How to grasp the dividend of the times after the explosive growth of electronic payment after the epidemic?

In the age of electronic payments, the dominance of credit cards is coming to an end.

After the pandemic, contactless payment opportunities were born, leading to a global shift in consumer patterns towards more convenient and fast electronic payment methods. Interoperable payment systems, convenient QR code payments, and low-cost operations have led to significant development and transformation in the global electronic payment industry in recent years.

Electronic payments have seen explosive growth, with cash usage dropping by nearly half

According to the Global Payments Report published by Worldpay in May 2024, electronic wallets have become one of the most influential payment methods worldwide, with online payment shares exceeding 50% for the first time. By 2026, it is expected that the global e-commerce market will grow to more than 8.5 trillion US dollars, driving the continued strong growth resilience and market vitality of electronic payment services.

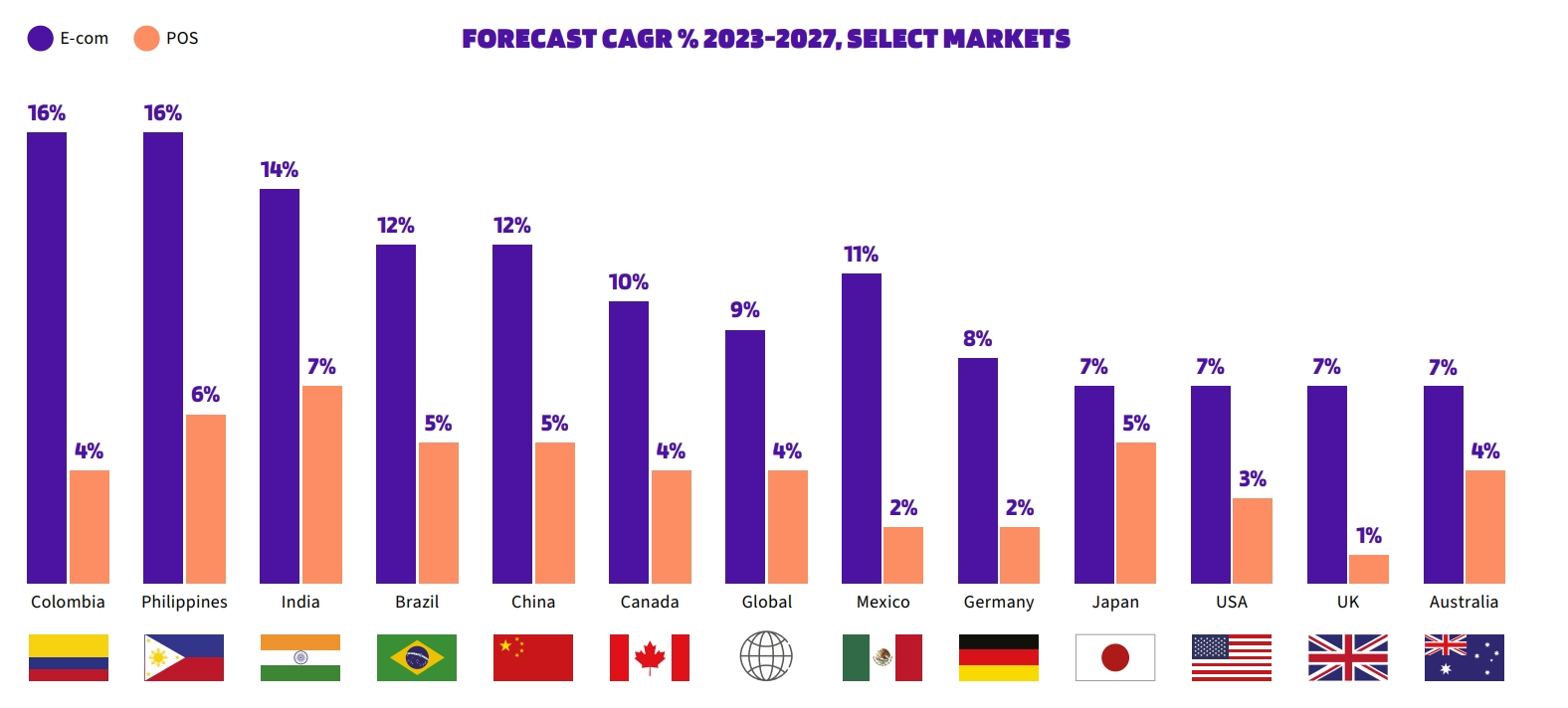

Regionally, electronic payment services have seen robust growth in all areas over the past few years.

Taking North America as an example, although the credit card system is mature (with VISA, MasterCard, American Express, and Diners Club, six of the world's major credit card organizations, all originating from the United States), electronic payment methods such as PayPal and Apple Pay have become very popular.

Payment methods in Europe show diversity: credit card payments, electronic wallets, third-party payments, and online bank transfers are flourishing, but third-party electronic wallets like PayPal and Klarna are increasingly being widely used.

In the Asia-Pacific region (excluding China), the proportion of e-commerce transactions through digital wallets has significantly increased from 12% in 2018 to 28% in 2022. The FIS 2023 Global Payments Report states that by 2026, India and Southeast Asia will be the regions with the strongest e-commerce growth in the Asia-Pacific region.

Driven by mobile commerce, Latin America has the fastest growth in global e-commerce, with a double-digit annual growth rate before 2026, and is expected to grow at a compound annual growth rate of 16% by 2026.

Worldpay believes that although credit cards are still the leader in e-commerce payments, their market share is gradually being eroded by account-to-account (A2A) payments and local payment methods such as digital wallets. Since 2018, the use of digital wallets has increased fourfold, and cash usage has decreased by nearly half. Global consumers are actively embracing new payment methods, but they also have higher demands for the selectivity and flexibility of payments.

It can be said that in the era of electronic payments, the dominant position of credit cards is about to end.

How to seize the dividend of electronic payments?

How can we embrace the opportunity of the electronic payment boom? Purchasing ETFs may be a good choice.

There are mainly passive funds that track the IPAY index and active investment funds similar to Doo Wealth available on the market. The former mainly tracks the Prime Mobile Payments Index, which tracks the stock prices of large communication companies such as credit card networks, payment infrastructure, and software services; the latter mainly tracks the stock prices of large electronic payment companies such as Apple, Oracle, Amazon, and VISA, sharing the future development dividends.

No matter which one you buy, please remember the following five investment tips:

Build a diversified investment portfolio: Although such ETFs have diversification characteristics, you should still include them as part of a broader investment portfolio. This means that ETFs can be combined with investments in other industries or asset classes, such as real estate, energy, healthcare, etc., to balance market fluctuations.

Hold long-term to achieve appreciation: Since the companies invested in by such ETFs are developing rapidly in terms of technological innovation and market expansion, long-term holding helps to grasp the growth trend of the industry and achieve capital appreciation. Do not rush to sell due to short-term market fluctuations.

Pay attention to industry development: You need to closely monitor new trends, technological innovations, and regulatory changes in the mobile payment and fintech industries, which may affect the performance of such ETFs. Regularly reading industry reports and analysis helps to understand how these changes affect investments.

Consider market timing: Understanding market fluctuations and grasping investment timing is equally important. Investing at market lows or selling part at high points can maximize the investment returns of such ETFs.

Seek professional advice: Sometimes, investing some fees to obtain professional financial advisory services is a wise choice! They provide personalized advice to help you review how to adjust your investment portfolio to better meet your financial goals and risk tolerance.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.