How to access gold in Exness?

Exness provides a variety of safe, simple and fast way to access funds, so you can invest in the whole transaction without worrying about the safety of funds。

When choosing forex trading, it is important to understand its information about deposits and withdrawals。Exness provides a variety of safe, simple and fast way to access funds, so you can invest in the whole transaction without worrying about the safety of funds。This article will give you a detailed introduction to various issues related to Exness access fees.。

Introduction to Exness

Exness is one of the European STP / ECN brokers regulated by FSA, CySEC, FCA, FSCA, FSC, FCS, CMA and is a trusted market leader。Since its development, Exness has been operating centers in all corners of the world: Seychelles, Curaçao, British Virgin Islands (BVI), South Africa, etc.。

To meet the habits of different types of traders, Exness has launched a variety of versions, including: social trading mobile app, personal zone for traders, Exness APP and web version.。

In Exness, each trading account offers a different kind of default currency:

| Account | Default Currency |

| cents | USC EUC GBC CHC AUC CAC |

| Standard, Pioneer, Bare Point, Zero Point | AED UAE Dirham, ARS Argentine Peso, AUD Australian Dollar, AZN Azerbaijan New Zealand Manat, BDT Bengal Taka, BHD Bahraini Dinar, BND Brunei Dollar, BRL Brazilian Real, CAD Canadian Dollar, CHF Swiss Franc, CNY RMB, EGP Egyptian Pound, EUR Euro, GBP Pound Sterling, GHS Ghana Seti, HKD Hong Kong Dollar, HUF Hungarian Forint, |

It should be noted that since the account currency cannot be changed after it is set, you must reopen a new account if you want to switch to another currency.。And if you make a deposit in a currency other than the base currency, you will need to pay an exchange fee。So carefully choose the default currency that suits you。As an alternative, Exness allows you to open multiple trading accounts in different base currencies using the same personal area。

Introduction to Exness

Minimum deposit requirements

The minimum deposit requirement is the minimum amount you need to transfer to your account when you start trading.。At Exness, the minimum deposit requirements for different accounts vary depending on the type of account。

- For standard accounts, the minimum deposit depends on your payment method;

- For professional accounts (Pioneer, Zero and Bare), the minimum deposit is fixed from $200 and the deposit amount requirements may vary depending on the country of residence.。

Payment method

In addition, you can deposit in any currency provided by the selected payment method, but if the deposit currency does not match your trading account currency, the deposit will be calculated at the corresponding currency exchange rate。

In rare cases, the local payment method used at the time of deposit (limited to one region) may not be displayed on the deposit and withdrawal tabs of the Personal Zone。In such cases, it is possible to withdraw funds to a bank account different from the one used at the time of the deposit, provided that the bank is supported by a local payment method and that the name of the account holder of the bank matches the name of the Exness account holder.。

Exness offers multiple payment methods for deposits, each with its own minimum deposit and different processing times:

| Payment method | Amount limit | Arrival time |

| Neteller | 10-50k USD | Instant - 30 minutes |

| Skrill | 10-100k USD | Instant - 30 minutes |

| ChipPay | 110-6.5k USD | Instant - 30 minutes |

| MyPay |

350-6.5k USD |

Instant - 30 minutes |

|

Tether (USDT、ERC20、TRC20) |

10-10m USD |

Instant - 1 day |

| Bank Card | 10-10k USD | Instant - 30 minutes |

| BinancePay | 10-20k USD | Instant - 30 minutes |

| CNPay | 110-6.5k USD | Instant - 30 minutes |

| SticPay | 10-10k USD | Instant - 30 minutes |

|

USD Coin (USDC、ERC20、TRC20) |

10-10m USD | Instant - 1 day |

However, different countries may support different payment methods, so be sure to check the payment methods available in your region before making a deposit, you can check the full list in the personal area。If some methods are blocked, you can learn more about them。

Precautions

Before starting trading, traders need to successfully complete the first deposit before they can start trading on the trading platform.。Exness provides a variety of payment systems to ensure that no matter where the customer is, they can be easily paid, but please note:

- Exness only accepts payments from accounts in the customer's name and does not accept payments from third-party accounts;

- Customers from South Africa and Kenya need to fully verify their personal data before they can be paid.

- Access to the gold can be 24 / 7 at any time, if not immediately to the account, your request will be accepted within 24 hours;

- All deposits are free, but banks, credit card providers or payment systems may charge additional transaction fees。

- The total credit limit for all accounts in a personal zone is $2,000 before authentication, address verification, and economic file verification are completed。The limit will be raised to $50,000 upon completion of identity verification and economic files, and the deposit limit will be removed upon completion of residency verification。

Exness Deposit Process

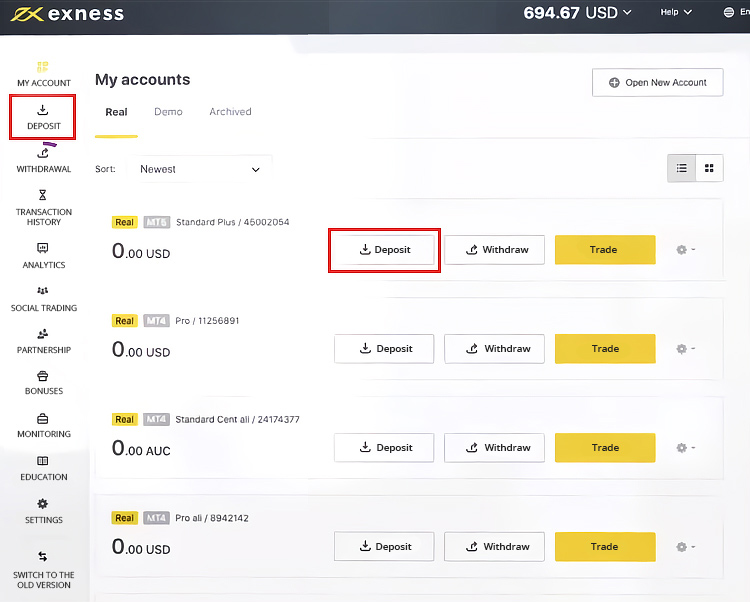

1.Go to the official Exness website and log in to the Personal Zone。If you don't already have an account, you can create a new one first。

2.After logging in, click "Deposit" on the side menu。

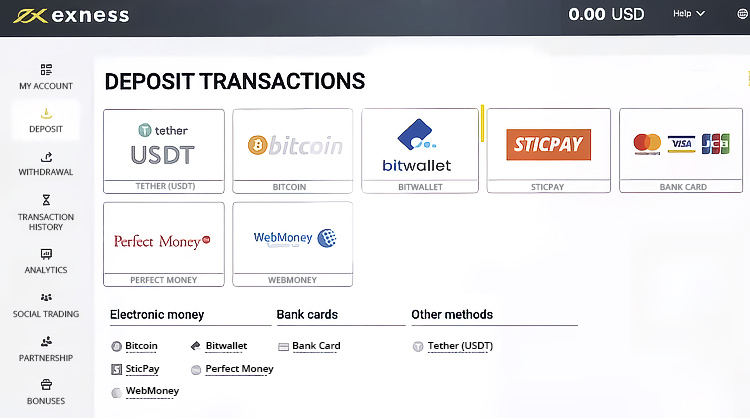

3.Select Preferred Payment Method。

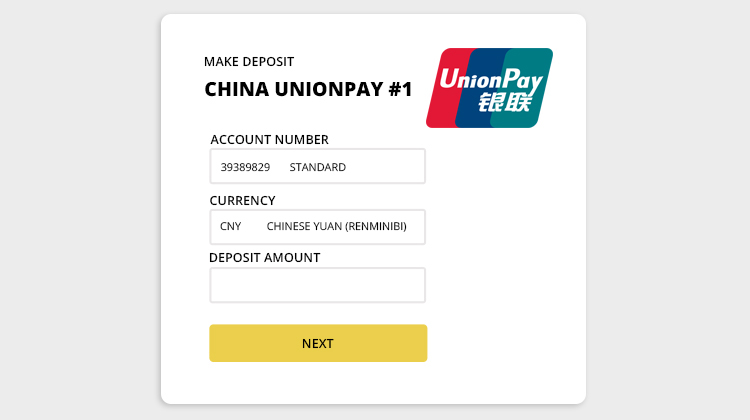

4.Enter account number, currency, and deposit amount in Exness。When finished, click Next。

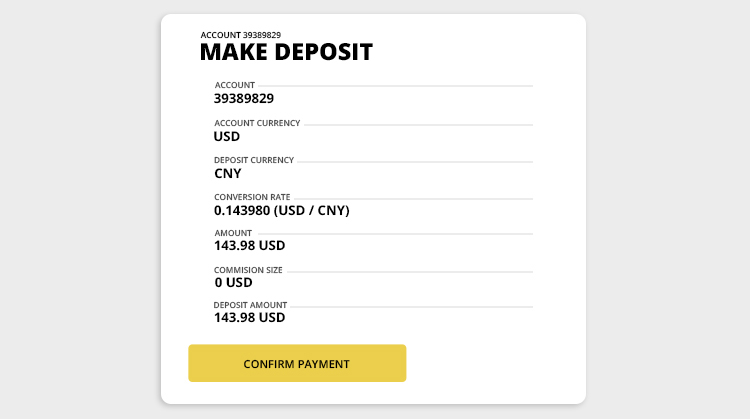

5.Double check the deposit details and click "Confirm Payment"。

6.The browser will jump to your payment provider, follow the on-screen instructions and accept the payment request (each payment method may be different)。After that, the funds will be processed and reflected in the account as soon as possible。

Exness Payment Introduction

Minimum withdrawal requirements

For Exness users, you can withdraw funds at any time on any day, but not through bank cards and Perfect Money。

After the account is frozen (when the grace period expires), you can still make withdrawals, but after the grace period expires, the internal transfer function will be turned off。

In Exness, the maximum withdrawal amount at any time is equal to the amount of margin available on the trading account (the remaining funds not held in the trading account), which can be viewed on the personal area。

Payment method

In rare cases, the local payment method used at the time of deposit (limited to one region) may not be displayed on the deposit and withdrawal tabs of the Personal Zone。In such cases, it is possible to withdraw funds to a bank account different from the one used at the time of the deposit, provided that the bank is supported by a local payment method and that the name of the account holder of the bank matches the name of the Exness account holder.。

Exness offers multiple payment methods for withdrawals, each with its own minimum deposit and different processing times.

| Payment method | Amount limit | Arrival time |

| Self-sustaining inter-account transfers | 1-1m USD | Instant - 1 day |

| Neteller | 4-10k USD | Instant - 1 day |

| Skrill | 10-1.2k USD | Instant - 1 day |

| ChipPay | 85-6.5k USD | 1 hour - 1 day |

| MyPay |

360-6.5k USD |

1 hour - 1 day |

|

Tether(USDT、TRC20) |

10-10m USD |

Instant - 1 day |

|

Tether(USDT、ERC20) |

100-10m USD |

Instant - 1 day |

| BinancePay | 1-20k USD | Instant - 30 minutes |

| SticPay | 1-10k USD | Instant - 1 day |

|

USD Coin(USDC、ERC20) |

100-10m USD | Instant - 1 day |

|

USD Coin(USDC、TRC20) |

10-10m USD | Instant - 1 day |

However, different countries may support different payment methods, so be sure to check the payment methods available in your region before making a deposit, you can check the full list in the personal area。If some methods are blocked, you can learn more about them。

Precautions

Before making a cash request, you should note the following:

- You can withdraw the equivalent amount of the available margin of the trading account shown in the personal area。

- If your Exness account has not been fully verified, the functionality of your account will be limited to some extent during this grace period。

- All withdrawals are free, but banks, credit card providers or payment systems may charge additional transaction fees。

- All withdrawals must use the same payment method, the same account and the same currency in which the deposit is made。If you use multiple deposit methods or have multiple wallets in the same method, you can withdraw funds in proportion to the deposit amount。

- If multiple withdrawals are used, the process must follow the priority of the payment system, first processing bank card withdrawals, then Bitcoin withdrawal requests, and then other。

- To ensure the safety of your funds, you can only withdraw funds to your own personal account。

Exness Cash out process

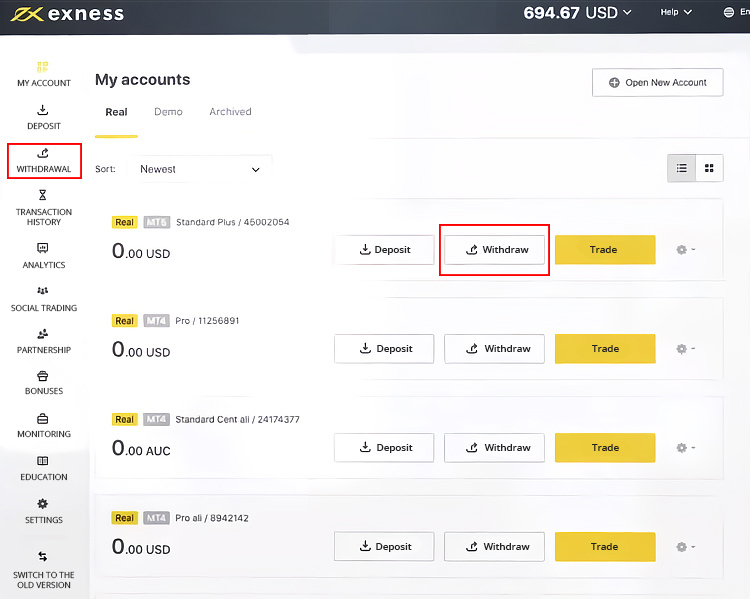

1.Visit the Exness website and log in to the Personal Zone。

2.Click "Cash Out" in the left menu。

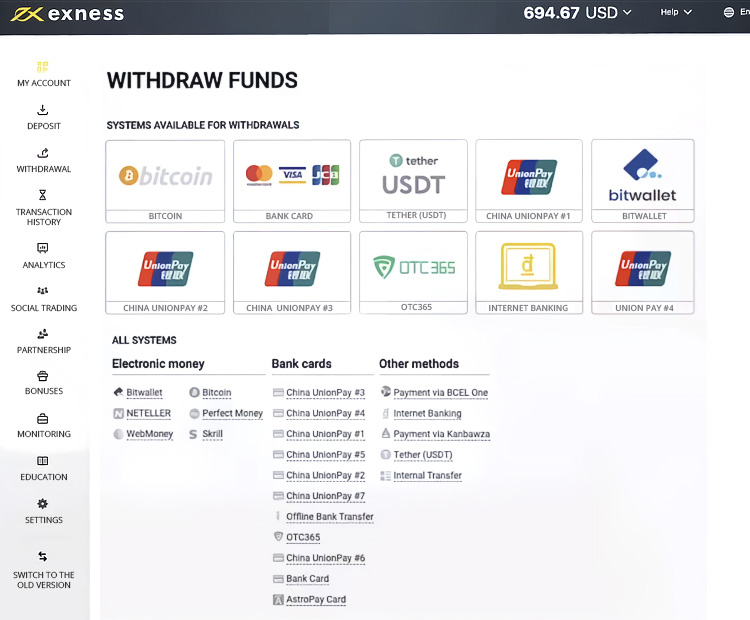

3.Select available payment methods。

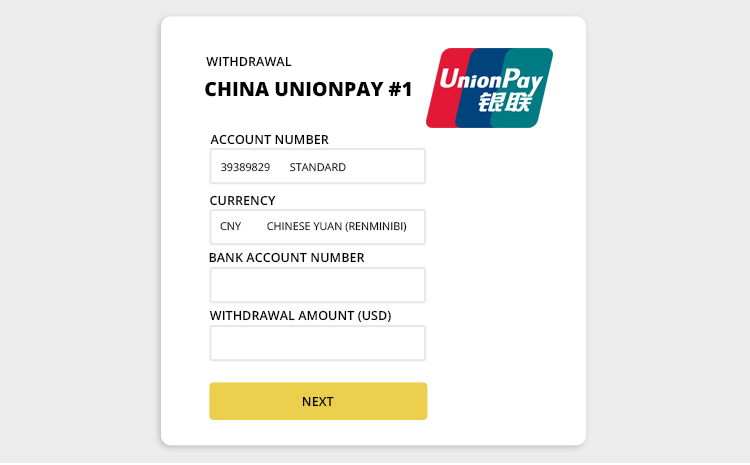

4.Enter your Exness account number, currency, and dollar withdrawal amount。Then, click Next。

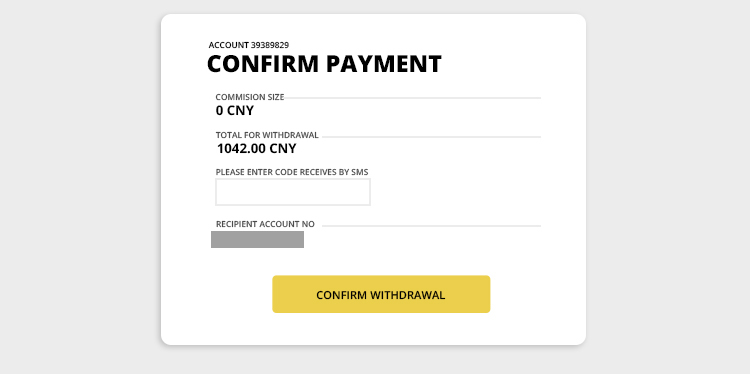

5.Check the details of your withdrawal request and enter the code received via SMS。Click "Confirm Payment"。

6.Enter the credentials of the target account, such as bank name and account name, then complete the transaction and your funds will be transferred out as soon as possible。

Conclusion

It is very simple to deposit or withdraw money from Exness。The process is relatively fast, especially if you use instant deposits and withdrawals。You can choose from many different payment methods, from local bank transfer to e-wallet。

In order to have unrestricted access to the full service, the account must be fully verified and you will have 30 days to complete the verification process, so be sure to check the personal area for full instructions。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.