Apple iPhone 16 Sales Decline? Chinese E-Commerce Platforms Begin Discounts

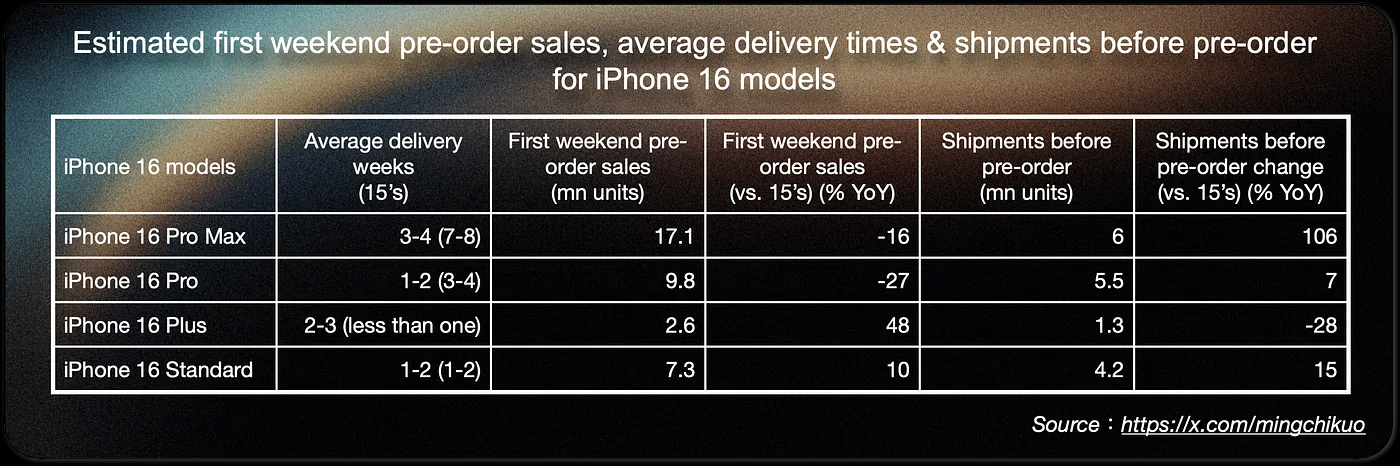

Ming-ChiKuo, an analyst at Tianfeng International Securities, said in a post that iPhone 16 series first weekend pre-order sales are estimated to be about 37 million units, a year-on-year decline of about 12.7 percent from last year's iPhone 15 series first weekend sales.

Since Apple's event, the iPhone 16's pre-sale performance doesn't seem to be quite in line with the switching super-cycle that analysts had previously predicted.

iPhone 16 sales fell yoy in the first weekend

Earlier this week, as a famous Apple analyst, Tianfeng International Securities analyst Ming-ChiKuo said in a post that the iPhone 16 series first weekend pre-order sales are estimated to be about 37 million units, a year-on-year decline of about 12.7% compared to last year's first weekend sales of the iPhone 15 series, with the key factor being lower-than-expected demand for the iPhone 16 Pro series.

Kuo said that a key factor in the lower-than-expected demand for the iPhone 16 Pro series is that the main selling point, Apple Intelligence, was not released alongside the iPhone 16. In addition, fierce competition in the Chinese market continues to affect iPhone demand.

Kuo, a well-known Apple analyst, said that the relevant data was compiled by him based on his latest survey of the supply chain and the relevant data on Apple's official website. Apple has started accepting pre-orders for the iPhone 16 series of phones on Friday, and they will go on sale in stores this Friday.

In addition to Kuo, J.P. Morgan analyst Samik Chatterjee also said in a client report that pre-orders for the iPhone 16 Pro “slowed slightly compared to last year”. But he said that pre-orders for the standard iPhone 16 were on par with the iPhone 15, which was launched last year.

iPhone 16 series not selling well in China?

Similar to Kuo's view, Barclays analyst Tim Long also mentioned in a client report that overall iPhone 16 pre-orders in China have declined compared to last year. In particular, orders for the Pro model fell by double digits year-over-year, while the base and Plus models saw year-over-year growth.

The analyst said early pre-order data from China suggests a weaker start to the iPhone 16 cycle, with negative changes to the product mix due to weaker consumer spending, macro pressures and competition. Moreover, Apple Intelligence Chinese version will not be launched until 2025, which could dampen early enthusiasm for the iPhone 16.

Currently, Chinese e-commerce platforms have begun to see discounted sales of the iPhone 16. Pinduoduo, which is known for its low prices, has started to sell the 512GB capacity iPhone 16 Plus at 8,999 yuan, which is nearly 10 percent lower than the official price of 9,999 yuan. In addition, the high-end model iPhone 16 Pro Max has also seen a price cut, although the range is much smaller, with the 256GB iPhone 16 Pro Max costing about 4 percent less than the official price.

In addition to slumping demand, local competition is also a major factor. Just hours after Apple's launch, Huawei announced the Mate XT, the world's first triple-folding phone. the phone will go on sale on September 20, and the number of people who have made reservations to buy it has currently exceeded 6.3 million.

China is an important but challenging market for Apple. in 2023, sales in Greater China were $72.6 billion. That figure is expected to fall to around $60 billion in 2024, according to analysts surveyed by FactSet.

Analyst's view on subsequent sales

Prior to the release of the iPhone 16, many analysts had predicted a super cycle of device updates from Apple. Analysts believed that an AI-enabled iPhone would be a huge draw for consumers.

However, Apple said at the launch event that Apple Intelligence will initially be available in English only in the United States, expanding to other English-speaking regions in December and adding Chinese, French, Japanese and Spanish versions by 2025. As users around the world wait longer for Apple Intelligence, it gives some analysts reason to believe that a massive upgrade cycle for users may not come as soon as initially expected.

Analysts are also split on their predictions for next Apple sales.

Tim Long is more pessimistic, he gave Apple a “hold” rating, and set a target price of $186, about 14% lower than the current share price. Based on the iPhone 16's first-week performance, he expects to ship about 51 million iPhones in September. He said Apple's fourth-quarter production could be at risk if sales disappoint. “We've heard that some iPhone suppliers have already done that.”

In contrast, Evercore ISI analyst Amit Daryanani was a bit more optimistic, observing, “Given the phased nature of the Apple Intelligence rollout, we continue to expect a stronger and more sustained iPhone cycle.”

Kuo, on the other hand, noted that while pre-order sales of the iPhone 16 Pro series declined year-over-year in the first weekend, supply chain production plans are unlikely to change significantly in the near term, and Apple still has the opportunity to boost sales through the release of Apple Intelligence and peak-season promotions (end-of-year holidays in the U.S. and Europe, and China's Double 11), which will serve as a change in demand for iPhone Focus.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.