Along with the worst quarterly report in 14 years, Citi plans to cut 20,000 jobs!

During the earnings call, Citi Chief Financial Officer Mark Mason revealed that by the end of 2026, Citi will cut as many as 20,000 employees worldwide, accounting for about 8% of all employees.。

The thunder of Citi's layoffs still exploded.。

Worst quarterly loss since financial crisis

On Friday (January 12), after the fourth quarter results, Citigroup said it would cut 20,000 jobs worldwide in the future, accounting for 8% of all employees.。

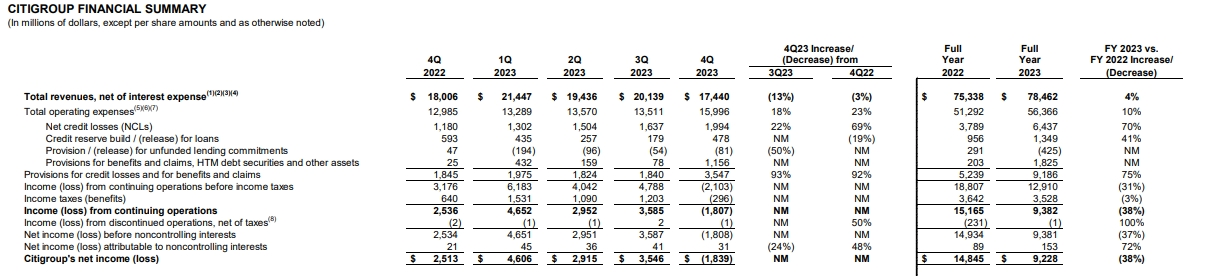

Data show that Citi's fourth-quarter net loss reached 18.$400 million, the worst since the financial crisis。Revenue fell 3% YoY to 174.$400 million, below market expectations of 187.$400 million。Adjusted EPS of 0.$84, higher than market expectations of 0.81 USD。

During the reporting period, Citi's fees and expenses amounted to $4 billion, severely dragging its performance back.。Of this, $1.7 billion is a special tax imposed by the Federal Deposit Insurance Corporation (FDIC) on large banks; $1.3 billion is related to exposure to Russian business and the devaluation of the Argentine peso, and about $800 million is related to restructuring.。

In addition, Citi's corporate loan revenue plunged 26% in its fiscal fourth quarter as rising interest rates dampened U.S. corporate borrowing demand。The decline in market volatility at the end of the year also indirectly affected Citi's investment business, resulting in a 25% plunge in Citi's revenue from the sale and trading of bonds, commodities and currencies during the reporting period.。

Citi CEO Jane Fraser acknowledged the results were "very disappointing," but also said the bank had made "substantial progress in simplifying Citi and executing our strategy," and predicted 2024 would be a turning point.。

Citi to cut 20,000 jobs in future

During the earnings call, Citi Chief Financial Officer Mark Mason revealed that by the end of 2026, Citi will cut as many as 20,000 employees worldwide, accounting for about 8% of all employees.。The restructuring is expected to reduce Citi's spending to $51 billion, bringing the bank closer to its profit target.。

Last September, Jane Fraser launched Citi's largest restructuring in decades, and the layoffs are part of Citi's massive restructuring plan.。The purpose of the restructuring plan is twofold, one to improve the current financial situation and the other to push up the share price.。Driven by Jane Fraser, Citi's 13 management layers have been streamlined to just eight, and in addition, the heads of Citibank's five business units will report directly to Fraser。

Jane Fraser said the moves will allow Citi to eliminate bureaucracy and be able to move Citi to a leaner, more centralized operating model.。In Fraser's vision, Citi's restructuring plan will also highlight the importance of technology and automation in the bank's growth.。Citi hopes that by streamlining its operations and consolidating technology solutions, it will be able to maintain its leadership in a rapidly digitizing world.。

The layoffs follow a round of smaller layoffs at Citigroup late last year, eliminating about 10 percent of the bank's senior management positions。Citi said it expects the bank's total workforce to fall to 180,000 by 2025 or 2026, from 240,000 at the beginning of last year.。In addition to the jobs cut through the restructuring process, Citibank plans to exit consumer banking in Mexico and elsewhere, with an expected reduction of another 40,000 employees.。

In addition to Citi, the U.S. financial system has also recently ushered in a wave of layoffs.。Wells Fargo showed in its recent results report that its headcount has increased from 23 at the end of the fourth quarter of 2022..90,000 reduced to 22 in 2023.60,000 people。There is also recent news that Goldman Sachs, a well-known investment bank, will also launch a new round of layoffs, which is expected to involve thousands of people.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.