Gravestone Doji Candlestick Pattern - What Is And How To Trade

Learn all about the Gravestone Doji candlestick pattern.What is, how to trade, and all the best trading strategies.

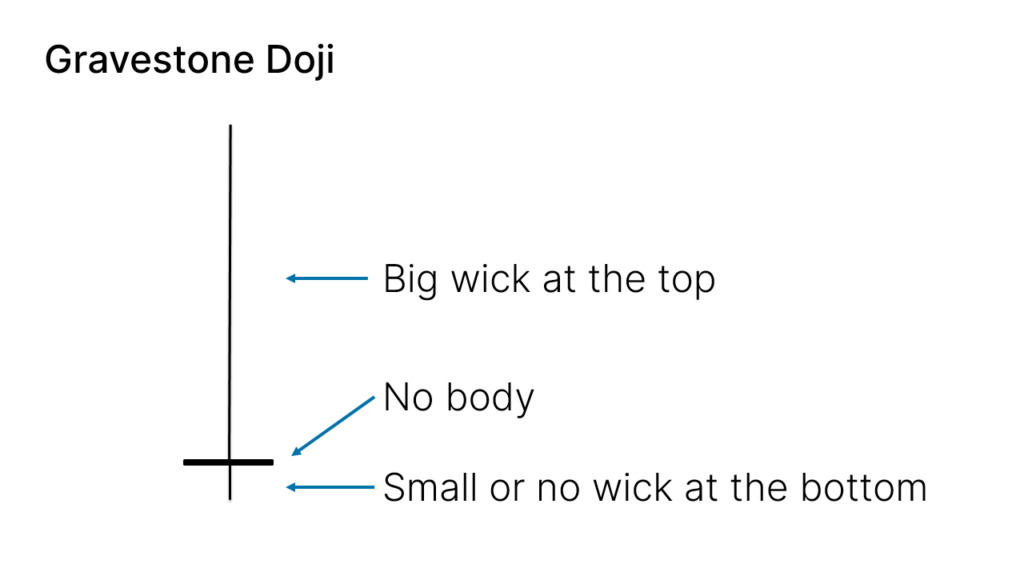

The Gravestone Doji is a Japanese candlestick pattern that typically appears after an uptrend and signifies a potential bearish reversal. This single-candle pattern features a very small body and a long upper shadow, with little to no lower shadow. The Gravestone Doji indicates that the buying pressure has been rejected, suggesting a potential downturn in the market.

Identifying the Gravestone Doji

To identify a Gravestone Doji, look for the following characteristics:

- Small Body: The candlestick body is very small, close to zero.

- Long Upper Shadow: The upper shadow is notably long.

- No or Short Lower Shadow: The lower shadow is minimal or non-existent.

On charts, the Gravestone Doji resembles an inverted cross, signaling that buying momentum has weakened.

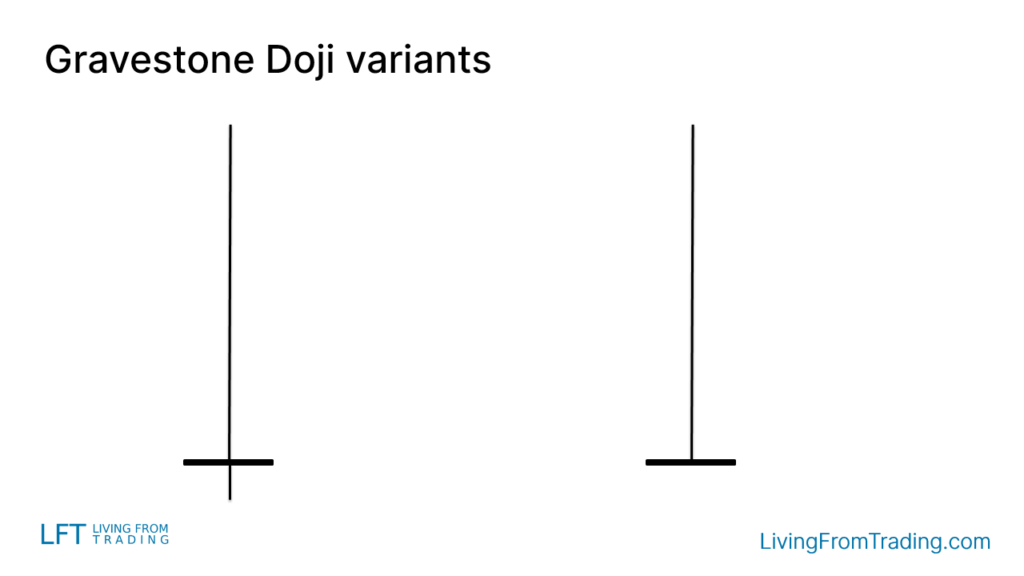

Variants of the Gravestone Doji

The Gravestone Doji may appear in different forms on charts:

-

Standard Gravestone Doji:

- Very small body

- Long upper shadow

- No or very short lower shadow

-

Gravestone Doji with Short Lower Shadow:

- Long upper shadow

- Small body

- Short but visible lower shadow

-

Gravestone Doji with Short Upper Shadow:

- Relatively short upper shadow

- Small body

- Minimal lower shadow

These variants still indicate a potential bearish reversal but may influence the application of trading strategies differently.

Trading Strategies

Trading the Gravestone Doji requires more than just recognizing the pattern; its context and location are crucial. Here are several effective trading strategies:

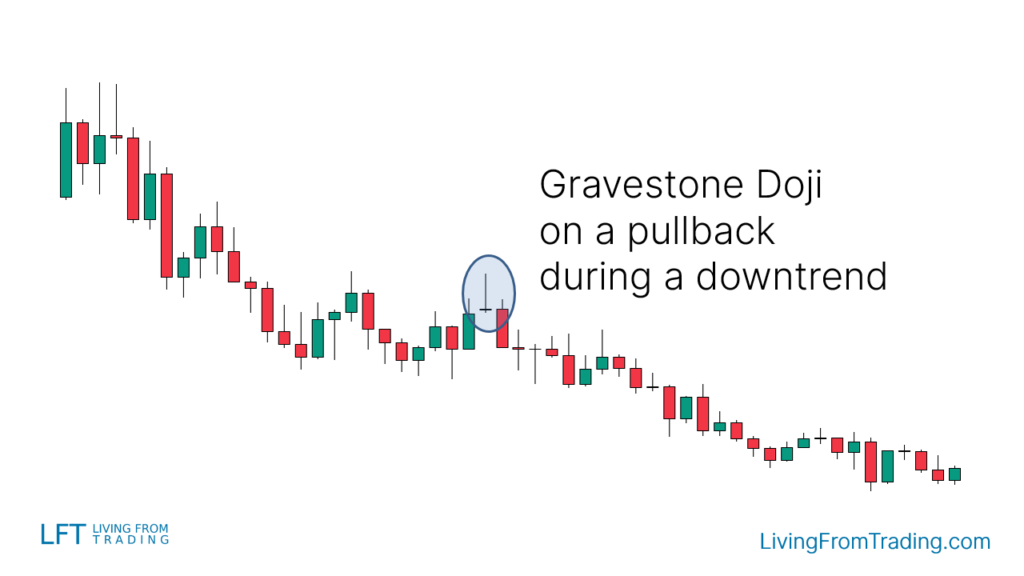

Strategy 1: Pullbacks on Naked Charts

The Gravestone Doji is an effective bearish reversal pattern, especially when the price is in a downtrend.

Steps:

- Identify a downtrend in the market.

- Wait for a price pullback and look for the formation of a Gravestone Doji.

- The appearance of the Gravestone Doji often signals the end of the pullback and the start of a new downtrend.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss and take-profit levels to manage risk.

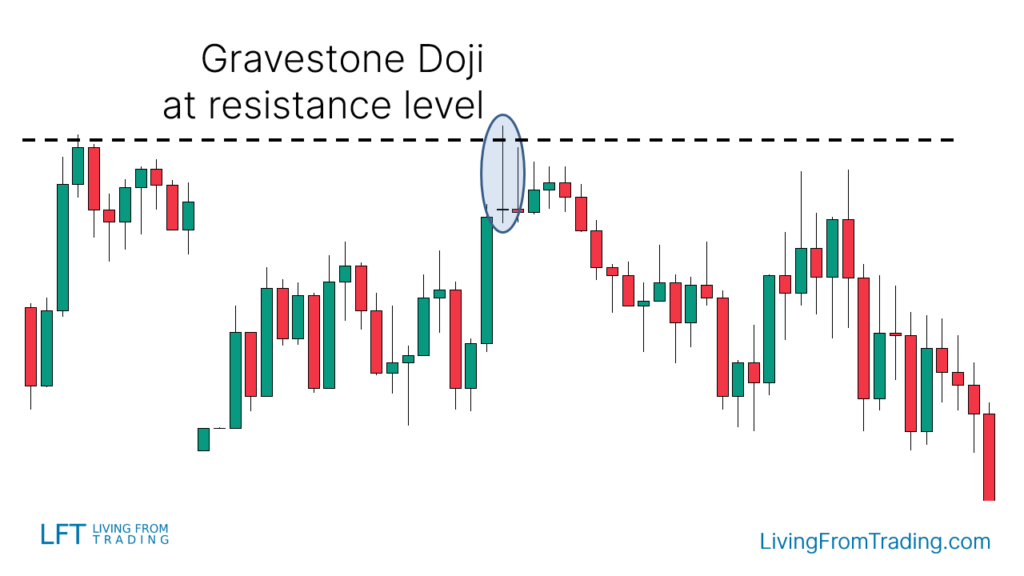

Strategy 2: Trading the Gravestone Doji with Resistance Levels

Resistance levels are key points for price reversals. Trading the Gravestone Doji near resistance levels can be particularly effective.

Steps:

- Draw resistance levels on your chart.

- Wait for the price to rise and test the resistance level.

- Check for the formation of a Gravestone Doji at the resistance level.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss above the resistance level and take-profit at a lower price target.

Strategy 3: Trading the Gravestone Doji with Moving Averages

Moving averages can help identify trends. In a downtrend, look for pullbacks to the moving average where a Gravestone Doji forms.

Steps:

- Identify a downtrend and apply a moving average to your chart.

- Wait for the price to rebound and touch the moving average.

- Observe for a Gravestone Doji at the moving average.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss above the moving average and take-profit at a lower price target.

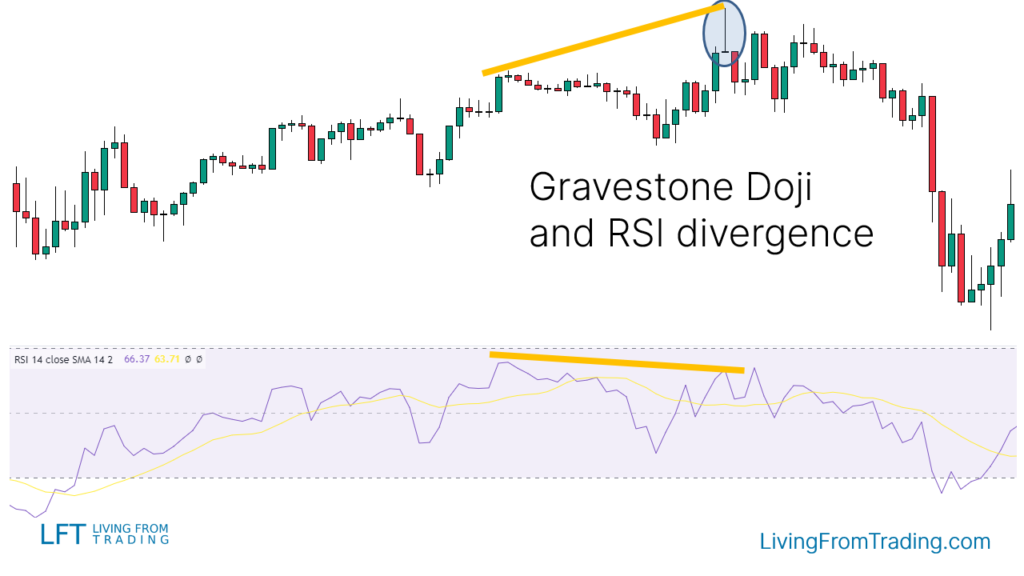

Strategy 4: Trading the Gravestone Doji with RSI Divergences

RSI divergences can signal potential reversals. A bearish RSI divergence occurs when the price makes higher highs while RSI makes lower highs.

Steps:

- Identify an uptrend and mark the highs.

- Compare price highs with RSI highs.

- Look for divergence where the price makes new highs but RSI does not.

- Confirm with a Gravestone Doji at a higher price high aligned with an RSI lower high.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss and take-profit levels accordingly.

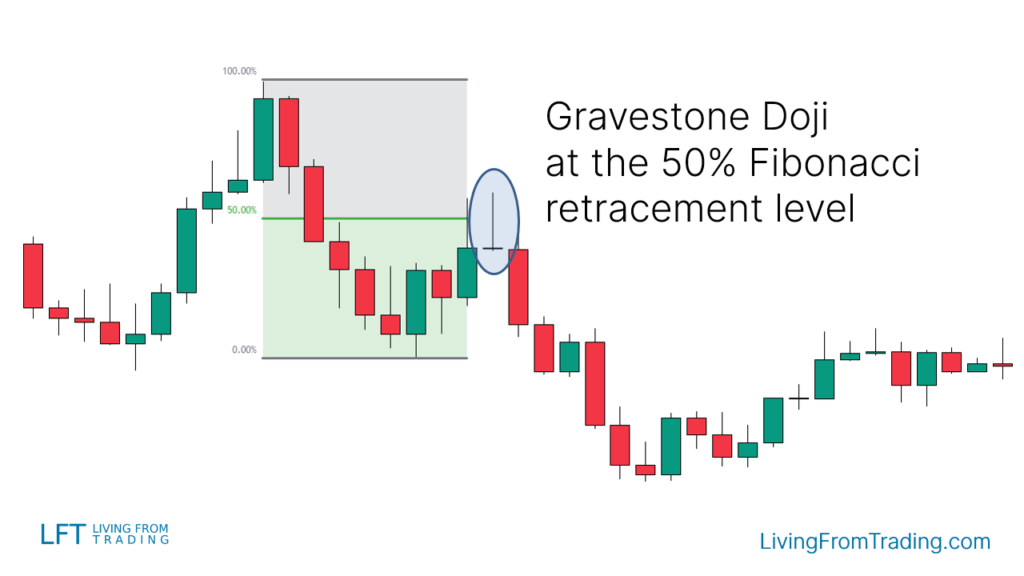

Strategy 5: Trading the Gravestone Doji with Fibonacci

Fibonacci retracement levels can indicate potential reversal points. Combining these with the Gravestone Doji can enhance trading precision.

Steps:

- Identify a downtrend and draw Fibonacci retracement levels from the high to the low of the move.

- Wait for the price to retrace to a Fibonacci level.

- Look for a Gravestone Doji at the Fibonacci level.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss above the Fibonacci level and take-profit at a lower price target.

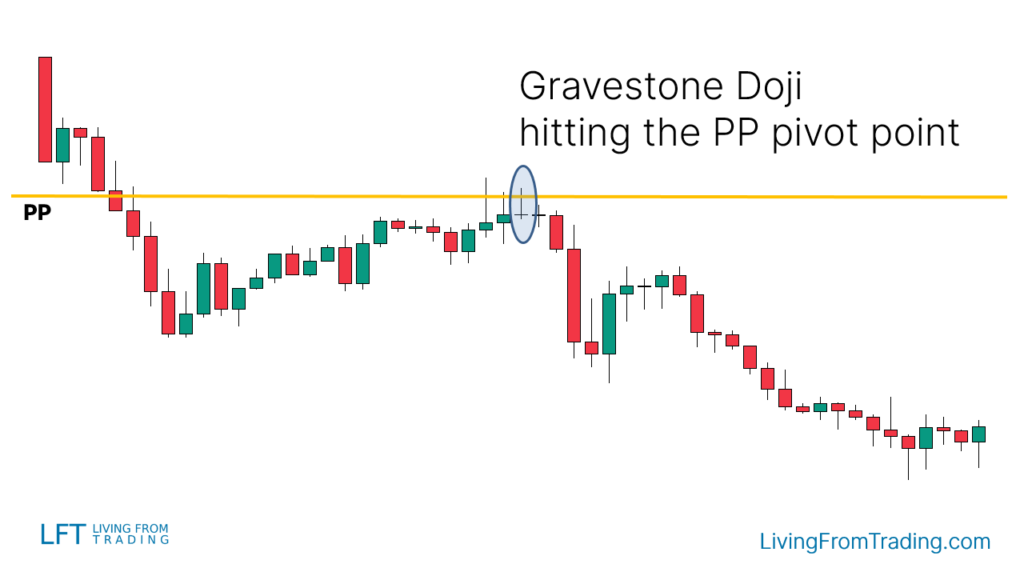

Strategy 6: Trading the Gravestone Doji with Pivot Points

Pivot Points are calculated support and resistance levels. Trading the Gravestone Doji with these points can be effective, especially in day trading.

Steps:

- Apply the Pivot Points indicator to your chart.

- Identify Pivot Points above the current price, which act as potential resistance.

- Wait for a price move up to a Pivot Point level.

- Look for a Gravestone Doji at the Pivot Point level, indicating rejection.

- Short when the price breaks below the low of the Gravestone Doji.

- Set stop-loss above the Pivot Point and take-profit at a lower price target.

Summary

The Gravestone Doji is a powerful bearish reversal signal appearing after an uptrend. Key characteristics include a small body and a long upper shadow. Successful trading of the Gravestone Doji involves recognizing its formation and integrating additional technical indicators to validate the signal.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.