How to deposit and withdraw money at FreshForex?

FreshForex provides customers with a variety of deposit and withdrawal methods to make account fund management more convenient。

Any trader needs a reliable deposit and withdrawal broker。Before trading, you need to top up your account; after making enough profit, you want to withdraw money from your account。Therefore, an effective management of account funds is essential for traders。

FreshForex is one of the brokers in the market that provides customers with seamless deposit and withdrawal options. The company guarantees that all customers must be able to deposit safely and easily within a short waiting time。

FreshForex offers more than 20 deposit and withdrawal methods。These include:

Bank card (Visa / MasterCard)

Neteller

Skrill

WebMoney

FasaPay

ADVCash

Perfect Money

Transfer Kilat

Quick payment

Cryptocurrency

Online banking services for dealers in Malaysia, Philippines, Indonesia, Vietnam, Thailand and Nigeria

Local depositors in Africa, Asia and Latin America

FreshForex offers a variety of options, you can freely choose the most convenient way。Each method has different conditions, please be sure to check the details before making a transaction。

How to deposit in FreshForex?

FreshForex has a low minimum deposit of just $10 / euro。FreshForex is therefore an extremely attractive option for traders who want to start small and gradually increase their account balances。

Open the FreshForex official website and log in to your secure client area。Then click on the "Deposit" button。

Choose your preferred deposit method and specify the remaining details such as deposit amount, deposit currency, etc.。Press "Deposit" to proceed to the next step。

The system will automatically take you to the payment provider page, you just need to confirm the payment according to the prompt on the screen。Please note that if you are making a deposit for the first time and choose to deposit by credit card, FreshForex will ask you to verify your credit card first。

You will be referred back to the FreshForex deposit page。After successful trading, the funds will be reflected in your trading account。

You can view deposit details under "Transaction History" in the client area。

It is worth noting that there is no charge for deposit in FreshForex。However, the payment provider or the corresponding bank may charge a fee。

How to withdraw money at FreshForex?

FreshForex minimum withdrawal amount is 5 USD / EUR。

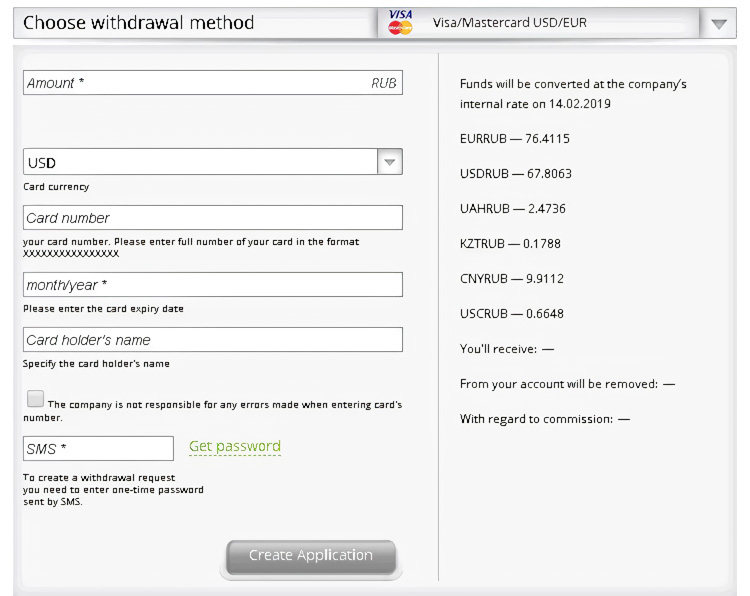

Go to your Security Agent and select the "Withdrawals" tab。You need to determine the withdrawal method。Remember that you can only use the same withdrawal method and the same deposit bank account。

Click the "Get Password" button next to the SMS bar and the confirmation password will be sent to your phone。Then, enter the password and click "Create Request"。

Next, you will see a message appear on the screen confirming that your application has been created。After some time, the funds will be deducted from your FreshForex account and returned to your bank account。

FreshForex will send you an email notification after processing your withdrawal request。

Please note that the withdrawal process may take some time (usually up to several working days)。Instant withdrawals will be processed in 10 minutes, but some payment methods (such as bank transfers) may take longer。You can track the progress of your application in the client area。After the transaction is successful, the status will change to "Completed"。

Withdrawal applications can be cancelled as long as they have not been processed。Just click "Cancel" next to the application you want to cancel in your account "Transactions with Account" > "Withdrawal" > "The List of Applications for withdrawals" form。

FreshForex is a Forex and CFD broker offering a wide range of trading products including stocks, cryptocurrencies, Forex and commodities。As a global company, FreshForex has more than 10,000 traders from 153 countries since its inception in 2008 and is registered with the Saint Vincent and the Grenadines Financial Services Authority (FSA).。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.