After Asmai's performance was booming, TSMC's unexpected financial report injected confidence into the AI track.

On October 17, global chip foundry giant TSMC announced its third-quarter results report, and all data comprehensively exceeded expectations.

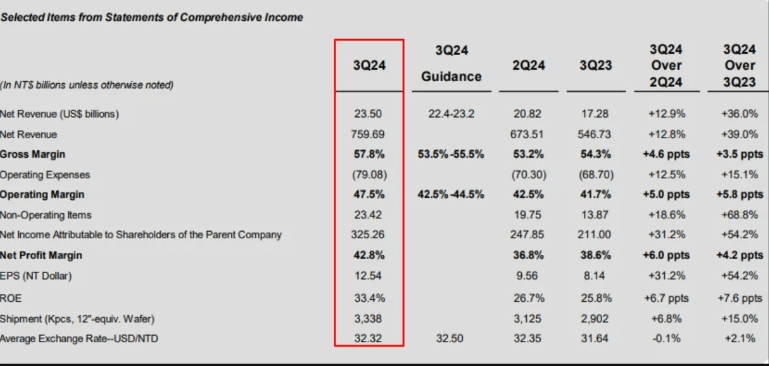

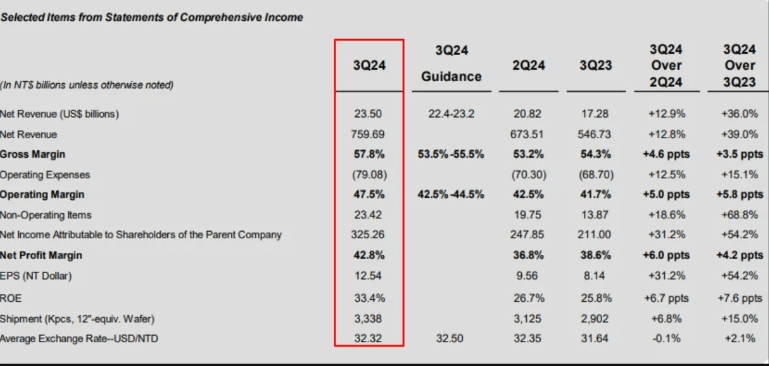

Data showed that TSMC's net revenue during the reporting period was NT$759.69 billion, a year-on-year increase of 39%, exceeding the estimate of NT$751.06 billion; net profit was NT$325.3 billion, exceeding market expectations of NT$299.3 billion, a year-on-year increase of 54%; gross profit margin reached 57.8%, up 4.6 percentage points month-on-month, and is expected to be 54.8%; Operating profit was NT$360.77 billion, exceeding the forecast of NT$330.82 billion, a year-on-year increase of 58%.

After Asmai's performance was booming, TSMC's unexpected financial report injected confidence into the AI track.Analysts said that although Asmai previously reported that its third-quarter order volume was only half of expected levels, suggesting that global chip manufacturing capacity growth may slow, TSMC's short-to-medium term revenue prospects remain solid.

TSMC's share price has soared more than 70% so far this year, surpassing many of Asia's largest technology companies.Behind the surge in TSMC's share price is strong sales of Nvidia chips, or the boom in artificial intelligence infrastructure.Not long ago in July, TSMC also raised its revenue outlook for 2024 because Amazon and Microsoft both increased their investment in artificial intelligence.

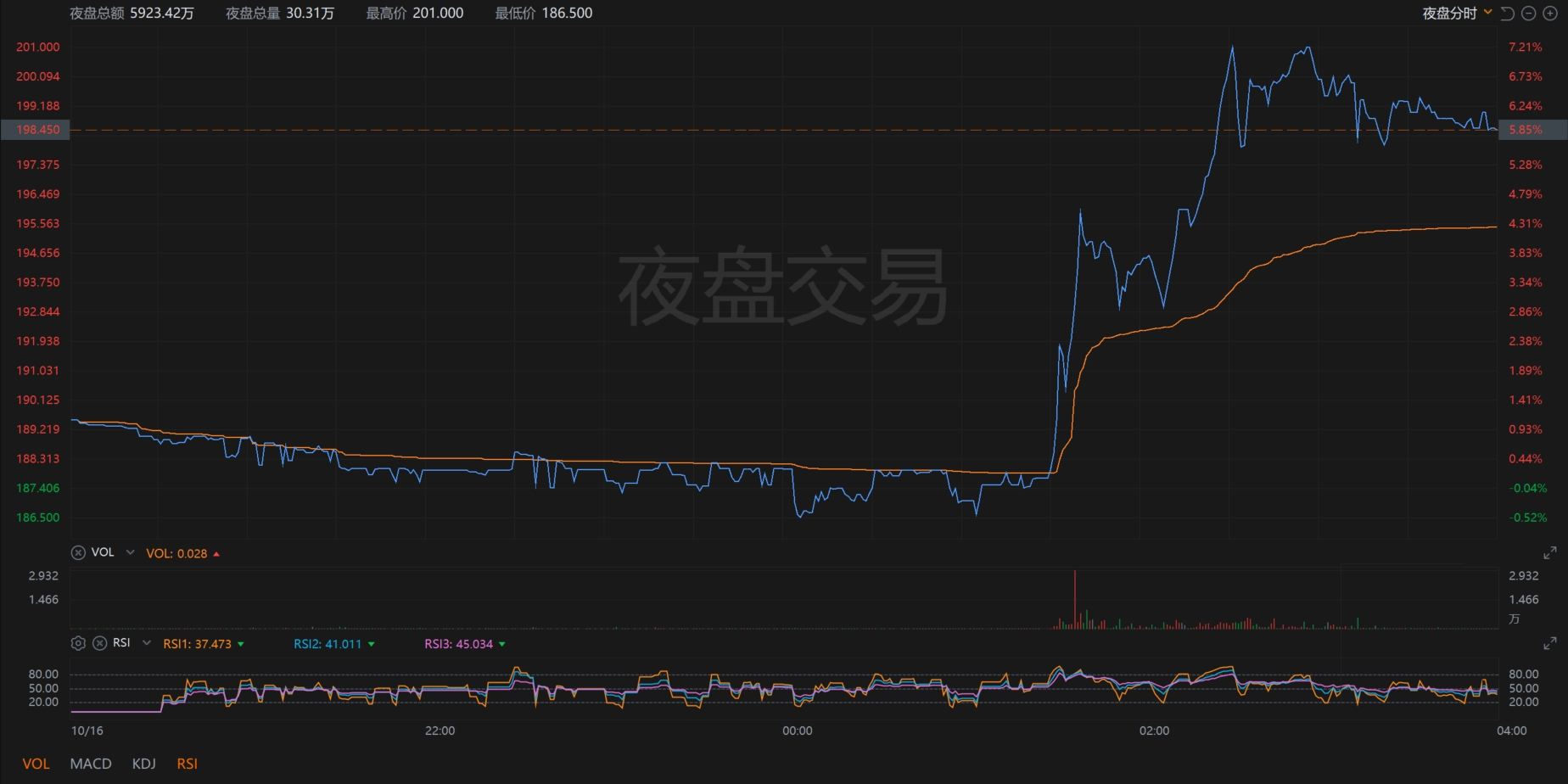

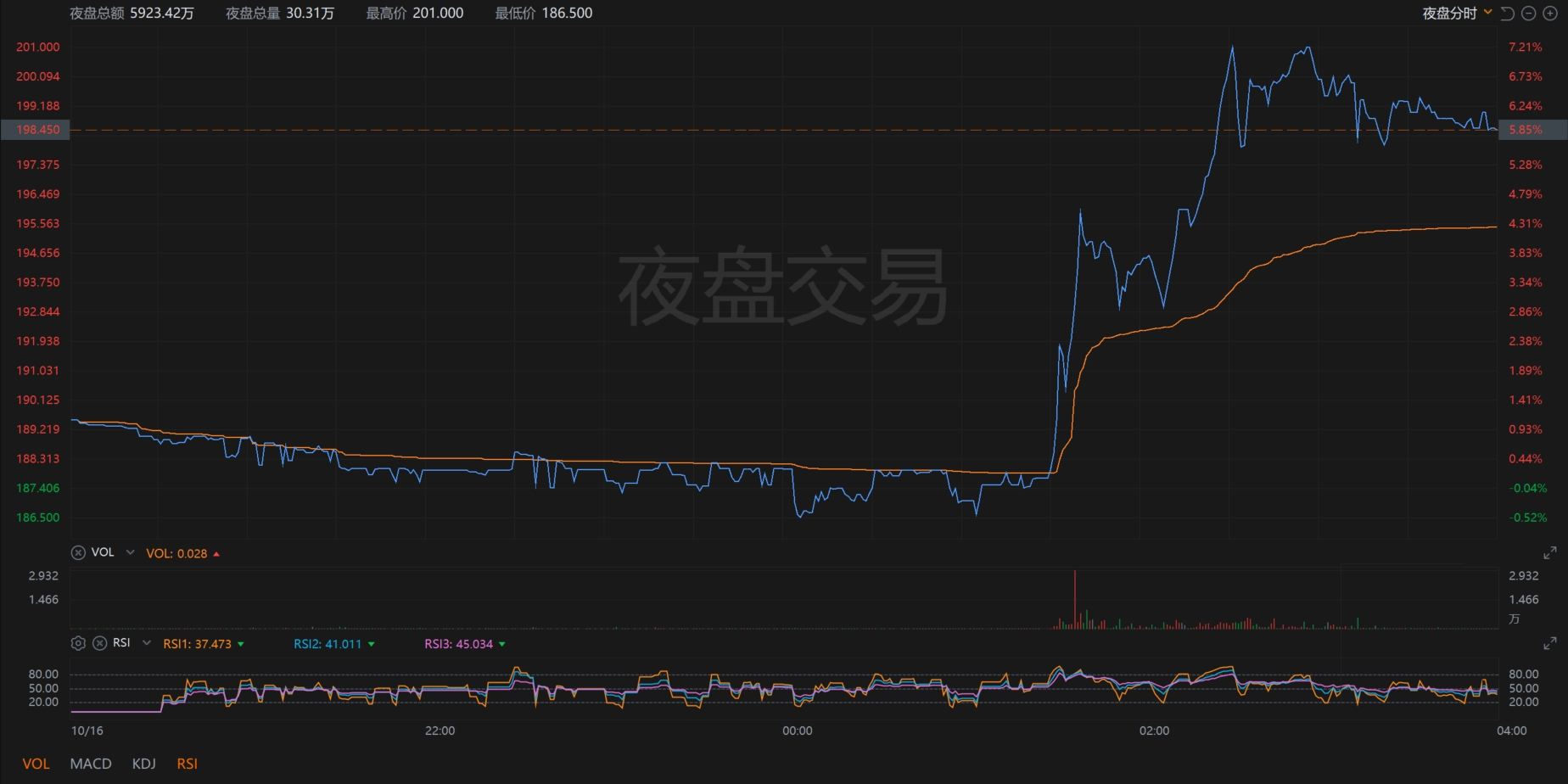

As of press time, TSMC's overnight gains have expanded to more than 7%, and it is set to hit a record high at the opening.The Nasdaq 100 index's main company and the S & P 500 index's main company rose before the market.Investor sentiment on chip stocks also expanded to Asian markets, with stocks of Japanese chip makers including Lasertec Corp. also narrowing their losses in Tokyo after the release of TSMC's third quarterly report.

TSMC's third-quarter results exceeded expectations, which was related to the increase in the proportion of advanced process revenue.In TSMC's chip narrative, 7-nanometer and more advanced technologies are counted as advanced processes, and the more advanced the chip, the higher the price.For example, TSMC's 2-nanometer chips are priced 33% higher than 3-nanometer chips.Advanced process chips are closely related to artificial intelligence infrastructure.

Among this performance composition, TSMC's advanced process chips accounted for 69% of total wafer revenue, an increase from 67% in the previous quarter. Among them, 3 nanometer shipments accounted for 20% of total wafer revenue;5 nanometer accounted for 32%;7 nanometer accounted for 17%.In terms of business, revenue from high-performance computing, smartphones, Internet of Things, automotive electronics, consumer electronics and other businesses increased by 51%, 34%, 7%, 5%, 1% and 2% respectively. TSMC's business in the third quarter ushered in a bumper harvest.

Looking to the future, TSMC said on its earnings conference call that it expects fourth-quarter revenue to be US$26.1 billion to US$26.9 billion, with an estimated US$24.94 billion, up from US$19.62 billion in the same period in 2023.The gross profit margin for the fourth quarter is expected to be 57% to 59%, with an estimated 54.7%.In dollar terms, revenue is expected to grow nearly 30% this year.

TSMC also said that as the company is racing to expand production, it expects capital expenditures to be slightly more than US$30 billion in 2024, and capital expenditures next year will increase compared with this year.

In terms of factory construction, TSMC expects that the first wafer fab in Arizona will achieve mass production in 2025, while the second wafer fab in Arizona will begin mass production in 2028.The company predicts that a third wafer fab in Arizona will begin mass production by the end of this century.The Japanese factory is progressing very smoothly and mass production will begin this quarter.