AIA Q1 financial report good news Asia many new business value "soaring," have achieved double-digit growth!

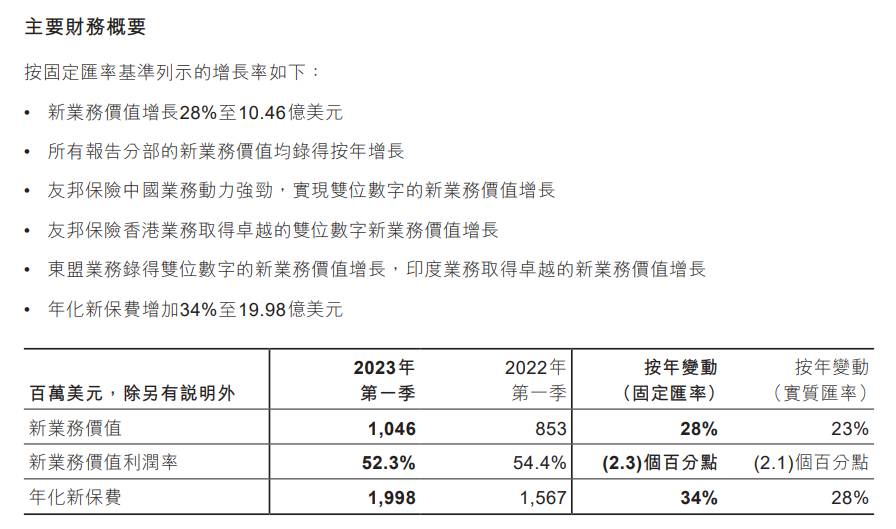

On April 27, AIA announced its first quarter 2023 results, which showed that the value of AIA's new business increased 28% to 10% in the first quarter of 2023..$4.6 billion, with an annualized premium increase of 34% to 19.$9.8 billion。

On April 27, AIA released its first quarter 2023 results report with a bright performance。AIA's new business value (NBV) grew 28% to 10% in the first quarter of 2023, performance data show..$4.6 billion, with an annualized premium increase of 34% to 19.$9.8 billion。AIA also said that all reporting segments achieved year-over-year growth in NBV。The company achieved double-digit NBV growth in its operations in Mainland China, Hong Kong, India and ASEAN.。

AIA's business in many places is booming, especially in mainland China, where the business accounts for a relatively high proportion, and the company believes that "the fundamentals of the Asian economy remain strong and mainland China's economic growth will improve after optimizing prevention and control measures, which is expected to bring further support."。"

Other markets saw NBV rise year-over-year, with strong business performance in India, Indonesia, New Zealand and the Philippines。Tata AIA Life ranks third among private life insurers in India。

AIA Q1 financial report, to which the major banks have responded。

Guotai Junan released a research report saying that the strong recovery in demand after the epidemic led AIA to increase NBV by 28% year-on-year in the first quarter, and it is expected that the company's mainland China and Hong Kong business will grow faster than expected this year, so it raised its overall NBV growth forecast for the year to 18% year-on-year..7%。Guotai Junan believes that AIA China will remain the largest contributor to the value of new business and expects strong savings demand from mainland Chinese residents and double-digit growth in agent capacity。The demand for insurance from local customers in Hong Kong, China has also increased significantly, while the demand from mainland tourists to purchase insurance in Hong Kong will also drive the continued growth of NBV, so the rating of "overweight" is maintained with a target price of 103..HK $96。

Credit Suisse reported that AIA's NBV rose 28% year-on-year in the first quarter, far exceeding market expectations, thanks to annualized new premium (ANP) growth。And gross margin fell 2.3 percentage points to 52.3%, mainly due to the shift in product mix to savings products in Mainland China and Hong Kong, China。The bank also said that in terms of its Hong Kong business, booming inbound tourism and continued marketing activities may support the company's performance in the second quarter.。Therefore, it maintains its target price of HK $101 and "outperform" rating.。

Haitong Securities believes that the current share price of AIA corresponds to 1.7x 2023 PEV, which the bank believes is undervalued and has a high margin of safety。Given that AIA enjoys a valuation premium over its peers, the Company 1.9 times 2023 PEV, with a reasonable value range of 95.16-99.HK $89, Maintain Outperform Rating。

Many of the big banks have raised their AIA ratings or target prices.。

Nomura sets AIA's target price from 96.HK $94 raised to 99.HK $91, Reiterates "Buy" Rating。Bank of America Securities raised its NBV growth forecast for AIA this year to 19% from 11%, while raising its price target from 93.7 HK $raised to 98.HK $4, Reiterates "Buy" Rating。Macquarie raised its adjusted earnings per share forecasts for this year, next year and 2025 by 4%, 5% and 4% respectively, while raising its target price from HK $95 to HK $98, maintaining its rating of "outperforming the market."。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.