Spinning Top Candlestick Pattern - What Is And How To Trade

Learn all about the Spinning Top candlestick pattern.What is, how to trade, and all the best trading strategies.

The Spinning Top candlestick pattern is a significant formation in Japanese candlestick charts, primarily characterized by market indecision. This article provides a comprehensive overview of the Spinning Top pattern, including its definition, identification methods, variations, and trading strategies to assist traders in making informed decisions.

Overview of the Spinning Top Candlestick Pattern

The Spinning Top pattern is indicative of market indecision. When this candlestick appears, the market price does not exhibit a clear direction, typically signaling market hesitation. In such cases, traders should avoid making immediate trading decisions and wait for more definitive signals.

Definition of the Spinning Top Candlestick Pattern

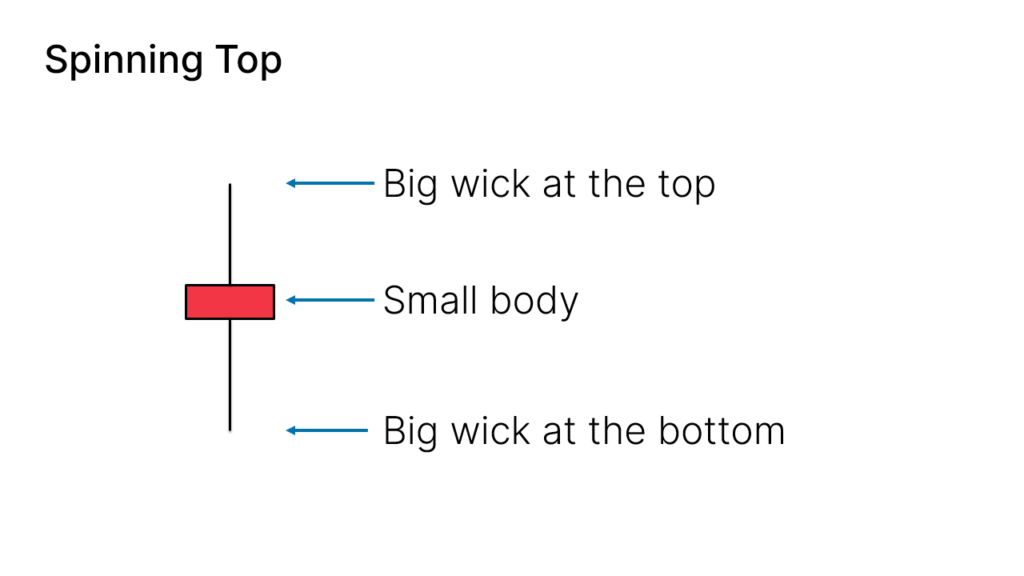

The Spinning Top pattern has the following characteristics:

- Small Body: The candlestick body is relatively small, whether it is green or red.

- Short Wicks: The wicks above and below the body are relatively short.

- Illustrative Example:

The Spinning Top pattern usually does not indicate a clear trend, so traders should exercise caution.

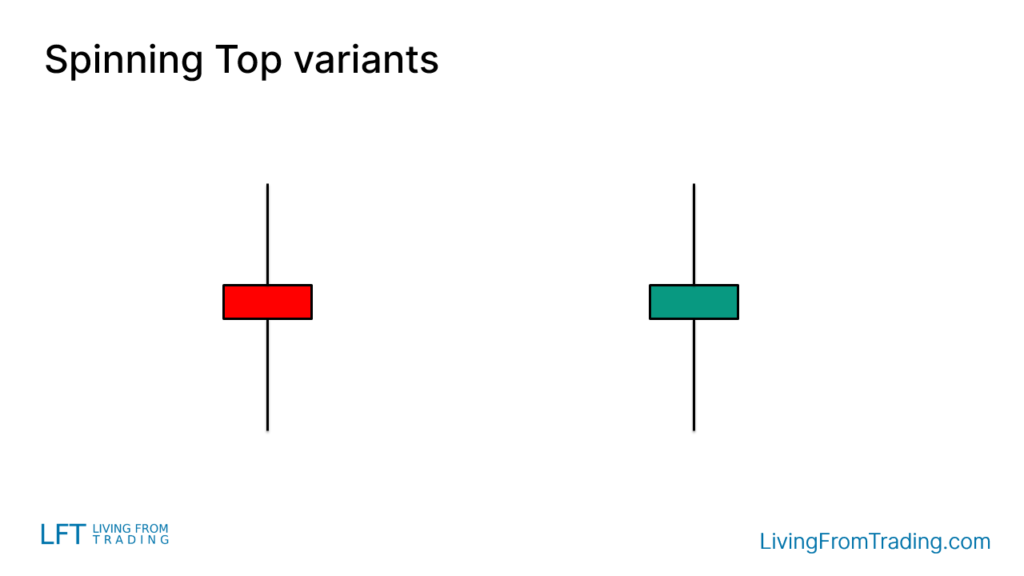

Variations of the Spinning Top Candlestick

The Spinning Top pattern can appear in various forms, mainly differing in body color and wick length:

- Body Color: The body of a Spinning Top can be either green or red, with the key feature being its small size.

- Distinguishing from Other Patterns:

- Doji Candlestick: A Doji features almost no body and very short wicks.

- High Wave Candlestick: High Wave patterns have long wicks with a small or non-existent body.

The wicks of a Spinning Top are intermediate in length compared to Doji and High Wave, and it is important not to confuse it with these other patterns.

Trading Strategies for the Spinning Top Candlestick Pattern

Since the Spinning Top pattern signifies market indecision, it is generally advisable for traders to stay on the sidelines when encountering this pattern. Traders should wait for additional candlestick patterns or technical indicators to confirm market direction.

- Stay on the Sidelines: After observing a Spinning Top pattern, avoid making trades until more conclusive signals appear.

- Combine with Other Patterns: If a bullish or bearish candlestick pattern emerges following a Spinning Top, traders may consider trading in conjunction with technical indicators for more confidence.

- Use Technical Indicators: Employ technical indicators such as moving averages, Relative Strength Index (RSI), etc., to further confirm market trends.

Conclusion

The Spinning Top candlestick pattern, representing market indecision, requires traders to be cautious and avoid hasty trading decisions. By combining this pattern with other candlestick formations and technical indicators, traders can better determine market direction and develop effective trading strategies. Understanding the characteristics and strategies related to the Spinning Top pattern can enhance trading accuracy and effectiveness.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.