AI craze does not retreat! Nvidia fourth quarter data "burst table" net profit increased nearly 8 times.

On Wednesday, local time, Nvidia released its fiscal fourth-quarter results after hours in U.S. stocks.。After the announcement of the results, by the fourth quarter results "burst" and the first quarter guidance exceeded expectations, Nvidia's shares rose more than 9% after the market.

On Wednesday (February 21, local time), chipmaker Nvidia announced its performance report for the fourth quarter of fiscal year 2024 ended January 28, 2024.。

Fourth quarter data "burst"

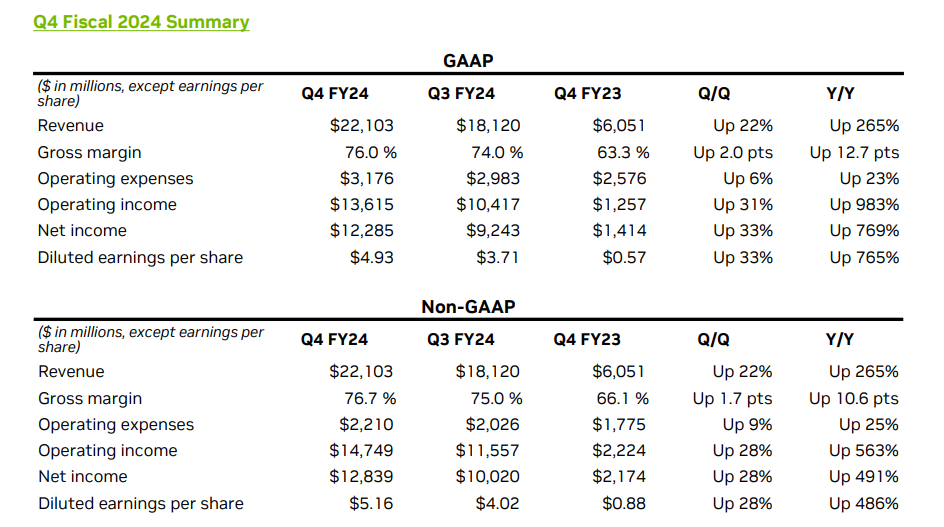

In the fourth quarter, Nvidia recorded revenue of $22.1 billion, up 22% from the previous quarter and up 265% from the same period last year, according to earnings data, which was also higher than analysts' expectations of 204.100 million dollars。The net profit was 122.$8.5 billion, up 33% month-on-month and 769% year-on-year。Non-GAAP adjusted EPS of 5.$16, up 28% month-on-month, up 486% year-on-year, also better than analysts' expectations of 4.60美元。Fourth Quarter Adjusted Margin 76.7%, exceeding analyst expectations of 75.4%。

Nvidia's fourth-quarter results mark the third consecutive quarter of triple-digit percentage growth in sales and earnings.。Its sales growth has been accelerating rapidly over the past three quarters。

For the full fiscal year, Nvidia's revenue grew 126% year-over-year to $60.9 billion.。Non-GAAP Adjusted EPS of 12.$96, up 288% YoY。

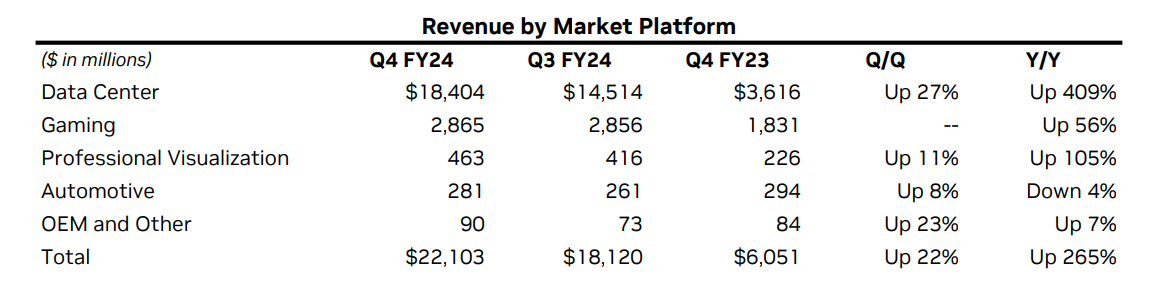

Specifically, in the fourth quarter, Nvidia's various business segments achieved sequential growth。

● Data center business。As the main source of Nvidia's revenue, revenue in this business segment reached a record $18.4 billion in the fiscal fourth quarter, up 27% from the previous quarter and a 4.9% year-on-year increase, higher than analysts' expectations of 172.100 million dollars。For the entire fiscal year, revenue in this business segment increased 217% year-over-year to $47.5 billion, a record high.。

● Game business。Revenue in this business segment was $2.9 billion in the fiscal fourth quarter, flat from the previous quarter and up 56% year-on-year.。Revenue for the entire fiscal year increased 15% year-over-year to $10.4 billion。

● Professional visualization business。Revenue for the fourth quarter of this business segment was 4.$6.3 billion, up 11% month-on-month and 105% year-on-year。Revenue for the full fiscal year increased 1% year over year to $1.6 billion。

● Automotive business。The segment's revenue in the fourth quarter was 2.$8.1 billion, up 8% month-on-month and down 4% year-on-year。Full fiscal year revenue up 21% YoY to $1.1 billion。

● OEM and other business。In the fourth quarter, the sector's revenue was 0..$900 million, up 22% month-on-month, up 265% year-on-year。

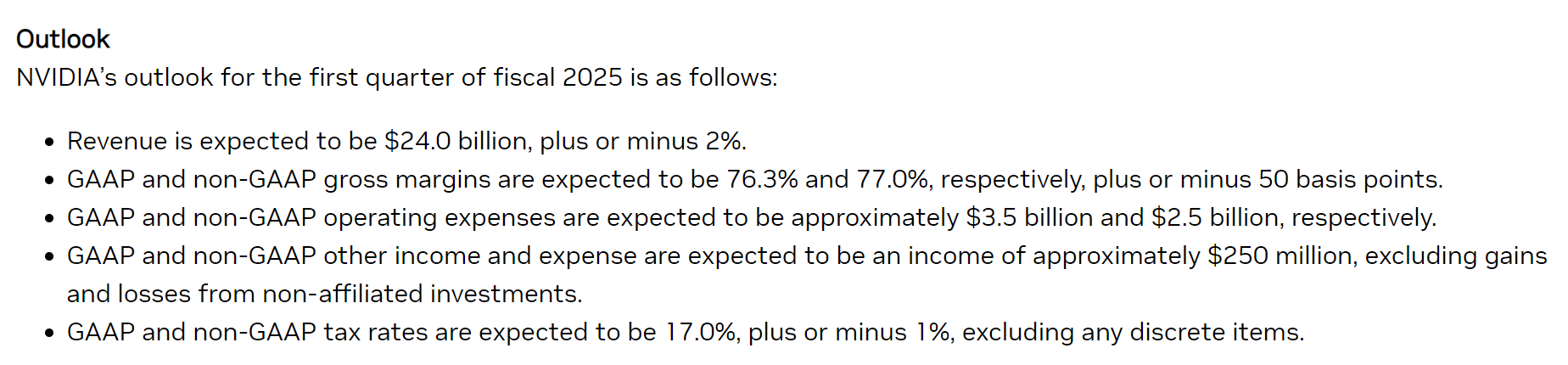

In addition, the company's guidance for the first quarter of the new fiscal year was higher than analysts expected.。Nvidia expects revenue in the first quarter of fiscal 2025 to reach $24 billion, up or down 2 percent, while Wall Street expects revenue of $21.9 billion.。

Withstood the pressure, Nvidia shares jumped 9% after hours

In recent days, the topic of whether artificial intelligence has been over-hyped has been discussed many times.。

Nvidia shares were lower for four consecutive sessions as a result。Before Wednesday's earnings announcement, Nvidia shares closed down nearly 3%, but after the announcement of the earnings report, by the fourth quarter results "burst" and the first quarter guidance exceeded expectations, Nvidia's shares rose more than 9% after the market value of 1.$67 trillion。

So far this year, Nvidia has risen 36%, adding more than $400 billion to its market value.。Nvidia's results are a bellwether of the intensity of the AI boom, indicating that investors are still showing great interest in AI。

It is worth mentioning that Nvidia has recently replaced Tesla as the most traded stock on Wall Street.。The average daily turnover of Nvidia shares in the past 30 trading days has been about $30 billion, surpassing Tesla's $22 billion.。And just last week, Nvidia's share price surpassed Amazon and Alphabet, which overtook Amazon and Google's parent company Alphabet to become the third-largest company in U.S. stocks by market capitalization, behind Microsoft and Apple.。

Chris Caso, an analyst at Wolfe Research, said in a note: "The whole market is watching the report and expectations have also improved.。Casso believes Nvidia's guidance is strong enough to "show continued momentum while also leaving room for continued gains in the second half of the year."。"

And Nvidia not only rose on its own, but also led a number of chipmakers to rise together.。In after-hours trading, AMD is up about 3%, Intel is up nearly 1%, and Qualcomm is up 1.2%, memory chip giant Micron rose 1.5%, artificial intelligence-related network equipment company Arista Networks rose 2.2%。

AIThe craze does not recede, the demand for chips does not decrease.

Nvidia's better-than-expected performance and guidance benefited from a surge in demand for AI chips。

Nvidia founder and CEO Huang Renxun said in the earnings report: "Accelerating computing and generating artificial intelligence has reached a tipping point.。Demand is surging across companies, industries and countries around the world。"

Nvidia's top chips for AI model training have been in short supply for some time。In a conference call with analysts, Huang said, "Demand will continue to be stronger than our supply throughout the year and we will do our best."。He said that while supply was growing, demand was not showing any signs of slowing.。At the same time, he added, the company is working to distribute its limited supply of chips fairly while avoiding shipping chips to people who are not ready to use them immediately.。

It is estimated that Nvidia's market share in artificial intelligence computing exceeds 80%。Tech giants such as Amazon, Meta, Microsoft and Google have stepped up their investments in AI in the past year, and they are all big customers of Nvidia, accounting for nearly 40% of its revenue.。

"Generative AI opens a whole new investment cycle。"Huang Renxun said。He believes that this will lead to a doubling of the global data center installation base in the next five years, which also "represents hundreds of billions of market opportunities every year."。

Nvidia sees demand not only from large cloud service providers, but also from enterprise software and consumer internet companies。

"Our data center platforms are powered by an increasingly diverse set of drivers - demands for data processing, training, and inference from large cloud service providers and GPU specialty providers as well as enterprise software and consumer internet companies," said Huang.。Vertical industries, led by automotive, financial services and healthcare, are now in the billions。"

Huang also hinted that the company will share more news about RTX graphics processing units (GPUs) in the near future.。"Less than six years after its launch, NVIDIA RTX is now a massive PC platform for generating AI, favored by 100 million gamers and creators," he said.。The year ahead (Nvidia) will bring significant new product cycles and exceptional innovation to help move our industry forward。He also welcomed everyone to next month's GTC, saying: "We and our rich ecosystem will shed light on the exciting future at the conference.。"

Challenges remain

Although Nvidia's performance is excellent, the company still faces certain risks, including increasing competition, the loss of the Chinese market and the fact that some customers are developing their own artificial intelligence chips.。

As a strong competitor to Nvidia, AMD recently began selling MI300 chips。The company expects the product to generate about $3.5 billion in revenue this year, up from its previous forecast of $2 billion.。

U.S. government restrictions on chip exports have also had an impact on Nvidia's business.。In the fourth quarter data, Nvidia said that in terms of data center revenue, the proportion of the Chinese market has fallen to the middle single digits.。On the call, Nvidia Chief Financial Officer Colette Kress said, "We expect the first quarter to remain within a similar range."。In contrast, data center revenue from restricted countries and regions such as China accounted for about 20% to 25% of the company's overall revenue.。

Previously, Kress had said the company's revenue forecast would be higher without export restrictions.。

In order to comply with the U.S. government's new export regulations, Nvidia has developed a "low-profile" chip for the Chinese market.。Nvidia stressed that it still does not have a license from the U.S. government to ship restricted products to China, but Huang said Nvidia has begun sending new chip samples to Chinese customers that meet the restrictions and do not require a license。If it goes well, this should help the company's business recover again in the local market。Huang said: "We will do our best to compete and succeed in the market.。"

In addition, more and more technology companies are choosing to develop their own chips, which is one of the challenges that Nvidia needs to face in the future.。Google, Microsoft, Meta and other companies have been reported to be developing their own chips.。

Not only are traditional technology companies doing self-research, but AI "upstart" companies OpenAI also want to try self-research artificial intelligence chips.。Previously, it was reported that OpenAI is considering a variety of strategies to promote its chip "self-sufficiency" plan, including working with more chip manufacturers to improve supplier diversification, acquiring AI chip manufacturers, and increasing the intensity of in-house design chips.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.