Thailand's digital currency subsidy program postponed to the first quarter of next year

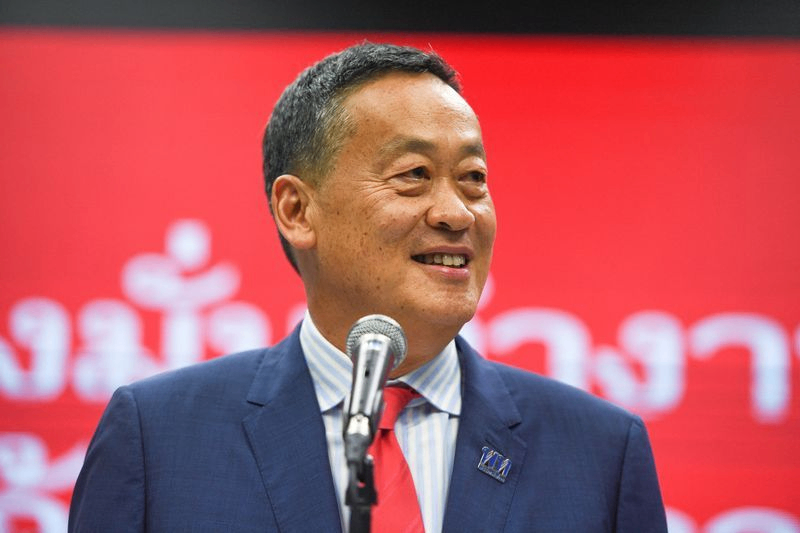

Thailand's Prime Minister Delays Distribution of Digital Currency by 3 Months and Reduces Beneficiary Range。The deputy finance minister says the government needs more time to develop the security system, which is scheduled to start in the first quarter of next year.。

Recently, Thailand's Deputy Finance Minister Julapun Amornvivat said that according to the instructions of Thai Prime Minister Srettha Thavisin, the government's plan to distribute 10,000 baht (about US $280) digital currency is unlikely to start on February 1 next year.。

The delay was allegedly because the government needed more time to develop a security regime for the program.。Julapun said, "We can't sacrifice the security of the system to get things done on time.。The implementation of the plan requires maximum security, but it is certain that the development work can be completed in the first quarter of next year, and the distribution of digital currencies will begin immediately.。

Regarding the planned irregularities, Julapun stressed that the security system being developed by the current government will effectively prevent all corrupt practices to avoid a series of illegal cases that have appeared in the rice pledge scheme of the Yingluck Shinawatra government in the past.。

"We are sure that there will be no irregularities。But if there are any corruption cases, the government will certainly take legal action, "he said.。

As one of the main campaign promises of the ruling Pheu Thai party, the "digital currency distribution plan" is the core of the plan to boost Thailand's economy.。The Thai government also said the subsidy was aimed at boosting the Thai economy and bringing GDP to its target of 5 percent annual growth.。

However, some economists warn that the plan will impose a huge fiscal burden on the country, which will increase public debt, as well as funding problems.。A growing number of economists, including two former governors of Thailand's central bank, say the policy poses too much risk to the economy at a time when public debt tolerance limits are being tested。

Thai Prime Minister Srettha said the multiplier effect of increased consumer spending would help the economy grow by 5 per cent next year and that tax revenues from economic activity would be part of the cost of the plan.。

In addition, many critics have called for "vulnerable groups to be the focus of subsidies," and Julapun responded at the meeting: "Since the country's GDP growth has been low, the plan is designed to stimulate the economy, not welfare policy.。If the government does nothing, GDP growth will continue to be low。"

It is understood that during the general election earlier this year, the Pheu Thai Party had promised that all Thai citizens over the age of 16 could receive this subsidy for consumption in shops within a radius of 4 km of their place of registration within six months.。However, it has been reported that the scope of the provisions or will be eliminated。

At the press conference, Thai Prime Minister Srettha said the government needs to realign plans to maintain fiscal discipline and prepare the necessary budget.。

Subsequent announcements showed that people with a monthly income of more than 70,000 baht or a total bank deposit of more than 500,000 baht were not eligible for collection.。As a result, the number of people who can benefit from the programme has been reduced from the projected 54.8 million to about 50 million; spending is also expected to be reduced by 48 billion baht to about 500 billion baht.。

On issues such as funding sources and distribution conditions, Julapun admitted that its subcommittee had not yet been able to conclude that it would meet again and submit proposals to the Digital Currency Distribution Committee, chaired by Prime Minister Srettha.。

Thai Prime Minister Srettha revealed that the funds will be raised from the loan and the government will ask parliament to pass a bill allowing the government to borrow。The Judiciary Committee will begin drafting the law within this month and submit it to Parliament by January 2024.。He said: "The law should be passed through all parliamentary processes by May 2024, when funds will be in place and the Government will also set aside a budget to repay the loan over the next four years.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.