Goldman Sachs has predicted where the four stages of AI investment are going now?

Artificial intelligence dividends, the market only eat less than 50%.

In the midst of this global AI craze, there is no doubt that the current winner is NVIDIA. However, the market always looks forward, and with the rise of latecomers and the continuous development of technology, the question that investors are most concerned about now is, who will be the next beneficiaries of AI?

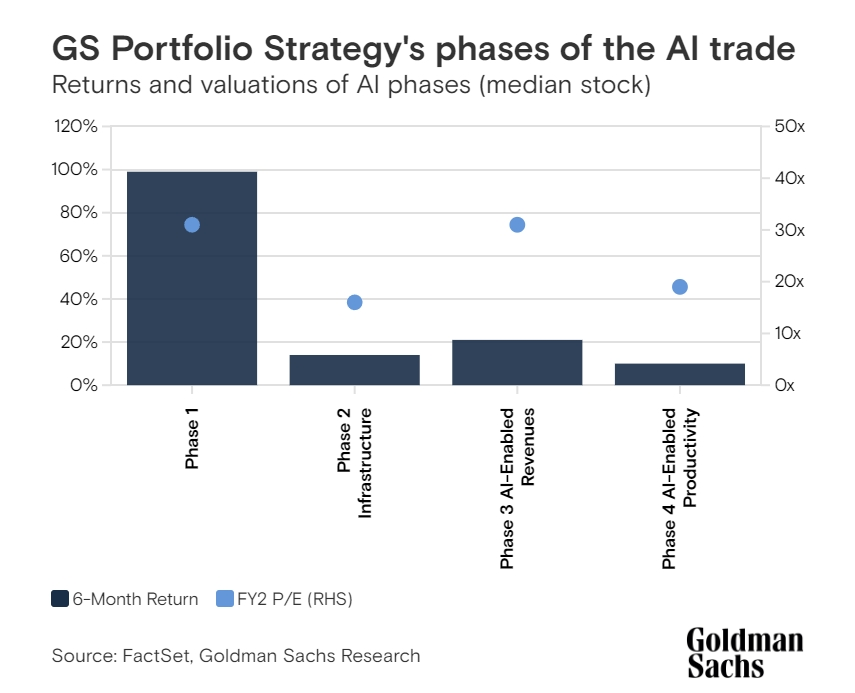

To understand this question, we first need to understand where the AI craze is currently at. According to Goldman Sachs' prophecy half a year ago, the development of AI is roughly divided into four stages:

- First stage: The most explicit AI beneficiaries benefit stage, represented by NVIDIA.

- Second stage: The companies focused on AI infrastructure benefit stage.

- Third stage: The companies focused on generating incremental revenue to monetize AI benefit stage.

- Fourth stage: The companies with the potential for the greatest profit increase due to widespread AI adoption and productivity enhancement benefit stage.

According to Goldman Sachs' latest estimates, the current investment hotspot is still concentrated in the second stage, with typical stocks of this category having risen by 27% since the beginning of the year, and their valuations are 0.4 standard deviations higher than the 10-year average, gradually entering a high valuation stage.

That is to say, the market has barely consumed less than 50% of the AI dividend.

Even in the second stage that Goldman Sachs considers, the large-scale investments of tech giants have not yet cooled down. The world's top internet giants, such as Amazon, Google, Meta, Microsoft, and Oracle, have all announced large-scale AI infrastructure.

Goldman Sachs estimates that their capital expenditures will reach $215 billion and $250 billion in 2024 and 2025, respectively, and a large part of this is related to AI.

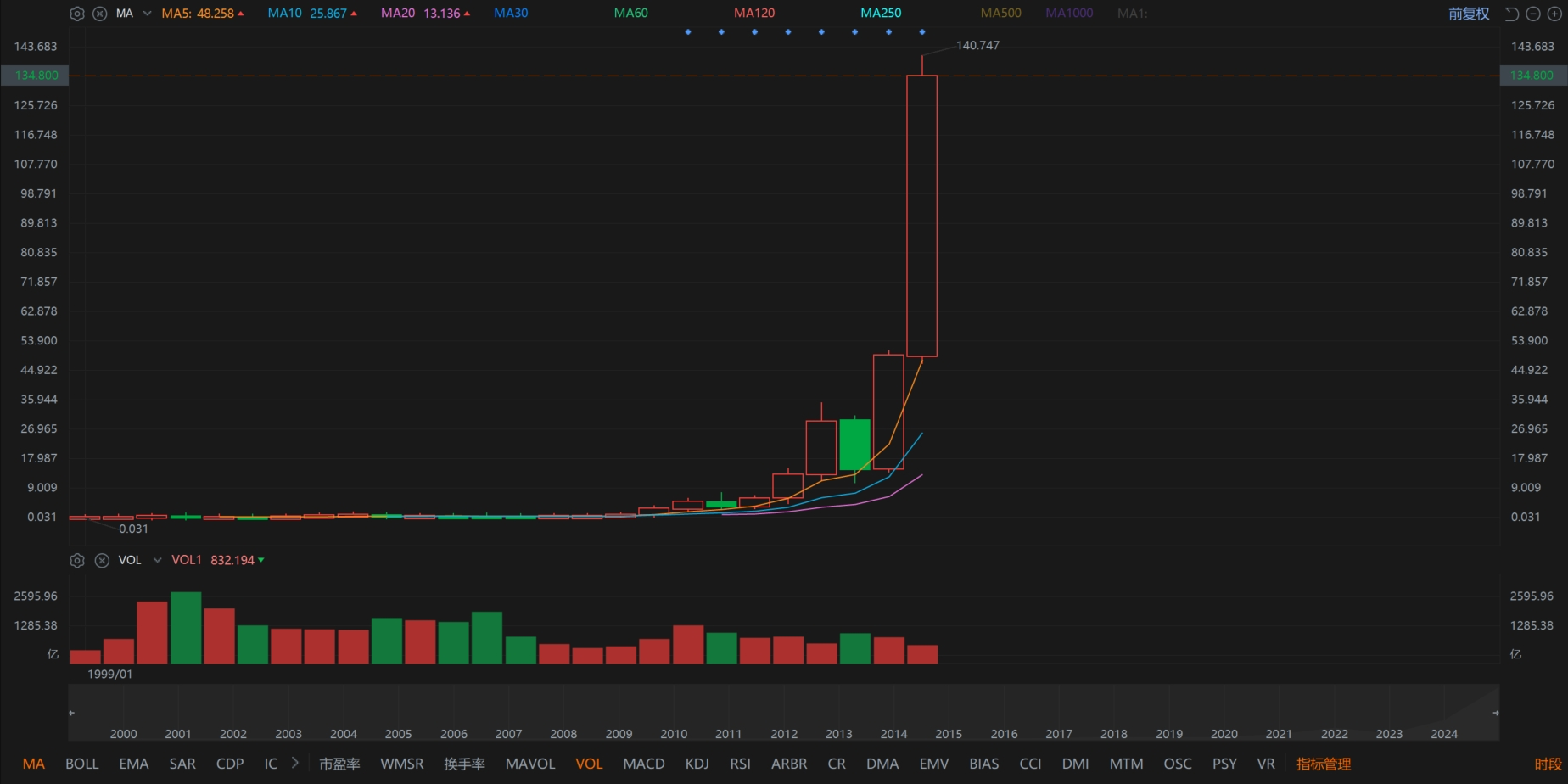

In addition to the dividends brought by cyclical infrastructure, on the other hand, the AI "leader" NVIDIA has never stopped expanding. Recently, with the AI craze reigniting, NVIDIA has once again become the darling of capital, strongly achieving a "five-day rise," with the stock price only one step away from a new high.

At the closed-door meeting held last week, NVIDIA judged that it is still in the early stage of the AI cycle.

Moreover, in NVIDIA's vision, the application of AI in the future will be more extensive and advanced. With the release of the OpenAI o1 model, AI models are beginning to shift towards solving more complex reasoning problems, which will increase the demand for hardware combinations, and NVIDIA's upcoming Blackwell rack product is the best solution.

NVIDIA's long-term vision is that within the next decade, companies will have thousands of "digital employees" to perform complex tasks - such as programmers, circuit designers, marketing project managers, legal assistants, etc.

If Musk's chopsticks can already pick up rockets, how far away is this vision?

However, it is still a threshold for ordinary people to participate in AI investment because the stock prices of AI concepts are relatively high.

Taking NVIDIA as an example, buying one share of NVIDIA would cost $135; Oracle and Google's stock prices are both above $150; Microsoft's stock price is around $400; and Meta's stock price is as high as nearly $600. For many people, buying one share of each of these companies would cost a significant amount of savings.

In contrast, ETFs related to artificial intelligence have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, achieving the aforementioned "buying in bulk effect," but without such a high purchase threshold.

Generally speaking, the capital threshold for ETFs is between individual stocks and OTC funds. Buying one lot (100 shares) may only cost a little over a hundred yuan, and some are even less than a hundred yuan, much lower than the threshold for individual stocks.

Moreover, ETFs offer a very rich selection of individual stocks. For investors who are not familiar with individual stock analysis, ETFs provide a simple investment method without the need to study each company in depth.

ETFs also do not have the risk of suspension or delisting. ETFs may fall sharply with the industry or the overall market, but they themselves will not explode, so they can maintain normal trading even in an extreme bear market, giving investors the opportunity to cut their losses and exit.

With low thresholds, transparent trading, rich product selection, no explosion risks, and support for intraday trading, for ordinary investors or novice investors, ETFs are the best choice to participate in the AI market.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.