ADA Price Drops 18% In a Week But Cardano Remains in the Top 10 Ranking

ADA price sees bearish trends persist but shows signs of easing momentum. Key levels at $0.78 and $0.99 may determine its next move.

- Cardano price drops 18% in a week, with bearish signals like a death cross and negative Ichimoku Cloud dominance.

- ADX indicates a strong but weakening downtrend, hinting at possible consolidation or reduced selling pressure.

- ADA must hold $0.78 support to avoid deeper losses, with resistance levels at $0.99 and $1 signaling potential recovery.

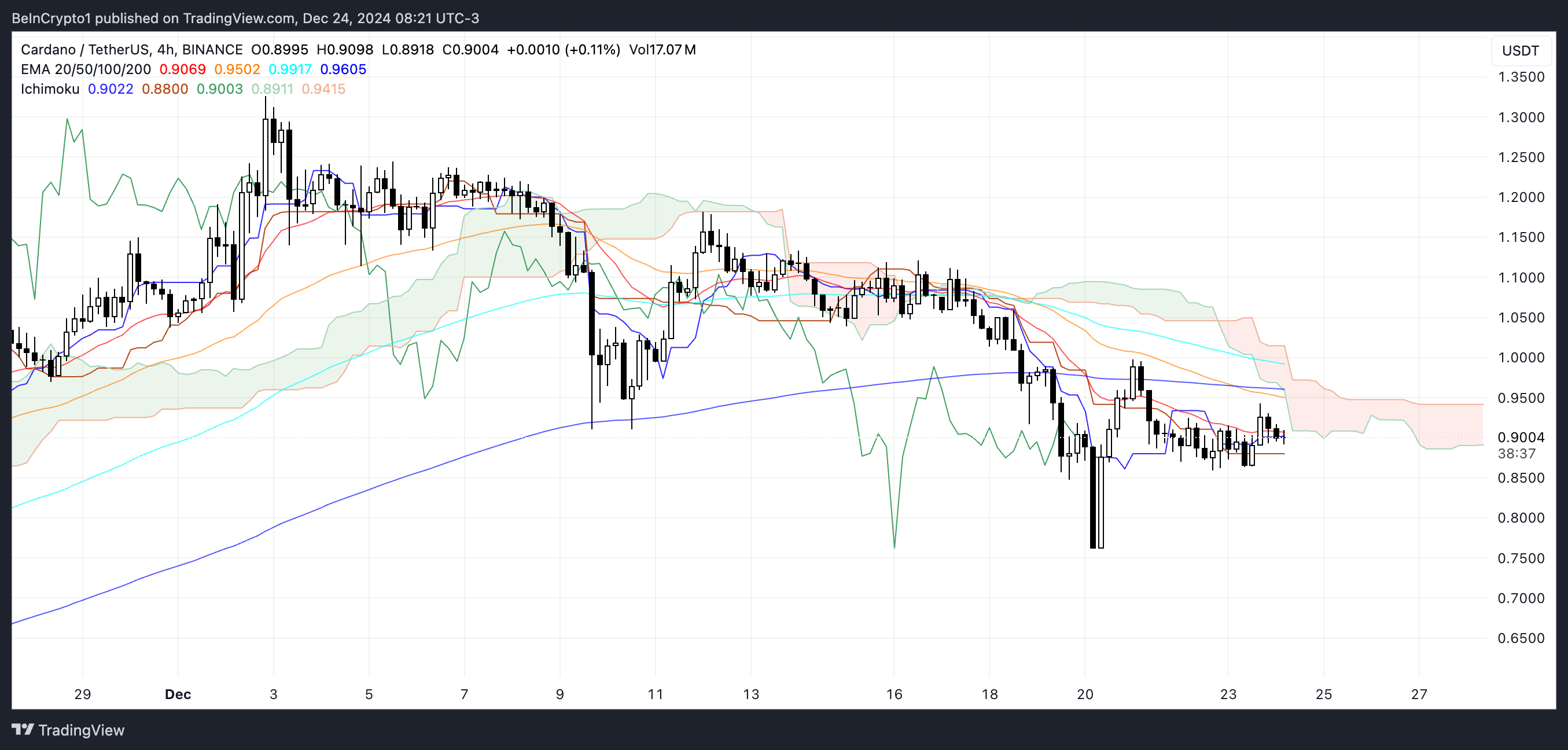

Cardano (ADA) price continues to show volatility, maintaining its position among the top 10 largest cryptocurrencies by market cap despite being down over 18% in the last seven days. The recent downtrend has been marked by bearish technical indicators, including a death cross on its EMA lines and a weak position on the Ichimoku Cloud.

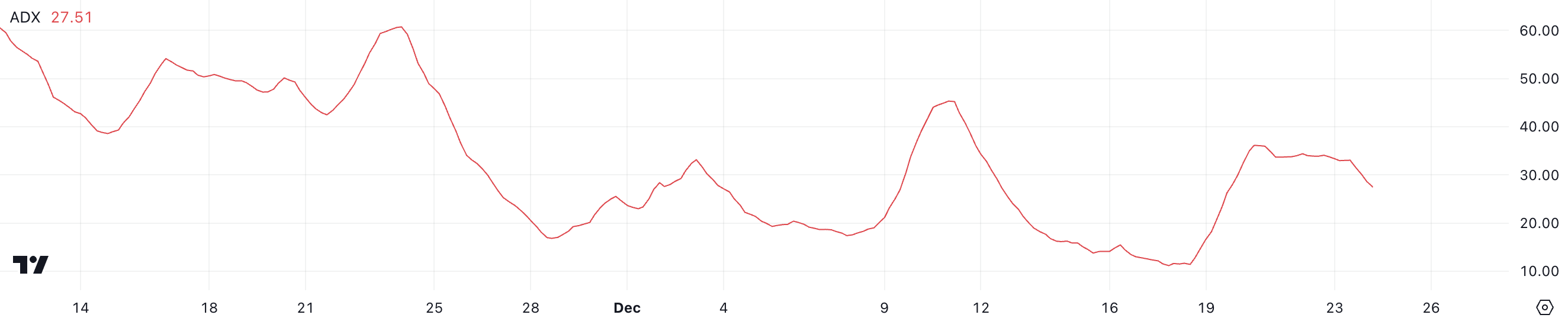

However, some signs suggest that bearish momentum might be slowing, with ADA’s ADX showing a slight decline after peaking earlier in the week.

Cardano Downtrend Is Still Strong But Could Be Losing Its Steam

The ADA Average Directional Index (ADX) is currently at 27.5, having risen from below 20 on December 19 but slightly declining from over 30 in recent days. This fluctuation in ADX reflects shifts in the strength of Cardano ongoing downtrend.

While an ADX above 25 typically indicates a strong trend, the slight drop suggests that the downtrend may be losing some momentum, although it still remains significant.

ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values above 25 signal a strong trend, while those below 20 suggest a weak or absent trend. With Cardano ADX at 27.5 and trending slightly downward, it indicates that while the current bearish momentum is still present, its intensity could be diminishing.

In the short term, this might lead to reduced selling pressure, allowing ADA price to consolidate or even attempt a minor recovery. That will depend on whether buying activity increases to counterbalance the bearish trend.

Ichimoku Cloud Shows a Negative Sentiment

The Ichimoku Cloud chart for ADA indicates a bearish trend. The price is positioned below the cloud (red and green shaded areas), signaling continued downward momentum.

The blue conversion line (Tenkan-sen) remains below the red baseline (Kijun-sen), confirming that bearish sentiment dominates the market. However, the narrowing gap between these lines hints at a potential slowdown in bearish momentum if the price stabilizes further.

The lagging span (green line) is situated below both the price and the cloud, emphasizing the persistence of the bearish trend. Furthermore, the future cloud (red) suggests ongoing bearish pressure. That happens because the leading span A (green edge) stays below the leading span B (red edge).

These conditions suggest that ADA’s setting is leaning bearish, with limited signs of immediate trend reversal unless further consolidation occurs.

ADA Price Prediction: Will Cardano Go Back To $1?

The ADA EMA lines formed a death cross on December 20, with the short-term EMA crossing below the long-term EMA, a classic bearish signal indicating sustained downward momentum. If this downtrend continues, Cardano price could face further downside, potentially testing support levels at $0.78.

Should bearish pressure persist and $0.78 fail to hold, ADA price could decline further to $0.65 or even $0.519. This would mark a possible 42% correction from current levels.

However, if the trend reverses and bullish momentum builds, ADA price could reclaim higher levels, starting with resistance at $0.99 and $1.039.

Breaking these levels would signal stronger buying interest and could pave the way for a rally toward $1.18. That would represent a potential 31% upside from current levels.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.