AI craze has not faded Nvidia's third quarter continued strong results! Revenue increased 2 times year-on-year record.

On Tuesday (November 21, local time), chipmaker Nvidia announced its financial results for the third quarter of fiscal 2024, which ended October 29, 2023..$200 million, up 206%。

On Tuesday (November 21) local time, chipmaker Nvidia announced its financial results for the third quarter of fiscal year 2024 ended October 29, 2023.。

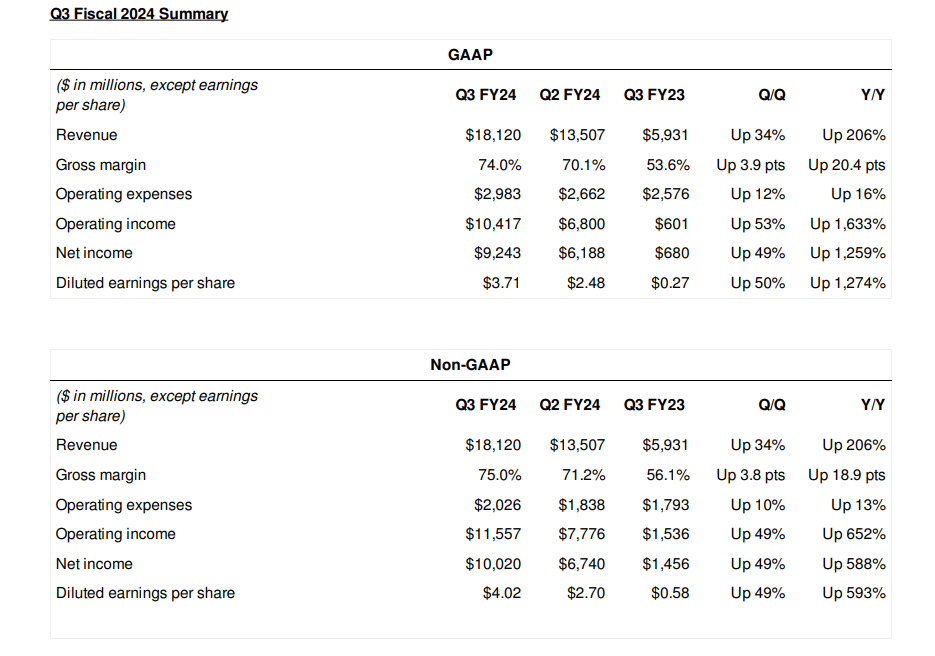

Financial data show that FY24Q3, Nvidia revenue reached a record 181.$200 million, up 206% YoY and 34% QoQ; net profit of 92.$4.3 billion, up 125.9% YoY and 49% QoQ; adjusted net profit of 100.$2 billion, up 588% YoY and 49% QoQ。Diluted EPS of 3.$71, compared to 0.27 美元。

In addition, for the fourth quarter, Nvidia still gives strong guidance。The company expects revenue to be $20 billion, up and down 2%, and GAAP and non-GAAP gross margins are expected to be 74, respectively, for the fourth quarter of fiscal 2024..5% and 75.5%, up and down 50 basis points。

Segmentation of business:

As the main force behind Nvidia's rapid revenue and profit growth, Nvidia's data center business (Data Center) recorded another record revenue in the latest fiscal quarter, up 279% year-over-year to 145.100 million dollars。

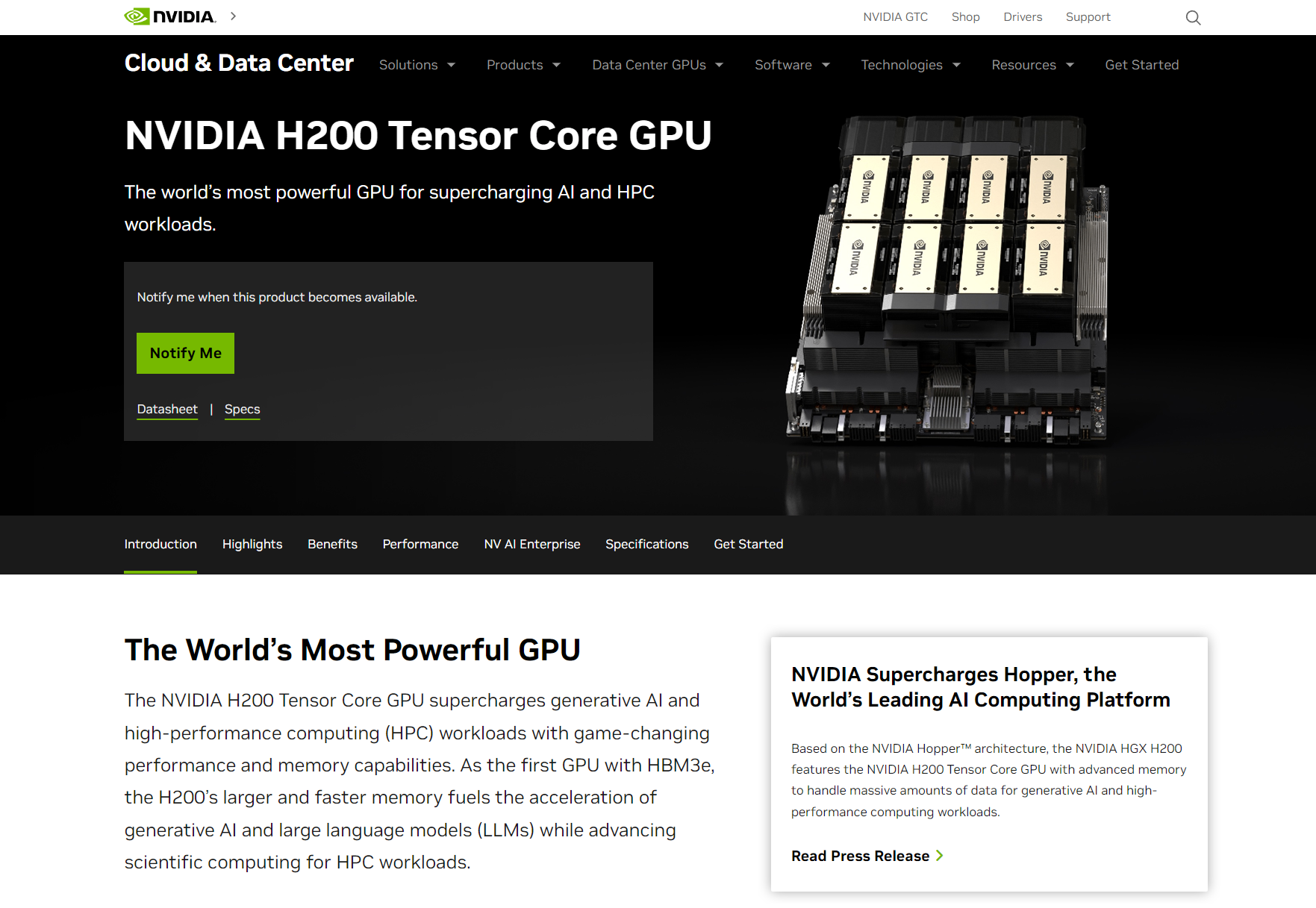

Regarding the data center business, Nvidia also mentioned in the report that it has recently launched a new generation of H200 chips, becoming the first GPU to use HBM3e (high-frequency wide memory), which is expected to go public in the second quarter of next year; in addition, the company has launched an NVIDIA Spectrum-X Ethernet network platform for AI, which will be integrated into servers such as Dell Technologies, HP Enterprise and Lenovo in the first quarter of next。

Game Business (Gaming)。In the third fiscal quarter, Nvidia's game business revenue was 28.$600 million, up 15% from the previous quarter and 81% from the same period last year。During the reporting period, Nvidia released TensorRT LLM ™ for Windows, increasing the speed of device LLM inference by 4x。

Nvidia also launched DLSS 3.5 Ray Reconstruction to create high-quality ray-traced images for intensive ray-tracing games and applications, including Alan Wick 2 and Cyberpunk 2077。It also added 56 DLSS games and more than 15 Reflex games, bringing the total number of RTX games and apps to more than 475.。

There are currently more than 1,700 games ™ on GeForce NOW, including Allan Wick 2, Bardu Gate 3, Cyberpunk 2077: Phantom Free, Forza Racing, and Starfield.。

Professional Visualization。Third-quarter revenue was 4.$1.6 billion, up 10% from the previous quarter and 108% from the same period last year。

This quarter Nvidia announced that Mercedes-Benz is using NVIDIA Omniverse to create digital twins to help plan, design, build and operate its manufacturing and assembly facilities around the world。Also announced is the new line of NVIDIA RTX Desktop Workstations ™ 6000 Ada Generation GPUs and NVIDIA ConnectX ® Smart Interface Cards for training smaller AI models, fine-tuning models, and running inference locally。

Finally, the car business (Automotive)。Third-quarter revenue was 2.$6.1 billion, up 3% from the previous quarter and 4% from the same period last year。NVIDIA strengthened its cooperation with Foxconn this quarter to use the next-generation NVIDIA DRIVE Hyperion to develop the next-generation electric vehicle ™ platform and NVIDIA DRIVE Thor ™ chip system for the global market。

Doubled investor expectations

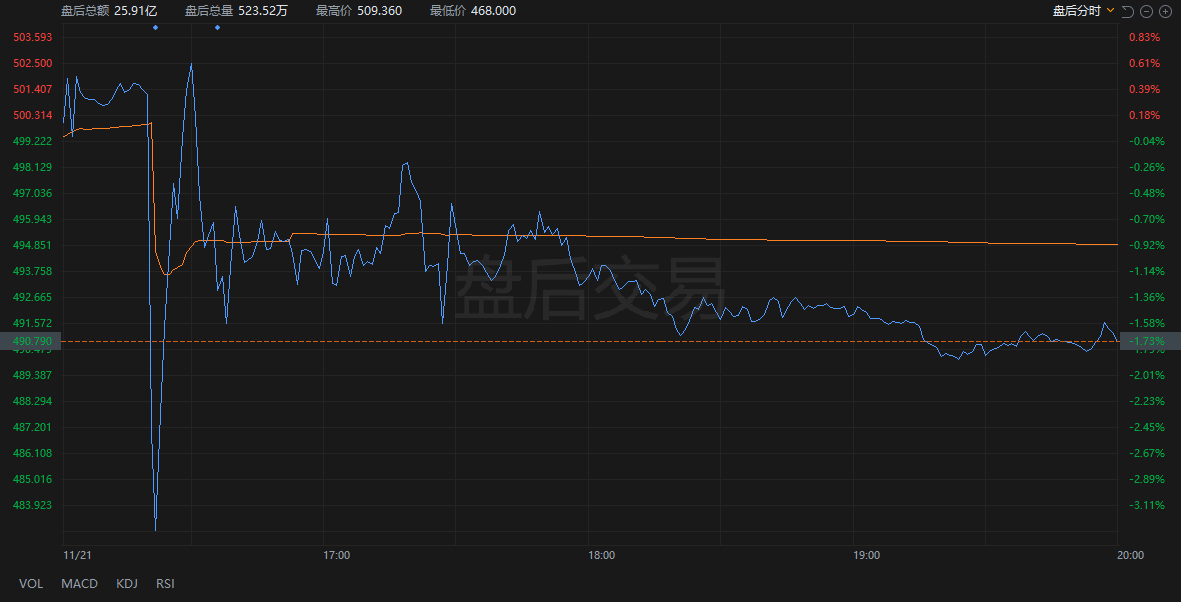

As you can see, Nvidia's results and guidance for the quarter have been excellent, but it doesn't seem to be enough to satisfy investors' appetites anymore。After the U.S. stock market on Tuesday, in the face of such an excellent answer from Nvidia, the trend was downward, once down more than 3%, and then closed down 1..73%。

Why such a strong earnings performance, investors still do not buy it?The main reason may be the continued tightening of AI chip export controls in the United States.。Nvidia executives also said in the report that the controls are clearly having a negative impact on Nvidia's production in China, and that the impact will be felt in the long run。

Specifically, in early August this year, U.S. President Biden formally signed an executive order that will restrict U.S. companies from investing in China's artificial intelligence and other fields; in October, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) issued new regulations on chip export controls, setting "performance density thresholds" and other indicators, upgrading the control of high-computing AI chips, and expanding the scope of restricted countries to countries other than China's Middle East.。

In addition, the recent market rumors that Nvidia will supply new AI chips to China from November 16, but did not supply them as scheduled.。At the results presentation, company executives said the company is working to expand data center product components, which may not be subject to new regulatory licenses, and is expected to go on sale in the coming months。However, the company does not expect these products to contribute a significant percentage of overall revenue.。

Nvidia expects data center revenue from China and other affected regions to drop significantly in the fourth quarter。Publicly available data centers contributed about 20-25% of revenue from restricted countries and regions such as China in the past quarter.。

For the restriction, some analysts have begun to lower their expectations, including KeyBanc Capital analyst John Vinh will NVIDIA 2025 fiscal year revenue forecast from $116 billion to $96.8 billion, and said he believes that the new restrictions are negative, because "eventually it will be difficult to meet demand."。The Wall Street consensus for Nvidia's fiscal 2025 (ending January 2025) was $82.3 billion in revenue, according to FactSet.。

Nvidia is currently developing new products that can be sold in these markets, but this will also take time。Bernstein analyst Stacy Rasgon wrote in a report earlier this month that he could infer from the new products being developed by Nvidia that they "will only reach the edge of the control threshold, but will not cross them."。He also said that local Chinese products could be competitive with Nvidia's new products。

But Nvidia CEO Huang Renxun said in the face of analyst inquiries, Nvidia's GPU capacity is constantly improving, software vendors, government and enterprise customers on the use of artificial intelligence hardware is also expanding, "absolutely believe that the data center can grow to 2025," Huang said。

Company CFO Colette Kress also said that under U.S. government regulations, some exports require licenses when shipping to China and some countries in the Middle East, while other types of chips require advance notice.。Nvidia is working with customers in these regions to secure permission to transport some of its products and to seek solutions that will not trigger restrictions.。

In addition, she also said that Nvidia is developing some new chips that will not trigger export restrictions.。These chips will be released in the next few months and will not have much impact in the short term。She noted that it is too early to predict the impact of such chips on future revenues, and there are too many factors involved.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.