NVIDIA FY25Q1 Hits New Record: Data Center Stood Out Once More!

In the first quarter of fiscal 2025, NVIDIA's stock rose above $1,000 per share in after-hours trading, thanks to its overperformed financial results.

On May 22 , NVIDIA announced its financial results for the first quarter of fiscal year 2025, ending April 28, 2024. Following the report release, its stock price surged 6% in after-hours trading, surpassing $1,000 per share.

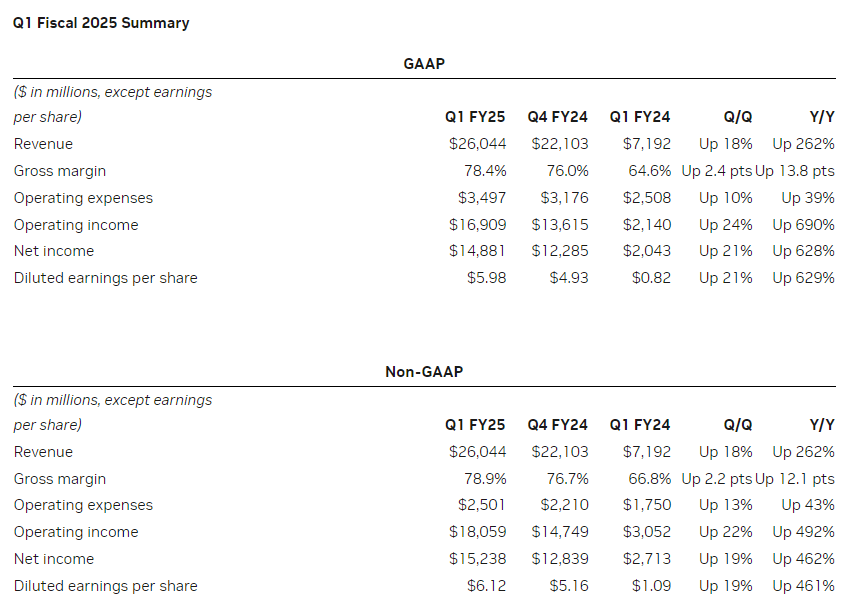

Data shows that NVIDIA's first-quarter revenue reached $26,044 million, a year-over-year increase of 262%; net profit soared over 628% year-over-year to $14,881 million; the gross margin for the period was as high as 78.4%, demonstrating excellent cost control and profitability; adjusted earnings per share were $6.12.

Among these, the data center business stood out as a highlight, with revenue growing 427% year-over-year to $22,600 million, setting a new historical high. Besides the data center business, NVIDIA's gaming business also showed steady growth, with first-quarter revenue reaching $2,600 million, up 18% year-over-year. Although the automotive and professional visualization businesses shines dimly, they still achieved sales of $329 million and $427 million, respectively.

For the second quarter, NVIDIA made strong projections: revenue is expected to reach $28 billion (±2%), with an adjusted gross margin of approximately 75.5% (±0.5%).

In addition to the outperformed earnings report, NVIDIA also announced a 10-for-1 stock split plan, making it easier for employees and investors to own shares. As of the close of trading on June 6, each holder of one share of common stock will receive an additional 9 shares of common stock, which will be distributed after the close of trading on June 7. Post-split, quarterly cash dividends will increase by 150% to $0.01 per share, payable on June 28.

AI Revolution Benefits GPU Sales

It is evident that NVIDIA's overall performance far exceeded expectations, closely linked to the doubling of revenue from its core data center business. NVIDIA's chips have provided strong momentum for the rise of AI, and sales of GPU chips are not expected to slow down amidst this "AI revolution".

Hopper GPU Sales Drive Growth

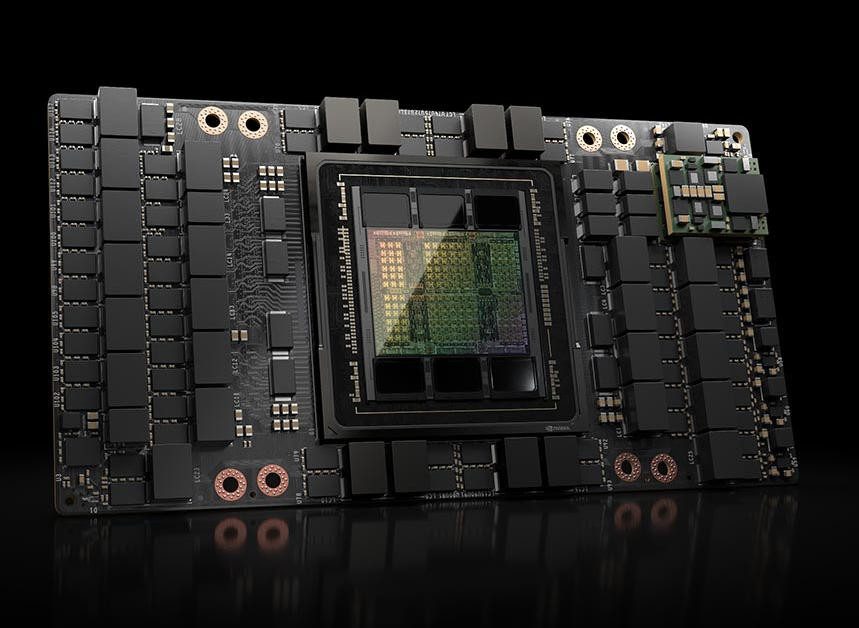

NVIDIA CFO Colette Kress stated that the robust growth of the data center business was mainly due to increased shipments of Hopper architecture GPUs (such as the H100) in response to high demand for large models, recommendation engines, and AGI applications.

In the subsequent conference call, she emphasized the importance of the cloud computing rental market in the current landscape, believing that cloud services will help customers quickly recover the costs of adopting NVIDIA chips because NVIDIA offers the fastest model training speed, lowest training costs, and lowest large model inference costs for cloud customers.

Currently, NVIDIA's clients include renowned AI companies such as OpenAI, Anthropic, DeepMind, Elon Musk's xAI, Microsoft, Meta, and Mistral, with large cloud service providers accounting for about 45% of its data center business revenue.

She also highlighted Meta's launch of the Llama 3 open-source large model. According to the introduction, this model uses a total of 24,000 H100 GPUs, and for a model with 700 billion parameters, an NVIDIA HGX H200 server can output 24,000 tokens per second and serve over 2,400 users simultaneously. Therefore, an API provider hosting the Llama 3 model can earn about $7 in token fees over four years for every $1 spent on an NVIDIA HGX H200 server.

Tesla's financial report also announced that the company has adopted 35,000 NVIDIA H100 GPU chips for AI training, expected to increase to 85,000 by the end of this year. Therefore, the automotive industry will also become the largest enterprise vertical in NVIDIA's data center business this year, bringing multi-billion-dollar revenue opportunities.

NVIDIA's founder and CEO Jensen Huang pointed out, "A new generation of industrial revolution has begun, and NVIDIA will work closely with enterprises worldwide to transition traditional data centers worth trillions of dollars to accelerated computing and establish specialized 'AI factories' for AI product production." In his opinion, AI technology will significantly boost productivity and revenue across various industries and optimize in terms of cost efficiency and energy efficiency.

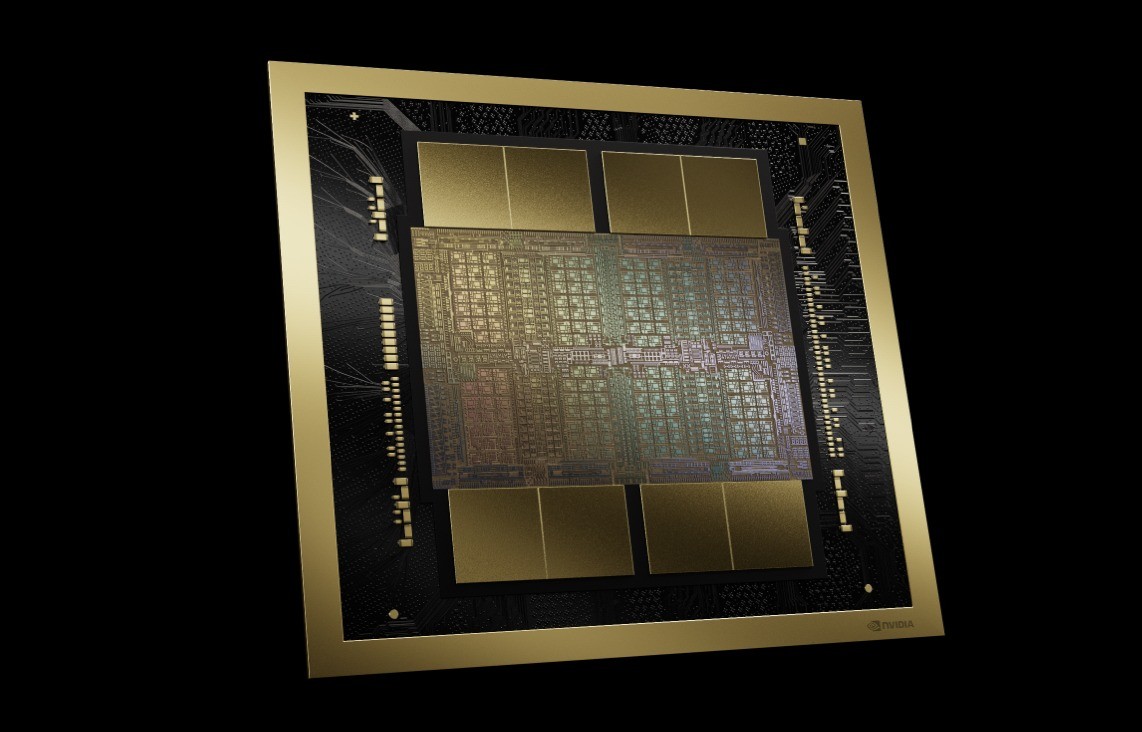

Blackwells Under Full Production

One year after the release of the Hopper architecture, NVIDIA officially launched the Blackwell chip this March, which is twice as powerful as the Hopper generation and offers about five times the inference performance.

Jensen Huang revealed, "The company is already prepared for the next wave of growth." The next-generation ultra-powerful Blackwell chips are in "full production," expected to ship in the second quarter, ramp up production in the third quarter, and be deployed in data centers in the fourth quarter, laying the foundation for AGI with trillion-parameter scale.

He also expects that in the context of surging demand for AGI computing power, this supply shortage might continue until 2025. However, the company can expect "substantial" revenue from the new generation Blackwell chips this year and enter a new growth phase.

Surprisingly, NVIDIA's R&D progress is now "taking off," and the company will continue to launch more advanced and powerful chips at the same pace. "Following Blackwell, we will introduce other chips at a yearly cadence," Huang stated.

Beyond the data center business, sales of NVIDIA's network components also achieved strong growth, benefiting from the "popularity" of InfiniBand end-to-end solutions (network components for chip interconnection), with network revenue growing 242% year-over-year to $3.2 billion.

NVIDIA stated, "Electronic computing is shifting from information retrieval to skill production. In the future, we will update how computers operate to generate answers, not just retrieve information".

Chinese Market Struggling With CHIPS

As one of the main sources of NVIDIA's data center revenue, the Chinese market once contributed about 20% to 25% of NVIDIA's data center business revenue. However, since the latest CHIPS and Science Act (CHIPS) issued by the US last October, NVIDIA's business in China has been significantly restricted.

Earlier this year, NVIDIA launched a "special version" of the H20 chip for Chinese customers to meet the strict chip export control requirements of the United States.

For this quarter's financial report, the company's executives also acknowledged the significant decline in sales in the Chinese market. "Due to the technical restrictions we are facing with, competition in Chinese market has become more intense. However, we will continue to do our best to serve local customers and markets," Jensen Huang said.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.