Bank of America: low inflation era is over, the dollar will continue to strengthen

Bank of America strategists say stubborn inflation will make it harder for major central banks to stick to their current inflation targets, which will drive the foreign exchange market from now on.。

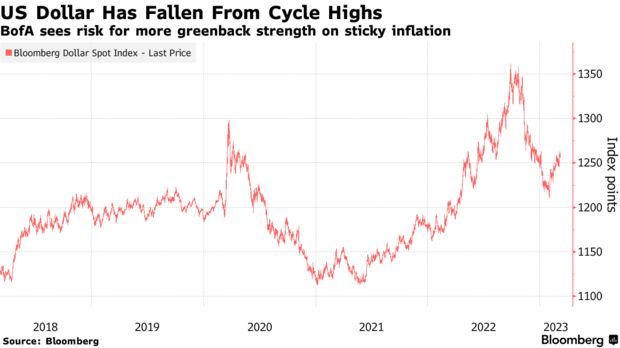

Bank of America strategists say stubborn inflation will make it harder for major central banks to stick to their current inflation targets, which will boost the foreign exchange market from now on.。Athanasios Vamvakidis, head of foreign exchange strategy at the Bank of America Group of Ten (G10), said the strong employment and inflation data had reinforced some belief that higher price pressures would persist and that the central bank's attempts to keep it below its desired target would jeopardize its credibility.。He added that this posed a risk of further dollar strength as inflation and developed country money markets were positively correlated。

Athanasios Vamvakidis said in a report: "Which central banks will stick to the inflation target and which will not, this will determine the future trend of foreign exchange."。He predicted it would be a "wink game."。He noted that central banks that promise to meet their inflation targets at all costs will see their currencies strengthen the most。He added that the era of low inflation is over.。

Although anchoring inflation at target levels has been the purpose of monetary policy since the 1990s, the 2% inflation target set by major central banks, including the Federal Reserve, has been the subject of renewed scrutiny as prices have soared。

In recent weeks, officials such as Fed Governor Philip Jefferson and Thomas Barkin have opposed an increase in the inflation target.。Others suggest that the central bank meet its 2% inflation target at a slower pace。There are concerns on the other side of the Atlantic.。Howard Davies, chairman of National Westminster Bank and former deputy governor of the Bank of England from 1995-97, said Britain would face "unpleasant" results if it tried to bring inflation down to target levels too quickly.。

In Athanasios Vamvakidis's view, the central bank's reliance on very loose monetary policy before the current surge in inflation could exacerbate the pain the economy needs to experience in returning to its 2% inflation target.。"Any central bank that seems more willing to do the easy part of its job than the hard part, more popular than unpopular, offering lots of good wine early in the party but not willing to take away the glasses when people are drunk, will lose credibility and see its currency devalue," he said.。"

Athanasios Vamvakidis said that historically, once inflation rises to such a high level, it takes time to reduce inflation, monetary policy is not tight enough, while the labor market is very tight and fiscal policy is too loose。

Athanasios Vamvakidis's dollar-bullish predictions came true to some extent last year, but the dollar's plunge in the final months of 2022 caught him off guard。Since then, his views on the persistence of inflation have become more assertive。He said in September that the Fed could avoid a "hard landing," but now he believes a "soft landing" is the least likely option.。He said: "It is too early to tell which central banks will stick to their targets and which will abandon them.。He expects the controversy to become even more important in the second half of the year.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.