Apple sees Southeast Asia as "Safe Haven"

Amid rising tensions between China and the US, as well as global concerns about trade decoupling, Apple announced plans to spend over US$250m to expand Singapore's Ang Mo Kio Park, expand global supply chain and transfer risks.

Amid rising tensions between China and the US, as well as global concerns about trade decoupling, Apple announced plans to spend over $250 million to expand Singapore's Ang Mo Kio Park, in order to support AI development and other key functional areas, and to provide new positions.

In 1981, Apple set up its first Singapore factory with only 72 employees, mainly responsible for producing Apple II. Since then, the team continued to grow, with a current size exceeding 3,600 people. Today, Singapore has become Apple's operational hub in Southeast Asia, as well as a hub for key departments such as software, hardware, and support services. Through direct employment, supply chain, and iOS system R&D, Apple has created approximately 60,000 jobs in Singapore. Also, it has partnered with piles of educational institutions, businesses, and social organizations, bringing dividends to the country through technology and innovation.

On April 18th, Apple CEO Tim Cook met with Singapore Prime Minister Lee Hsien Loong and Deputy Prime Minister and Finance Minister Wong Shyun Tsai. Until now, Cook's Southeast-Asia tour finally came to a close with this meeting.

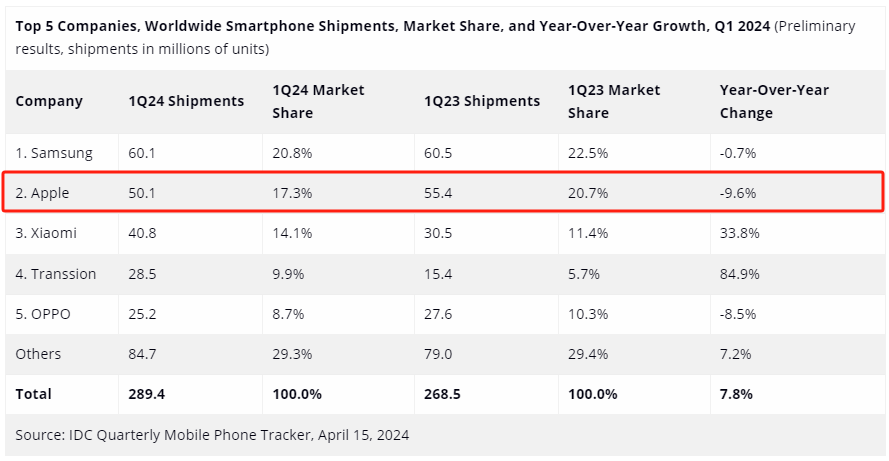

According to IDC's latest data, Apple's global iPhone shipments fell 10% year-on-year in Q1 due to increasing competition in Chinese market, while Apple's sales in Southeast Asia, on the other hand, have exceeded expectations. Canalys data shows that the mobile phone market in Southeast Asia is expected to grow by 7% year-on-year by 2024, much higher than the 3% growth rate in the rest of the world.

Currently, most of Apple's production takes place in China, and with rising tensions between the U.S. and China, as well as global concerns about trade decoupling, Cook's trip is likely to be aimed at paving the way for Apple's sales activity to heat up in Southeast Asia, and try to diversify its supply chain.

For the expansion this time, Apple stated that the construction will start later this year, involving significant upgrades to two buildings acquired in 2022, to integrate dispersed spaces, and strengthening team collaboration.Not only that, but the expanded campus will be entirely powered by renewable energy, continuing Apple's practice across its all facilities since 2018.

But for Apple, its diversification path goes far beyond that.

On April 15, Tim Cook appeared in Hanoi, Vietnam, and after meeting with Prime Minister Pham Minh Chính, its official website announced increased investment in Vietnam's supply chain. Since 2019, Apple's cumulative investment here has exceeded 400 trillion VND (around $15.7 billion), creating about 200,000 jobs. Vietnam Prime Minister Pham Minh also said at the meeting that Vietnam would establish a dedicated working group to support Apple's investments in the country.

For Apple, Vietnam's fan base is also steadily expanding. This year, Apple opened its first online store in Vietnam. The country is gradually becoming an important manufacturing base for Apple, primarily responsible for the production of iPads, AirPods, and Apple Watches, with suppliers for MacBook (Foxconn, Quanta) also making significant investments in Vietnam.

On April 16th, Cook arrived in the Indonesian capital Jakarta to meet with Indonesian President Joko Widodo and proposed the idea of establishing a manufacturing plant in Indonesia.

Prior to this, Apple's factory had never landed in Indonesia, but since 2018, the company has been building a local developer academy, with a total cost of around 1.6 trillion INR (about $99 million).

Indonesian Industry Minister Agus Gumiwang Kartasasmita said, "If Apple decides to set up a factory in Indonesia, Indonesia's export capacity will undoubtedly help enhance Apple's supply chain." Even without a factory, Apple can still collaborate with Indonesian companies to import product components."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.