Impact Of Australian CPI And BOJ Comments: How Will AUD And JPY Perform?

This article analyzes the impact of recent position changes in AUD/USD and USD/JPY on future price action.

Australian Inflation Data Remains Mixed

Australia's annual inflation rate rose to 3.5% in July, down from 3.8% in June, according to the Australian Bureau of Statistics. While the figure was slightly higher than the expected 3.4%, which at first glance seemed encouraging, part of the decline was due to subsidized electricity prices, which resulted in an artificially low Consumer Price Index (CPI). While electricity and gasoline prices eased on a monthly basis, rent, food and gas prices rose.

The market has lowered its previous expectations for a possible rate cut in November and now sees a greater likelihood of a rate cut in December, with the market projecting a 72% likelihood of a 25 bps rate cut.

AUD/USD Trend Analysis

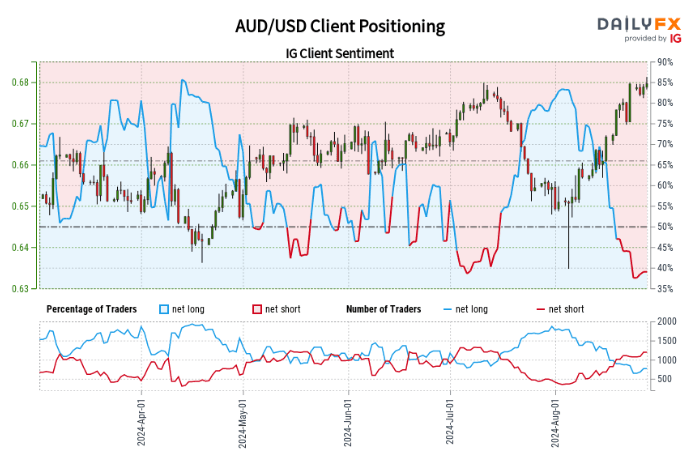

According to retail traders, 40.75% of traders currently hold long positions with a long/short ratio of 1.45:1. Compared to yesterday, long positions have increased by 2.06%, but are down 9.60% from last week. Short positions decreased by 2.21% from yesterday but increased by 5.80% from last week.

Given that traders are mainly holding short positions, this suggests that AUD/USD may continue to appreciate.

Current positions show a decrease in net short positions compared to yesterday, but an increase from last week. This status quo combined with recent changes leads to a mixed trading outlook for AUD/USD.

AUD/USD Daily Chart

BoJ Comments Reaffirm Hawkish Policy Stance

Bank of Japan (BoJ) Deputy Governor Ryozo Himino told a meeting of business leaders in Kofu that the central bank will continue to raise interest rates if inflation continues to meet expectations. He also clarified the need for the bank to monitor the financial market with “utmost vigilance” after the market volatility experienced earlier in the month.

Last week, Bank of Japan Governor Kazuo Ueda was summoned to the Diet to explain the decision to raise interest rates in July, and Kazuo Ueda reiterated his determination to continue to raise rates if inflation continues to stabilize at the expected 2% level.

USD/JPY trend analysis

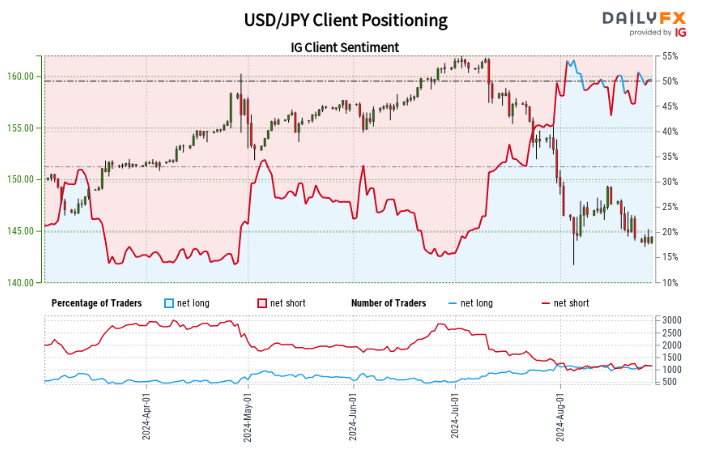

According to information from retail traders, 51.35% of traders currently hold long positions with a long/short ratio of 1.06:1. Long positions have increased by 5.09% since yesterday and by 6.11% from last week. Short positions are down 2.41% since yesterday and 3.07% from last week.

The contrarian view, which goes against market sentiment, suggests that USD/JPY may continue to fall given that traders are holding predominantly long positions.

The recent increase in net long positions, as well as the current market sentiment, strengthens the bearish reverse trading view on USD/JPY.

USD/JPY Daily Chart

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.