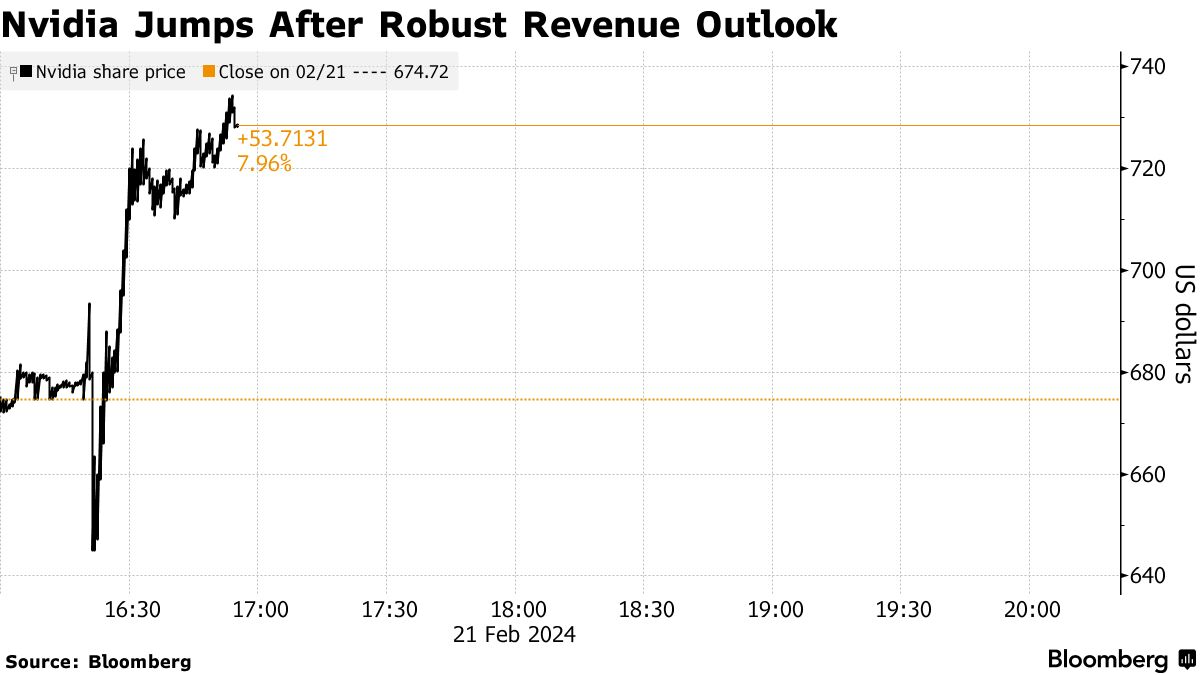

Nvidia's fourth-quarter results beat expectations, after-hours trading sparks rally

For the fourth quarter, Nvidia reported a staggering 265% year-over-year increase in revenue and a faster profit growth rate than analysts had forecast.。This increase was mainly due to an almost 770% increase in profits.

Nvidia's earnings yesterday not only beat Wall Street's expectations, but also significantly strengthened the ongoing bull market, especially the impact on technology and artificial intelligence (AI) stocks.。The performance highlights Nvidia's key role in the AI revolution, an area that continues to drive optimism across the market.。

Nvidia's earnings yesterday not only beat Wall Street's expectations, but also significantly strengthened the ongoing bull market, especially the impact on technology and artificial intelligence (AI) stocks.。The performance highlights Nvidia's key role in the AI revolution, an area that continues to drive optimism across the market.。

OUTPERFORM PERFORMANCE

For the fourth quarter, Nvidia reported a staggering 265% year-over-year increase in revenue and a faster profit growth rate than analysts had forecast.。The increase was mainly driven by an almost 770 per cent increase in profits, highlighting Nvidia's dominance in artificial intelligence and chip manufacturing.。

The company's adjusted earnings per share increased 765% from the same period last year, reflecting the company's profitability and operational efficiency during the period.。The market reaction to Nvidia's earnings has been very positive, with shares up 6 in after-hours trading..4%。This rally reflects not only the company's strong results, but also the market's confidence in Nvidia's leadership in artificial intelligence and computing technology.。

Analysts have praised Nvidia's achievements, with some calling CEO Huang "the godfather of artificial intelligence," which shows Nvidia's transformational impact on the industry.。

Results guidance for next quarter promising

This view is further reinforced by Nvidia's revenue guidance for the upcoming quarter, which is expected to grow 233% year-over-year.。The forecast beat Wall Street's expectations and suggests there is still strong demand for Nvidia's AI chips.。This demand is driven by the application of AI technology in various industries, from gaming to the automotive industry, showing Nvidia's unique advantages in a wide range of growth trajectories.。

U.S. stock market confidence in AI stocks increases

The impact of Nvidia's performance on the overall market is very important。The success of the company is one of the key factors in the bull market in technology and artificial intelligence, contributing to the optimism in these industries。Nvidia's growth reflects the growing importance of AI technologies in driving productivity and profitability, a trend that is expected to continue.。This has had a ripple effect, spurring a rally in index futures and a rally in global peers and suppliers, strengthening the bull market in tech and AI stocks.。

In addition, Nvidia's ability to respond to regulatory challenges, such as U.S. restrictions on the export of advanced AI chips to China, still achieved significant growth, which is a testament to the company's resilience and strategic vision.。The company's efforts to export replacement chips that meet these restrictions to China demonstrate its ability to adapt in a rapidly changing global market.。

In sum, Nvidia's recent earnings and subsequent market reaction highlight the company's key role in the ongoing bull market, particularly in tech and artificial intelligence.。The company's performance not only reflects its dominant position in the AI and chip manufacturing industries, but also demonstrates the market's confidence in the continued growth and profitability of AI technology.。With NVIDIA's continued innovation and leadership in this space, it is likely to continue to be a key driver of market trends and investor sentiment in the tech and AI sectors.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.