Netflix Beats Q2 Earnings Forecasts with Over 8M Subscriber Growth

According to the results, Netflix's net increase in paid streaming users in the second quarter was 8.05 million, far exceeding Wall Street expectations, and the advertising business is expected to occupy a key position from 2026.

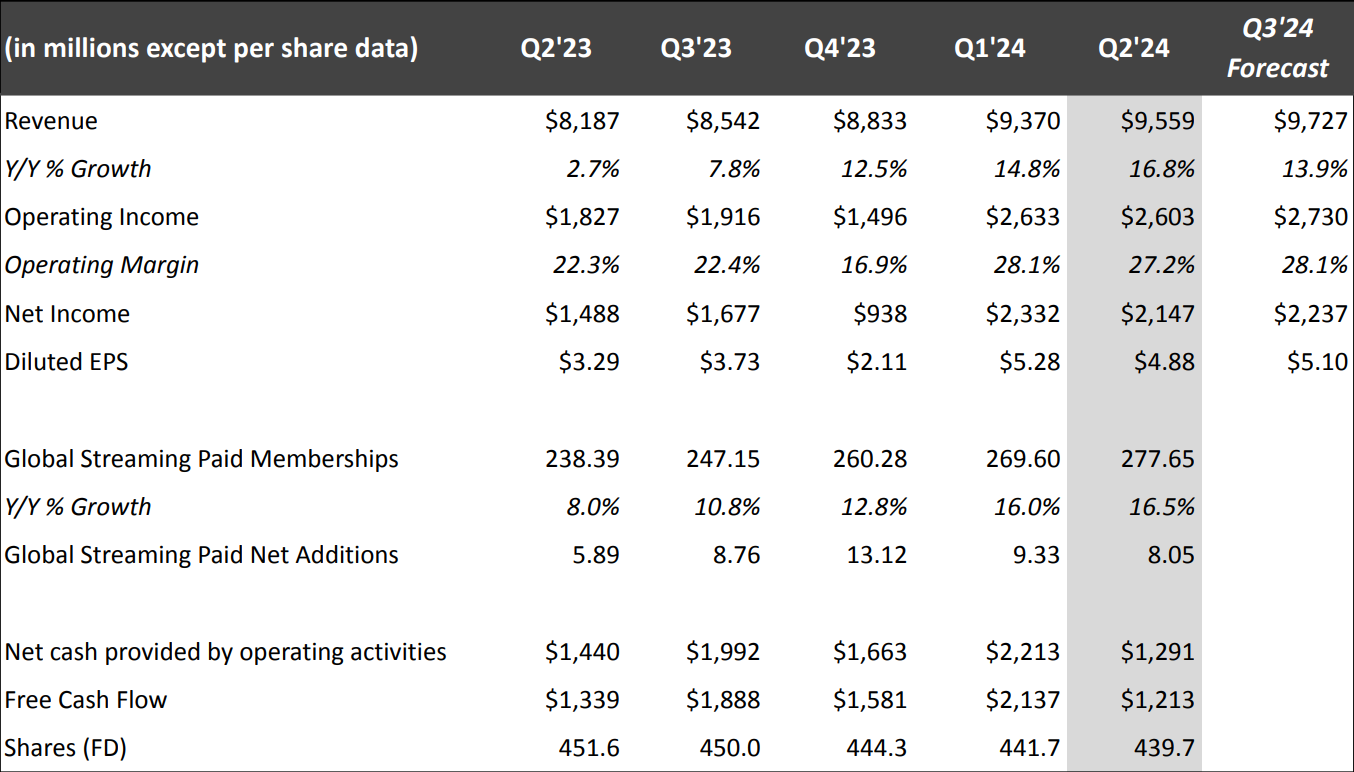

On July 18, Netflix announced its second quarter earnings for the second quarter ended June 30, 2024. Data showed that Netflix's total revenue during the period was US$9.56 billion, a year-on-year increase of 16.8%; net profit was US$2.147 billion, a year-on-year increase of 44.3%; diluted earnings per share was US$4.88, a year-on-year increase of 48.3%.

It is worth noting that Netflix's net increase in streaming paid users in the second quarter was 8.05 million. As of now, Netflix's total number of global users has exceeded 277 million, a year-on-year increase of 16.5%; the number of advertising members increased by 34% from the previous quarter, but the specific figures were not disclosed.

For the ongoing third quarter, Netflix predicts that the quarter's revenue will be US$9.73 billion and earnings per share will be US$5.10; the year-on-year increase in customer volume may be lower than last year, because the same period last year was the beginning of the crackdown on shared passwords.

The management said: "Our updated revenue forecast reflects stable membership growth trends and business momentum, partially offsetting the strength of the U.S. dollar against most other currencies."

After the earnings report was released, Netflix's stock price fell by more than 6% due to lower-than-expected second-quarter performance guidance, but gradually recovered the losses during the conference call. Since the beginning of this year, Netflix's stock price has risen by 32.07%.

Preferred Contents Drive User Growth

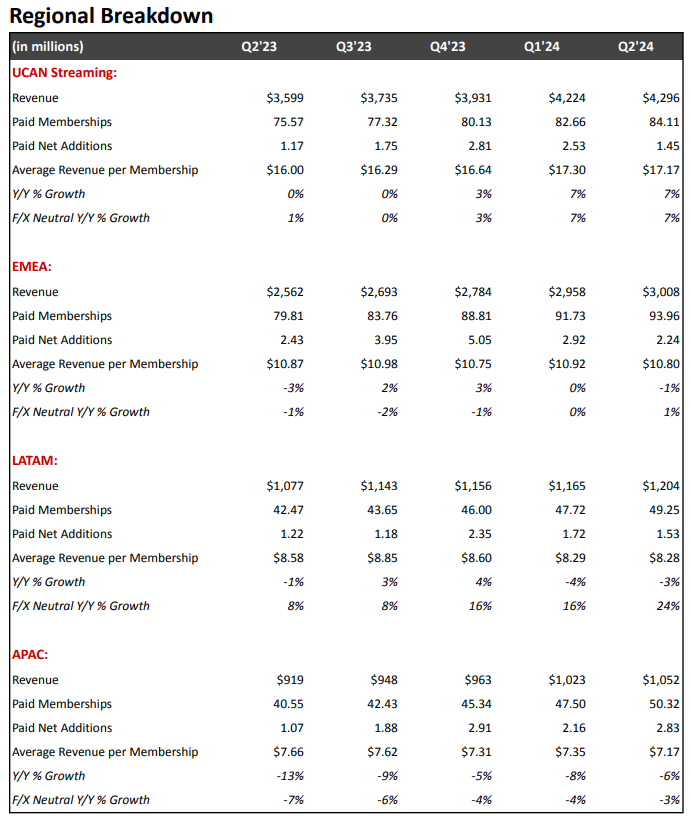

Report shows that the Asia-Pacific region is the fastest growing region for Netflix users, with a net increase of 2.83 million regional paid subscribers, accounting for more than 35% of the total user growth; Europe, the Middle East and Africa ranked second, with a total of 2.24 million new users in three months; the United States and Canada (Netflix's home market) had a net increase of 1.45 million users; Latin America added 1.53 million users.

Netflix co-CEO Ted Sarandos pointed out in the earnings call: "Content and product-market fit are key factors for us to attract, retain members and make profits."

In the second quarter, Netflix launched a number of popular series, such as "Bridgerton Family", "Reindeer Baby" and "Under Paris", which stimulated Netflix's share of total TV viewing in the United States to climb to 8.4% in June, second only to YouTube's 9.9%.

Not only that, the popular shows also helped Netflix gain 8.05 million net new subscribers in the second quarter, the highest level in the second quarter since 2020, making its streaming service revenue and profits far exceed Wall Street forecasts.

Last quarter, Netflix said it would stop providing quarterly membership or average revenue per user data starting in 2025, and said it would "use revenue and operating profit margin as the primary financial indicators, and user engagement (i.e., usage time) as the evaluation criterion for customer satisfaction."

Advertising Business Under Expanded

After streaming subscription growth slowed in 2022, Netflix began trying different business strategies to drive revenue growth. In May of this year, Netflix announced that it would launch its own advertising platform and would no longer work with Microsoft to develop the technology. And judging from the data this quarter, Netflix's advertising business has also greatly helped its user growth, with the number of subscribers increasing by 34% month-on-month.

In November 2022, Netflix's ad-supported plan was launched in 11 countries including the United States, Japan and South Korea, priced at $6.99 per month, including 4-5 minutes of advertising per hour, and the advertising duration ranged from 15-30 seconds. Currently, Netflix's registration volume for this business accounts for more than 45% of the advertising market.

However, Netflix also emphasized that due to the late start of the business and the large size of the subscriber population, it will not become the company's main source of revenue in 2024 or 2025. Netflix Chief Financial Officer Spencer Neumann also believes that the company's advertising business has grown well, but the base is too low, and it is expected to occupy a key position in 2026 and beyond.

To further boost the business, Netflix said it would gradually stop eligibility for basic plan memberships (a $9.99/month ad-free plan) in the United States and France, having canceled the registration option in the United Kingdom and Canada last year.

Netflix co-CEO Greg Peters said: "The company's top priority is to scale its advertising business. We are building our own advertising technology platform to replace the existing Microsoft system, which will be tested in Canada in 2024 and widely launched in 2025."

Live & Games Create New Income

There is news that Netflix will increase live sports content (such as two NFL games on Christmas) over the next three years in an attempt to attract more advertising revenue.

Netflix co-CEO Ted Sarandos explained: "We launched live TV because our members love it, it can significantly increase member engagement, and advertisers will love this content."

In fact, Netflix has been trying to increase sports event content, such as golf tournaments, boxing matches, football matches, etc., but Ted Sarandos said that Netflix does not have enough funds to bear the broadcast of large-scale sports events, and the company will only focus on more attractive content. Power’s “exclusive live broadcast”.

In addition to live sports, Netflix is also expanding its investment in video games and plans to release a new game every month. Later this year, the company will create a Squidward-inspired multiplayer game, tentatively slated to launch during the second season premiere of the series.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.