Altcoin Season Chances Drop, But 3 Indicators Point to Potential Revival

Despite a recent drop, altcoin season chances are still high due to several indicators observed on-chain. Here is all to know.

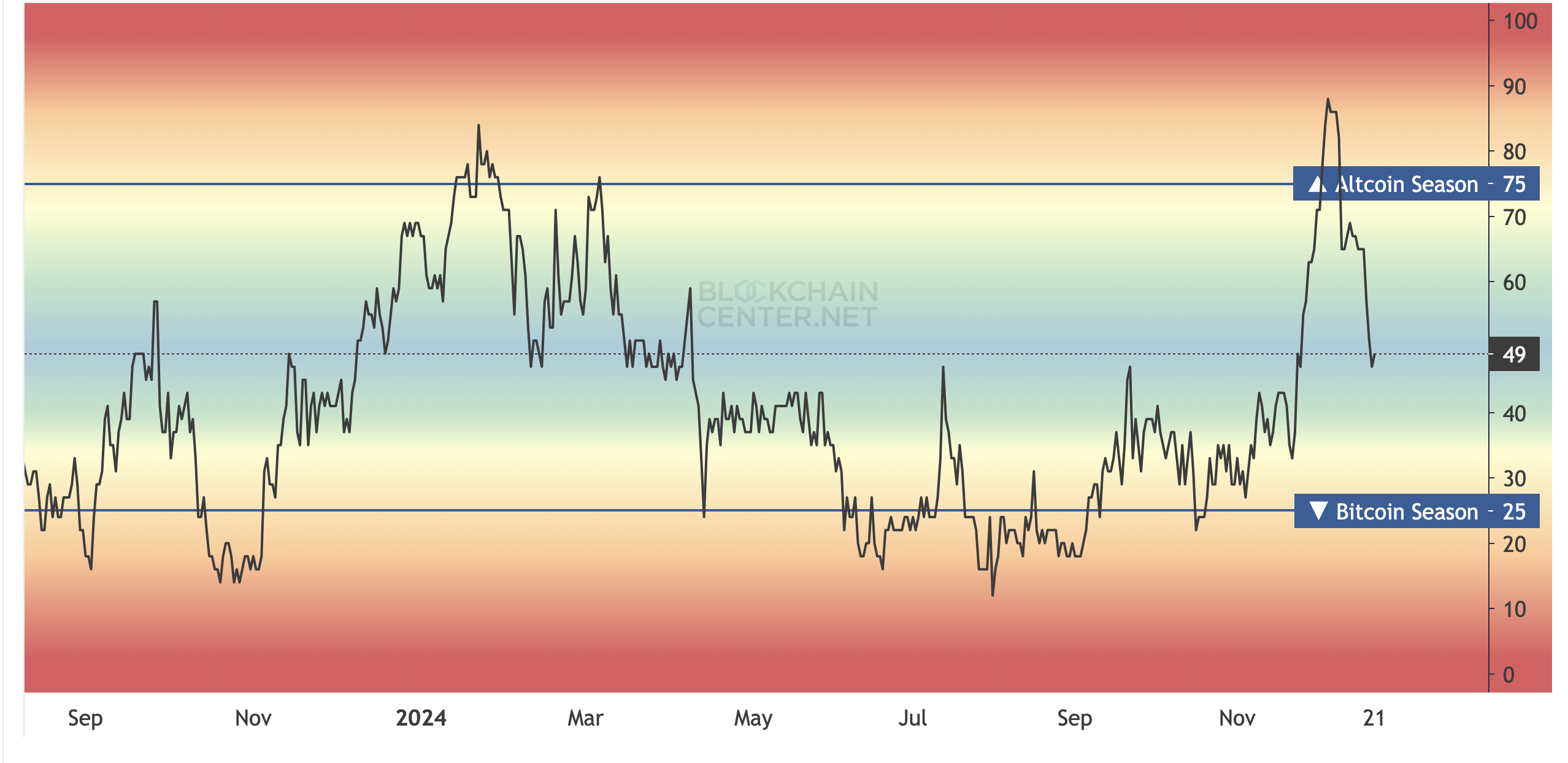

- The altcoin season index dropped to 49, indicating that non-Bitcoin crypto price have declined.

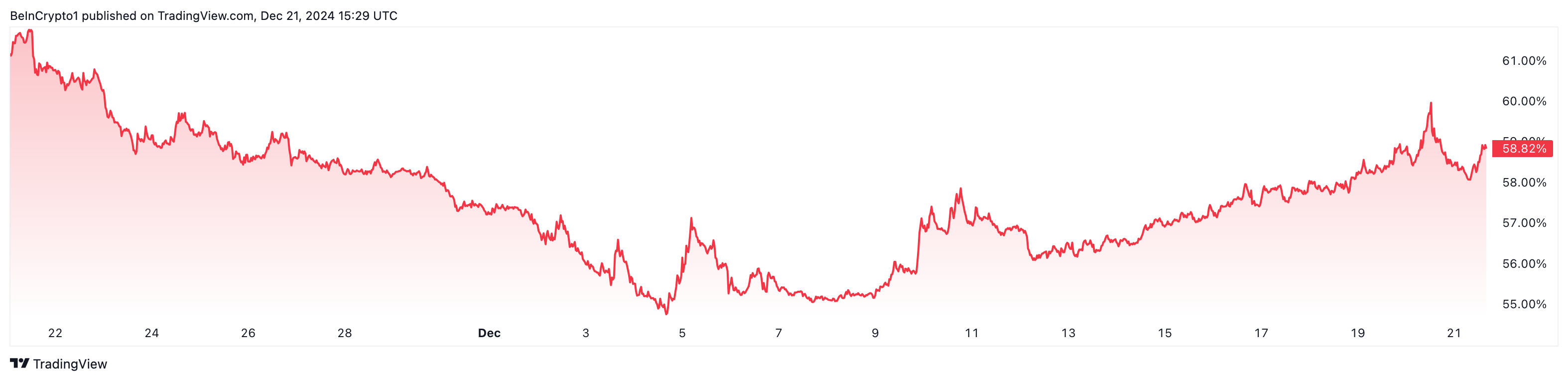

- Bitcoin dominance has dropped from 61% to 58%, indicating that altcoins crash is temporary.

- The TOTAL2 market cap is down, but analysis shows that the value could rise toward $1.65 trillion.

On December 4, the Altcoin Season Index hit 88, suggesting that non-Bitcoin cryptocurrencies might perform better than the number one coin. However, the altcoin season chances might have been dealt a huge blow.

Despite that, it appears that the much-anticipated season might still come back. Here are three indicators suggesting that many of the top 50 cryptos might soon see notable hikes.

Alts Gets Pushed Down Again

Altcoin season refers to a period when altcoins outperform Bitcoin in terms of market cap growth. The Altcoin Season Index measures this trend, determining whether 75% of the top 50 cryptocurrencies are outperforming Bitcoin.

Typically, an index value above 75 signals the onset of altcoin season, while a value at 25 reflects Bitcoin dominance. However, as of now, the index has dropped to 49, highlighting a setback for altcoins as Bitcoin regains a stronger foothold in the market.

But despite the drawdown, it does not appear that the alt season is over. One indicator suggesting this is Bitcoin dominance.

An increase in Bitcoin dominance often signifies a growing preference for Bitcoin over altcoins, particularly during periods of market uncertainty. This trend suggests that investors see Bitcoin as a safer option, given its relative stability and established market position.

As dominance rises, interest in smaller cryptocurrencies may decline, potentially leading to reduced capital inflows for altcoins. Some weeks back, Bitcoin’s dominance climbed to 62%, suggesting that altcoins might not continue to play second-fiddle

But at the time of writing, it has dropped to 58.82%, indicating that altcoins have taken some share of control. Should the decline continue, then BTC prices might drop while altcoin prices might soar.

The Altcoin Market Cap Still in Line to Rally

The TOTAL2 market capitalization, which tracks the top 125 altcoins, has recently dropped to $1.35 trillion, suggesting that non-Bitcoin assets are underperforming. This decline often signals that altcoin season may be delayed, with Bitcoin dominating the market.

However, there’s a silver lining: the TOTAL2 has broken above a descending triangle, signaling a potential trend reversal. While the altcoin season may face setbacks for now, this breakout implies that altcoins might gain momentum if volume starts to rise.

Should this volume pick up, TOTAL2’s market cap could climb to $1.65 trillion, signaling the revival of altcoin season chances and potentially driving prices higher.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.