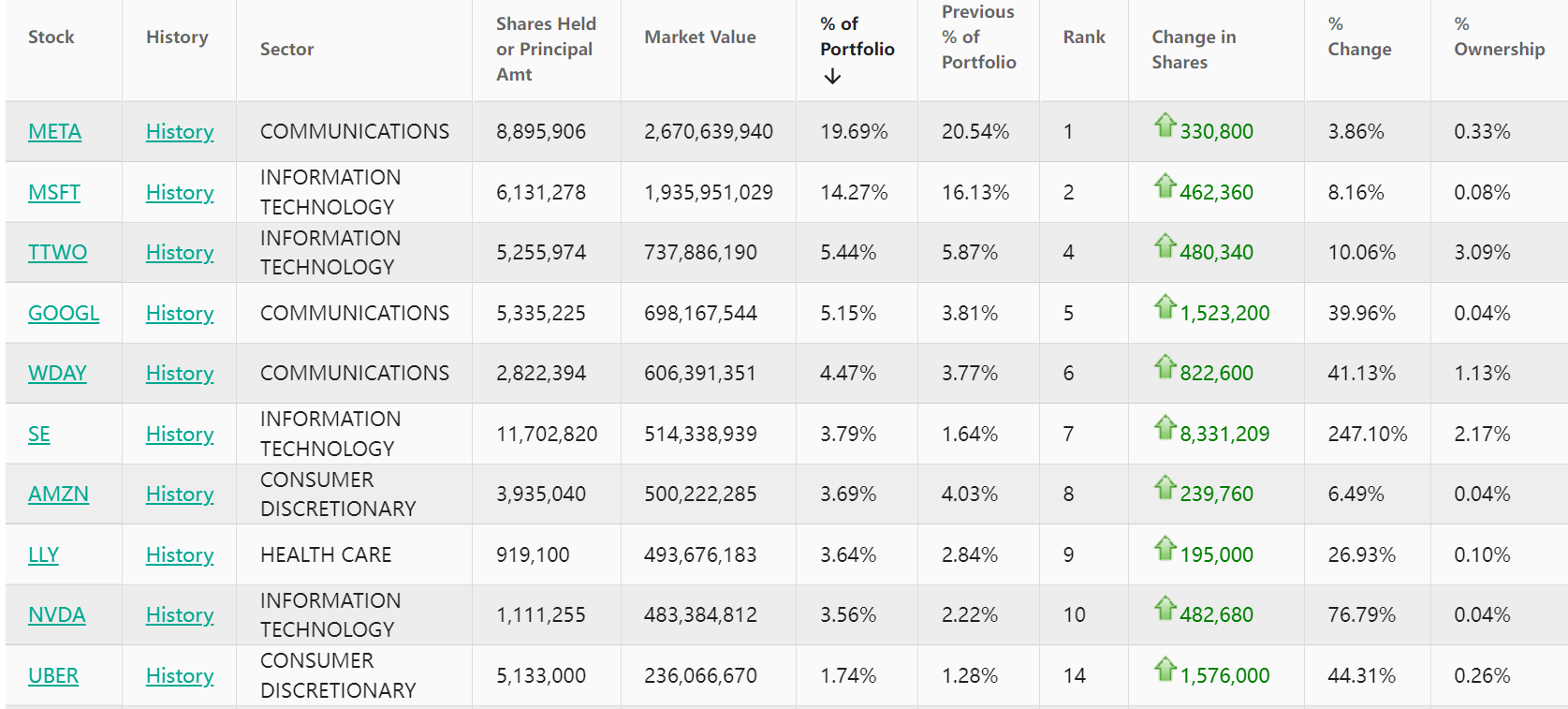

For example, Tiger Global Management, a widely watched fund in the investment community, disclosed that it increased its holdings of a number of large technology stocks in the third quarter.。Among them, the largest increase in holdings is the chip giant Nvidia, increased holdings of nearly 77%。For Google, the fund increased its holdings by nearly 40% in the third quarter。

In addition, the fund increased its holdings by 8.16% of Microsoft stock, increased its stake in Amazon by 6.49%, the shareholding of Meta increased by 3.86%。

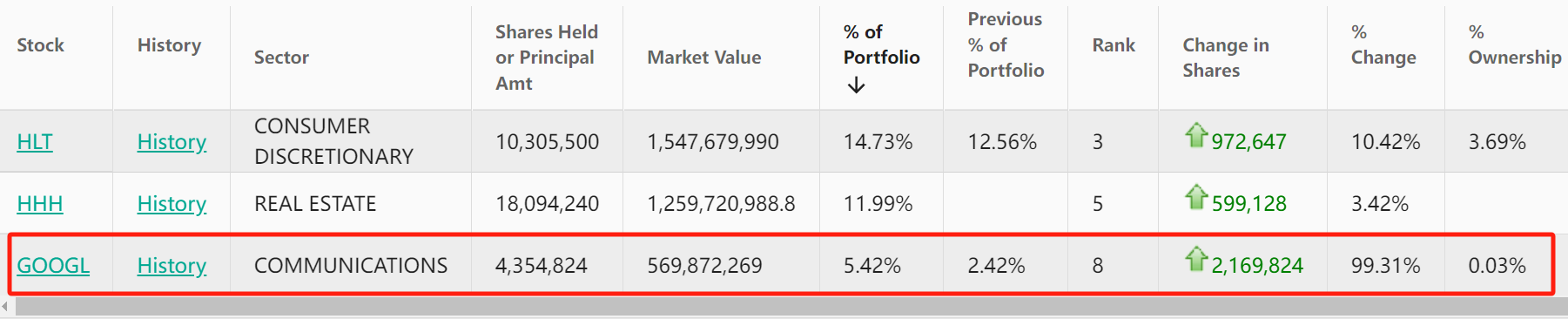

Billionaire Bill Ackman's Pershing Square Capital Management is also a market-focused hedge base.。Recently, the fund disclosed data showing that at the end of the third quarter, the fund significantly increased its stake in Google by nearly 100% to 4.4 million shares.。

Meta also attracts a lot of hedge bosses.。

Daniel Loeb, founder and CEO of hedge fund Third Point, said in a filing that it held about 1.1 million shares of Meta stock as of the end of the third quarter.。Coatue Management, a fund owned by another hedge fund magnate, Philippe Laffont, increased its Meta position by 9% to 6.2 million shares on September 30.。Ratan Capital Management also reported a 67% increase in Meta holdings in the third quarter.。

In addition to its large Meta position, Ratan Capital has significantly increased its Amazon stake by about 72%.。The fund also added 20,000 shares of Google on September 30.。

In 2022, a number of technology stocks in U.S. stocks fell sharply, causing Tiger Global and other hedge funds with heavy positions in technology stocks to suffer heavy losses。But this year, with the U.S. stock "Big Seven" led the rise, pushing the market back up。The S & P 500 is up about 18% this year, compared with a 20% decline in 2022。

The "Big Seven" refers to Microsoft, Apple, Alphabet, Meta, Amazon, Nvidia and Tesla.。

The AI craze, which has continued to climb this year, has rekindled the enthusiasm of investors, especially fund managers, for technology stocks.。Since January, Meta's stock has surged 169%, Amazon is up 70%, Microsoft is up 53%, and Nvidia is up about 230%.。Many fund managers' portfolios are starting to weigh in on the tech sector, which has played a key role in helping the broader market recover from last year's decline。

Back in August, Goldman Sachs said in a research note that hedge funds' exposure to the seven largest technology stocks by market capitalization was at an all-time high.。Goldman, which runs one of Wall Street's largest prime brokerage firms, is able to track capital flow trends。Goldman Sachs mentioned in the report that the "Big Seven" of U.S. stocks together account for about 20 percent of the total net market capitalization held by hedge funds tracked by Goldman Sachs.。Goldman Sachs further said that "hedge funds continue to embrace large tech and AI-related stocks."。"

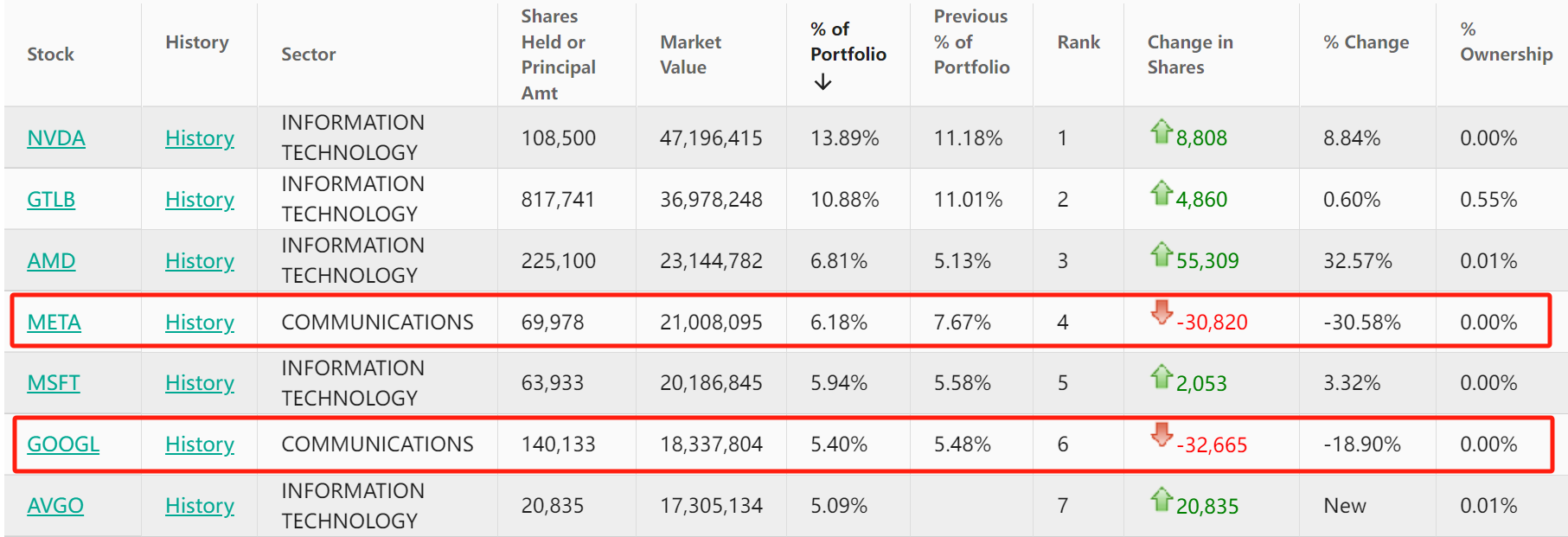

However, not all hedge funds are actively adding to their positions in technology stocks。After suffering heavy losses last year, there are also cautious watchers who "have been afraid of a snake bite for ten years," such as Glen Kacher's hedge fund Light Street Capital, which cut its Meta stake by 31% in the third quarter after increasing its stake by 27% in the second quarter.。Light Street also cut its Google stake by 19% in the third quarter.。

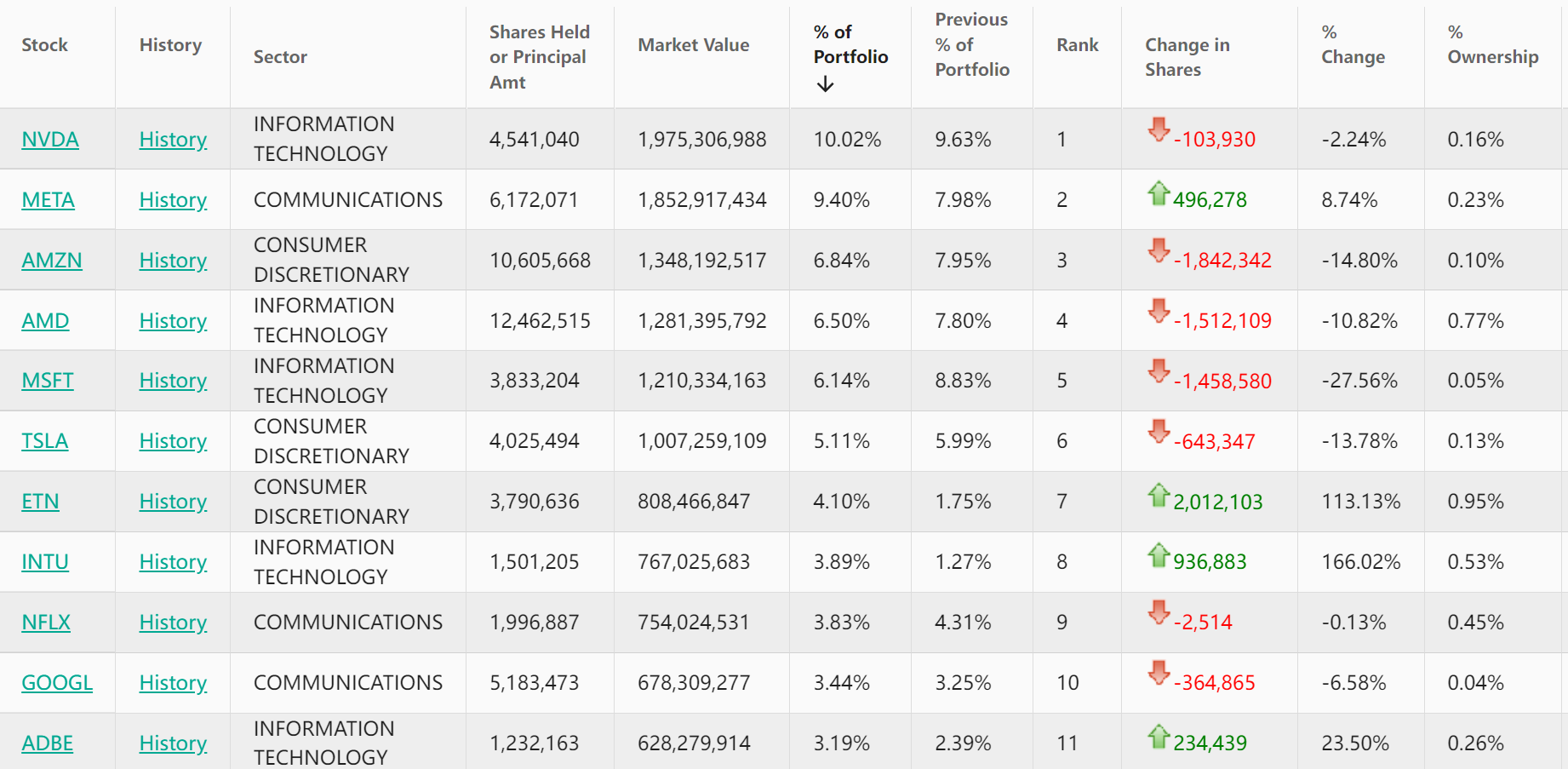

Coatue, on the other hand, cut its Microsoft stake by 28% and reduced its holdings, including Nvidia (2.24%), Amazon (14.8%), Microsoft (27.56%), Tesla (13.78%), Google (6.58%) and other positions in multiple technology stocks.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.