What is stop loss?How to set a stop loss point?

The less willing you are to stop losing when times are bad, the more costly you will have to pay in the future, and a stop-loss strategy can be used to protect your principal。If you want to survive in the market for a long time, you must know how to take care of your hard-earned money.。

Stop loss (stop loss, Stop Loss) is the stop loss, the purpose is to control the amount of loss degree。The so-called Stop Loss Point (Stop Loss Point) means that when the stock price falls to a certain price, it is necessary to immediately sell the stock out of the market, to achieve a loss position (realized loss), to avoid losses continue to expand.。

Why set up a stop loss?

The less willing you are to stop losing when times are bad, the more costly you will have to pay in the future, and a stop-loss strategy can be used to protect your principal。If you want to survive in the market for a long time, you must know how to take care of your hard-earned money.。

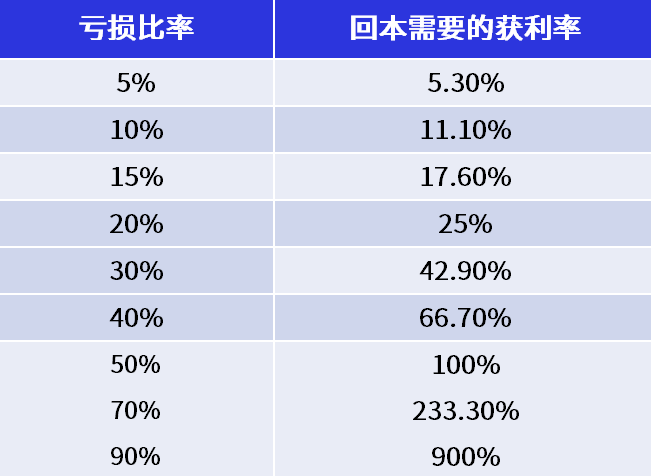

The chart below shows a comparison of losses and profits required to cover them.。

Why make a stop loss plan before entering the site?

Because when doing their homework before entering the market, most people are able to plan rationally and calmly how the deal should be executed。And when your people are already in the stock market, most people tend to be affected by the beating of the stock price numbers, and their emotions follow.。Especially when the stock price keeps going down, almost everyone becomes irrational。

If you don't make a good plan before entering the market, when the stock price falls, it is easy to lose money because you feel sorry for yourself, and there is a concave single, unwilling to "cut meat" to stop the loss of compensation.。Some people even make the irrational act of averaging down (average down), which eventually leads to widening losses。When losses continue to expand, the more difficult it is for investors to execute stop losses, creating a vicious cycle.。

How to catch the stop damage point?

It is generally common to set the stop loss point, nothing more than the use of the fall to a certain percentage of the stop loss exit, or the use of key support price as a stop loss position, or even the use of moving averages as a stop loss observation line.。

Regardless of which method you use as a stop-loss strategy, the most important thing is whether you actually execute the。

percentage stop loss method

The percentage stop loss method, as the name implies, is to stop the loss when the stock price falls by a certain percentage.。Most investors in the market will use a 10% drop in cost price as a stop loss point, while a more aggressive investor will be less than 10%。

Suppose an investor buys a stock with a share price of $50 and uses a 10% drop as a stop loss point, which means that when the stock price falls to $45, he or she should perform the stop loss action as planned.。However, this approach is not necessarily 10% as a stop loss point, investors can according to their own risk tolerance, to do stop loss conditions set。

Critical support stop loss method

The key support is a technical investment, which refers to the support formed by a large number of K-bar lows, multiple K-bar lows connected, or the position of the jump gap.。When the share price falls below these key support positions, it means that the share price trend weakens, which can easily lead to a surge of sell orders from the collective consensus of the market, leading to a rapid decline in the share price.。

mean line stopping loss method

Using the moving average (Moving Average) as a stop loss point is also a stop loss method often used by investors in the market.。

The moving average is divided into short-term, medium-term and long-term moving averages.。Investors who generally operate short-term, pursuing the efficiency of short-term capital utilization, will use the short-term moving average (5, 10MA) as the basis for judging the strength of the stock price.。

Investors in swing operations, on the other hand, usually use the medium-term moving average (20, 60MA) as an observation position and will leave the market as soon as the share price falls below the moving average support.。

Because the moving average can be seen as the average cost position of the investor over the past period of time。Using the 10-day moving average (10MA) as an example, assuming that the 10MA is shown as 50, which represents an average closing price of $50 over the past 10 days, it can also be used to represent the average cost to investors on those days。As long as the share price falls below 10MA, it means that most of the investors who bought in the past 10 days have been trapped.。

How to set up a stop loss list in advance?

First of all, to cultivate "disciplined" investment behavior, which also requires constant deliberate practice.。Plan a stop-loss strategy before each investment, and know how to deal with and resolve the dilemma in case the stock price moves less than expected.。

For investors who are unable to stop the loss decisively, they can actually use the wisdom provided by some brokerage apps to place an order or build a stop-loss function to assist investors in performing the task of stopping the loss.。Investors only need to set up a good stop loss order, when the stock price hit the stop loss price, you can automatically stop the loss, the use of technology to overcome human weaknesses。

However, the smart orders and stop-loss functions of each brokerage firm are different, so you must understand the restrictions and conditions before using them and choose the right trading tool for you.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.