U.S. Bitcoin ETFs See $274M in Net Inflows, Bitcoin Lingers Near $83,000 U.S. Bitcoin ETFs See $274M in Net Inflows, Bitcoin Lingers Near $83,000

Key momentsA $274 million influx into U.S. Bitcoin ETFs on Monday, a six-week high, ended weeks of outflows.All five Bitcoin ETFs reported net inflows, with Fidelitys FBTC leading at $127.3M, followed

Key moments

- A $274 million influx into U.S. Bitcoin ETFs on Monday, a six-week high, ended weeks of outflows.

- All five Bitcoin ETFs reported net inflows, with Fidelity’s FBTC leading at $127.3M, followed by ARKB ($88.5M) and IBIT ($42.3M).

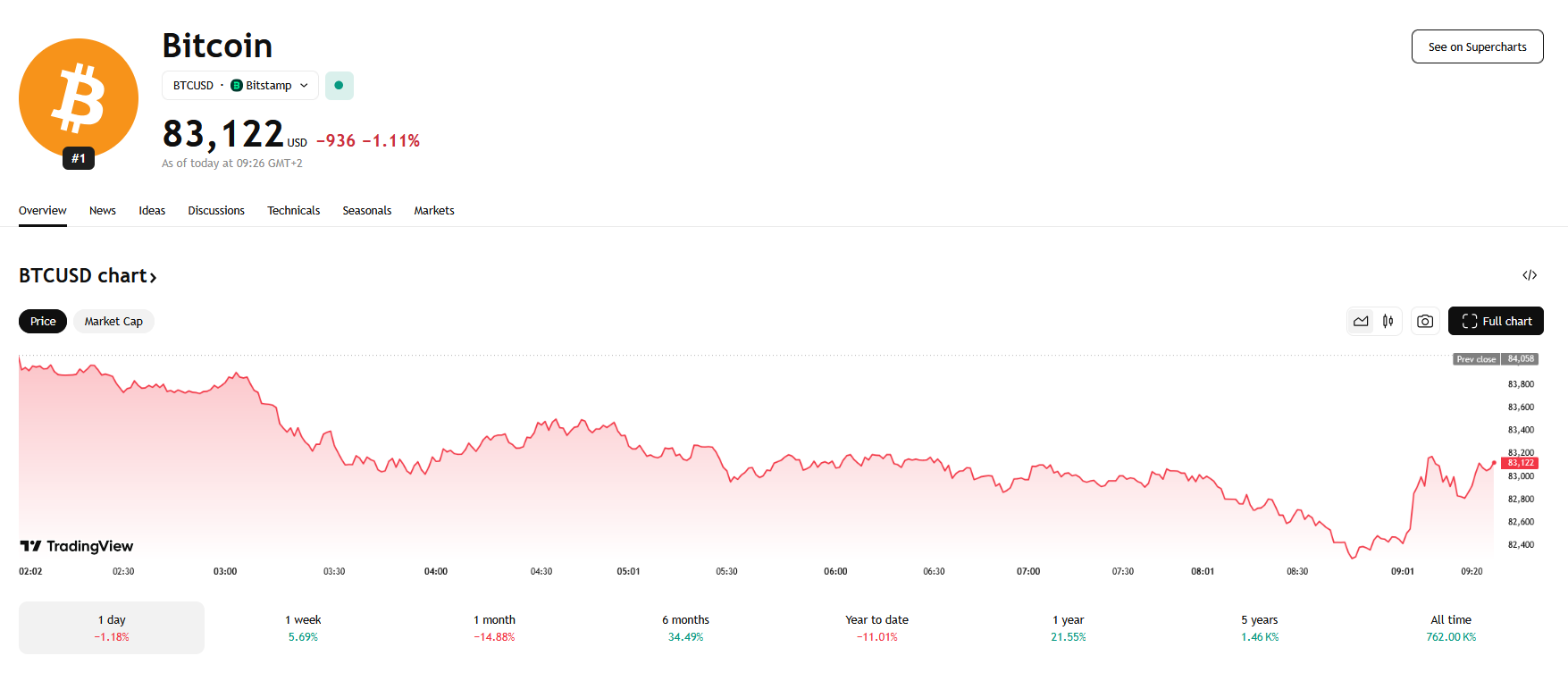

- The price of Bitcoin remained largely unchanged, fluctuating between $83,000 and $84,500.

Bitcoin ETFs Gain Momentum

A notable resurgence in interest has been observed within the realm of U.S.-based spot bitcoin exchange-traded funds, as these financial instruments recently experienced their most significant daily influx of capital in six weeks. This financial surge, totaling $274 million, occurred on Monday, marking a departure from the sustained period of net outflows of approximately $5.4 billion that had characterized the preceding weeks.

Monday’s influx suggests a renewed confidence in the digital asset, potentially driven by a stabilization of bitcoin’s price and a resurgence of institutional interest. The market saw five distinct bitcoin ETFs register net inflows, a positive development further underscored by the absence of any funds reporting outflows. Fidelity’s FBTC led the charge, attracting $127.3 million, while Ark and 21Shares’ ARKB saw $88.5 million deposited. Even BlackRock’s IBIT, the largest spot bitcoin ETF by net assets, participated in the positive trend, recording inflows of $42.3 million.

Analysts point to several potential factors contributing to the observed trend. One explanation centers on the quarter-end rebalancing of institutional portfolios, a common practice that could be driving increased demand for bitcoin ETFs. Additionally, the appeal of lower-fee ETFs may be attracting investors seeking cost-effective exposure to the digital asset.

However, the cryptocurrency market remains inherently volatile, and the recent influx of capital does not guarantee sustained upward momentum. Indeed, the price of bitcoin has remained somewhat stagnant, trading within a narrow range between $83,000 and $84,500.

The above observation raises questions about the immediate impact of ETF inflows on the cryptocurrency’s market value. While the significant financial infusion suggests a renewed appetite for bitcoin among investors, it has not yet translated into a dramatic price surge.

Experts caution that institutional rebalancing could also trigger outflows if price weakness emerges. Furthermore, the overall market sentiment remains sensitive to macroeconomic factors and regulatory developments.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.