Last Friday, the market was surprised that "buy Broadcom, sell Nvidia".

On December 16, after surging 24.4% last Friday, setting the largest gain in a single day, Broadcom Inc. It continued to rise 11.2% on Monday.According to Dow Jones Statistics, Broadcom's gain on Friday created a market value gain of $206 billion for the company, ranking sixth in history.Currently, the stock is on track to record its best monthly performance in history-a gain of more than 50% since December.

Broadcom's rise is mainly affected by three aspects.

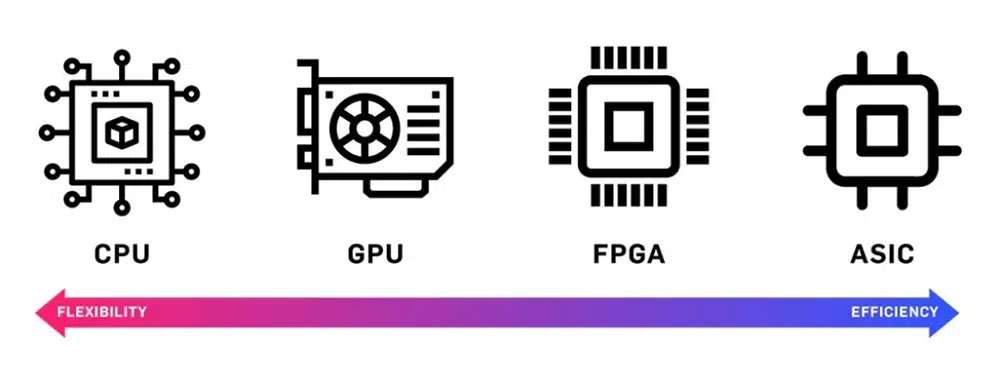

The most important thing is that the market has begun to pay attention to the needs of ASICs (application-specific integrated circuits) in the field of artificial intelligence.Market analysts believe that the AI model is shifting from the pre-training stage to the logical reasoning stage, and ASIC-specific chips may replace GPU-specific chips and become a new choice for AI companies.

Unlike GPUs, ASICs are semiconductors produced for specific product requirements, while GPUs are standard semiconductor products suitable for general purpose high-performance computing.At present, due to tight GPU production capacity and high prices, many technology giants have begun to develop their own ASIC chips for their own use, such as Google, Amazon, Microsoft, etc.

The market believes that the application of ASIC in the field of generative artificial intelligence (AI) may gradually replace some GPU market share.This trend poses a potential threat to Nvidia, and Broadcom's shares have surged sharply.

Secondly, the positive guidance given by Broadcom Chinese CEO Chen Fuyang also confirmed the market's speculation.

He said at a fourth-quarter earnings call that he expects artificial intelligence to bring revenue to the company in fiscal year 2027 to reach US$60 billion to US$90 billion.As companies increase investment in GenAI infrastructure, the demand for Broadcom network chips is also growing.

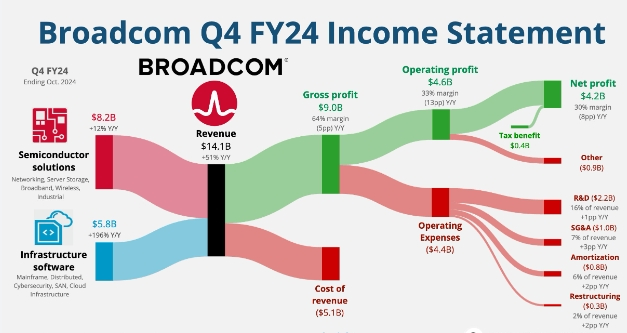

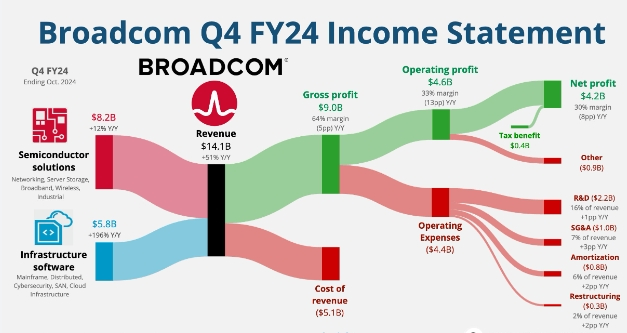

In the fourth quarter, revenue from Broadcom's infrastructure software division increased by 196% year-on-year to US$5.82 billion, pushing total revenue to increase by more than 50% from the same period last year to US$14.05 billion, exceeding market expectations.

After the data was released, Broadcom's share price jumped to a record high, closing up 24.43% at US$224.8/share, with a total market value of US$1.05 trillion, becoming the ninth member of the "Trillion-Dollar Club".

Finally, market optimism about Broadcom is spreading on Wall Street.

Bernstein's Stacy Rasgon wrote on Monday: "Broadcom's artificial intelligence is developing strongly and is looking for its own 'Nvidia moment'. New products may increase sharply in 2025 (the second half) and in a few years... Welcome major opportunities.”

He wrote that based on its current ultra-large customer deployment lineup, the company expects the serviceable market size in the artificial intelligence field to reach US$60 billion to US$90 billion by fiscal year 2027.Management mentioned that if more companies that are discussing with Broadcom join in, the market size may be larger.

Rasgon said Broadcom is his first choice in the semiconductor field and talked about various factors for the company.Like many other companies in the industry, Broadcom's core business outside of artificial intelligence is "still pretty bad", but "but the core semi-finished product layout looks better in 2025 because of some signs of improvement and ease of comparisons."

Rasgon also said that Broadcom's business performance on VMware exceeded expectations, and one year after the VMware transaction was completed, it significantly exceeded expectations in many aspects.

However, he is also optimistic about Nvidia, believing that investors "still need to pay attention" to the stock.