Temu dumped $2 billion! Explaining "bitter before sweet" with ads

According to foreign media reports, Temu invested about $2 billion in advertising spending on the Meta platform in 2023 and ranked among the top five Google advertisers.。

According to foreign media reports, Temu, an overseas shopping platform owned by Pinduoduo, became the largest advertiser on the Meta platform in 2023, spending about $2 billion on advertising;。

Temu's investment in the overseas digital advertising market since its entry into the U.S. market is evident in the initiative, which aims to attract more overseas customers, using a "loss-for-market" strategy to gain a larger market share in the U.S.。However, Temu, which was only established in 2022, has spent such a huge amount of advertising money on the Rio Tinto market during its growth phase, to the surprise of both Meta and Google executives.。Temu disputed the $2 billion figure but did not clarify the exact level of spending.。

Under the pressure of rival Shein, Temu and other local Chinese e-commerce platforms are investing heavily to win a place in the U.S. market.。Competition in the same industry has led to the development of related industries, and the competition of various e-commerce companies has not only increased the price of digital advertising, but also led to the growth of employment and revenue in the logistics and shipping business.。

For the two giants in the digital advertising market, Meta and Google, the surge in spending in the e-commerce industry has helped them gradually return to profitability amid a weak advertising market and Apple's new targeted advertising policy.。People familiar with the matter also said that Google is very active in acquiring Temu as a customer, and its business representatives have had numerous discussions with Temu executives about the links between the supply chain and advertising overhead.。

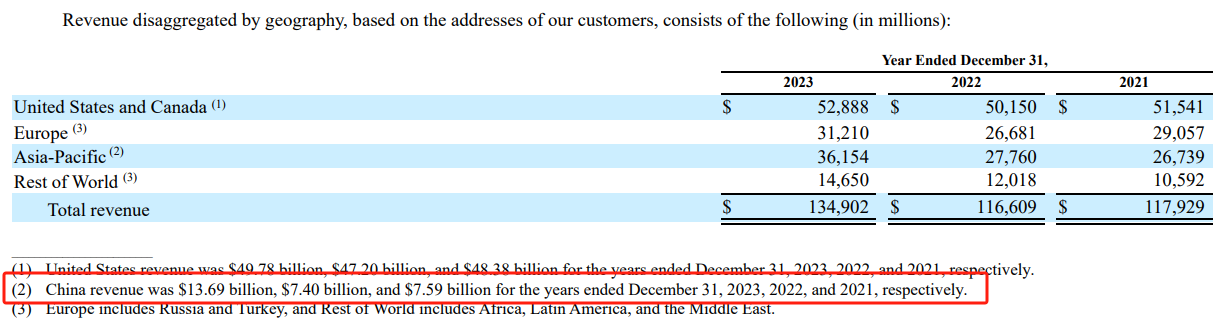

Meta's latest earnings report is the best proof of Temu's "dividend"。In 2023, Meta Greater China revenue nearly doubled to 136.$900 million, a huge reversal from the slight decline in 2022, and the stock price soared, rising more than 20% after the opening, and the market value soared $200 billion overnight, setting a new record for the U.S. stock market.。

During the earnings call, Zuckerberg said bluntly that Meta, with the support of Chinese advertisers, produced the strongest earnings in the company's history last year.。Susan Li, the company's chief financial officer, believes that Meta's significant revenue growth in the fourth quarter was mainly due to heavy spending by Chinese companies and the diversion of video recommendations from artificial intelligence, which means that Temu's massive advertising has played a major role。

For Pinduoduo, its third-quarter revenue was 94.$400 million, up about 94% year-on-year, but Temu results were not disclosed, but it is estimated that the business's annual operating loss may be as high as 36.$500 million; Goldman Sachs also expects Temu's massive investment in advertising and marketing to result in an average loss of $7 per order.。Previously, data showed that Temu became Amazon's second largest advertiser in 2023, and its spending at the end of the year even exceeded that of Amazon itself.。

However, Temu's "cut meat" input also attracted considerable user viscosity.。In the fourth quarter of 2023, Temu users spent an average of 23 minutes per week, surpassing Amazon's 18 minutes and Walmart's 14 minutes to top the user viscosity list.。

By the beginning of 2024, Temu had adopted a different strategy, moving to the "American Spring Festival Gala" - the Super Bowl arena.。Super Bowl Audience Exceeds 1.2.3 billion people, Temu aired a total of six 30-second commercials during the race, with additional giveaways worth more than $10 million.。It is understood that a single 30-second ad costs about $7 million, and there is no doubt that this big-spending marketing strategy will further enhance Temu's visibility in the U.S. market.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.