Apple Inc (AAPL) Earnings Interpretation 2024

Summarize Apple's fiscal 2024 quarterly results for your reference。

Apple Inc. recently released its latest financial reports, providing insight into the company’s performance amidst the current global economic environment and offering crucial clues about its future direction. This article delves into Apple's quarterly earnings, examining revenue, profits, performance across business segments, new product launches, market strategies, and future outlook.

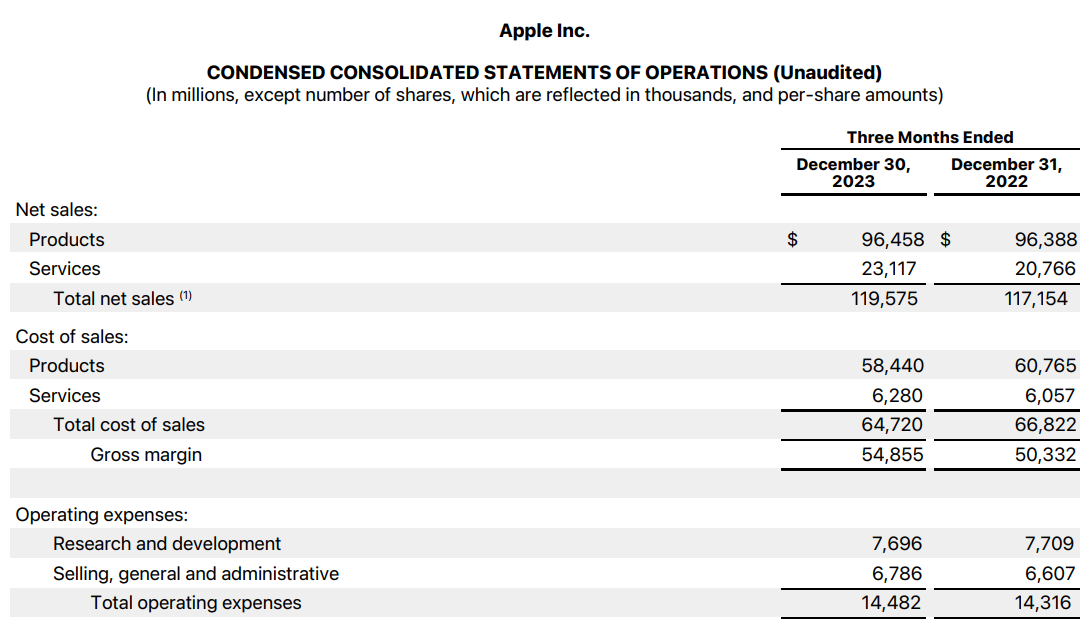

Apple Q1 FY2024 Performance

Apple's financial results for the first quarter of FY2024 revealed revenue of $119.6 billion, a 2% increase year-on-year. Net profit reached $33.916 billion, up 13% from $29.998 billion in the same period last year. Diluted earnings per share (EPS) stood at $2.18, marking a 16% increase and setting a new record high, with a gross margin of 45.9%. The company’s board of directors announced a cash dividend of $0.24 per share.

Tim Cook, Apple’s CEO, highlighted the strong performance in December, noting significant acceleration in growth compared to the previous quarter. He mentioned that due to Apple’s fiscal calendar, the December quarter had only 13 weeks compared to 14 weeks in the same period last year.

This marked the first growth since Q4 2022, ending a year-long trend of declining revenues, a trend not seen since 2001. While revenue recovered, sales expenses in the quarter were $64.72 billion, down over $2 billion from $66.822 billion in the same period last year.

Additionally, Apple spent nearly $27 billion on dividends and stock buybacks, generating nearly $40 billion in operating cash flow and returning approximately $27 billion to shareholders.

Regarding the rapid development of generative AI (AIGC), Apple has not yet launched specific AIGC products, focusing instead on machine learning to improve the accuracy of its auto-complete features. Tim Cook hinted that Apple has been investing significant time and resources in AI development, with more details to be revealed later this year.

Full earnings analysis please refer to: Apple's new fiscal quarter mixed: FY24Q1 revenue back to growth Greater China fell more than expected

Apple Q2 FY2024 Performance

On May 2, Apple Inc. officially released its highly anticipated Q2 FY2024 financial report.

The report showed total revenue of $90.75 billion, a 4.31% decrease year-on-year, yet exceeding market analysts' expectations of $90.33 billion. Net profit stood at $23.64 billion, down 2.15% year-on-year, with EPS of $1.53.

These figures indicate that despite challenges such as global economic uncertainty and slowing consumer demand, Apple maintained strong market competitiveness and profitability.

Business Segment Breakdown

-

iPhone: As Apple's core business, iPhone revenue reached $45.96 billion, a 10.46% year-on-year decline. This reflects the saturated smartphone market and consumers’ anticipation of new product releases. However, Cook stated that iPhone sales met analysts' expectations, and without last year’s base effect, revenue would have remained stable. This suggests that despite challenges, the iPhone retains a strong market position and consumer loyalty.

-

Streaming Services: Contrasting with the decline in iPhone sales, Apple’s streaming services performed exceptionally well. Revenue from services reached $23.87 billion, up 14.2% year-on-year, driven by continuous growth in subscriptions to Apple Music, iCloud, and Apple TV+. Apple’s focus on subscription services helps offset hardware sales declines and provides a more stable revenue stream.

-

Mac: The Mac segment saw steady growth, with revenue at $7.45 billion, a 3.9% increase year-on-year. This was largely driven by the strong performance of the new MacBook Air models. The MacBook Air, powered by the M3 chip, received widespread market praise for its performance and design, making it a key driver of Mac segment growth.

-

iPad: The iPad segment underperformed, with revenue at $5.56 billion, a 16.64% year-on-year decline, mainly due to the lack of new iPad releases since 2022. However, Apple is expected to launch new iPad models on May 7, which could revive market demand for this product line.

-

Wearables, Home, and Accessories: Revenue in this segment was $7.91 billion, down 9.7% year-on-year. Despite market pressures, Apple remains a leader in this field. With growing consumer interest in health and fitness, Apple’s wearables are expected to continue to show potential.

Full earnings analysis please refer to: Apple FY24Q2: iPhone revenue fell sharply streaming business outperformed

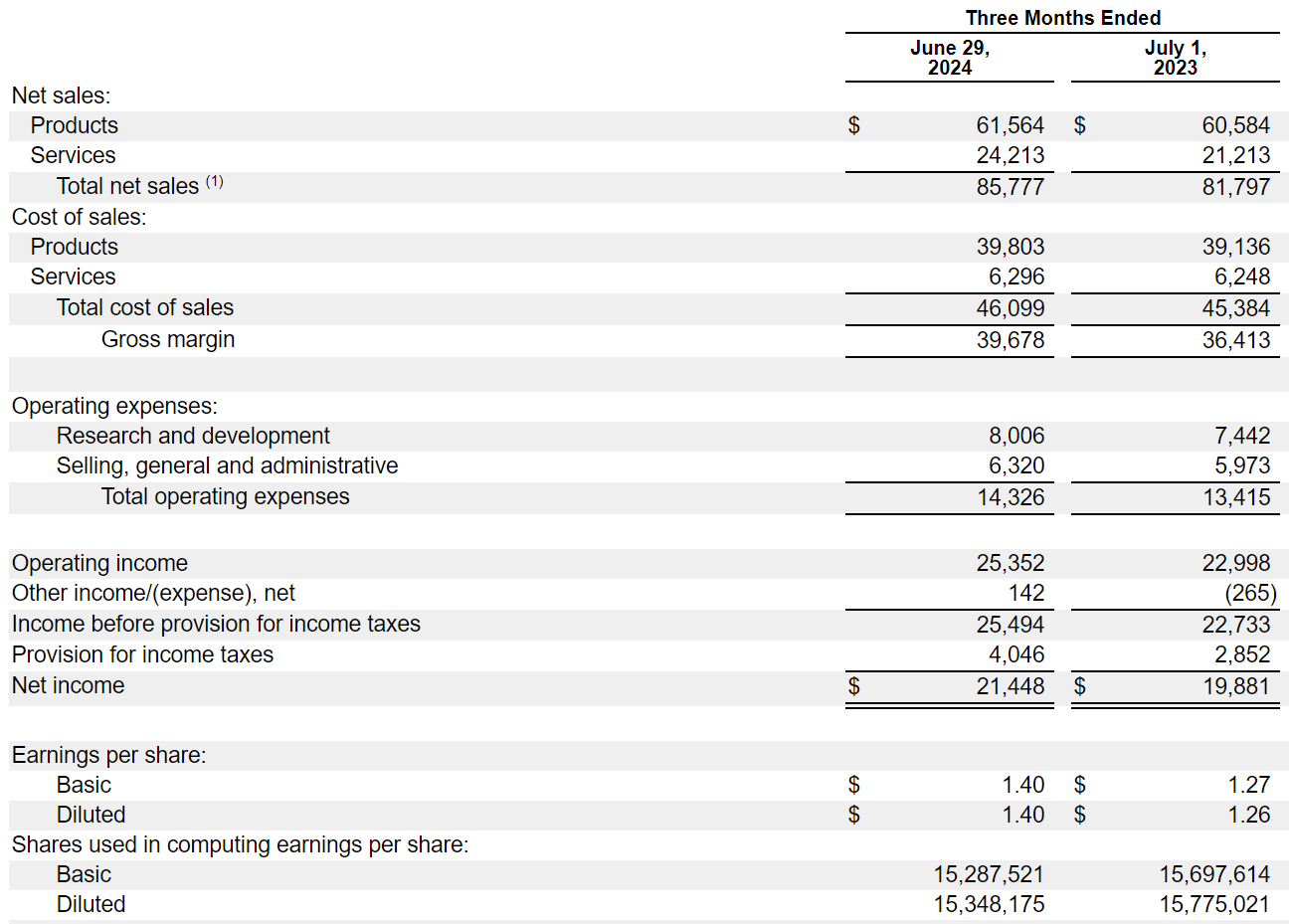

Apple Q3 FY2024 Performance

On Thursday, August 1, after U.S. market hours, Apple released its Q3 FY2024 earnings report for the period ending June 29, 2024. The data showed that Apple’s Q3 revenue reached $85.8 billion, a 5% year-on-year increase, surpassing market expectations of $84.5 billion.

Profits grew by 7.9% year-on-year to $21.45 billion, with EPS up 11% to $1.40, also exceeding market expectations of $1.35. As of June 29, 2024, Apple held $26.635 billion in cash and equivalents.

Apple CFO Luca Maestri mentioned in the earnings call that the company expects the revenue growth rate in the quarter ending September to be similar to the 5% just reported, implying next quarter's revenue around $94 billion, above analysts' expectations of $93.4 billion.

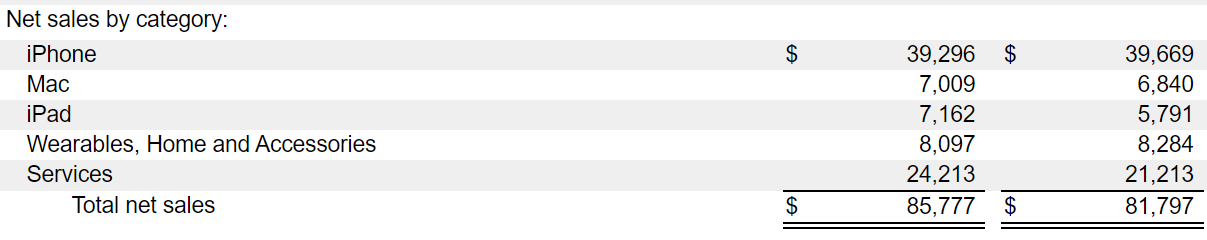

Segment Sales Data

-

iPhone: Revenue fell 0.9% year-on-year to $39.3 billion, above analysts' expectations of $38.95 billion. Notably, this marks the second consecutive quarter of declining iPhone sales globally.

-

Mac: Revenue increased 2.5% year-on-year to $7.01 billion, exceeding analysts’ expectations of $6.98 billion.

-

iPad: This segment showed impressive growth, with revenue up 23.7% year-on-year to $7.16 billion, significantly beating analysts' expectations of $6.63 billion. The growth was closely tied to the launch of new iPad models in May, including the iPad Pro with an M4 chip and a faster, larger-screen iPad Air. This strong performance partially offset the decline in iPhone revenue.

-

Wearables, Home, and Accessories: Revenue in this segment was $8.1 billion, down 2.3% year-on-year. Service revenue reached $24.213 billion, up 14% year-on-year. Both figures surpassed analysts’ expectations.

Since Apple introduced its smart system, Apple Intelligence, at the WWDC, several analysts have predicted a wave of device upgrades among Apple users. Apple has indicated that Apple Intelligence is only compatible with the iPhone 15 Pro/Pro Max and newer models.

When asked about upgrade rates, Cook responded that it was too early to draw conclusions, as Apple only announced the system and chip requirements for Apple Intelligence in June.

Full earnings analysis please refer to: Apple FY24Q3: iPad performance bright Greater China sales continue to fall

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.