AAVE Tops Crypto Gainers with 26% Surge Amid Aave's Governance Shift

Key momentsAAVE experienced a 26% price increase in 24 hours, driven by a newly proposed Aavenomics Implementation: Part One”.The proposal aims to revamp Aaves economic model, including revenue redist

Key moments

- AAVE experienced a 26% price increase in 24 hours, driven by a newly proposed “Aavenomics Implementation: Part One”.

- The proposal aims to revamp Aave’s economic model, including revenue redistribution, AAVE tokenomics adjustments, and secondary liquidity management.

- The proposal includes plans for new features like Anti-GHO and Umbrella, along with a $1 million weekly AAVE buyback and distribution program to manage liquidity.

Aave’s AAVE Token Skyrocketed Over 26% in 24 Hours, Fueled by Sweeping Governance Proposal Aimed at Overhauling Platform’s Economics

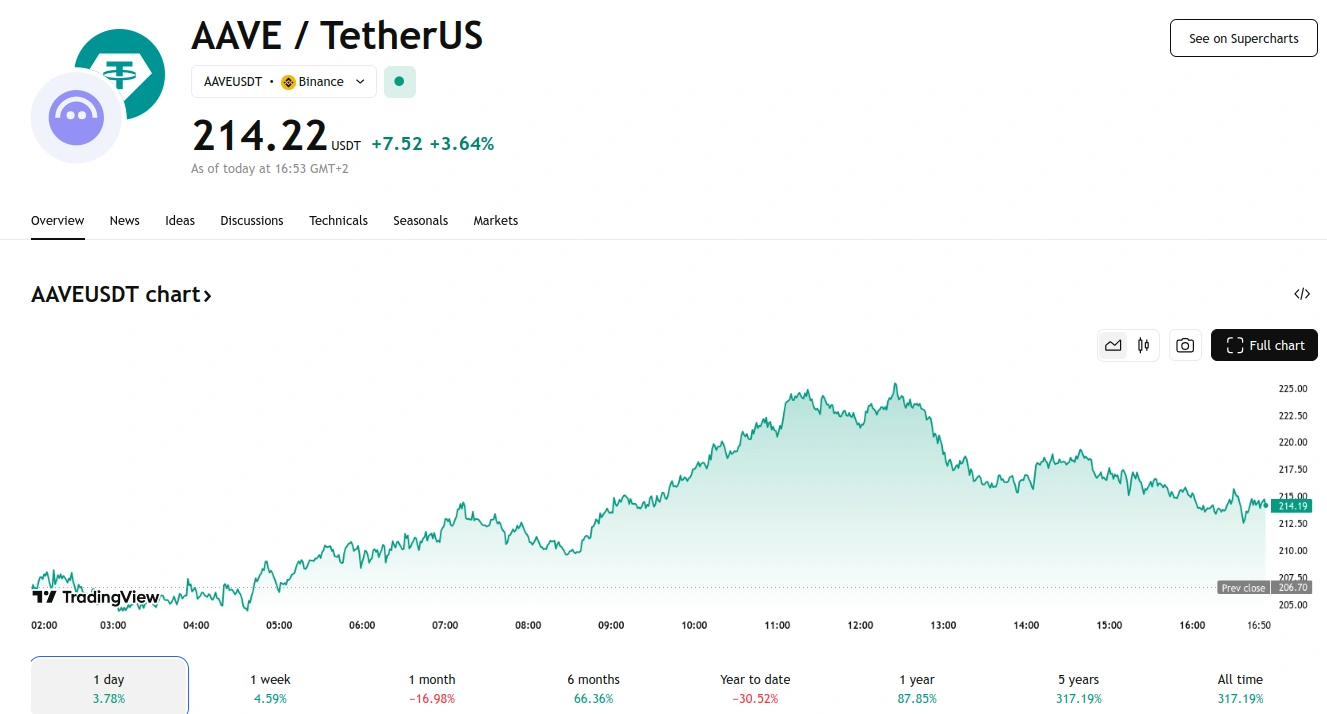

According to CoinMarketCap data, AAVE reached $220, reflecting a 26.6% increase. Its market capitalization climbed to $3.33 billion, and trading volume more than doubled to $728.45 million.

On March 4th, the Aave Chan Initiative (ACI) unveiled the “Aavenomics Implementation: Part One” ARFC, a proposal to revamp Aave’s economic model, seeking community input. This initiative builds on the August 2024 “TEMP CHECK” approval, which aimed to establish a framework for redistributing surplus revenue to key contributors.

The current proposal focuses on implementing the first phase of the updated Aavenomics, including revenue redistribution, AAVE tokenomics adjustments, and secondary liquidity management, alongside finalizing the LEND to AAVE migration.

Key elements of this phase include the formation of a four-member Aave Finance Committee (AFC) comprising ACI, Chaos Labs, Tokenlogic, and Llamarisk, requiring a 3/4 signature for decisions.

Tokenlogic is slated to manage the initial six-month budget through monthly treasury proposals and token approval allowances.

A $1 million weekly AAVE buyback and distribution program is proposed for liquidity management, with treasury funds used to acquire AAVE on secondary markets and return them to the ecosystem reserve, adjusting after the initial six months based on protocol budget.

New features are also planned, including Anti-GHO, a non-transferable ERC20 token for clearing GHO debt or converting to staked GHO (StkGHO), and Umbrella, a mechanism to safeguard users from bad debt during market downturns. GHO, Aave’s stablecoin, has reached a $200 million circulating supply.

Furthermore, ACI reported a 115% increase in Aave’s treasury, now totaling $115 million, since mid-2024.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.