As global artificial intelligence technology drives the market value of American technology giants to continue to rise, the sudden emergence of China's local artificial intelligence company DeepSeek is becoming a key variable in reshaping international investors 'perception of China's technology assets.This start-up with the "low-cost + high-performance" open source model as its core competitiveness not only challenges the market's inherent expectations of technological differences between China and the United States through technological breakthroughs, but also drives China technology giants such as Alibaba and Tencent Holdings. The revaluation of the value of the giant has prompted investors to re-examine their artificial intelligence potential and the convergence logic of valuation discounts.

The change in market sentiment is first reflected in the structural adjustment of risk appetite.Jian Shi Cortesi, portfolio manager at Swiss asset management firm Gam Investment Management, pointed out that the valuation of China's technology sector, which has been dragged down by geopolitics, regulatory policies and competitive patterns, has long been at historical lows. The expected P/E ratio of the Hang Seng Technology Index is less than 17 times, which is significantly lower than the 27 times the Nasdaq 100 Index and its own five-year average of 25 times.

However, as the performance of the DeepSeek model in fields such as mathematical reasoning and code generation is comparable to that of the world's top levels, coupled with the commercialization of artificial intelligence applications by China technology companies, investors 'focus is shifting from "risk avoidance" to "growth potential mining." This cognitive transformation may become the core driving force for valuation repair.InvalidParameterValue

The linkage effect between technological breakthroughs and capital markets has already appeared in recent market performance.At the end of January 2025, the release of the DeepSeek open source model triggered a violent shock in the U.S. stock technology sector. Nvidia's single-day market value evaporated by more than US$300 billion. During the same period, the Hang Seng Technology Index rose 9% in a week and entered a technical bull market. The Nasdaq China Golden Dragon Index also closed up 4.33%, with Alibaba leading the gains of 6.22%.

The activity of the options market further confirms this trend: Hang Seng Technology Index call contract volume hit a peak since October in early February, and the volume of 6500 call contracts in a single day is about twice that of put contracts, indicating that derivatives traders are becoming aggressive in bets on upside space.InvalidParameterValue

The underlying logic of this round of value revaluation lies in the potential of artificial intelligence technology to restructure the profit models of technology companies.Alex Au, managing director of Alphalex Capital Management, analyzed that DeepSeek has significantly improved the inclusiveness of artificial intelligence technology by reducing model training and deployment costs, which will accelerate the penetration of enterprise-level AI applications and open up incremental space for cloud computing infrastructure providers.

Take Alibaba as an example. Its cloud service PAI platform has achieved one-click deployment of the DeepSeek model. Combined with the iteration of its own Tongyi Thousand Questions model (such as Qwen 2.5-Max's breakthrough in multimodal tasks), Alibaba Cloud is expected to reduce customers While using AI, it consolidates market share through ecological collaboration.It is worth noting that international cloud service providers such as Amazon AWS and Microsoft Azure have also quickly connected to the DeepSeek model, which highlights its technical versatility on the one hand, and indirectly verifies the global competitiveness of China's AI industry chain on the other hand.InvalidParameterValue

From the perspective of capital flow, the convergence of valuation differences has received substantial support.In January 2025, the single-day capital inflow of the KWEB ETF, which tracks Chinese stocks, reached US$105 million, a four-month high. Tencent continued to absorb mainland funds through the Hong Kong Stock Connect channel. Although its 26-fold TTM P/E ratio is higher than that of Ali. 18.5 times, it is still attractive compared with the historical valuation center.More importantly, the cash flow advantage of leading companies provides guarantees for their technology investment: Tencent plans to double the repurchase amount to more than HK$100 billion in 2024, and Alibaba spent US$12.5 billion to repurchase shares and distribute US$4 billion in dividends during the same period., high dividends and repurchase efforts not only demonstrate management confidence, but also provide downside protection for stock prices.InvalidParameterValue

Looking ahead, the upcoming earnings season may become a key catalyst.Investors will pay close attention to management's statement of AI R & D investment, cloud service needs and model monetization paths, and the ecological synergy caused by DeepSeek (such as Huawei Shengteng Cloud Services and Tencent HAI Platform's integration of its models) may further strengthen the market's expectations for the speed of technology implementation.If China technology companies can continue to prove that their AI capabilities can be translated into sustainable revenue growth, the current P/E ratio of 17 times the Hang Seng Technology Index may be just the starting point of a new valuation cycle.As Alex Au said: "When technological breakthroughs resonate with capital flows, value traps can be transformed into value discovery.”

With the rise of DeepSeek, the artificial intelligence arms race has become the core driving force of global technological innovation and is widely used in many fields such as finance, medical care, and education.Looking forward to 2025, artificial intelligence infrastructure will still maintain a strong development momentum.

As the core infrastructure of AI computing, data centers are ushering in a period of rapid development.In order to meet the needs of AI model training and reasoning for massive data storage and high-speed computing, technology giants such as Google, Microsoft, and Amazon have increased their investment.Data centers not only continue to expand in physical scale, but also continue to innovate at the technical level, reducing energy consumption through liquid cooling technology, and introducing high-speed network architecture to improve data transmission efficiency to improve overall computing performance.

GPUs play a key role in AI computing, and their powerful parallel computing capabilities greatly accelerate the training and reasoning process of deep learning models.Taking Nvidia as an example, its A100 and H100 chips have become the first choice for many AI projects due to their excellent computing performance.At the same time, customized chips such as ASICs are optimized for specific AI algorithms, achieving higher computing efficiency and lower energy consumption in scenarios such as image recognition and speech recognition.

Broadcom CEO said that customers are formulating a three-to-five-year AI infrastructure investment plan, and it is expected that the investment boom in artificial intelligence by large technology companies will continue until the end of 2030.Although fluctuations in training demand may put some pressure on sub-areas such as Remeters and optical modules, the popularization of key links such as GPUs, ASICs, and DCI in the AI reasoning stage will bring new development opportunities to the industry, and the overall AI infrastructure construction will remain strong. growth.

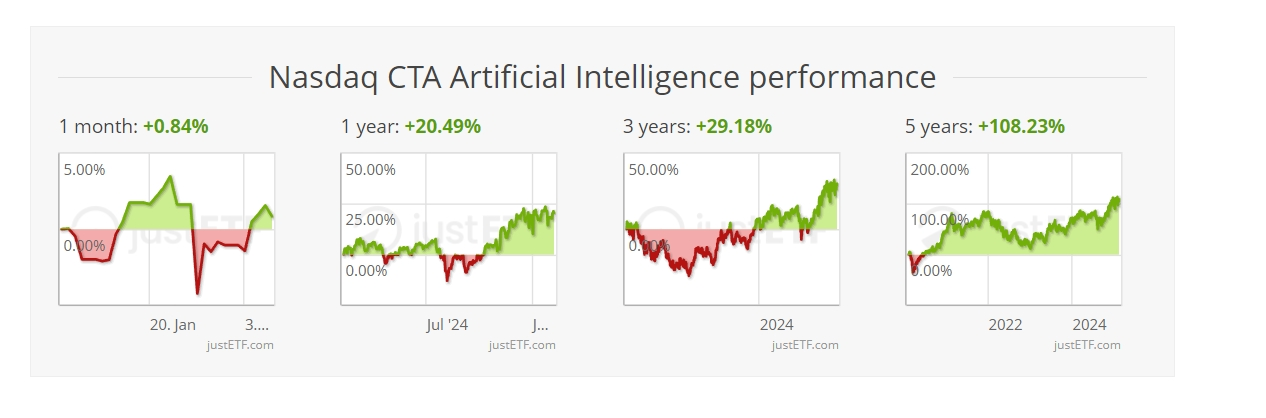

Against the background of large-scale infrastructure where artificial intelligence is blooming, the advantages of artificial intelligence ETFs are gradually emerging.

Currently, the stock prices of companies related to the concept of artificial intelligence are generally higher, such as NVIDIA, Oracle, Google, Microsoft, Meta, etc. The capital cost for ordinary investors to hold multiple stocks is higher.In contrast, artificial intelligence-related ETFs have the advantage of low funding barriers, and generally only costs more than 100 US dollars to purchase one piece (100 copies).

ETFs have a rich selection of products, covering upstream and downstream companies in the artificial intelligence industry chain. Investors can achieve risk diversification and share the dividends of industry development without in-depth research on individual stocks.In addition, ETFs have no risk of suspension or delisting, and can trade normally even in a bear market, providing investors with an opportunity to stop losses.Based on its advantages such as low threshold, transparent trading, rich selection, high stability and support for on-site trading, ETFs have become an ideal choice for ordinary investors and novice investors to participate in the artificial intelligence market.

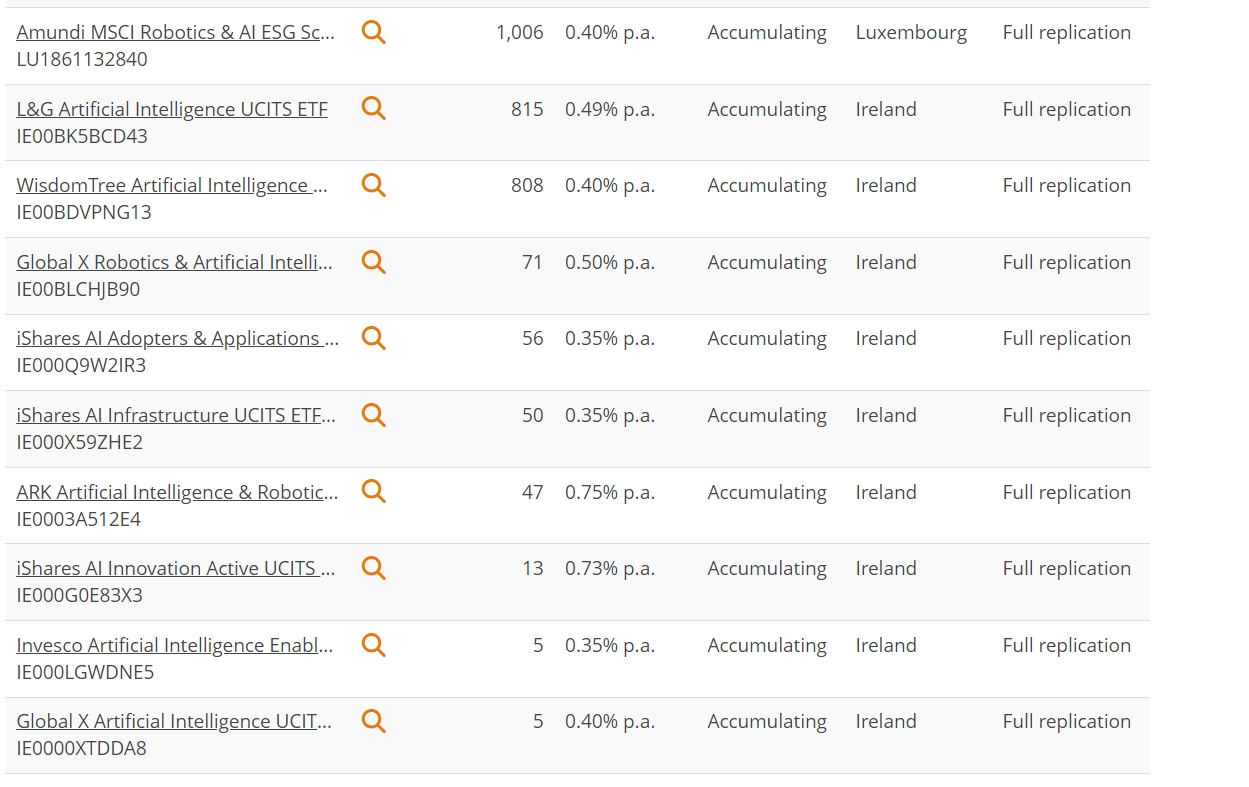

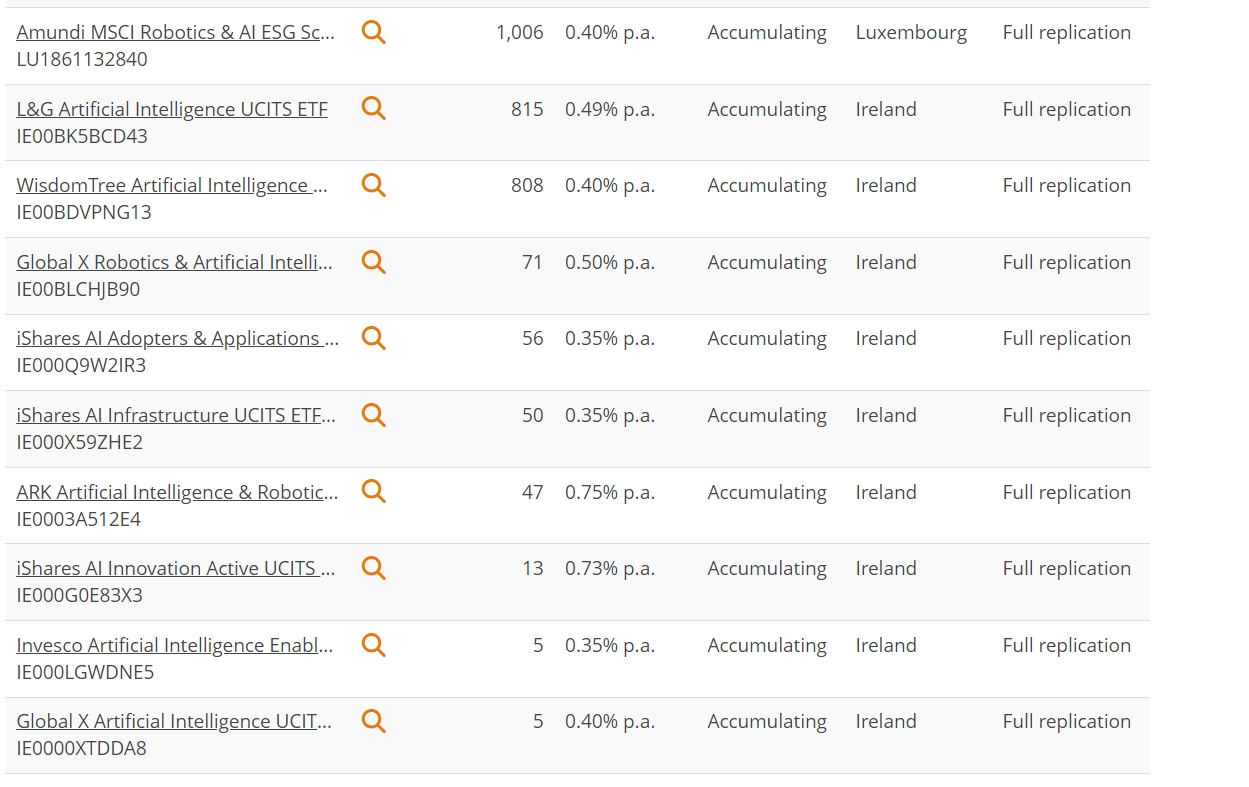

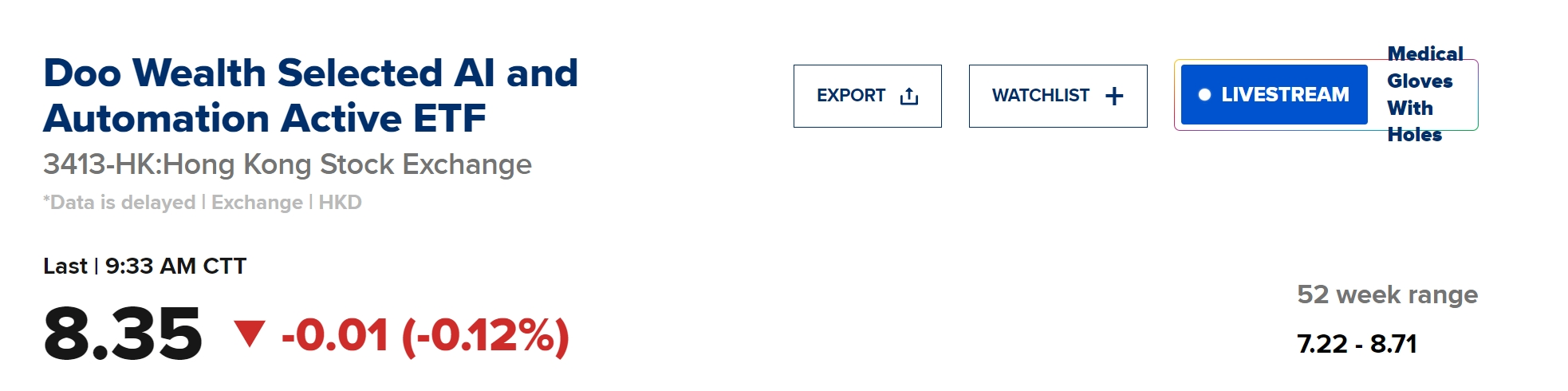

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Looking forward to 2025, artificial intelligence infrastructure, as the cornerstone of the development of AI technology, will continue to flourish under the dual promotion of technological innovation and market demand.By rationally using financial instruments such as ETFs, ordinary investors are expected to gain a share of the technological transformation of artificial intelligence.