International oil prices hit the highest in more than a month Biden "open the gate to release oil" impact geometry?

It is conceivable that if this part of the "low-cost oil" flows into the market, it will have a significant impact on the entire oil price system.

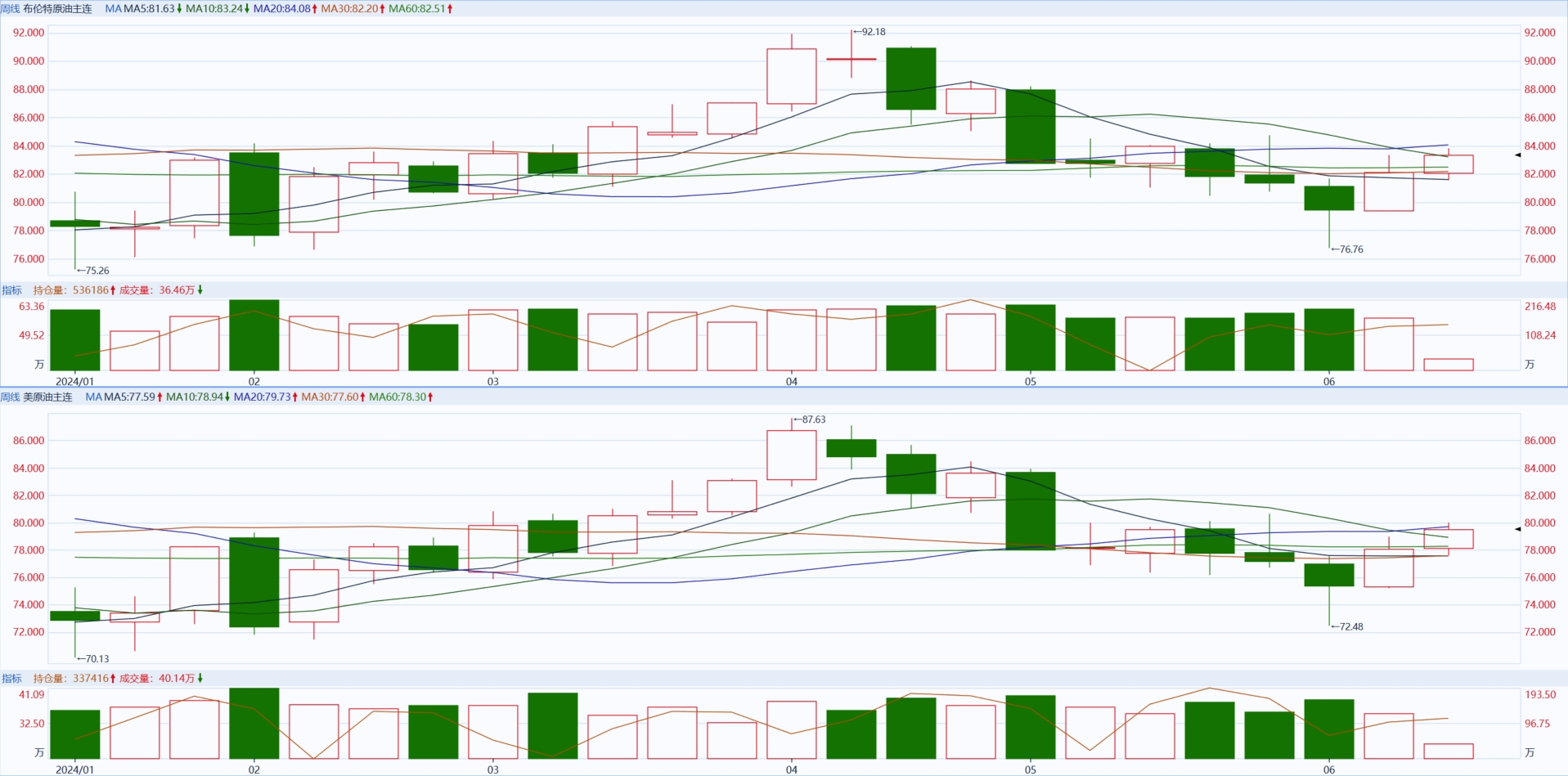

On June 17, international oil prices surged, with WTI crude futures rising by $1.88, or 2.4%, to settle at $79.72 per barrel, marking the highest level since late April. Brent crude futures rose by $1.63, or 2%, to $84.25 per barrel, also the highest since April.

The main reason for the over-one-month high in international oil prices is OPEC+'s stronger-than-expected market assurance. The organization stated that it would suspend or cancel plans to increase supply from the fourth quarter of this year based on market conditions, which boosted oil prices to some extent. Additionally, eight OPEC+ member countries, including Saudi Arabia, Russia, and Iraq, announced the voluntary extension of production cuts, which also supported oil prices.

Data shows that by the OPEC+ June meeting, the total production cut by OPEC+ members was 5.86 million barrels per day, accounting for about 5.7% of global demand. The cuts include 2 million barrels per day from all OPEC+ members, 1.66 million barrels per day from the first round of voluntary cuts by nine member countries, and 2.2 million barrels per day from the second round of voluntary cuts by eight member countries. According to the original plan, this round of production cuts will expire in June.

The widespread production cuts by oil-producing countries are not only due to oil price considerations but also due to weak global oil market demand. Although OPEC+ predicts that global oil market demand will increase by 2.25 million barrels per day this year, the International Energy Agency (IEA) reports that global consumption demand growth this year is only 1.06 million barrels per day, far below OPEC+'s forecast. In this regard, U.S. shale oil giant EOG Energy commented that OPEC+'s extension of production cuts this time is somewhat conducive to the balance of global crude oil market supply and demand.

Against the backdrop of continuous supply structure repair, the Biden administration's plan to release strategic petroleum reserves adds another layer of uncertainty to the oil market.

Media reports indicate that to prevent gasoline prices from soaring this summer and to curb inflation before the November elections, the Biden administration will release millions of barrels of oil into the market.

White House energy advisor Amos Hochstein recently stated that oil prices are "still too high for many Americans," and he hopes to see oil prices "come down further." He added, "I think if necessary, our Strategic Petroleum Reserve (SPR) is sufficient." The SPR refers to the country's strategic petroleum reserves.

Public data shows that U.S. inflation has fallen by about 60% since hitting multi-decade highs in 2022. According to the American Automobile Association, the average price of gasoline in the U.S. on Sunday was $3.45 per gallon, slightly down from a year ago but still more than 50% higher than when Biden succeeded Trump as president in 2021.

Currently, the maximum capacity of the U.S. SPR is 714 million barrels, with an average inventory price of $29.70, far below the trading price of crude oil at $80. It is conceivable that if this "low-cost oil" flows into the market, it will have a significant impact on the entire oil price system. Although the strategic oil release may temporarily lower energy prices, restoring it in the future will come at a great cost.

However, the SPR oil release may face strong opposition from Republicans. Previously, Biden announced the release of oil reserves twice at the end of 2021 and in 2022, surpassing all U.S. presidents. Last month, Republican lawmakers described the 2022 SPR release as an "attempt to influence the midterm elections" in a letter to Energy Secretary Jennifer Granholm. They asked Granholm to "ensure that the SPR is not misused for political purposes in this election year."

In addition to the above events, investors need to watch for the U.S. May retail sales monthly rate, speeches by Federal Reserve officials, geopolitical news, and API crude oil inventory data this week.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.