The world's largest gold ETF recorded a series of reductions in central bank purchases, but hit a new high.

All in all, gold is currently showing mixed signals until it breaks through 1985 or falls below 1935-1950, or shows a clear trend.。

On August 2, spot gold oscillated in the $1940-1950 / oz range。Following yesterday's fall of more than 1%, spot gold temporarily stopped the decline in the day, currently slightly down 0.14%, reported 1949.$48 / oz。

The job market has cooled, and the Fed is still afraid to slack off.

On the macro front, on August 1, local time, the U.S. ISM Manufacturing Index for July recorded 46.4, below the 50-year-old line for the ninth consecutive month, representing that U.S. manufacturing remains in the contraction zone。

Separately, U.S. JOLTS job openings recorded 958 in June.20,000, a new low since April 2021, indicating that the previously hot labor market has weakened.。Specifically, commodity-producing industries such as manufacturing play an important role in reducing job vacancies。

According to the JOLTS job openings report, the number of voluntary resignations fell by nearly 300,000 in June, while the rate of voluntary resignations by employees also declined, falling to 2..4%, the lowest level since February 2021。In general, a higher rate of voluntary turnover indicates a tight labor market and that workers are confident of leaving their current jobs in search of better opportunities, and vice versa.。

Some analysts say the data means that the labor market restructuring triggered by the epidemic, especially the prospect of low- and middle-income workers finding better opportunities in other industries, does not yet seem to have become a reality.。For the Fed, that means the job market may have been cool enough。

Earlier, on July 26, local time, the Federal Reserve raised interest rates by 25 basis points as scheduled, raising the benchmark interest rate by 25 basis points to 5.25% -5.50% range, the benchmark interest rate ceiling has exceeded its pre-Lehman peak.。From the FOMC statement, the wording of this meeting and last month compared to almost no change, only one noteworthy change, that is, for the current economic growth judgment, the Fed from moderate (modest) to moderate (moderate)。Some analysts say this may mean that the Fed's judgment on the economic situation has become increasingly optimistic。

But, according to Fed Chairman Jerome Powell, while Fed staff are now predicting a "significant slowdown" rather than a recession, there are plenty of signs that a recession is coming: the index of leading economic indicators has fallen 15 times in a row, the yield curve has inverted, and the number of corporate defaults has been rising.。

And the latest jobs data is just as Powell judged - job openings are down and labor demand is slowing.。But, fortunately for the report alone, companies still want to keep existing workers, i.e., unemployment is unlikely to soar anytime soon。

Central bank purchases hit a new high in the first half of this year

On the news front, yesterday, the World Gold Council released a new issue of its Global Gold Demand Trends Report.。

According to the report, purchases by central banks around the world hit a record high in the first half of 2023.。The report shows that in the first half of this year, the total global demand for gold reached 2,460 tons, an increase of 5% over the same period last year.。Among them, the global central bank gold purchase demand in the first half of the year reached a record 387 tons; global gold bars and gold coins total demand of 582 tons; although the gold price remains high, gold jewelry consumer demand is still resilient, the second quarter year-on-year growth of 3%, the first half of the total demand of 951 tons。

In response, Louise Street, senior market analyst at the World Gold Council, said, "In the past year, central bank purchases have hit record highs, dominating the global gold market.。Despite the slight slowdown in this demand in the second quarter of this year, this trend still highlights the importance of gold as a safe-haven asset; especially in the face of continuing geopolitical tensions and a challenging economic environment.。"

World Gold Council CEO Wang Lixin said, looking ahead, seasonal factors indicate that gold demand may pick up after the second quarter。Given the low base in 2022, year-over-year growth is expected to reach double digits in 2023。In terms of gold jewelry, various consumer stimulus policies may help gold jewelry demand growth。However, high domestic gold prices and economic growth uncertainty may hinder the growth of gold jewelry demand.。In terms of gold investment, market risk aversion may provide a boost to gold retail investment against the backdrop of economic recovery uncertainty and potential weakness in RMB assets

The world's largest gold ETF position continues to decline, the average gold price in the second half of the year is $2012 / oz.

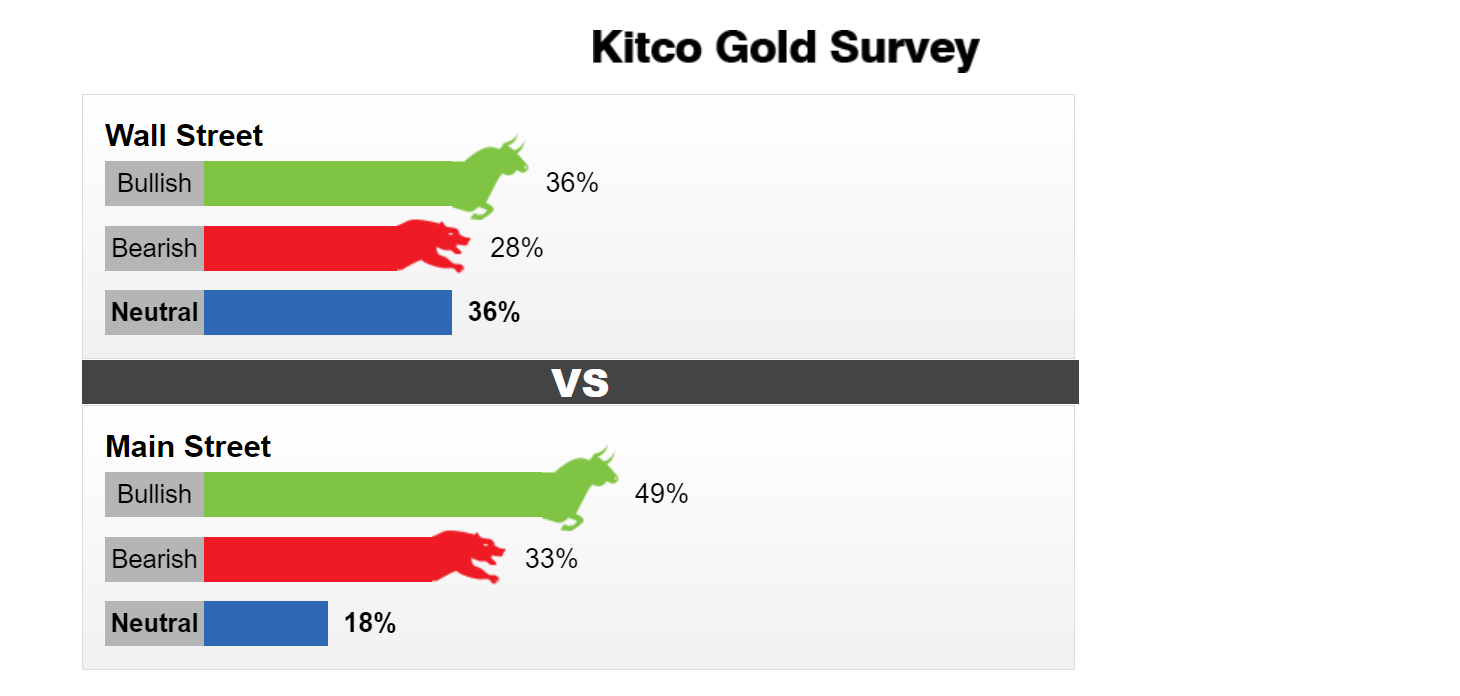

According to the new Kitco News Gold Survey, of the 14 Wall Street analysts surveyed on Friday, five each (36% each) took a bullish or neutral stance on gold this week, while four analysts (28%) said they were bearish on gold prices this week.。

As for retail investors, according to online polling, a total of 322 respondents participated in the Kitco News gold survey, of which 158 respondents (49%) expected gold prices to rise this week; another 106 (33%) said gold prices would close down this week; and 58 investors (18%) were neutral in the short term.。According to the survey, investors expect gold prices to trade around $1984 an ounce by the end of the week。

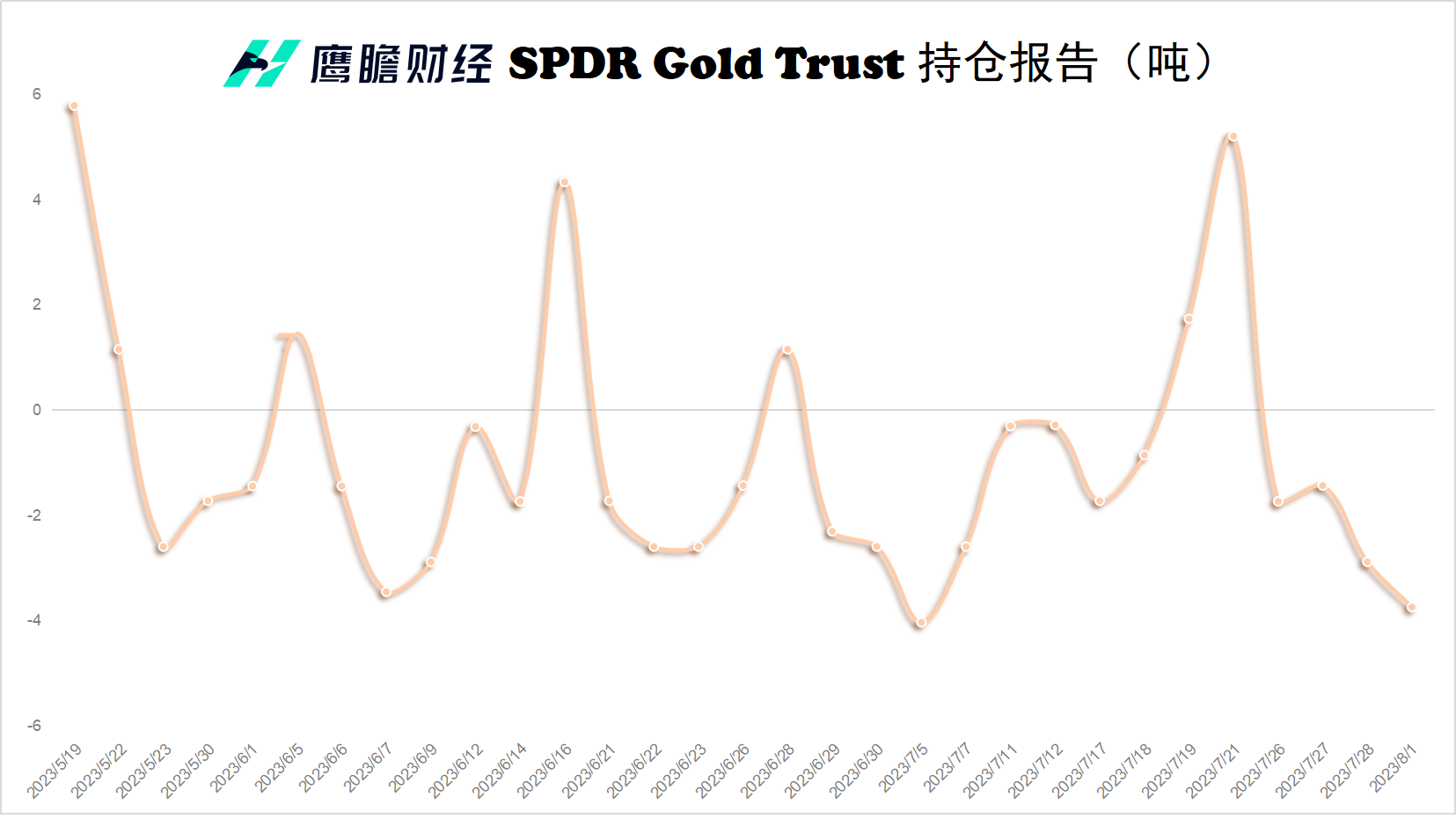

In terms of positions, according to the CFTC official website position data, as of the week of July 25, COMEX gold futures speculative net long position decreased by 19,616 lots to 116,291 lots, representing a reduction in the upward momentum of gold prices.。In addition, according to a position report by the SPDR Gold Trust, the world's largest gold ETF, on August 1, the ETF again reduced its holdings of gold 3.75 tons, has been reduced for four consecutive days since July 26。

According to JPMorgan's mid-year forecast, analysts expect gold prices to average around $2012 an ounce in the second half of the year.。Despite the poor performance of gold prices in June, they rose 5% in the first 6 months of the year..4%, making it the second best performing asset class, after developed market equities。

The Bank of China, for its part, said that gold has been forming ever-shifting highs and lows over the past two weeks, with the 50-day moving average, along with Friday's 20-day moving average close to $1945, stopping a major downward trend.。However, the negative trajectories of the relative strength index and the MACD indicator reflect the lack of momentum in demand.。The characteristics of range shock trading are still more obvious.。

On the upside, only a breakout of the 1985 level, or side is expected to continue to hit the 2000 mark; on the downside, the market will pay close attention to the 1935-1950 region, which contains the short-term moving average, the tentative uptrend line from the June low and the upper end of the channel, 38.2% of the Fibonacci line is also here。Therefore, a fall below the region could trigger a major sell-off to the 1892-1900 region。

All in all, gold is currently showing mixed signals until it breaks through 1985 or falls below 1935-1950, or shows a clear trend.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.