Boeing Admits Guilt in Two 737 Max Crashes! Fine Could Exceed $200 Million

On the evening of July 7th, the US Department of Justice announced that Boeing would plead guilty to a criminal fraud charge.

Boeing pleads guilty

On the evening of July 7th, the US Department of Justice announced that Boeing would plead guilty to a criminal fraud charge. The accusation stems from two 737 Max plane crashes (two in Indonesia in 2018 and Ethiopia in 2019), resulting in a total of 346 deaths.

Last week, federal prosecutors gave Boeing two options: either plead guilty and pay a fine as part of the sentence, or face trial on a serious criminal charge of conspiring to defraud the United States.

Obviously, Boeing has chosen the former.

According to an agreement reached with US prosecutors, Boeing will face a criminal fine of up to $487.2 million, the highest amount allowed by law, but the Department of Justice has stated that the actual amount will be determined by judges. The Department of Justice requires judges to record the fines previously paid by Boeing in their accounts, which, if approved, would reduce the fines to $243.6 million.

In addition, according to the agreement, Boeing needs to spend at least $455 million over the next three years to strengthen its compliance and security plans. The agreement also stipulates that Boeing must establish an independent inspector to monitor the company's compliance status, and the inspector must publicly submit an annual progress report. During the three-year term of the inspector, Boeing will be on probation.

The agreement still needs to be approved by a federal judge before it can take effect.

An official from the Department of Justice stated that the agreement does not represent Boeing's immunity from other accidents, including the January incident of an Alaska Airlines 737Max9 aircraft landing at Portland International Airport after a closed hatch fell off during flight.

This agreement also does not involve current or former executives of Boeing, only the company itself. Boeing confirmed in a statement that it had reached a principle agreement with the Department of Justice on the resolution clause, but did not provide further comments.

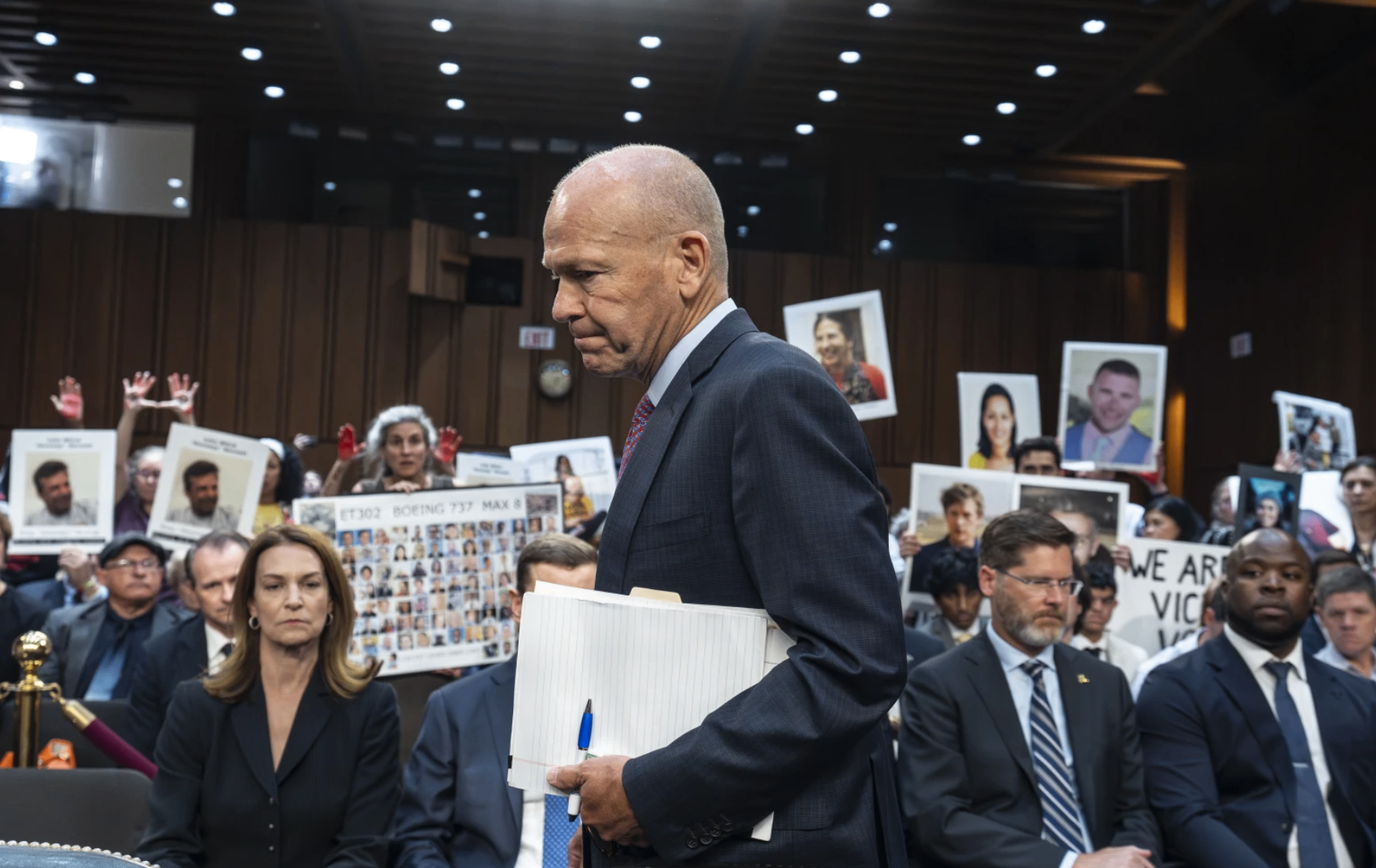

Hard to convince

The relatives of the victims are not satisfied with the above agreement, and they hope that Boeing can accept stricter trials and bear more serious economic consequences.

It is reported that the relatives of the victims in the two plane crashes hope that Boeing will face criminal trial and pay a fine of up to $24.8 billion.

The relatives of the accident victims have called for a criminal trial of Boeing to investigate the knowledge of Boeing's internal personnel in deceiving the Federal Aviation Administration. They also hope that the Department of Justice will sue Boeing's senior officials, not just the company.

Some lawyers for the families of the victims have stated that they plan to pressure Judge Reed O'Connor, who is in charge of the case, to refuse the agreement.

Paul Cassell, a lawyer for some of the families of the victims, said, "This private transaction failed to recognize that Boeing's conspiracy had resulted in 346 deaths. Through clever lawyer collusion between Boeing and the Department of Justice, the fatal consequences of Boeing's crimes were covered up."

Sanjiv Singh is a lawyer for 16 families who lost their loved ones in the October 2018 Indonesian plane crash, and he called the plea agreement "extremely disappointing". He said that these terms "seem to me like a private agreement."

Some legal experts suggest that criminal convictions could jeopardize Boeing's status as a federal contractor. The company has signed numerous contracts with the Pentagon and NASA. However, federal agencies can grant exemptions to companies convicted of serious crimes to maintain their eligibility for government contracts. Lawyers for the families of the crash victims expect Boeing to receive exemptions.

Boeing's Predicament

In recent years, Boeing's aircraft have experienced frequent accidents, which has led to chaos among the company's executives.

In March of this year, Dave Calhoun, President and CEO of Boeing, announced his resignation as CEO by the end of 2024. Meanwhile, Boeing's Chairman of the Board, Larry Kellner, informed the board that he does not intend to run for re-election at the annual shareholder meeting in May.

Currently, Boeing's board of directors is still searching for a new CEO.

In addition, the company's financial situation is not ideal. In the first quarter of this year, Boeing's revenue was $16.57 billion, a year-on-year decrease of 8%, due to a decrease in 737 model deliveries and the grounding of the 737 MAX 9. Net loss of $355 million, compared to a net loss of $425 million in the same period last year. Boeing delivered a total of 83 civilian aircraft in the quarter, a year-on-year decrease of 36%.

Boeing previously stated that it may spend approximately $8 billion in cash in the first half of 2024.

After the release of the first quarter financial report, Moody's announced a downgrade of Boeing's credit rating from Baa2 to Baa3, only one level higher than the "junk" rating, and gave a negative rating outlook.

Moody's predicts that Boeing will face financial difficulties in the coming years, with free cash flow unable to meet Moody's previous expectations. Boeing may need to address cash flow shortages by issuing new debt, and the unfavorable factors faced by Boeing's commercial aircraft division will continue at least until 2026.

As of March 31, 2024, Boeing's cash balance was $7.5 billion. Moody's believes that Boeing's annual free cash flow will not be able to cover the $4.3 billion debt due in 2025 and the $8 billion debt due in 2026. Moody's also expects Boeing to issue new debt to raise funds.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.