Diversify your trading with eToro's smart portfolio

In this article, we summarize everything you need to know about eToro Smart Portfolios, including how to access them, how to choose the right portfolio, and the pros and cons.

Building a diversified long-term portfolio is no easy task. It requires a lot of research and consideration of whether the assets can balance each other out and generate higher returns in the future. To make things easier, eToro offers a very useful feature called Smart Portfolios.

eToro's Smart Portfolios is a new investment product that allows traders to diversify their portfolio in the simplest way possible. Let's learn more about this exciting feature in this article.

eToro's smart portfolio - a new theme investment introduction.

Formerly known as CopyPortfolio, eToro's Smart Portfolios are long-term portfolios curated by eToro analysts, experts and partners.Each portfolio has a unique strategy and consists of a variety of assets under a specific theme.

This form of investment is often referred to as thematic investing.It is generally similar to sector investing, but has a broader scope. Essentially, thematic investing aims to identify macro trends that are expected to evolve over time.

While these assets have a common theme, they actually span diverse sub-sectors, regions and even asset classes. For example, a smart portfolio in the European Economy eToro might consist of stocks of leading companies in various industries across the continent, such as banks, automobiles, pharmaceuticals, luxury goods, and so on.

Unlike other investment programs that focus on "past winners", thematic investments look to a future world that may be different from the past. As such, assets must be thoroughly researched and considered in terms of balance, exposure, expected returns and risk levels.

eToro's thematic investments

To ensure success, eToro's team of analysts keeps a close eye on the most popular trends, which are expected to have a significant impact in the future.

At the time of writing, more than 70 portfolios are available. With eToro's smart portfolios, it's easy to diversify your holdings without paying huge management fees.

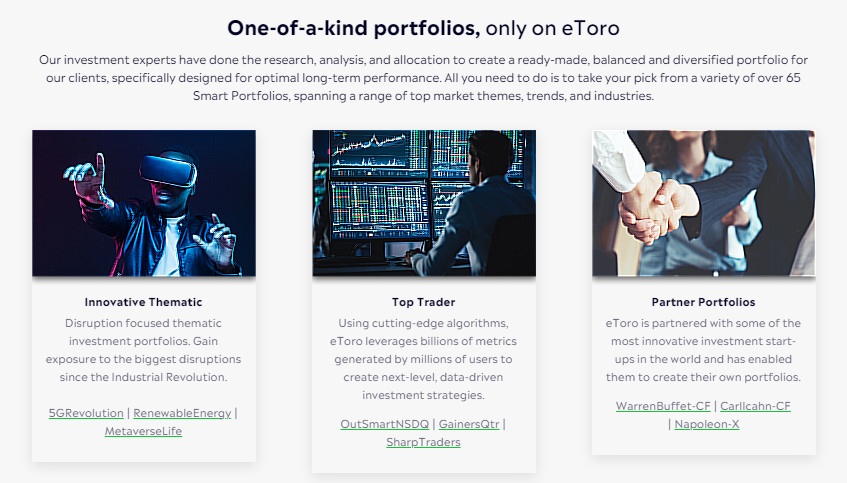

Types of eToro portfolios

At eToro, you can choose from three types of portfolios, namely:

🔝 Top Trading Portfolios

These portfolios are curated by the best performing traders based on their predefined strategies.Currently, there are three top trader portfolios available on the platform, such as ActiveTraders, SharpTraders and GainersQtr.

🌈 Thematic

As the name suggests, thematic portfolios focus on specific themes, sectors, regions or trends. Themes themselves range from traditional industries to advanced technologies.One example is InTheGame, which consists of a variety of top gaming companies and corporations from around the world, providing diversified investment opportunities in the gaming industry.

👨👩👦👦 Partners

The portfolios have been developed in collaboration with some of the most innovative partners, fund managers and experts in various fields, including artificial intelligence, cryptocurrencies, sentiment analysis and more.

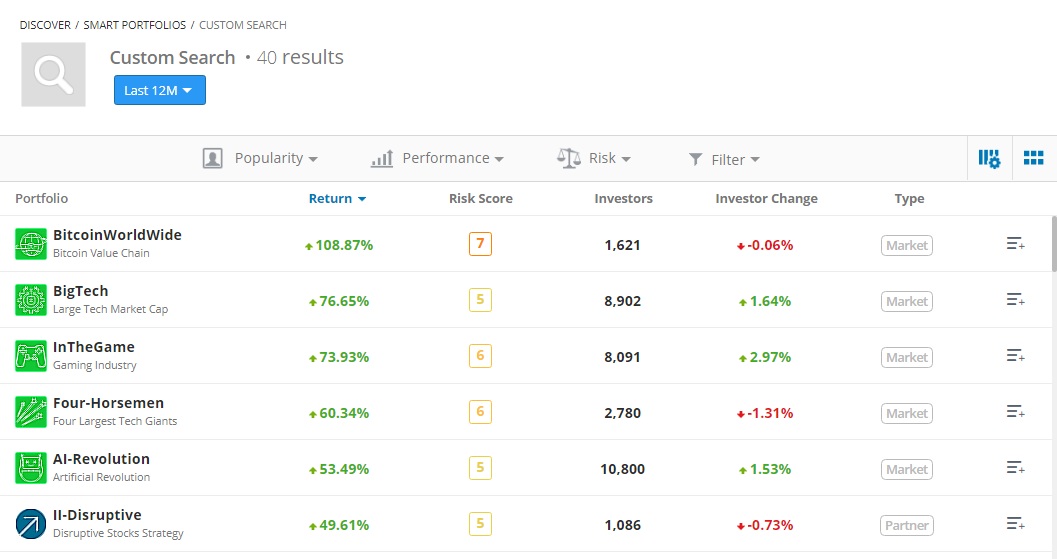

In addition to portfolio types, eToro brokers also allow you to filter options based on other parameters such as popularity, performance, risk score and time. This will obviously help you to narrow down the options and find the ones that best meet your investment goals.

How to Invest in eToro's Smart Portfolio

Investing in eToro's Smart Portfolios is actually quite simple and can be done in just a few clicks. Just follow the tutorial below:

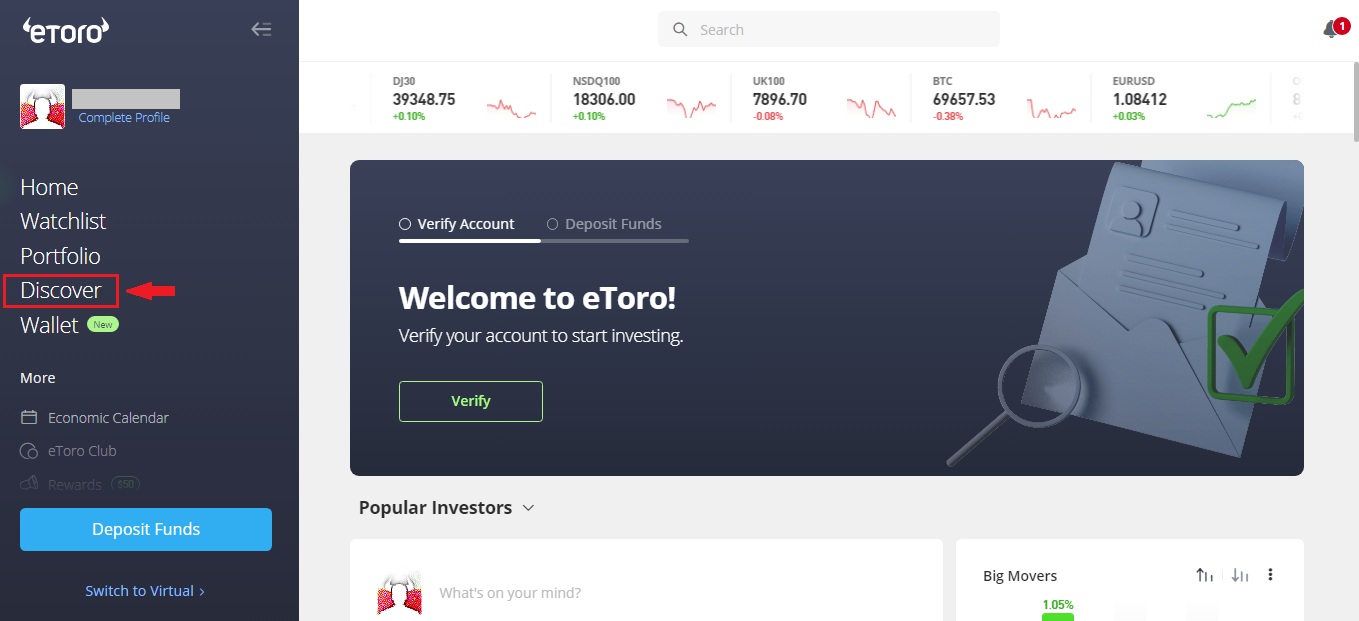

1. Open the official eToro website and login to your account.

2. Click on "Discover" in the menu on the left side of the dashboard.

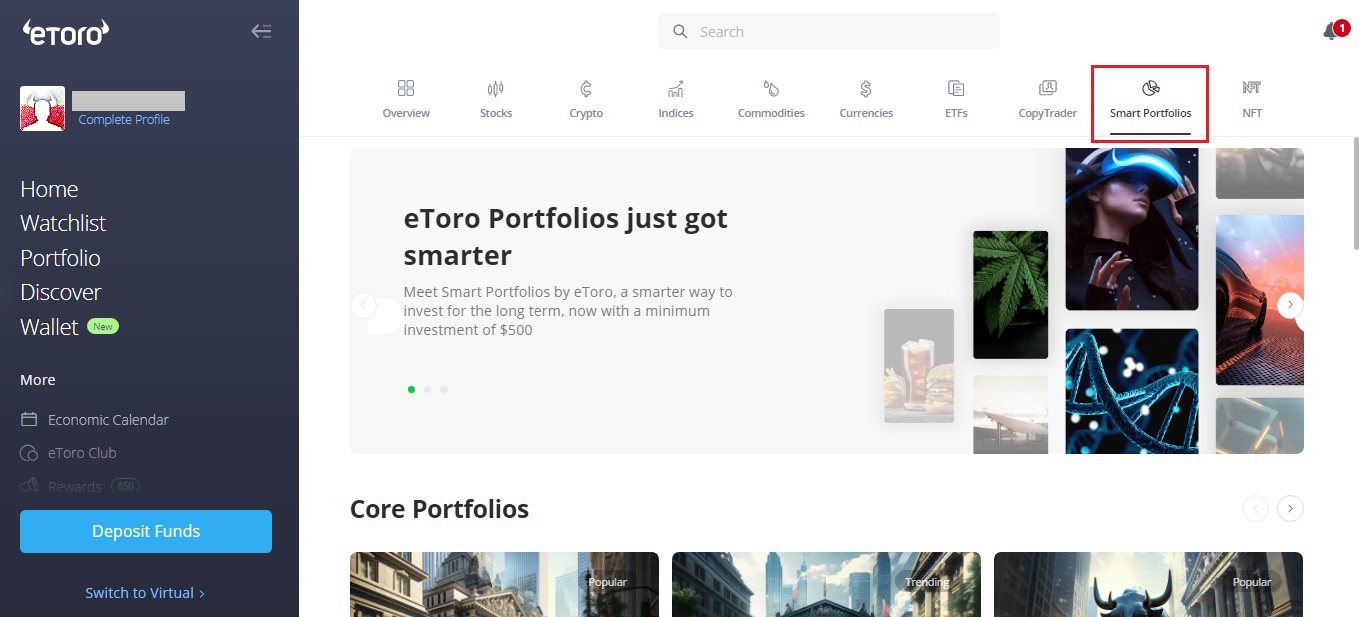

3. Select Smart Portfolios to go to the eToro Smart Portfolios page and view the various types of investments available.

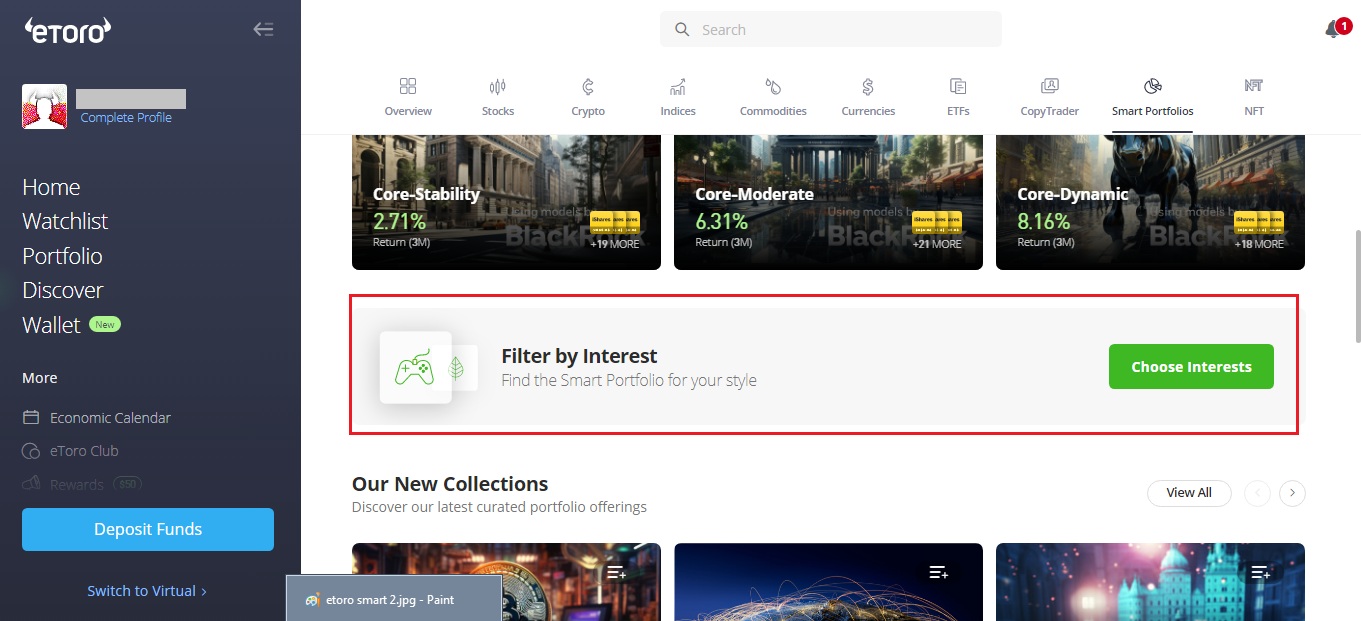

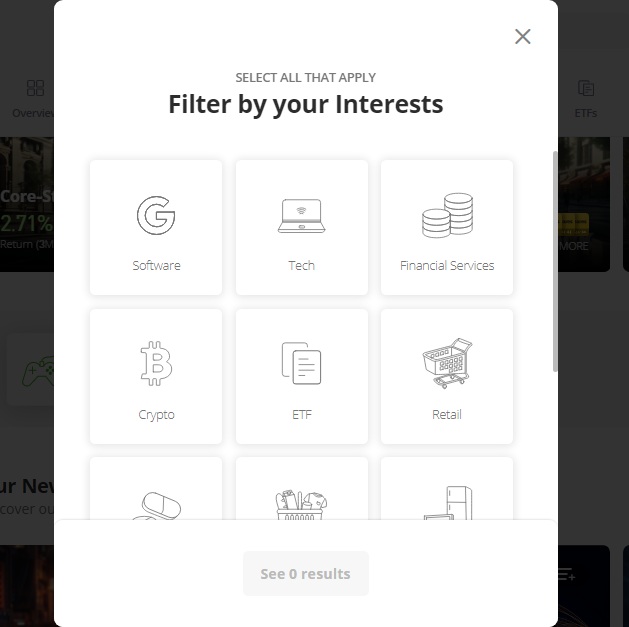

4. At the bottom of the official website page you will find the filtering function.You can narrow down the options according to your interests.

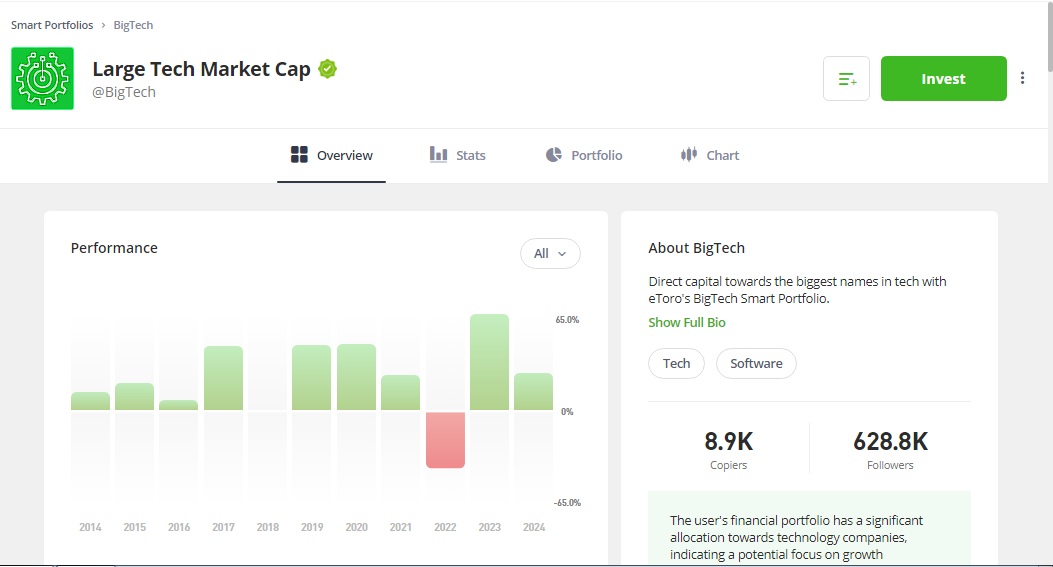

5. Select the portfolio in which you wish to invest.

6. You will be taken to the eToro Portfolio page where you can see more details of the offer.When you are ready to make an investment, click the green "Invest" button.

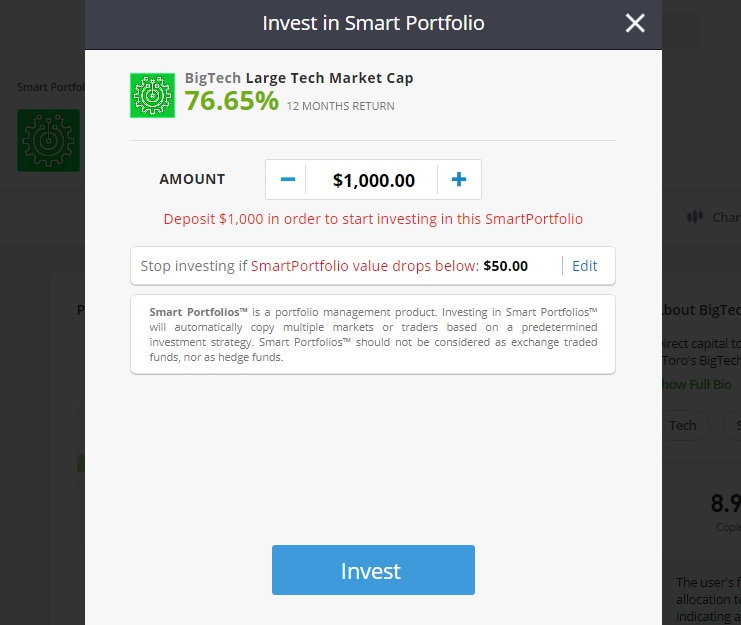

7. eToro requires a minimum investment of $500.Then, set the stop loss figure and click "Invest" to complete the process.

8. Your active portfolios will be displayed on the Portfolio page, which you can access from the Dashboard.Here you can easily manage all your portfolios and even view the trading history.

How to Choose the Right Portfolio

To ensure you get the most out of eToro, you need to pick your investments carefully.There are lists of portfolios in various categories, which you need to understand well enough to pick the most suitable ones.

How can you ensure a successful investment if you don't know how the products in your portfolio work? Therefore, in this case, the first thing you need to do is to select the subject category based on your interest.

Next, take a closer look at the portfolio.On the details page, you'll see the portfolio's past performance, risk score, and number of replicators and followers. Make sure these numbers match your investment goals and risk tolerance.Remember, a good portfolio is the only thing that will give you peace of mind.

Another suggestion is to manage your stop loss effectively.If you don't know how the stop loss works, then once it reaches a certain point, it will close your investment and return the remaining funds to your account.We recommend not setting the number too high as this may trigger the stop loss early.Instead, calculate your risk tolerance and use market analysis to find the right number.

Advantages and Disadvantages of eToro Smart Portfolio

eToro's Smart Portfolio is an innovative product that you probably won't find anywhere else. Here are the pros and cons you should consider.

| ✔ ️ Experts | Disadvantages |

| eToro's Smart Portfolios are curated and monitored by a group of experts and analysts, providing a degree of professional oversight and advanced strategies. | eToro's Smart Portfolio doesn't have a lot of customization options, which can be a drawback for traders who prefer specialized strategies. There is no option to modify long-term or short-term trades, and asset allocation is not adjustable. Success depends entirely on a trader's ability to choose which eToro Smart Portfolio will deliver the best overall return. Once they have chosen a portfolio, the investment follows the performance of the portfolio in the market without any opportunity to adjust the strategy. |

| Allows you to diversify across a wide range of assets, thereby reducing overall risk. | Investing in eToro's Smart Portfolios means that you have less control over your portfolio, as you can only rely on the decisions made by a team of analysts. |

| Saves time by eliminating the need to conduct your own research. | eToro's Smart Portfolios are not without risk.Human or algorithmic error may affect the performance of a portfolio. |

| eToro's Smart Portfolio is highly flexible and easy to manage. You can enter or close your holdings at any time, allowing you to smoothly switch between products as needed. | Some portfolios are not available in certain countries, so you need to check availability before investing. |

| The barrier to entry is relatively low.You can invest as little as $500. | |

| No management fees. |

Finally

eToro's Smart Portfolios are a unique combination of automated investing and professional management that makes it easy for investors to let go of their investments.To minimize risk, a team of analysts adjusts the balance every so often by reassessing market conditions and managing positions.

Of course, as with any other investment, there is never a guarantee of long-term profitability.Therefore, diversification is always important. Take your time to build your long-term portfolio based on your investment objectives and risk tolerance.

Frequently Asked Questions about eToro Smart Portfolio

1. Why Diversification Is So Important for Investors?

Financial markets are very unpredictable, so there is always the possibility of large price fluctuations that could ruin your carefully planned strategy.To avoid this risk, it is highly recommended not to put your eggs in one basket.

Instead, diversify your risk and increase your returns by investing in different sectors, asset classes and regions.This is what diversification is all about and how it allows you to avoid excessive losses.

2. What is the best way to diversify your investments?

The purpose of diversification is to find balance in your investments.You need to spread your wealth across different sectors that are more likely to move in opposite directions.

Therefore, when one of the sectors is losing money, you can rely on the other sectors to bring you profits.This is why you should always keep an eye on market updates and news.By doing so, you will be able to know if it is the right time to cut your losses and take the next step in investing.

3. Whether eToro's smart portfolio is actively or passively managed?

According to eToro, it uses Dynamic Asset Allocation, which is a mix of active and passive methods. eToro's smart portfolios are not monitored daily, but experts regularly balance them to adapt to market conditions.

This can mean closing existing positions or opening new ones to maintain the strategy. The rebalancing cycle varies for each portfolio, so it is optimized for each investment.

4. How to Profit from eToro Smart Portfolio?

The only way to enjoy the profits you have made is to close the eToro Smart Portfolio. You can do this by opening the eToro Smart Portfolio page, selecting "Close Investment" and then clicking "Stop Investment".This will close all your positions in the eToro Smart Portfolio and the funds will be transferred to your account balance.

5. Does eToro offer additional investment and strategy features?

In addition to eToro's Smart Portfolios, you might also want to try eToro's CopyTrader feature, which allows you to copy other traders' strategies.In fact, it's one of the most popular features on the eToro platform.

eToro also offers TipRanks, which reveals a wealth of valuable market information for stock traders.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.