Starbucks China failed to "counterattack" quarterly revenue again lags behind Ruiyu

This week, Luckin Coffee and Starbucks released their new quarterly results.。According to the data, Ruixing's net income totaled RMB 7.2 billion, or 9.$86.8 billion; revenue on Starbucks' China side was 8.$40.6 billion, again behind Ruiyu。

This week, Ruixiang Coffee (hereinafter referred to as "Ruixiang") and Starbucks have released the new quarter's earnings。As the two largest coffee chain brands in the Chinese market, the competition between the two is becoming increasingly fierce.。

The "drama" of the counterattack was not staged.

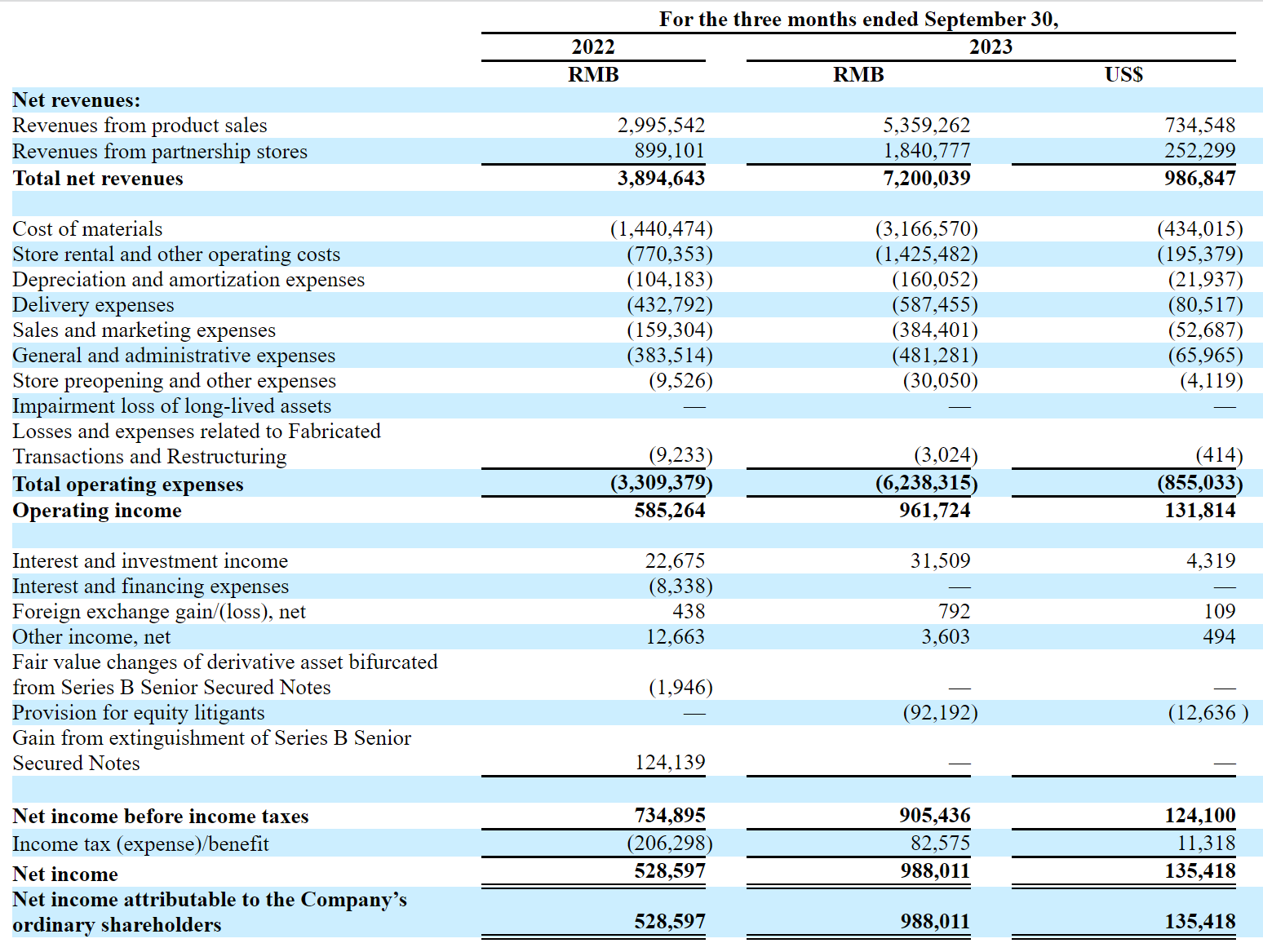

Ruixing released its third-quarter results before U.S. stocks on Wednesday (November 1).。Performance data show that the total net income of Ruixing in the third quarter was 7.2 billion yuan (RMB, the same below), equivalent to 9..86.8 billion U.S. dollars, up 84% year-on-year.9%。Net profit is 9.8.8 billion yuan, an increase of about 86.9%。

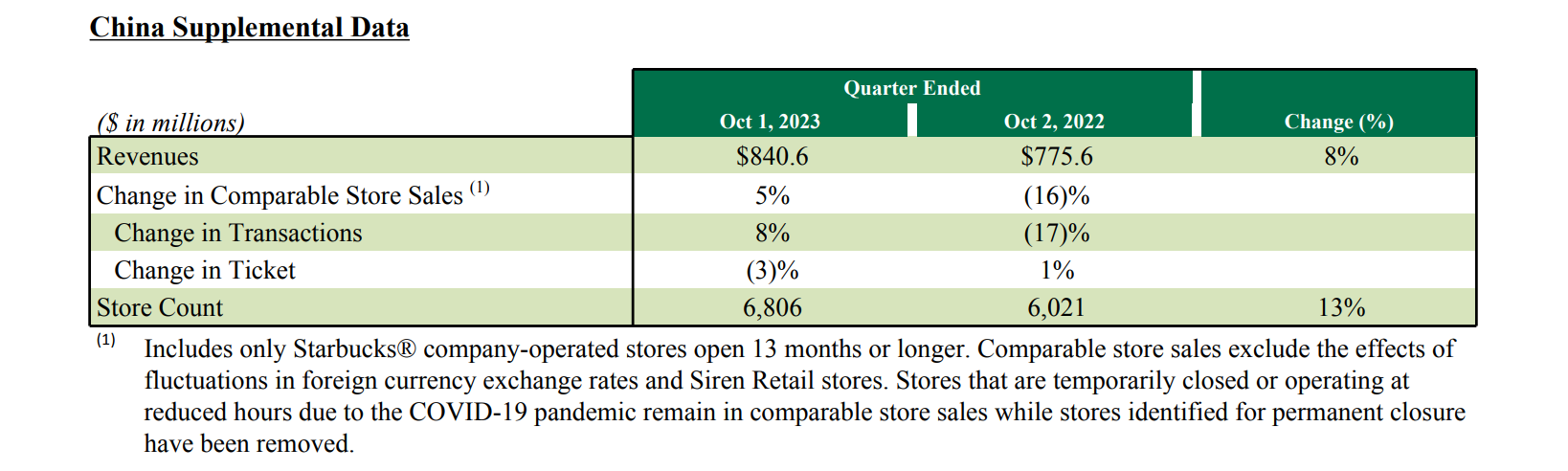

Starbucks, on the other hand, released its fourth-quarter results for fiscal 2023 on Thursday (November 2) before the U.S. stock market.。Data show that in the fourth quarter, Starbucks China market revenue of 8.$40.6 billion, up 15% YoY。Same-store sales increased 5% year-on-year, same-store transaction volume increased 8%, and average customer unit price decreased 3%。For the full fiscal year 2023, Starbucks China revenue reached $3 billion, up 11% year-over-year, and same-store sales increased 2%。

From the two results, Starbucks' revenue performance in the Chinese market is still inferior to that of Ruiyu。

Last quarter, Starbucks' first single-quarter revenue in the Chinese market was surpassed by Ruiyu.。At the time, Starbucks China CEO Wang Jingying said in a telephone conference: "We welcome competition because competition actually expands the coffee market and accelerates the popularity of coffee consumption.。"We are focused on delivering a premium coffee experience, building an emotional bond with our customers and partners through high-quality coffee and a unique Starbucks experience that no other brand can replicate."。"

But unfortunately, there was no news of a counterattack in Starbucks China's new quarterly results, and revenue once again lagged behind Ruiyu。

Three great tricks of Ruixing

Ruiyu once again put Starbucks, an old coffee chain brand, "behind," thanks to its three tricks。

The first trick is low price。In the third quarter, Ruixing continued to carry out the "Ten Thousand Stores Celebration" campaign, in which 9.9 yuan coffee continues to drive up sales of store products。

On the basis of low prices, Ruixing's ingenious new products are also a major factor driving the significant growth in sales.。In September, Ruixing and Guizhou Maotai's joint coffee - Maotai latte detonated the network, directly driving the door online and offline purchase channels to achieve "double explosion."。According to the official introduction, the sales volume of the single product exceeded 5.42 million cups on the first day of its launch, and the sales volume directly exceeded 100 million yuan.。

It is understood that, including the sauce-flavored latte, Ruiyu launched a total of 12 current drinks in the third quarter, an average of one new drink a week.。

The effect of low-cost superposition of new products is also very obvious.。In the third quarter, Ruixing disclosed that its average monthly trading customers reached 58.48 million, a significant increase of 132.9%, another record high。The number of new customers exceeded 30 million, and as of the third quarter, the cumulative number of consumer customers has exceeded 200 million.。

But low prices have also eroded Rexroth's profit margins.。In the third quarter, Ruixing's net profit margin was 13.4%, compared with 13 in the same period last year..6% down slightly。Fortunately, the growth of economies of scale in the product offset part of the decline in profits, so that profit margins are not significantly reduced.。

In a phone call, Ruixing Chairman and CEO Guo Jinyi responded to questions about profits。He said: "Although the profit in the third quarter has fallen, but fully in line with the company's strategic expectations, China's coffee industry is in a period of strategic opportunities for rapid growth, industry competition is increasingly fierce, the development pattern is far from fully formed, so market share has become the core goal of the company's development.。"

In order to take advantage of economies of scale to a greater extent, has entered the "ten thousand store era" of Ruixing is still rapidly expanding stores, which is one of the company's tricks.。

According to the earnings report, Ruixing opened 2,437 new stores in the third quarter, up 22.5%, with a total of 13,273 stores。Among them, there are 8,807 self-operated stores and 4,466 affiliated stores, maintaining the leading position in the industry.。In contrast, Starbucks added about 300 new stores in China in the fourth quarter.。

And most importantly, compared to Starbucks stores that are largely concentrated in big cities, Rexroth's stores have been sinking into lower-tier cities。

"As competition in the Chinese coffee market intensifies, we will continue to encrypt the number of stores in high-tier cities, while accelerating the expansion of the sinking market through the joint venture model to further expand market share," Ruixing said in its earnings report.。By the end of this year, the total number of Ruixiang coffee stores is expected to exceed 15,000.。"

Guo Jinyi said: "The company's performance in the third quarter remained strong, with another record-breaking revenue and further improvement in store penetration.。We will continue to increase investment, focus on customer value, social value and partner value, and strive to build Ruixing Coffee into an excellent, world-class century-old coffee brand.。"

Starbucks: North American market bright, the next two years in China to add more than two thousand stores

If you look not only at Starbucks' performance in China, but at Starbucks' overall performance, Starbucks' performance in the fourth quarter is still very bright.。

According to Starbucks' earnings report, the company achieved revenue in the fourth quarter 93.$700 million, up 11.4%, higher than market expectations of 92.900 million dollars。Net profit surges nearly 39% to 12.$200 million, or diluted EPS 1.$06, well above 0 per share.$97 consensus。

In the fiscal fourth quarter, Starbucks' same-store sales in North America rose 8% year-over-year, benefiting from increased traffic and strong consumer spending, beating market expectations.。Average fares in North America increased 6% year-over-year and same-store transactions increased 2% in the fiscal quarter.。

Affected by strong performance。Starbucks shares jumped nearly 10 percent to close at 100 on Thursday.$01, the biggest gain in a year and a half。

Fourth Quarter, Starbucks Continues to Expand Its Global Footprint。A total of 816 new stores opened during the quarter, bringing its global total to more than 38,000, with more than half of them located outside the United States.。The U.S. and China are Starbucks' first and second largest markets, respectively, and together they account for 61% of Starbucks' global stores。Starbucks has 16,352 and 6,806 stores in the U.S. and China, respectively。

In terms of store expansion, Starbucks said it plans to expand its global number of stores to five by 2030..50,000, increasing the number of stores outside North America to 3.50,000。As of October 1, Starbucks had more than 3 stores worldwide..80,000, with about 20,000 stores outside North America。This means that Starbucks will add about 1.70,000 stores, and about 1.50,000 new stores to open outside US。

However, Starbucks expects the number of stores in China to increase from the current 6,800 to 9,000 by the end of 2025.。Two years of new 2,200 stores, which is less than the number of new stores in the third quarter of Rexroth, it seems that Starbucks is still ready to continue to take the "steady and steady" route.。

Despite a bright fiscal fourth quarter in 2023, Starbucks said growth is likely to slow in the year ahead as it faces uncertainty about the global economy.。For the entire fiscal year 2023, Starbucks' revenue grew by 11.6%, to $35.9 billion。The company said it expects revenue growth in the next fiscal year to be below this range of 10% to 12%.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.