8 Best Forex Trading Strategies

Choosing the best strategy is the basic first step to successful Forex trading。Even if you don't want to use one of the eight forex trading strategies below, knowing them can help you build an understanding of the market。For example, your preferred forex strategy may be scalping, but realizing that market conditions are more favorable for a "momentum" type forex strategy will benefit you。

Choosing the best strategy is the basic first step to successful Forex trading。Even if you don't want to use one of the eight forex trading strategies below, knowing them can help you build an understanding of the market。For example, your preferred forex strategy may be scalping, but realizing that market conditions are more favorable for a "momentum" type forex strategy will benefit you。

The market can only move in two directions: up or down。Statistically, tossing a coin and deciding whether to buy or sell should produce a 50-50 win rate。The actual profit / loss ratio for retail traders is actually 70-30, as European regulations require regulated brokers to disclose。While each broker's situation is different, the question is, how does a 50-50 situation become a 70-30。

One of the main reasons is that traders choose a currency trading strategy, but they cannot invest enough time and resources; some traders over-trade and invest too much time。Looking for buy and sell signals without any signals drains your cash balance。

Establishing clear goals, ensuring that your strategy can be achieved, and applying it with certain principles is the first step to turning things around。Whether you are a beginner, or an experienced trader seeking the best forex strategies, it is important to remember that these courses can be learned from trading virtual funds on a demo account。Expanding risk will help you recognize the importance of cultivating a trading psychology, the best forex traders are good at managing trading sentiment。

Here is an overview of some popular and effective forex trading strategies, graded according to the time of operation, requiring the highest priority。Three criteria need to be kept in mind when comparing and selecting: the time and resources required to manage, the frequency of transactions, and the typical holding period。

reselling

Before going into the details of the meaning of "scalping," it is necessary to quickly understand the nature of the foreign exchange market。The volume of currency transactions carried out on a daily basis in the foreign exchange market is huge, with some currency transactions based on basic economic activities, such as US customers selling dollars to buy euros to buy Mercedes-Benz cars in Germany.。Speculators also play a role, and even a small amount of sterling against the dollar will increase the volume of trading in the market。This creates market liquidity, with millions of buyers and sellers participating in the same market and making the same price movements.。

Liquidity is an important consideration because scalping involves trading with short-term price fluctuations and works better in more liquid markets。

Scalping is one of the effective forex trading strategies that involves trading short-term price movements。While there is no particular reason, the strategy is often associated with small-scale trading。

Many beginners are attracted to scalping forex strategies。They are very intense and regularly trade a lot。These results lead us to take the time to observe market movements and trade monitoring, thereby quickly learning lessons。

The aim is to make small profits often, which is achieved by opening and closing positions throughout the day.。They can be directional, buy all or sell all, but are more likely to be a mix of both。Scalping can be done manually or through an automated trading program, where the algorithm determines the trading order。Beginners may be attracted to manual methods, but cross-referencing some algorithmic models is also beneficial。

Trading spreads are important。As a result, scalpers gather in the most liquid markets, where the difference between bid and ask prices is usually small。

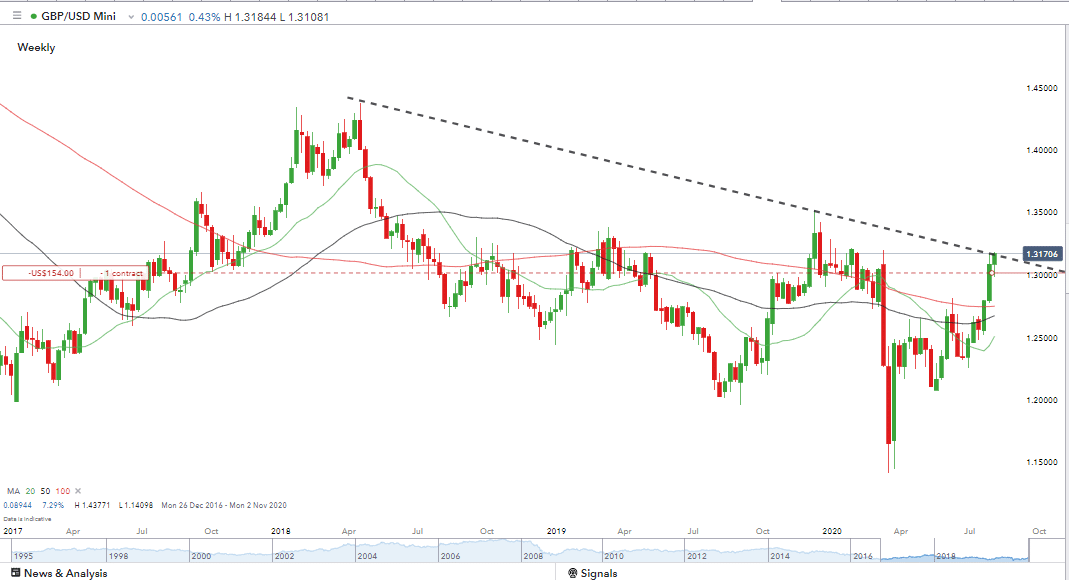

In the example below, the pound appreciates against the dollar and encounters a long-term resistance line。

GBPUSD - Weekly Candles - Scalping Strategy

The downtrend line since 2018 is an important technical indicator。The weekly price chart shows that GBP / USD has seen a series of green / bullish candles over the past three weeks and the price action looks bullish。

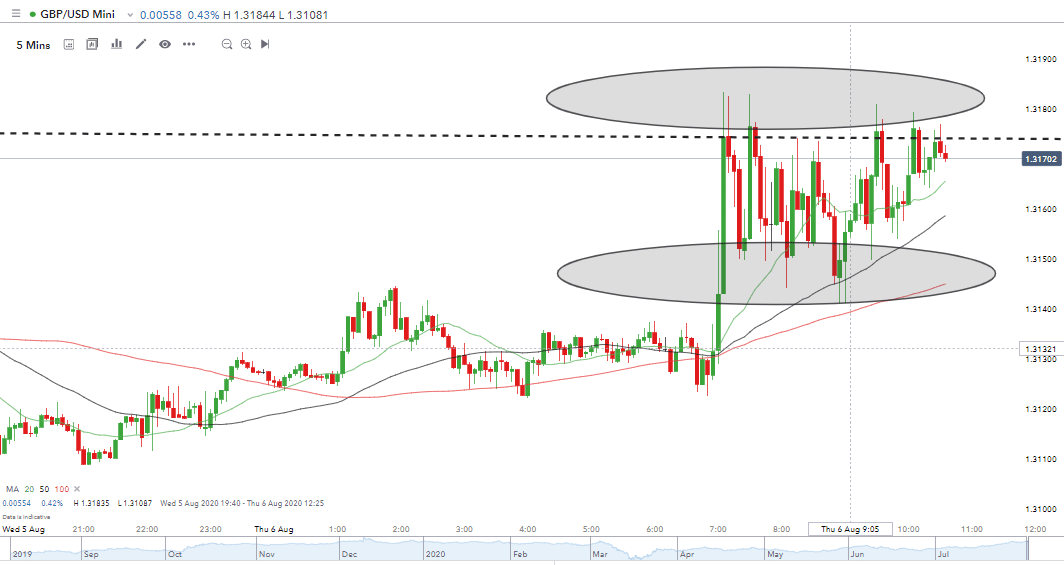

GBPUSD - Five Minute Candle - Scalping Strategy

Zoom in on the five-minute chart showing prices colliding with the downtrend line and falling back。This may be the price consolidation before the resistance level is breached。This could be the moment when the uptrend loses momentum。For scalpers, the interest in long-term price movements is not as good as the short-term trading opportunities offered by buying in lower areas and selling in higher areas。Closing these trades and re-trading in reverse will generate more than three hours of profit.。

The stop loss will be set relatively close to the entry level of the trade, which means that when a breakthrough finally occurs, the losing trade will not erode all the profits obtained in the previous period。

Crowded Trading

Since many strategies are well known in the market, trading opportunities are available through crowded trading。For example, scalping forex strategies may become crowded and many traders set their stops near the same level, these strategies may be triggered, causing the price to briefly spike。

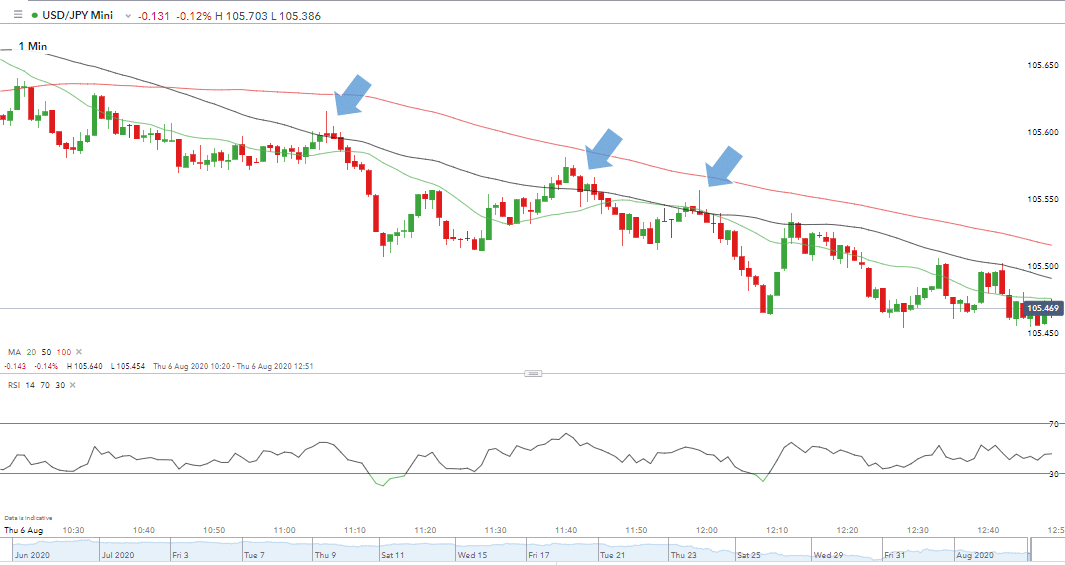

A one-minute candle chart of the USD / JPY shows that scalping opportunities exist for sell trades when the price hits and falls back 50 SMA。In three cases, the suggestion that the price will break upward causes short position stops to be hit, and these positions are closed。Of course, these deals represent buying pressure。Maybe not the strong buying pressure associated with a real breakout。

Dollar Yen - One Minute Candle - Crowded Trading

The domino effect translates into a long shadow on the candle and the opportunity to sell at a higher price from triggering a stop loss is the opportunity to scalp the scalper。It can be traded as a strategy on its own, or it can be incorporated into a scalping strategy by running a position with a broader stop loss。

Intraday trading

The strictest definition of intraday trading is that all positions are closed at the end of the trading day - there is no overnight risk。This feature of the strategy was developed in response to intraday trading activity in the stock market。Stock prices and those on exchanges such as Nasdaq are typically close to 9-5, and price movements between the previous day's close and the next day's opening can be large and out of investors' control.。

The forex market operates on a 24 / 5 basis, but the principle of intra-day trading has been carried over to the currency market, meaning that risk can be reduced。

Therefore, the strategy requires you to invest some time and resources, but with a certain degree of flexibility。Intraday trading strategies may involve making a trade at the beginning of a trading session and closing the position at the end of the trading session。

Range trading

Prices do not move in a straight line, and range trading involves changes in trading prices within a range。The strategy is effective when the market is experiencing a period of low volatility, and if the medium- to long-term price direction is not yet determined, prices are likely to "go sideways."。

Technical analysis is the primary tool used by the strategy。In the scalping strategy detailed above, there is an opportunity to trade within the range, which is caused by the price encountering a significant trend line resistance level。

Other indicators may also cause prices to trade within a certain range, and there may even be market calm, for example, during the summer months, many institutional investors are on vacation。National holidays, especially in the United States, have traditionally been a signal that markets can be volatile, while the rest of the world waits for American big shots to return to work and give markets a sense of direction.。

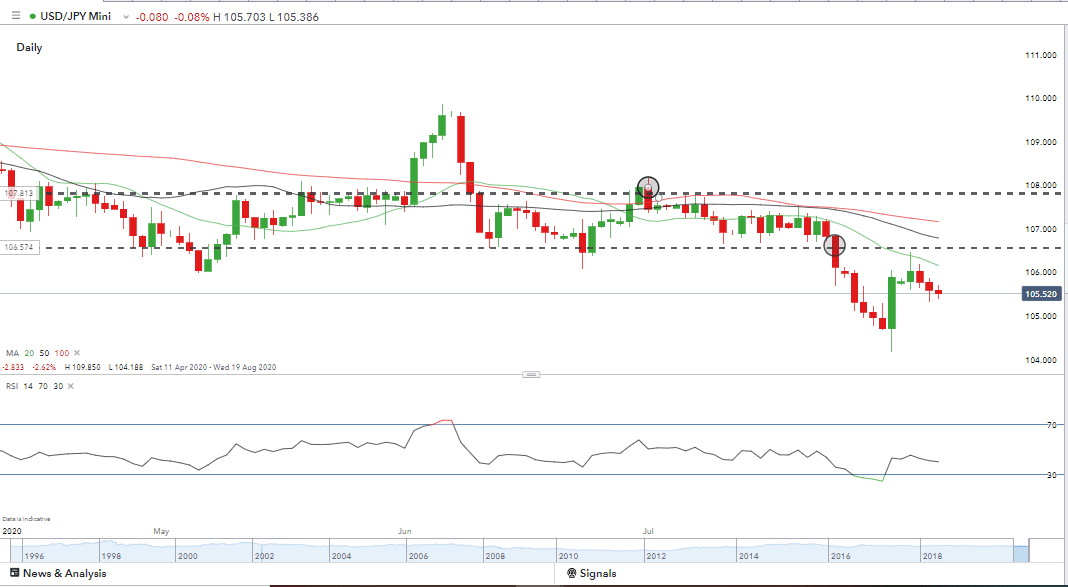

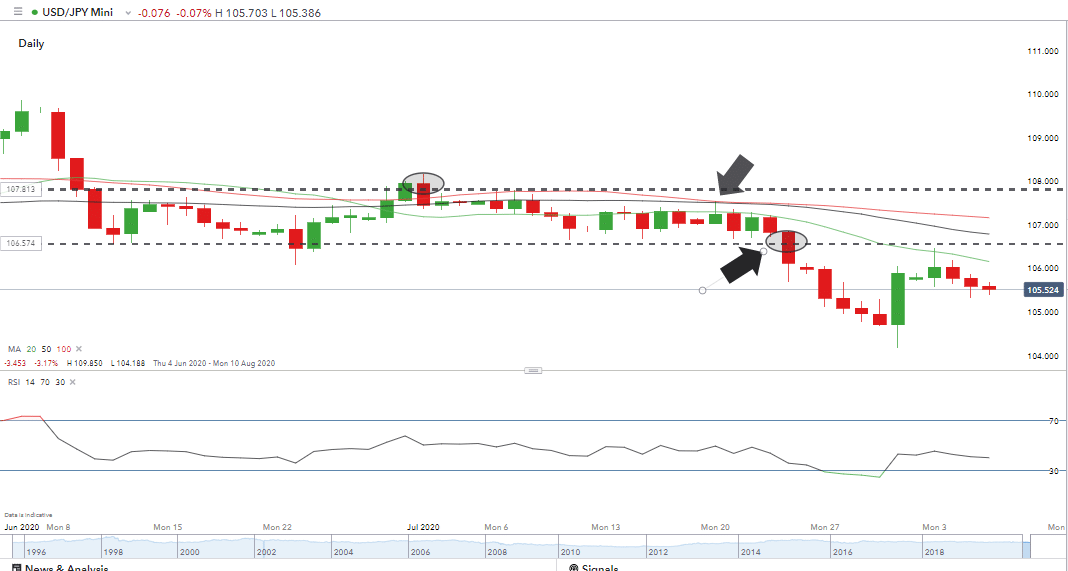

USD JPY - Daily Candle - SMA Range Trading

Range trading can be done using a variable time frame。The chart above shows the range opportunities that appear in the daily candle chart for the dollar and yen over a 24-day period.。

USD JPY - Daily Candle - SMA Range Trading

Zoom in and see that the price level cap is based primarily on the 100-day moving average。It is a resistance to price increases and a selling opportunity for range traders。The buy signal is less clear, indicating that the price is just back to touching the 100 SMA。When the price breaks down, there is a lack of direction。

The goal of those who follow a range trading strategy is to make enough profit during range trading and set a stop loss that is strict enough to protect profits when the inevitable breakthrough finally occurs。

Tracking Trends

One of the most straightforward Forex trading strategies involves identifying and tracking price trend movements。Traders of all experience levels use it。In fact, strategies such as Blue Trend, run by hedge fund BlueCrest Capital, generated billions of dollars in profits for investors during the 2008 financial crisis.。The company's computer algorithms are identifying medium- and long-term trends, then depressing them, backing up again.。

Short-term trends can be traded, using minute candle charts is as effective as using daily candle charts。However, the strategy is associated with longer holding periods。

One of the basic forex tricks associated with trend discovery is that "higher highs and higher lows" indicate a bull market and vice versa。

The hourly candle chart of the pound against the dollar shows a series of higher highs and higher lows (yellow and black arrows) until you want to treat either of the two red candles as a lower high。

Stops are often contradictory to ensure you don't get kicked out of your position before the trade starts。Trailing stops are also a feature of the market, so profits are not given up。

Beginners often make the mistake of trading pullbacks, reversing short-term trends into long-term trend patterns。Reversing trades can be profitable, but it's worth developing the skills needed to conform to the trend rather than buck it。

Fundamental Analysis

Recent geopolitical events such as Brexit illustrate how social shocks affect FX prices。Sterling falls sharply against dollar after 2016 Brexit referendum result。

Once the market calms down, technical analysis can be useful for exiting such trades, but less so for entering them。

carry trade

Arbitrage trading involves forecasting foreign exchange movements based on the interest rate policies of various central banks.。If the Bank of Japan is expected to lower interest rates, speculative funds will shift from the yen to other currencies with higher interest rates。

The Bank of Japan's current negative interest rate is -0.1%, while the Reserve Bank of Australia's interest rate is 0.25%。Japan's economy is suffering from chronic deflationary pressures, while certain sectors of the Australian economy, notably the property market, are seen as posing inflation risks.。

The intermittent nature of central bank announcements means it's a strategy for holding for longer periods, some for weeks, months or even years.。This allows the flow of funds from one country to another and is reflected in foreign exchange rate movements。If your account with a long position pays interest on the credit balance, then of course there is also the opportunity to earn a second passive income from this part of the strategy。

documentary transaction

The last strategy reminds you that they need to fit your situation。Documentary trading is taking orders from other traders and applying them to your account.。As an increasingly popular form of trading, it may be the relatively freest method。

Many strategies use technical analysis, which may not be as effective if optimism dominates the market。If "missing out" and "buying because prices are rising" prevail, moving averages, trend lines and oscillators become weaker。

No matter which method you choose, be consistent and ensure that your method is adaptable. Your method should keep up with the changing dynamics of the market。Although you may have a preferred strategy, if market conditions do not suit it, then not trading or using a different strategy may help your profits。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.