U.S. August ADP plunges 45% month-on-month, rate hike cycle really ends?

Arguably, if the next crucial U.S. non-farm payrolls report and PCE data satisfy the Fed。This protracted cycle of rate hikes may really be over。

On August 30, local time, the United States announced the ADP employment report, known as "small non-farm"。U.S. ADP employment rose less than expected in August, recording only 17.70,000 with an expected value of 19.50,000, up from 32 last month..40,000 people plummeted 45% and recorded the smallest increase in 5 months。

Jobs data continues to be weak, market bets on Fed to stay put in September

In addition to the slowdown on the demand side of the labour market, wage growth is also falling at the margin.。Data show that in August this year, the wages of American employees increased by 5.9%, a record low in nearly two years。

The cooling of the labor market is supported by another piece of data: July JOLTS job openings also fell more than expected, reaching a more than two-year low, according to the U.S. Labor Department on Tuesday, one of the jobs data that the Federal Reserve is highly concerned about.。

Overall, the Fed's labor market data released this week was relatively weak, as the bank expected。Following Fed Chairman Jerome Powell's hawk at the Jackson Hole central bank's annual meeting, markets have rekindled bets that the Fed's rate hike cycle is coming to an end。

Affected by the data, U.S. stocks opened high yesterday, but in the midday before a collective turn down, and then resume the rally, the Dow had turned down at one point in late trading, but eventually the three major U.S. stock indexes closed up。By the close, the Dow closed up 37.57 points, up 0.11%, at 34,890.24 points。S & P 500 closes up 17.24 points, up 0.38%, at 4514.87 points。Nasdaq closes up 75.55 points, up 0.54%, reported 14019.31 points。

Currently, according to CME Fed Watch, the bank's probability of holding down in September has risen to nearly 89%, while the probability of further rate hikes in November has fallen below 42%。Arguably, if the next crucial U.S. non-farm payrolls report and PCE data satisfy the Fed。This protracted cycle of rate hikes may really be over。

U.S. employment slowed significantly in August Leisure and hospitality underperformed

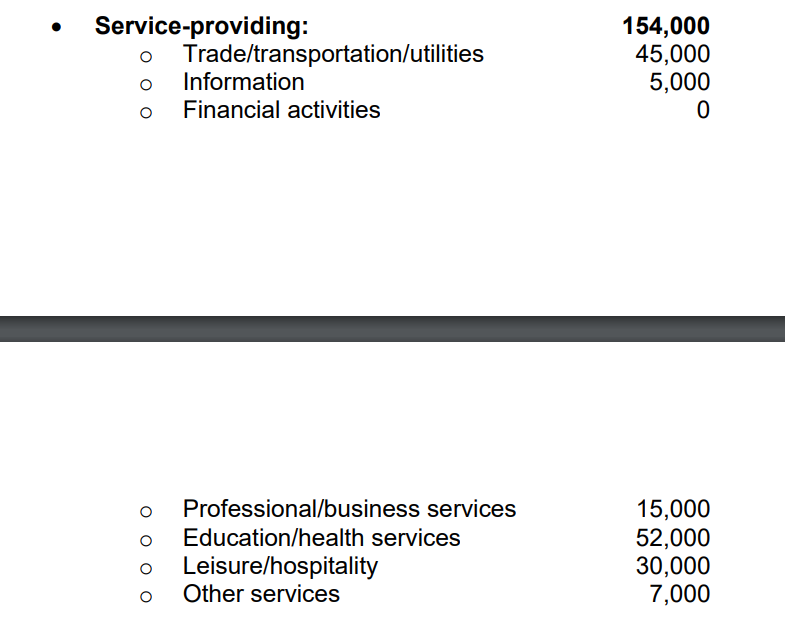

Specifically, in August, the service sector in the United States increased by 15.40,000 jobs。Among them, education and health contributed 5.20,000 jobs; trade, transport and utilities contributed 4.50,000 jobs; leisure and hospitality contributed 30,000 jobs; professional and business contributed 1.50,000 jobs; information sector contributes 0.50,000 jobs。

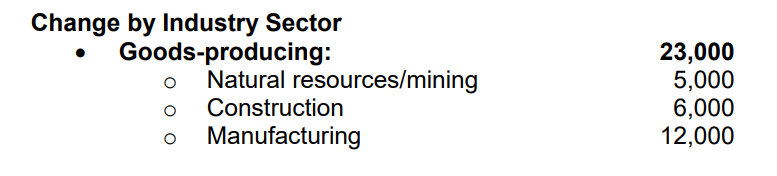

The commodity production sector increased by 2.30,000 jobs。The manufacturing sector contributed 1.20,000 jobs; construction contributed 0.60,000 jobs; mining contributed 0.50,000 jobs。

According to this report, there are clear signs of a slowdown in job growth this month, mainly dragged down by the leisure and hospitality sectors.。After months of strong hiring, the number of jobs created by employers in the hotel and restaurant industry fell to 30,000 in August, down from 20 in July..10,000 jobs。

Commenting on the data, ADP chief economist Nela Richardson said this month's figures were consistent with the pace of job creation before the epidemic.。After two years of exceptional growth associated with economic recovery, wages and employment are moving towards more sustainable growth as the impact of the epidemic on the economy fades。

A New York independent metals trader believes that "the Fed is likely to remain on hold in September as the weaker-than-expected ADP report and GDP revision continue the softening momentum of economic indicators, so gold is trading at this month's high."。

Former Boston Fed Chairman Eric Rosengren (Eric Rosengren) said that if the labor market and economic growth continue to gradually slow at the current rate, the Fed can end the rate hike cycle。However, Rosengren added that a rate cut is unlikely to be on the agenda until the core PCE price index falls to "close to 3% rather than 4%."。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.