Doji Candle - What Is And How To Trade

Learn all about the Doji candlestick pattern.What is, how to trade this handle, and all the best trading strategies.

The Doji candlestick pattern is a crucial tool in technical analysis, reflecting market indecision and uncertainty. This article will provide a detailed overview of the Doji candlestick pattern, including its definition, identification methods, variants, and trading strategies to help investors make informed trading decisions.

Definition of the Doji Candlestick

The Doji is a Japanese candlestick pattern that signifies market indecision. When a Doji candlestick appears, the price typically lacks a clear direction. Therefore, investors should avoid making immediate trades upon seeing a Doji and wait for clearer price action signals.

Features of the Doji Candlestick

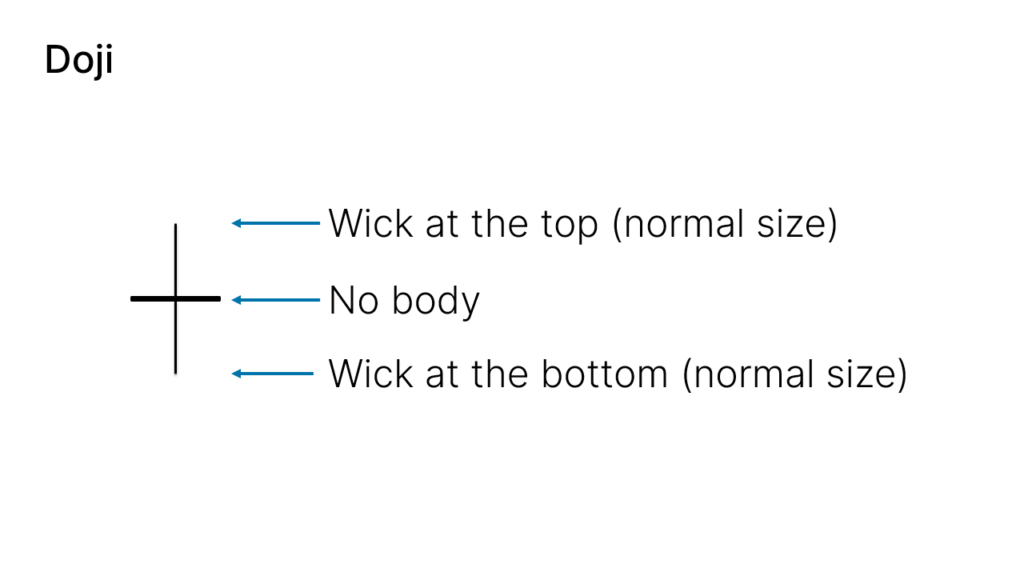

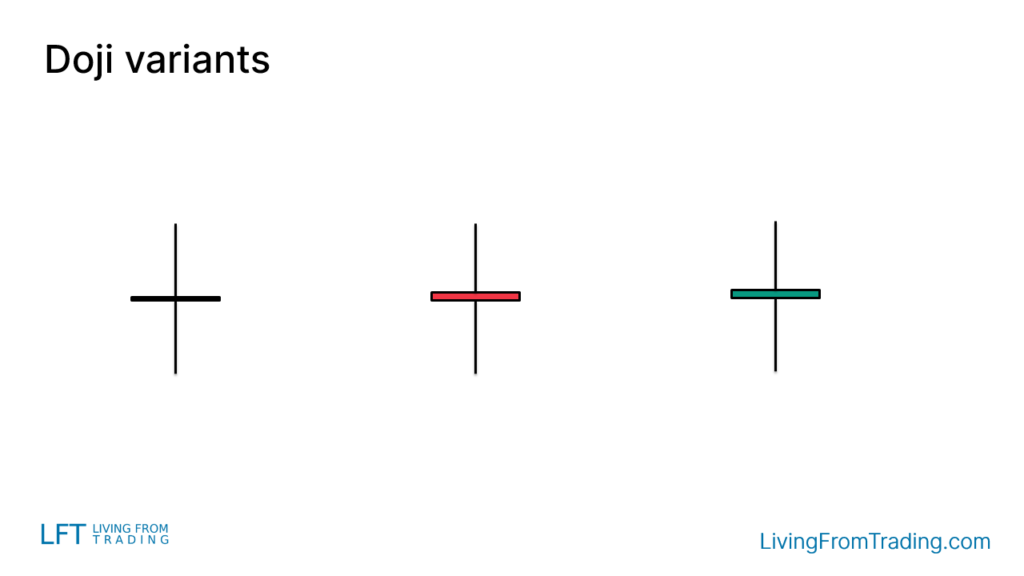

- Virtually No Body: The Doji candlestick has a very small body, sometimes even none at all.

- Short Wicks: Although the wicks are present, they are generally shorter compared to the body.

- Chart Example:

How to Identify the Doji Candlestick

To identify the Doji candlestick pattern, consider the following:

- Tiny or No Body: The body of the candlestick is very small or nonexistent.

- Short Wicks: The wicks are present but shorter compared to the body.

- Distinguishing from Similar Patterns:

- High Wave Candlestick: High Wave candlesticks have very long wicks.

- Spinning Top Candlestick: Spinning Top candlesticks have wicks of intermediate length, between the Doji and High Wave.

Trading Strategies for the Doji Candlestick

Since the Doji candlestick represents market indecision, investors should avoid making immediate trading decisions and wait for additional market signals. Here are some strategies for trading the Doji:

- Stay on the Sidelines: Avoid making trading decisions immediately after a Doji appears. Wait for further market information.

- Wait for Confirmation: Look for subsequent candlestick patterns or other technical indicators to confirm the market's true direction.

- Combine with Technical Indicators: Once the market direction becomes clearer, combine the Doji candlestick with other technical indicators (such as moving averages, RSI) to form a trading strategy.

Summary

The Doji candlestick is a single-candle pattern that reflects market uncertainty. When encountering a Doji, investors should refrain from immediate trading decisions and instead wait for additional signals to clarify the market direction. By combining the Doji pattern with other candlestick patterns and technical indicators, investors can enhance the accuracy and effectiveness of their trading decisions.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.