What is the difference between EBIT and EBITDA?What is the connection with net profit?

EBIT (EBIT) and EBITDA (EBITDA) are metrics that assess the performance and profitability of a company's core business.

EBIT refers to earnings before interest and taxation, while EBITDA refers to earnings before interest, taxation, depreciation and amortization.

This article will introduce the definition and calculation formula of EBIT and EBITDA, as well as the considerations when using these two indicators to evaluate the profitability of enterprises.

What is EBIT?

EBIT (Earnings Before Interest And Taxation) is profit before interest and taxes, referred to as "EBIT"

A company earns operating income (Revenue) from its main business (products or services), less expenses such as operating costs (COGS), sales and marketing expenses, to arrive at operating profit.

After that, the company pays this operating profit to creditors, such as bank loan interest and other financial expenses;

Generally, the company's net profit published in the news or on the website is net of loan interest and taxes。However, since each company has the same level of debt and the amount of tax it is required to pay, it is also necessary to observe and assess the profitability of the company's main business by focusing on EBIT.

EBIT Formula

EBIT is the sum of "net profit," "interest" and "tax."。Specifically, it is the result of subtracting "operating costs" and "operating expenses" from "operating income" and adding "non-operating income (expenses)."

What is EBITDA?

EBITDA (Earnings Before Interest, Taxation, Depreciation and Amortisation) is earnings before interest, taxes, depreciation and amortization, or "EBITDA"

EBITDA and EBIT are both used to assess the profitability of a company's main business, but the difference between the two is that EBITDA excludes depreciation and amortization expenses in addition to interest and taxes.

Depreciation

Depreciation is the carrying expense incurred by a company to reduce the value of tangible assets (machinery, inventory, plant, etc.)。On the books, this will have a slight impact on earnings, otherwise the impact on earnings will be slightly more pronounced

Amortization (Amortisation)

Amortization and depreciation are much the same, except that they are for intangible assets, including patents, copyrights, etc.

Importantly, depreciation and amortization are only book costs and do not affect the company's cash flow。After all, the amount paid to purchase an asset is already recorded in the cash flow statement at the time.

Because of this, many analysts and fund managers exclude depreciation and amortization as two account costs when evaluating a company's earning power to more accurately measure the company's earnings performance

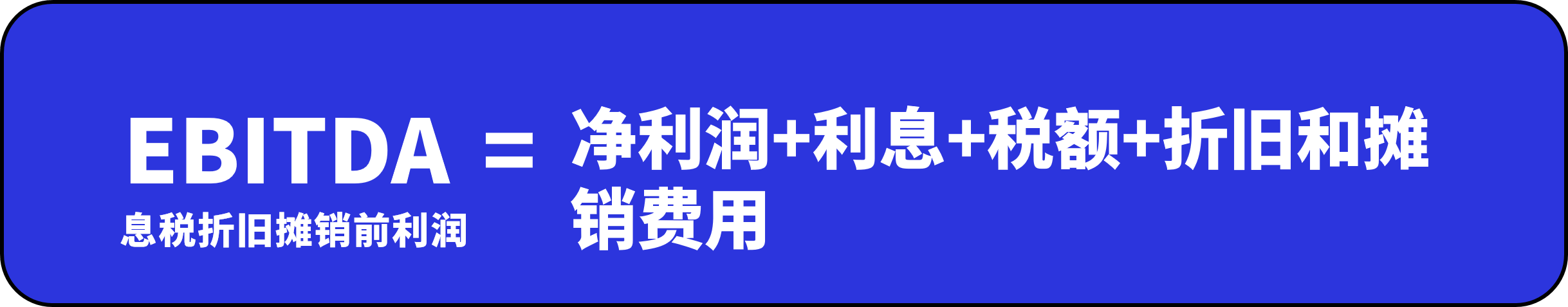

EBITDA Formula

EBITDA is the sum of "net income," "interest," "taxes" and "depreciation and amortization expense" and the sum of "EBIT EBIT" and "depreciation and amortization expense."

Difference between EBIT and EBITDA

The results of EBIT and EBITDA can measure the profitability of the company's use of the main business, and in practice, EBIT and EBITDA apply to different production.

EBIT is suitable for analyzing asset-heavy companies, such as automotive, aerospace, manufacturing companies, etc., because their capital expenditures (CAPEX) and sources of income are closely related to their tangible assets.

In other words, the replacement of assets can shake a company's performance and cash flow, so it's best for investors to take depreciation into account when calculating a company's earning power

EBITDA is suitable for analyzing asset-light companies, such as software development, consulting firms, etc.

Considerations for assessing EBIT and EBITDA

Corporate debt cannot be ignored.

As mentioned earlier, neither EBIT nor EBITDA takes into account the interest on the company's loans, which is equivalent to excluding the company's debt repayment costs.

However, investors must not ignore the level of debt, interest costs, etc. when analyzing a company's fundamentals, after all, EBIT and EBITDA figures are bright, but the high cost of debt repayment will also be detrimental to the company's development prospects.

In summary, EBIT and EBITDA are definitely not the only indicators for evaluating a company, and must be analyzed with data such as net profit and debt levels to get a more comprehensive answer.

Only suitable for inter-industry comparison

EBIT and EBITDA are only suitable for comparing performance between peers, which is valuable because the business models and asset classes used within peers are relatively similar;

SUMMARY

EBIT and EBITDA are both metrics to assess the performance and profitability of a company's core business, and analyzing a company's EBIT and EBITDA data changes over time provides a better insight into whether the company's profitability is changing, whether it is growing or going downhill.

Of course, this does not mean that investors can exclude debt, and companies with higher debt are relatively more financially risky, even in times of economic downturn.。Therefore, investors are advised to refer to different data metrics at the same time in order to more accurately assess the company's performance and make appropriate investment decisions.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.