How the market reacted after the Trump rally shooting?

As the "favorite to win the US presidential election" this year, Trump's chances of winning the election have also increased after being hit by a bullet.

Over the weekend, the news of the attack on former US President and Republican candidate for the 2024 US presidential election, Trump, caused a global sensation.

Trump was hit in the ear during a shooting incident at a campaign rally in Pennsylvania on Saturday, and was rushed to the hospital after the attack. The Federal Bureau of Investigation (FBI) referred to this incident as an "assassination". Later that day, Trump's campaign team stated that Trump was in "good condition" and had not suffered any major injuries except for an upper right ear injury.

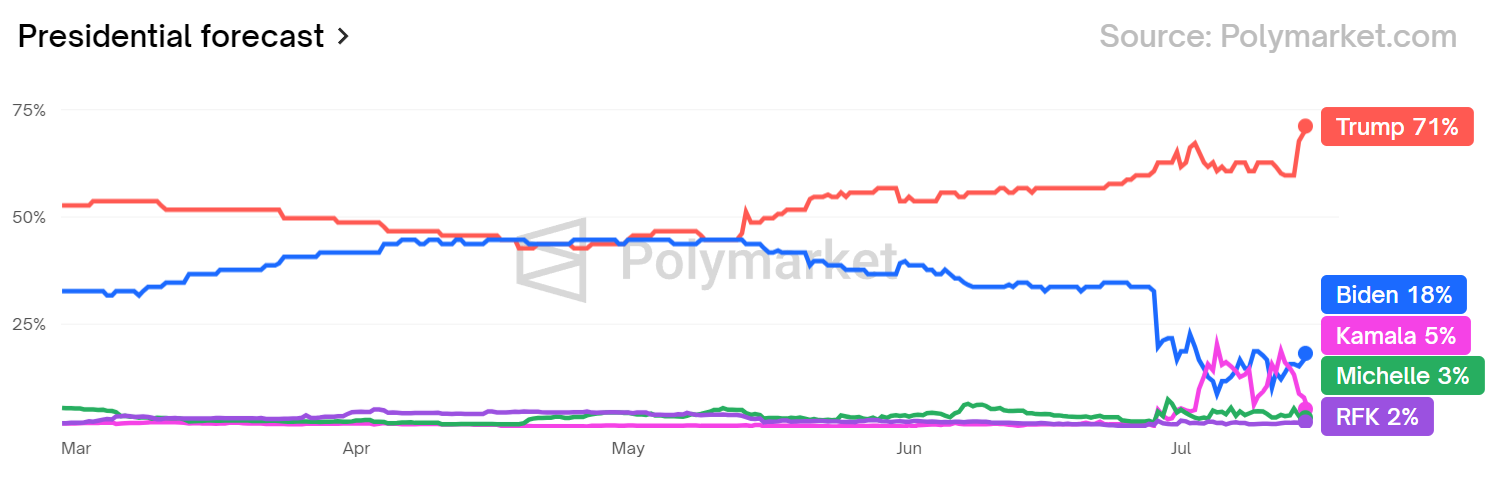

As the "favorite to win the US presidential election" this year, Trump's chances of winning the election have also increased after being hit by a bullet. According to data from prediction website Polymarket, the probability of Trump winning the 2024 presidential election has significantly increased from 60% to 71% after the attack.

After the Trump incident, the capital market also reacted accordingly.

● Dollar and US bonds

The market generally believes that Trump's proposition of relaxing fiscal policy and raising tariffs may benefit the US dollar and weaken the price of US treasury bond bonds.

And the trend of market changes after Trump's probability of winning the election has increased is indeed the same. On Monday, the US dollar strengthened against multiple currencies.

Mark McCormick, Global Head of Forex and Emerging Markets Strategy at Toronto Dominion Bank, said, "For us, this news does further confirm that Trump is the leader. We still have confidence in the performance of the US dollar in the second half of the year and early 2025.

At the same time, the yield of US treasury bond bonds also rose.If Trump wins overwhelmingly in the election, it could lead to greater upward pressure on bond yields and a steepening yield curve, "said Charles Henry Monchau, Chief Investment Officer of Banque SYZ.

Marko Papic, Chief Strategist at BCA Research Inc. in California, stated that bond investors should be particularly cautious as this attack could increase Trump's chances of being elected and ultimately lead to concerns about the fiscal outlook.

Earlier, Biden's poor performance in the first election debate led to a surge in bond yields, indicating that US treasury bond bonds (especially longer-term bonds) are sensitive to signs that Trump will have the opportunity to implement his fiscal expansion agenda.

At some point, the bond market should realize that President Trump's chances of entering the White House are higher than any of his competitors, "Papic wrote in the report." I still believe that as his chances of entering the White House increase, the likelihood of a disturbance in the bond market will also increase.

Michael Purves, CEO of Tallbacken Capital Advisors in New York, believes that if Trump wins this year's US election, it could lead to bond selling and exacerbate inflation as interest rates fall.

If (Trump) wins and fulfills his promised obligations, you will see a larger sell-off at the back end of the bond market, "Purves said." I think the bond market is the biggest trading market this year (in the election), not the stock market.

● Bitcoin

With nearly four months left until the US presidential election, the emergence of political violence has intensified concerns about instability in the US and prompted investors to turn to safe haven assets.

Kyle Rodda, Senior Financial Market Analyst at Capital.com, stated that after the shooting incident, customer funds began to flood into the Bitcoin and gold markets. For the market, this means safe haven trading, but it is more inclined towards non-traditional safe haven assets.

On July 15th, Bitcoin experienced a surge. As of press time, Bitcoin has surged 9%, bringing its annual increase to nearly 50%.

Analysts have pointed out that given the attractiveness of Bitcoin to investors seeking to hedge against political turmoil by avoiding traditional financial assets, as well as Trump's support for cryptocurrency, Bitcoin may further rise.

● U.S. stocks

As of 06:04 PM New York time, the September futures of the S&P 500 index rose by 0.1%, while the trading volume of the Nasdaq 100 index futures contract remained relatively stable. Early trading showed no panic in the market, with the Chicago Board Options Exchange VIX July futures trading at 12.89, slightly higher than Friday's close of 12.83.

Michael Purves, CEO of Tallbacken Capital Advisors, believes that at the index level, stocks will continue to be driven by corporate performance rather than these events.

But he also said that if Trump is seen as the winner in November, some stocks will receive an additional boost. The market generally expects stocks in the banking, healthcare, and oil industries to benefit from Trump's victory.

David Mazza, CEO of Roundhill Investments, said, "This attack will exacerbate market volatility." He predicted that investors may seek temporary safe haven in defensive stocks such as large cap companies. He said, "This also increases support for stocks that perform well on steep yield curves, especially financial stocks.

This reaction is similar to the one after the first presidential debate at the end of June, when Biden's poor performance briefly boosted Trump's chances of being elected.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.