When the U.S. central bank started raising interest rates to deal with inflation, they started selling gold ETFs.

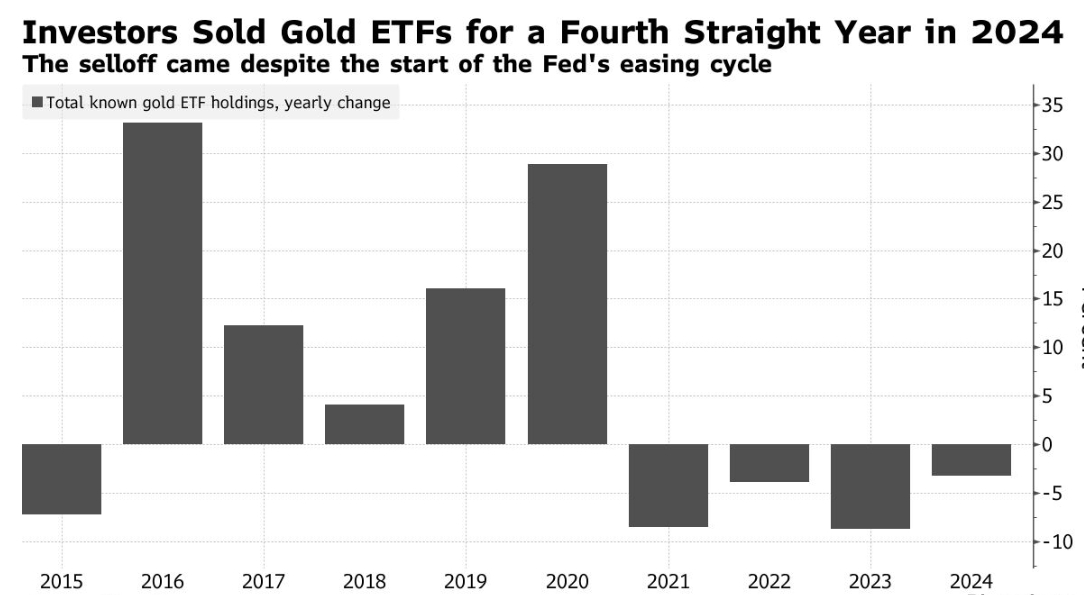

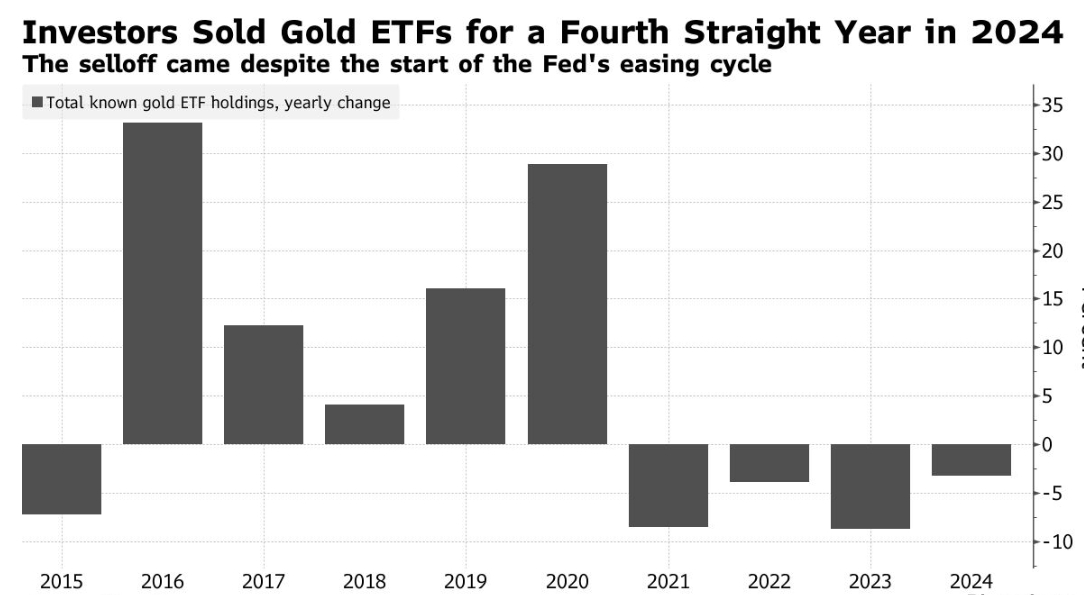

In 2024, despite gold prices hitting record highs and the Federal Reserve's easing monetary policy, investors sold off gold-backed exchange-traded funds for the fourth consecutive year.

Gold ETF sold off for fourth consecutive year

Although optimistic expectations for the Federal Reserve to cut interest rates in 2024 helped gold ETFs rebound slightly, the results of the U.S. election in November ended this new momentum.The strengthening of the U.S. dollar after Donald Trump's election victory led to another sell-off in these exchange-traded funds, and gold and silver prices fell from historical highs as investors shifted their money elsewhere, including stocks and cryptocurrencies.

In times of political and economic uncertainty, investors often seek the safety of gold and silver.They bought gold ETFs during the 2020 epidemic and began selling gold ETFs two years later when the U.S. central bank began raising interest rates to combat inflation.Since gold bars do not pay interest, the increase in interest rates has greatly reduced the attractiveness of gold bars.

At the same time, the geopolitical risks of conflicts in Ukraine and the Middle East have led emerging market central banks, Asian investors and consumers to flock to physical gold as a portfolio diversification and hedging tool.This has also reduced demand for gold ETFs.

Analysts believe gold and silver will rise further this year

The Federal Reserve's interest-rate cycle, continued safe haven demand and a wave of purchases from central banks drove last year's 27% gain, and many analysts believe gold and silver will rise further this year.

Kotak Securities analyst Kaynat Chainwala said in a report that despite the Fed's cautious tone, continued buying by central banks and geopolitical uncertainty are expected to keep gold in the spotlight as a preferred safe-haven asset.

Federal Reserve Chairman Jerome Powell said last month that the central bank would be more cautious about continuing to reduce borrowing costs amid renewed inflation concerns.Lowering interest rates usually benefits gold and silver that do not pay interest.

Key economic data due Friday, including U.S. jobless claims and manufacturing reports, will be closely watched for clues about the trajectory of the Fed's easing policy.

As of press time, spot gold rose 1.3% to US$2,658.26 per ounce.The Bloomberg Dollar Spot Index rose, erasing earlier losses.Silver, palladium and platinum all rose.