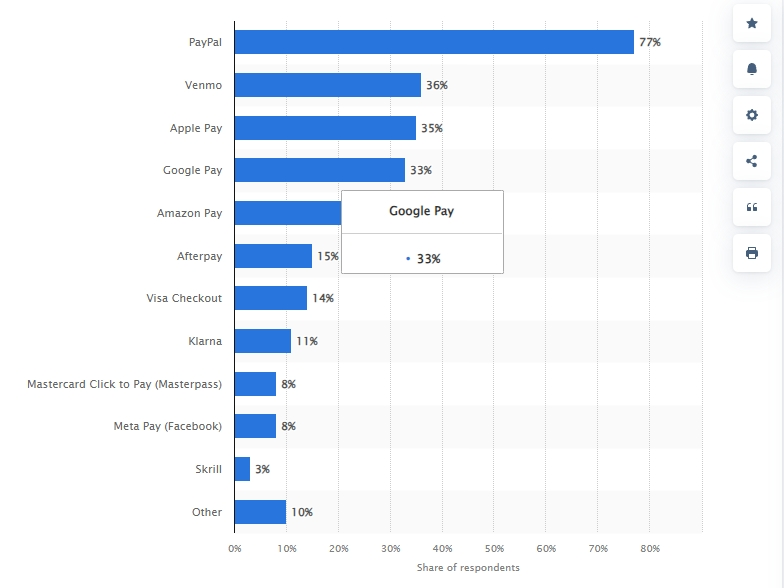

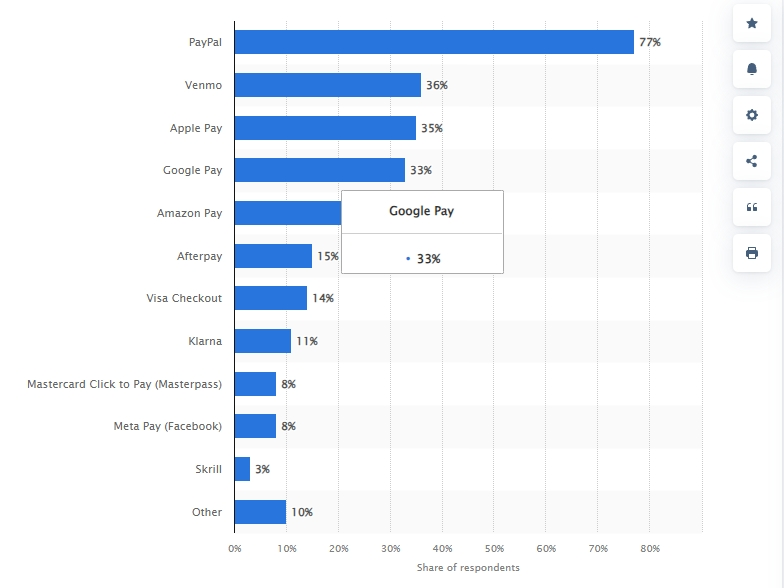

Recently, well-known data website statista announced the market share ranking of U.S. electronic payment brands from October 2023 to September 2024.Data shows that global electronic payment giant PayPal won the championship with an overwhelming 77%.Venmo with social attributes and Apple Pay, a subsidiary of Apple, are ranked second and third.Google Pay followed closely.

PayPal: The strong will always be strong

PayPal's victory is not surprising.

As one of the first companies to participate in mobile payments, PayPal has repeatedly benefited from the rapid spread of mobile payments after the epidemic.According to PayPal's latest financial report, in the first quarter of 2024, PayPal's net revenue reached US$7.699 billion, an increase of 9% compared with US$7.040 billion in the same period last year; net profit was US$888 million, compared with US$795 million in the same period last year. The increase is 12%, which is quite eye-catching.

In terms of total payments (TPV), the most eye-catching thing, PayPal also achieved a good result of 403.86 billion yuan in the first quarter, a 14% increase from last year's US$354.508 billion.Since PayPal is the dominant company in the field of mobile payments, by observing PayPal's TPV, we can indirectly understand the development trend of the entire mobile payment field.

Venmo: Has entered PayPal's key development list

Venmo is a bit similar to China's "Alipay".

The app was established in 2009 by alumni of the University of Pennsylvania. It initially provided small mobile payment services in the United States, but was indirectly bought by PayPal after attracting market attention.Since then, Venmo's development has reached another order of magnitude: Venmo, which started as a microfinance company, handled transfers of as high as US$7.5 billion in 2015 in just a few years, and as high as US$3.2 billion in the first quarter of 2016.

Unlike other payment tools, Venmo also adds social attributes to the software.Users can not only add friends to the software, but also leave messages to each other when transferring money to increase interaction.Venmo's rapid development has also attracted the interest of parent company PayPal. The company said it will accelerate Venmo's development in the United States after the second quarter of this year.This strategic shift has begun to have a positive impact and is expected to continue in the coming quarters.

Apple Pay: Ten years to sharpen the sword

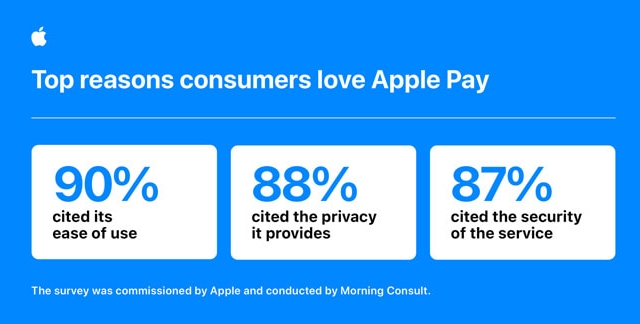

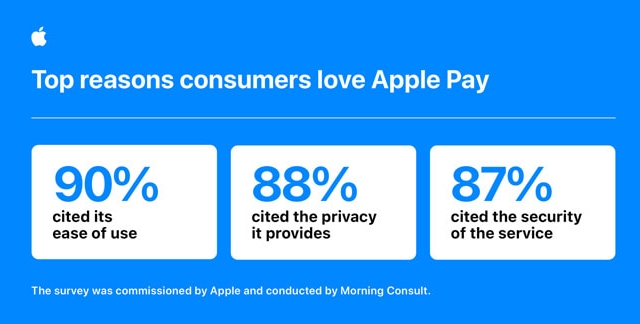

As an upstart to join the mobile payment track across borders, Apple Pay has also entered its tenth year of development.At the just-concluded 10th anniversary celebration of Apple Pay, Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet, said: Today, Apple Pay is used by hundreds of millions of consumers, millions of websites and app checkouts, tens of millions of stores in 78 markets around the world, and is supported by more than 11,000 banks and network partners.

In terms of hardware, Apple Pay has the support of Apple phones, which are popular around the world; in terms of software, Apple has invested heavily in customizing a secure and user-friendly payment system for Apple Pay that uses NFC technology.It can be said that the development of Apple Pay is the result of Apple's efforts.This business has been growing steadily since its launch in 2014.

In 2021, Apple Pay's revenue has exceeded the $1 billion mark; fast forward to 2022, Apple Pay's revenue has nearly doubled to an astonishing $1.9 billion.Especially after the epidemic, as more and more users have developed the habit of contactless payment, many digital payment software such as Apple Pay have received a steady stream of dividends.

How to grasp electronic dividend payment?

Now, this dividend continues.

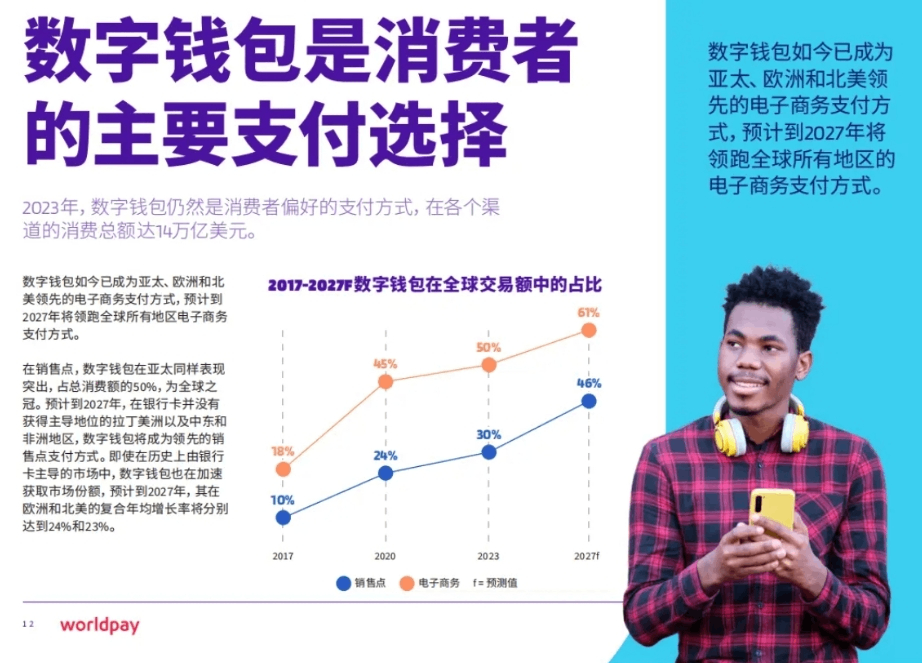

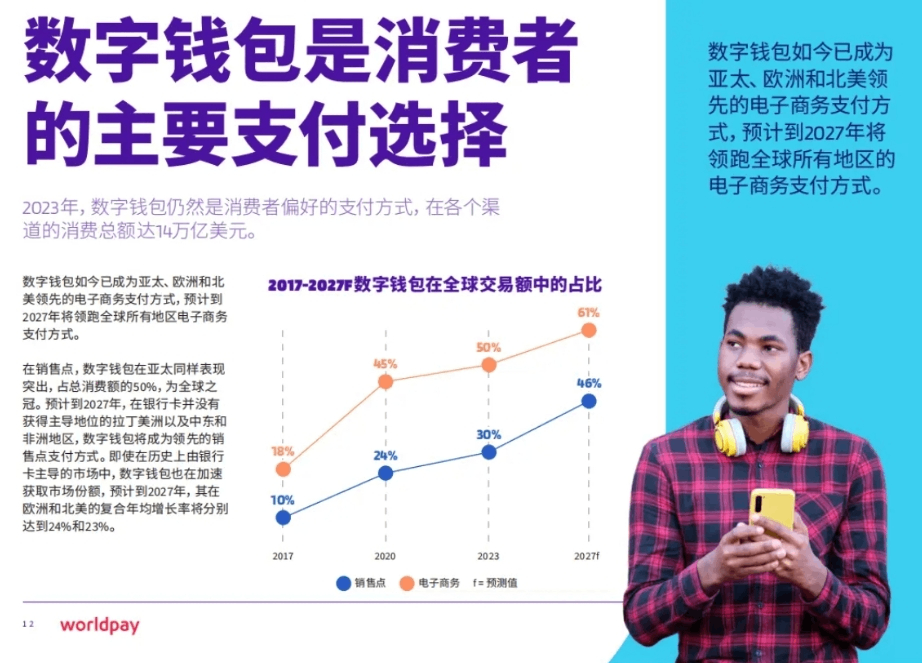

According to statista, with the rapid adoption of mobile payments, transaction volume at the track is expected to reach US$19.89 trillion by 2026, with a compound annual growth rate of 24.4% during the forecast period.Worldpay also predicts that by 2027, half of global transactions will be in the form of electronic payments, with total payments exceeding US$25 trillion.

In this wave of growth, millennials have made huge contributions.Generation Z naturally prefers to adopt digital services.Online banking is the most commonly used banking channel among teenagers.Generation Z's growing demand for a more personalized, flexible and highly relevant consumer experience is feeding back on the profitability of digital payment tracks.

In this environment, top players in digital payments are also increasing their investment and expanding their business in digital payment services.For example, China e-commerce company Alibaba created Alipay to promote payment services between sellers and customers, thereby enhancing its operations and increasing customer engagement.In addition, Meikeduo in Latin America, Amazon in the United States, Lotte in Japan, and Shrimp Pi in Singapore have all launched their own electronic payment solutions.

So, how should ordinary people grasp electronic payment dividends in the post-epidemic era?Buying an ETF may be a good choice.

On the one hand, digital payment ETFs can package many of the listed companies mentioned above, allowing investors to receive dividends from a basket of stocks, focusing on sharing rain and dew.On the other hand, the selling price of ETFs is also cheaper than buying individual stocks alone, which can also greatly lower the threshold for investing and participating in the digital payment market and reduce risks.

Moreover, ETFs do not face the risk of suspension or delisting.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.For ordinary investors, mastering cash flow means mastering the ability to resist risks, while ETFs 'low threshold and risk diversification properties undoubtedly provide an additional layer of insurance for novice investors.