How to research the market with eToro's TipRanks?

eToro's TipRanks brings a suite of market insight tools to complement your analysis as you trade stocks, with features including insider trading and hedge fund activity。

TipRanks:

- Analyst consensus and target price: a summary of the recommendations of professional analysts around the world, whether analysts recommend buying, selling or holding a stock.。Target Price Provides an estimated price range for the stock based on analysts' assessments and forecasts。

- Analyst Ratings: Provides a breakdown of an analyst's personal rating of a particular stock, such as "buy," "hold," or "sell."。Understanding these ratings helps measure market sentiment and underlying stock performance。

- Hedge fund activity: tracking hedge fund actions on a stock, including information on hedge fund buying or selling activity。Monitoring movements of hedge funds can provide valuable information for understanding market trends。

- Internal transactions: revealing actions taken by company insiders (such as executives, directors or major shareholders), including the purchase or sale of company stock。Analyzing insider trading helps assess a stock's health and potential。

TipRanks use case

Let me explain how eToro's TipRanks is used on the platform。

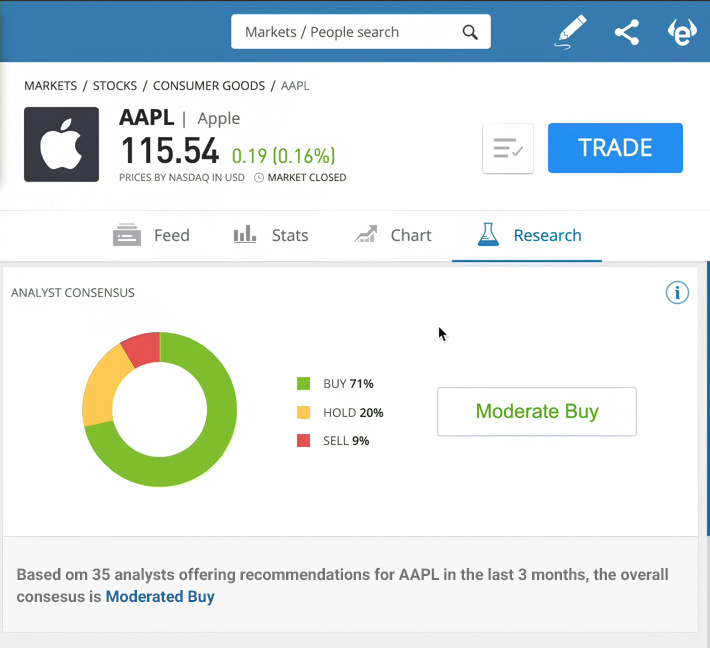

First, you must identify the stocks you want to analyze。For example, select Apple Stock (AAPL), click Apple Stock, and then navigate to the "Research" tab of the right menu。

At the top of the Research tab you will find "Analyst Consensus and Target Price"。

Analyst Consensus and Target Price

Over the past three months, 35 analysts have unanimously said "moderate buy," with 71% recommending "buy," 20% recommending "hold," and 9% recommending "sell."。This data can be used as a general indicator of whether other analysts expect Apple's stock price to rise or fall.。

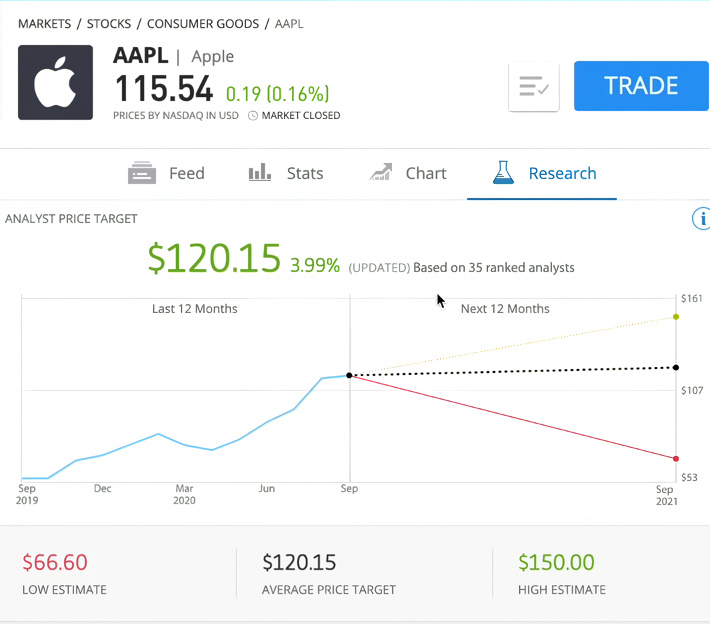

Scroll down to see analyst price targets on the eToro platform。In this case, most analysts predict Apple's stock price will reach 120.15美元。

In addition, you will see a maximum valuation of $150 and a minimum valuation of 66.60美元。Further down you will see the analyst's rating。

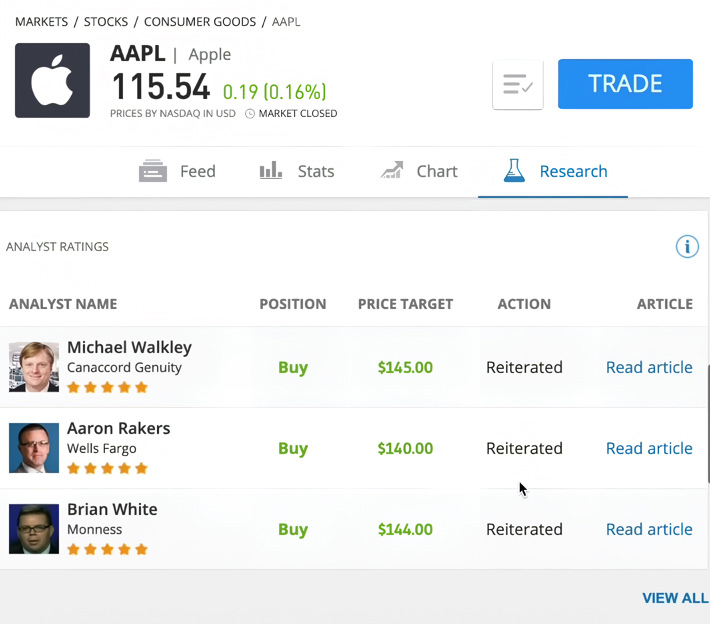

Analyst Ratings

In this table, the ratings of 3 bank or financial institution analysts and their recommendations and articles further support the investment in AAPL。eToro's TipRanks assigned a star rating to each analyst to determine their credibility.。

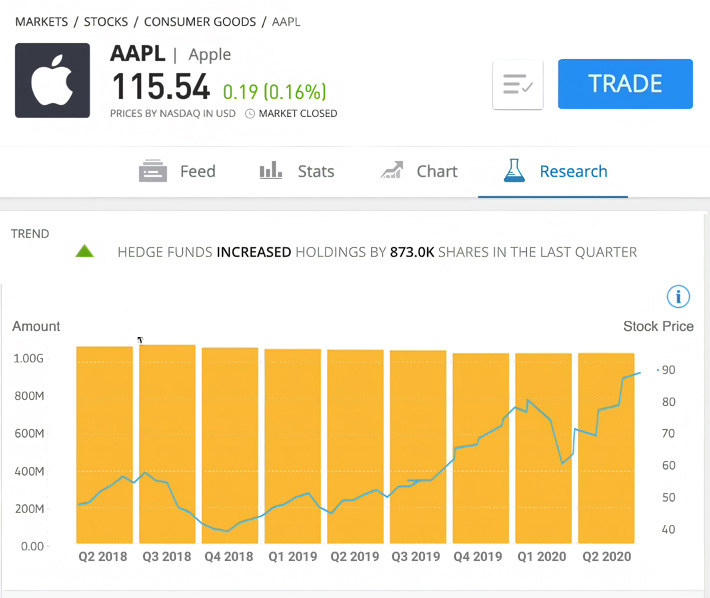

Hedge Fund Activities

The eToro platform shows prominent hedge fund firms such as Berkshire Hathaway and Goldman Sachs buying Apple shares。

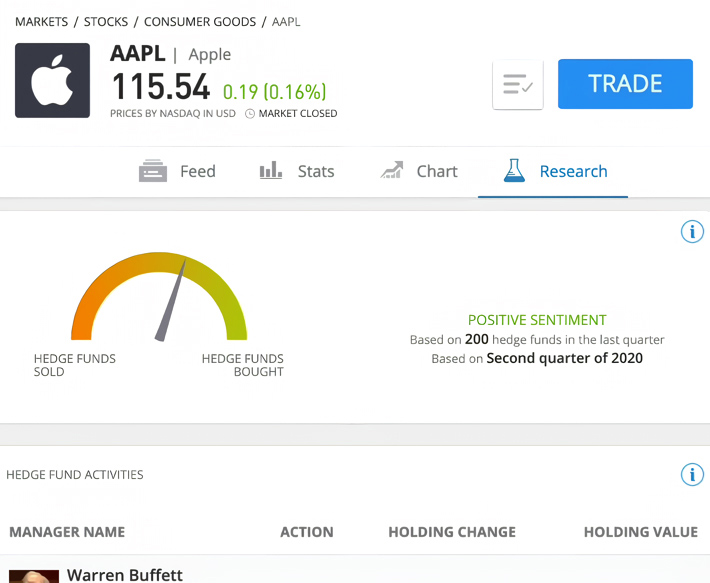

As you can see from the above display, hedge funds have been buying Apple shares since the second quarter of 2018。Further down is hedge fund sentiment, suggesting that Apple stock received a positive view from 200 hedge funds in the second quarter of 2020。

eToro's TipRanks show that the value of Apple stock held by Warren Buffett remained unchanged at about $89 billion in the second quarter.。You'll also notice that Fisher Asset Management's Ken Fisher's holdings of Apple stock increased by 2%。Meanwhile, Apple shares held by PRIMECAP management firm Theofanis fell 2%。

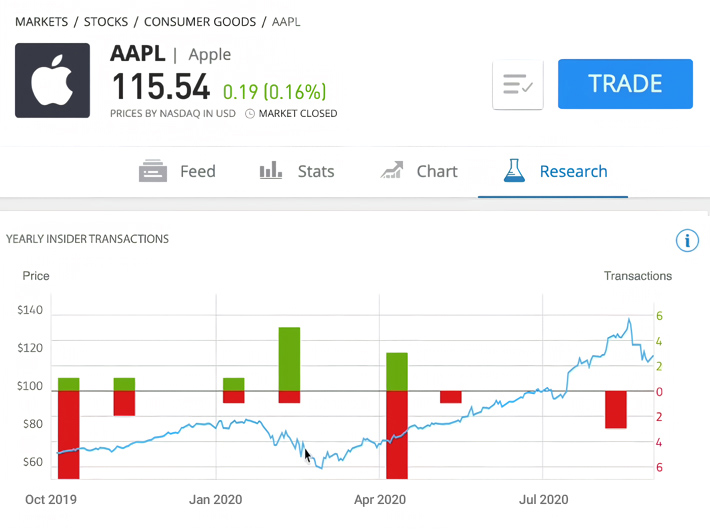

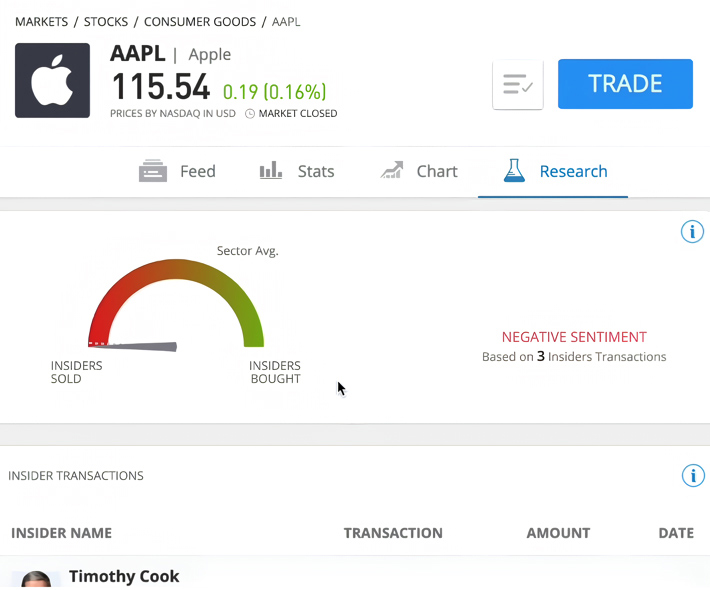

Internal transactions

eToro's TipRanks can also show insider trading, i.e. stock trading by Apple employees。

eToro's TipRanks shows that in March 2020, many Apple employees bought shares because they felt the stock price was too low。This information provides more information for understanding potential stock price movements.。

Apple CEO and Director Timothy Cook sold shares twice on August 25, 2020, for a total of 1.$484.3 billion and 1.$317.6 billion。

结论

Judging from the above data provided by eToro's TipRanks, Apple stock is clearly attractive to buy。Leading analysts have set a price target of $150 per share, as evidenced by the activity of hedge funds to increase their holdings of Apple shares in recent months.。

As the reasons for Tim Cook's sale of shares remain to be clarified, the negative sentiment of insiders is not so important。

Advantages and Disadvantages of eToro TipRanks

Here are some of the pros and cons to consider when analyzing U.S. stocks using eToro's TipRanks:

| Advantages | Disadvantages |

| ✔ ️ Aggregate data: eToro's TipRanks gathers information from different sources, including analysts, blogs and market research firms, to more fully reflect market sentiment towards specific stocks。✔ ️ Analyst Ratings: eToro's TipRanks ranks analysts based on accuracy and forecast performance, helping investors gauge their confidence in specific analyst recommendations。✔ ️ Forecasting function: eToro's TipRanks allows investors to view future stock price forecasts based on historical analysis and current market trends。 | Relying on historical data: eToro's TipRanks, like many other stock analysis tools, relies heavily on historical data。While it can provide insight into future performance, it can sometimes be inaccurate。It may ignore unexpected market events or trends。Complexity: eToro's TipRanks can be complex and challenging for beginner investors。Learning to effectively use all its capabilities and data takes time and effort。 |

FAQ

What is TipRanks??

TipRanks is a comprehensive research tool designed for investment traders to help them make more informed decisions based on data. It integrates news, stock market research ratings and analyst forecasts into actionable insights.。

How many people use TipRanks??

In terms of its user base, TipRanks has an impressive reach, with over 4 million monthly users currently using its service.。In addition, its influence is not limited to individual traders, but also includes many financial institutions, including eToro, Nasdaq, E * TRADE, TD Ameritrade and Santander。

This widespread adoption underscores the platform's credibility and utility within the financial industry。

Is eToro's TipRanks trustworthy??

Traders often face trust issues when utilizing third-party tools for market analysis。However, TipRanks has earned significant praise and trust from its user base.。Received "excellent" reviews on Trustpilot, TipRanks scored an impressive 4 out of 1416 reviews.7 out of 5。

This positive feedback highlights the reliability and effectiveness of the platform in helping traders make decisions。Many traders, including eToro traders, prefer TipRanks to low-price stock promoters because they recognize that TipRanks is committed to providing transparency and data-driven insights rather than engaging in potential predation.。

Other advantages of trading at eToro?

- Social Trading: eToro Broker has a vibrant community of over 30 million users worldwide。Features like CopyTrader enable traders to automatically replicate successful trades by experienced investors, improving their chances of success in the market。

- Personalized Trading: eToro prioritizes personalization, allowing traders to customize their trading dashboards to match their unique strategies and preferences。

- Cross-device experience: eToro ensures a seamless trading experience across all devices, enabling traders to stay connected and responsive to market developments。

- Low fees: eToro stands out for its low cost, enabling a wider audience to trade。With low trading and forex fees, as well as free stock and ETF trading, traders can optimize their investment returns。

- Low minimum deposit: Start trading with a low initial deposit of just $200。

- Fast account opening: eToro simplifies the fast and hassle-free account opening process, ensuring that traders can quickly take advantage of market opportunities。

Tools to use with TipRanks

- Stock screening tool: eToro's stock scanner allows users to screen stocks based on various criteria, helping to identify market movers。

- Advanced Charts: Take advantage of eToro's TradingView-powered advanced charts with a user-friendly interface, interactive charting tools, customizable templates, and dark mode to reduce eye strain。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.